Starting a farm in Australia sounds exciting, right? But it’s not as simple as planting seeds and waiting for results. Many new farmers hit roadblocks because they don’t know the legal steps involved.

Skipping these steps can lead to fines or even shutting down your farm.

Did you know that every Australian farmer needs licenses, permits, and proper registration before starting? Things like water rights, land use laws, and biosecurity measures are non-negotiable.

This guide will walk you through the top 10 legal must-haves to get your farm running smoothly.

Ready to learn what it takes? Keep reading!

Crafting a Business Plan for Your Australian Farm

Define your farming goals clearly. Choose what type of agriculture you want to focus on, like cattle, grains, or fruits. List out land needs, labor costs, and equipment expenses. For example, buying a tractor might cost $50,000 or more.

Study the market deeply before planting seeds. Research competitors in your area and find gaps to fill with unique crops or services. Identify who will buy from you—local markets or large companies? Include this customer segmentation in your plan for smart sales strategies.

Set long-term expansion plans now. Plan how much money is needed for growing later by including financial projections upfront. Review your business plan often; update it as trends shift in agriculture or local demand changes.

Selecting the Right Business Structure for Your Farm

Picking the right setup for your farm is a big step. Your choice impacts taxes, liability, and how you operate day-to-day.

Operating as a Sole Trader

Starting as a sole trader gives you full control over your farm’s operations. This structure is simple to set up and requires an Australian Business Number (ABN). Filing for one is straightforward online.

Though easy to start, it ties personal and business assets together. If the farm faces debt, your own savings or property could be at risk.

Farmers often choose this setup when starting small. A solid business plan helps with growth and financing needs. Banks may require contracts or agreements before offering loans under this structure.

Forming a Partnership

Two or more people can share control, income, and losses by forming a partnership. The Partnership Act 1891 governs this structure in Australia. Partners must agree on roles and responsibilities through a written partnership agreement.

This document helps avoid disputes later.

Partners are personally responsible for the debts the business owes unless stated otherwise. An Australian Business Number (ABN) is usually required to register your partnership officially.

Seeking legal advice is wise to clarify liability, governance, and income-sharing processes early on.

Establishing a Pty Ltd Company

A Pty Ltd Company stands on its own as a legal entity. It protects shareholders by limiting their liability to the money they invested. Under the Corporations Act 2001, setting up this structure comes with specific rules.

You need to register your business name and secure a director identification number. Directors also carry responsibilities like keeping records and meeting tax obligations.

This type of company must follow strict laws, but it offers benefits too. For example, unlike sole traders or partnerships, it keeps running even if ownership changes hands. Regulatory compliance may seem tough at first, but this setup provides strong shareholder protection.

Now let’s move on to registering your farm and securing an ABN!

Registering Your Farm and Securing an ABN

You must register your farm and secure an ABN to run a legal agricultural business in Australia. This step is key for tax compliance and business identification.

- Apply for an Australian Business Number (ABN) through the Australian Tax Office (ATO) website. It is free and quick if you have all necessary documents.

- Provide proof of identity, such as a passport or driver’s license, during the application process.

- Share details about your farm’s activities and business structure on the form. Be clear about what your farm will produce or do.

- If you hire overseas workers, confirm they hold eligible work visas before assigning tasks requiring ABN registrations.

- Update your ABN information whenever details change, like farm address or business type.

- Report income regularly under your ABN to stay compliant with ATO rules.

- Keep all business records organized for at least five years, including financial statements and receipts tied to your ABN.

- Notify the ATO if you stop running your farming operations to cancel the ABN properly.

Next, focus on obtaining licenses and permits to meet legal requirements fully.

Acquiring Necessary Farming Licenses and Permits

Getting the right permits is like planting seeds—you can’t grow without them. Farm licenses keep your operations legal and smooth.

Applying for Land Use Permits

Starting a farm in Australia requires specific permits. Land use permits are crucial for legal farming activities.

- Check zoning regulations in your area. Farms must follow local laws on land use and planning.

- Contact local authorities for guidance. They provide details on the application process.

- Submit an environmental assessment if required. This ensures your farm will not harm the environment.

- Ensure the land suits agricultural purposes as per regulations. Some areas may have restrictions on certain farming activities.

- Complete all necessary forms for approval. These might include plans detailing water use, crop types, or livestock management.

- Apply early to prevent delays in starting your farm project. Approval timeframes can vary depending on the complexity of your request.

- Pay any required fees during the application process. Costs differ by state and region.

- Keep copies of all documents submitted to local authorities for later reference or questions about compliance rules.

- Monitor updates from business.gov.au for changes in rules and advice on permits specific to your location.

- Follow up with authorities if you face delays in hearing back about approvals or requested modifications to applications made earlier

Obtaining Water Access Licenses

You need a Water Access License (WAL) to take water from natural sources. These licenses are important for fair water use and protecting resources.

- Water licenses in New South Wales follow the Water Management Act 2000. This law ensures fair water sharing and good resource management.

- WALs give you rights to a share of available water in your area. You can only take what your license account allows.

- There are types of WALs, including regulated rivers, unregulated rivers, aquifers, and domestic or stock needs.

- Regulated river licenses apply for areas where waterflow is controlled by dams or weirs. Unregulated ones relate to streams without major control systems.

- Farmers needing groundwater must get an aquifer license. This protects underground water like wells or springs.

- Domestic and stock water users also require these permits unless exempted under specific rules.

- In emergencies, farmers can access limited water for fire preparation without requiring a WAL.

- Managing your license properly is key since overuse can lead to penalties or restrictions on future access.

Adhering to Environmental and Biosecurity Regulations

Farms must follow the Biosecurity Act 2015 to protect crops and animals. This law helps stop pests and diseases from spreading. Farmers need to report any signs of issues like sick animals or damaged plants quickly.

Inspections may happen, so always keep records clean and updated.

Exporting goods? The Export Control Act 2020 sets strict rules for shipping farm products overseas. It ensures animal health, plant safety, and high-quality exports. The Department of Agriculture oversees these laws, ensuring farms stay safe while protecting the environment from climate risks like droughts or floods.

Navigating Employment Laws and Ensuring Workplace Safety

Farm owners must comply with the Fair Work Act. This law sets standards for wages, work conditions, and employee rights. Clear employment contracts are a must to protect both workers and owners.

These agreements should outline pay, duties, and leave entitlements. Poorly written contracts can lead to disputes or legal trouble down the road.

Workplace safety laws focus on preventing accidents. Safety protocols like training programs reduce risks in daily tasks. Jobs involving heavy machinery or chemicals need strict safety measures.

Regular checks ensure tools meet compliance standards too. Keeping records of safety actions helps prove compliance if inspected by authorities later on.

Securing Your Farm’s Intellectual Property

Protecting your farm’s creations keeps competitors from copying them. Register a trademark to secure your business name, logo, or brand. This boosts consumer trust and strengthens your market position.

For instance, if you develop a new crop variety, securing legal protection ensures it stays proprietary.

Intellectual property registration also defends against potential exploitation by others in the industry. Seek legal advice to build an effective IP strategy that fits your needs. Early action can save costs and protect long-term profits for your farm’s success.

Securing Insurance for Your Farming Operations

Farmers face risks like floods, droughts, and livestock diseases. Insurance can protect your farm from these dangers. A Farm Pack Policy offers coverage for crops, buildings, animals, and machinery.

Liability insurance helps if someone gets hurt on your property. Property insurance covers damage to barns or homes on the farm.

New technologies in agriculture insurance can lower premiums while reducing risk. Options like drought or flood insurance are vital as weather becomes harder to predict. Companies like Connect Business Insurance provide flexible options for Australian farmers.

Start with comprehensive coverage to shield your operation from big losses!

Preparing Key Legal Documents for Farm Management

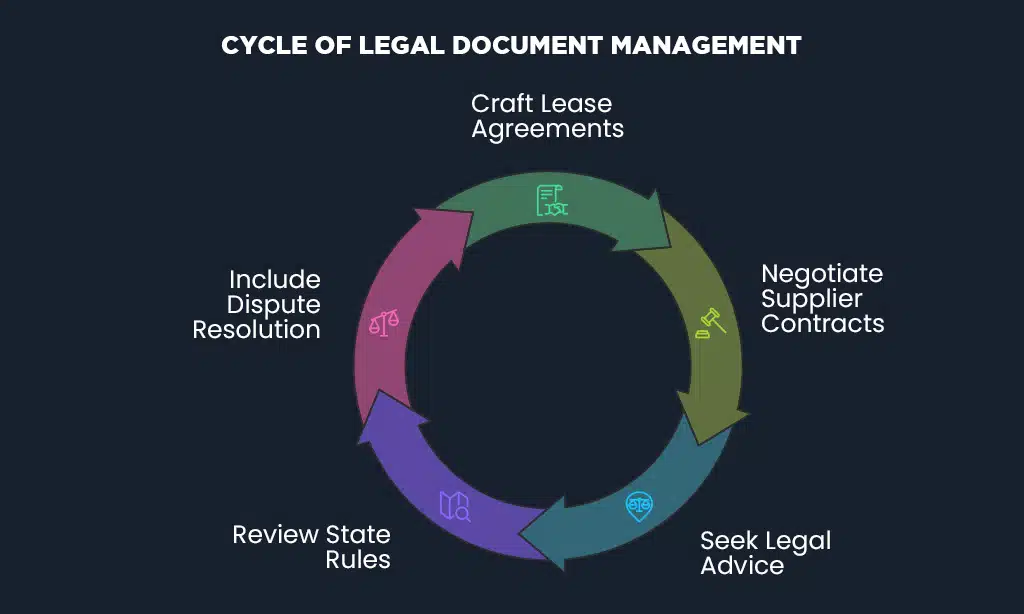

Legal documents keep your farm running smoothly. They help avoid disputes and protect your interests.

Crafting Lease Agreements

Farm lease agreements set the ground rules between landlords and tenants. They outline lease duration, rental terms, land use, upkeep duties, and conditions for ending the deal. Cash leases mean fixed payments to the landlord.

Share leases let tenants pay with a crop yield percentage.

Disputes over these contracts may involve mediation or legal action. It’s smart to clearly define each party’s role in daily farm management. Get legal advice before signing anything to avoid problems later on.

Next up is negotiating supplier contracts!

Negotiating Supplier Contracts

Start with clear goals and know your needs. Talk openly with suppliers to agree on fair terms. Contracts should cover pricing, delivery schedules, quality standards, and penalties for late or poor supplies.

Simple language avoids confusion later.

Review state rules that affect supplier agreements. Include a dispute resolution clause in case of issues. Good deals help you plan budgets better and keep the farm running smoothly.

Complying with Taxation and Financial Regulations

Farmers earning over AUD 75,000 a year must register for GST. Keep all financial records organized to prepare for taxes and audits. Software or accounting help can simplify this.

Use the Instant Asset Write-Off rule if buying equipment under $20,000 until 2026. Deduct costs of fences built after May 12, 2015, or fodder storage bought after August 19, 2018. Farm Management Deposits can shift income across years and reduce interest on farm loans too.

Takeaways

Starting a farm in Australia requires preparation. You must know the legal rules and follow them carefully.

Jessica Lane, an experienced agricultural consultant with 25 years of expertise, shared her insights. She holds a degree in Agricultural Law from the University of Sydney. Jessica has worked with hundreds of farmers across Australia.

Her work focuses on helping farms meet legal standards while staying profitable.

Jessica says understanding business structures and permits is essential. Choosing between sole trader or company status affects taxes and liability. Securing licenses like water rights ensures smooth operations ahead.

These steps protect farms legally and financially.

She emphasizes ethical practices too. Farms should respect land use laws and biosecurity rules to safeguard nature and public health alike. Transparency builds trust with consumers when labeling products truthfully.

For new farmers, Jessica advises starting small but well-managed farms first. Study local zoning laws before buying land to avoid surprises later on.

A guide like this offers clear steps for farming startups compared to general advice elsewhere online, Jessica notes positively; it simplifies complex topics into actionable steps anyone can apply easily at any scale or budget size.

This approach helps streamline the process for beginners who might otherwise feel overwhelmed by excessive red tape, ensuring plans are developed effectively and remain commercially viable to meet diverse needs long-term.