Decentralized Autonomous Organizations (DAOs) are transforming the digital economy by offering an innovative approach to governance and decision-making. These blockchain-powered entities operate without centralized control, enabling community-driven initiatives across finance, social projects, and Web3 ecosystems.

However, despite their growing adoption, DAOs and decentralized platforms face significant legal challenges.

The lack of clear regulatory frameworks, legal entity recognition issues, liability concerns, and taxation complexities create uncertainty for both developers and participants. In this article, we will explore the seven major legal challenges facing DAOs and decentralized platforms, providing an in-depth analysis of the risks and potential solutions. A

dditionally, we will examine real-world examples, highlight emerging trends, and provide actionable insights for those navigating the legal landscape of decentralized governance.

1. Regulatory Uncertainty and Compliance

Regulations surrounding DAOs and decentralized platforms vary widely across jurisdictions. Some countries are embracing blockchain innovations, while others impose stringent restrictions. The challenge lies in the absence of uniform global regulatory standards, making compliance a complex task for DAOs operating across multiple regions.

- United States: The SEC has scrutinized DAOs, particularly regarding token sales and securities compliance.

- European Union: The EU’s MiCA (Markets in Crypto-Assets Regulation) seeks to regulate crypto-related activities, including DAOs.

- Asia: Countries like China have banned crypto transactions, making DAO operations legally complex.

- Latin America & Africa: Emerging markets are exploring decentralized finance (DeFi) and DAOs but lack clear regulatory frameworks.

Compliance Challenges for DAOs

DAOs face difficulties aligning with regulatory requirements such as:

- Securities Laws: Many DAOs issue governance tokens, which may be classified as securities.

- AML & KYC Requirements: Decentralized platforms often lack user identification protocols, raising compliance concerns.

- Jurisdictional Conflicts: Operating across multiple countries exposes DAOs to conflicting legal obligations.

| Region | DAO Regulation Status | Key Concerns |

| USA | Unclear, SEC scrutiny | Securities classification, tax obligations |

| EU | MiCA regulation emerging | Cross-border compliance, financial oversight |

| China | Crypto banned | Restrictive policies, legal risks |

| Switzerland | Favorable blockchain laws | DAO-friendly registration options |

Case Study: The SEC vs. The DAO

In 2017, the SEC ruled that The DAO, an early decentralized investment fund, violated securities laws. The ruling marked the beginning of regulatory scrutiny over DAOs and set a precedent for token classifications.

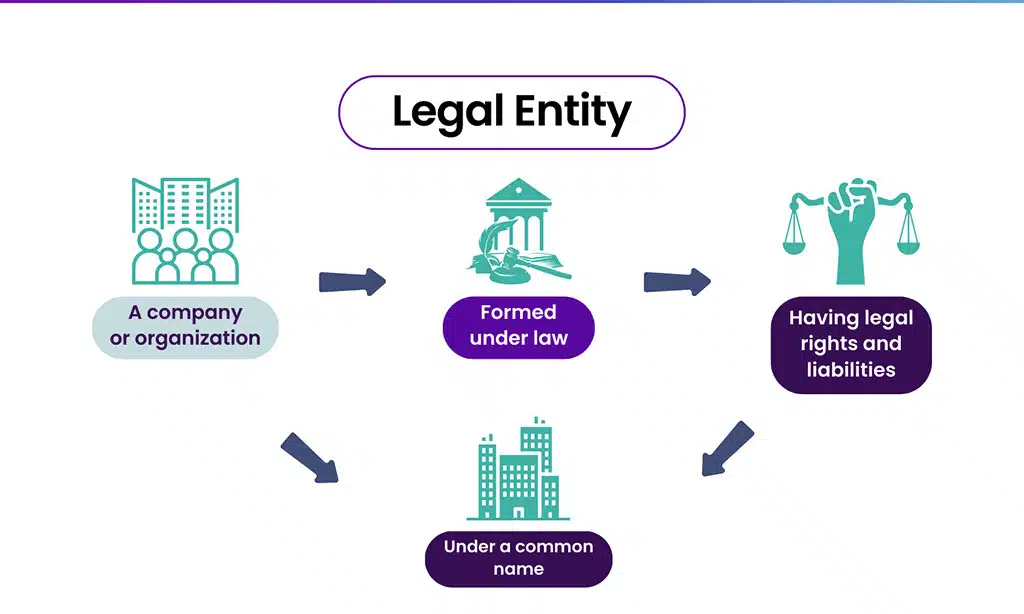

2. Legal Status and Entity Recognition

One of the biggest legal challenges facing DAOs and decentralized platforms is their legal status. Traditional businesses operate as corporations, LLCs, or partnerships, but DAOs often lack formal recognition. This absence of legal personality raises concerns about accountability, taxation, and liability.

Several jurisdictions have proposed solutions:

- Wyoming, USA: Allows DAOs to register as LLCs, providing limited liability protection.

- Switzerland: Offers blockchain-friendly legal frameworks to formalize DAO operations.

- Singapore & Malta: Emerging as crypto-friendly jurisdictions, providing pathways for DAO registration.

- El Salvador: The country’s Bitcoin-friendly policies hint at potential DAO adoption frameworks.

Risks of Operating Without Legal Status

Without formal legal recognition, DAOs face:

- Limited liability protection: Individual members could be personally liable.

- Unclear tax obligations: No defined corporate taxation structure.

- Enforcement difficulties: Smart contracts cannot always resolve legal disputes.

| Jurisdiction | DAO Legal Status | Key Benefits & Risks |

| Wyoming (USA) | LLC registration available | Legal recognition, liability protection |

| Switzerland | Favorable laws for DAOs | Clear operational structure |

| Malta | Crypto-friendly but evolving laws | Regulatory flexibility |

| China | No legal recognition | High legal risk |

3. Smart Contracts and Liability Issues

DAOs rely on smart contracts for decision-making, but these automated scripts are not immune to errors. If a bug or exploit leads to financial losses, determining accountability becomes complex.

- Developers: Could be held responsible if flaws exist in the smart contract code.

- DAO Members: If governance decisions lead to failures, liability may fall on participants.

- No Legal Precedents: Courts have yet to establish clear rulings on smart contract failures.

Security Risks and Audits

Security vulnerabilities in smart contracts pose legal risks for DAOs:

- Hacks and exploits (e.g., The DAO hack in 2016).

- Lack of external audit requirements (no legal mandate for smart contract reviews).

- Irreversible transactions, making fund recovery difficult.

| Issue | Legal Challenge | Example |

| Smart contract errors | Unclear liability | The DAO hack (2016) |

| Exploits and hacks | Lack of legal recourse | Poly Network attack |

| Governance attacks | No formal protections | Beanstalk governance exploit |

4. Governance and Decision-Making Challenges

DAO governance relies on token-based voting, but legal risks include:

- Majority rule vs. minority protection – Do laws safeguard minority token holders?

- Voting fraud risks – Sybil attacks or vote manipulation can lead to legal disputes.

- Anonymous governance participants – Hard to enforce accountability.

Enforceability of DAO Decisions

- Are DAO votes legally binding? Most jurisdictions do not recognize DAO governance decisions.

- Who enforces DAO rules? Smart contracts automate decisions but lack legal oversight.

- Dispute resolution issues – No formal arbitration mechanisms for DAO conflicts.

| Governance Issue | Legal Concern | Potential Solution |

| Token-based voting | Legal enforceability | Hybrid governance structures |

| Sybil attacks | Vote manipulation | Identity verification measures |

| Anonymous governance | Lack of accountability | Reputation-based voting systems |

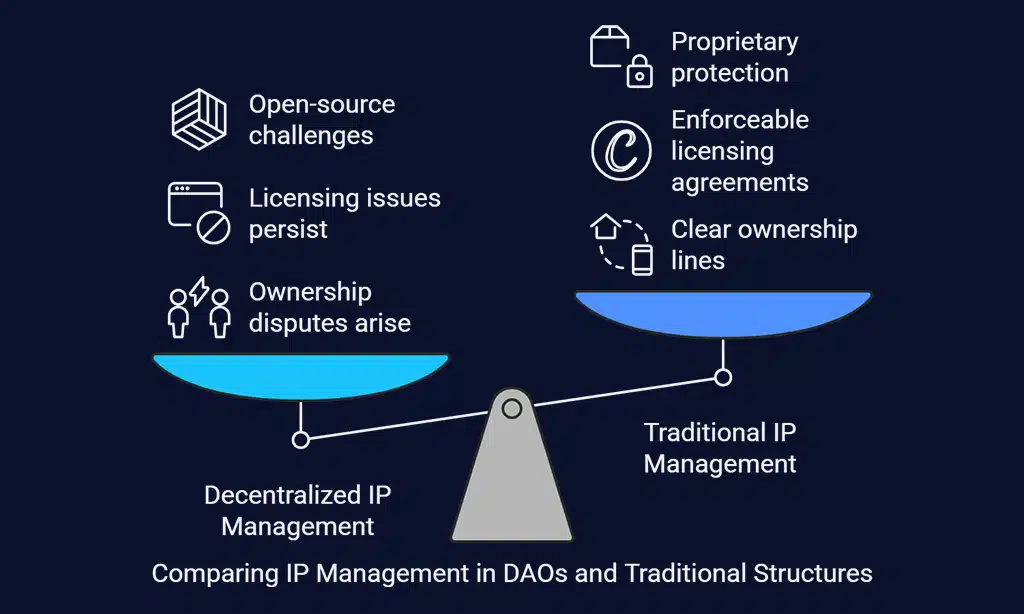

5. Intellectual Property Rights in DAOs

DAOs often generate intellectual property (IP), including software, NFTs, and research, but managing IP rights within decentralized structures is complex. Key challenges include:

- Decentralized Ownership: Unlike traditional corporations, DAOs lack a clear legal entity to hold IP rights.

- Open Source vs. Proprietary Rights: Many DAOs prefer open-source models, but protecting proprietary innovations is difficult.

- Licensing Agreements: Smart contracts can automate licensing, but legal enforceability remains unclear.

| IP Challenge | Legal Concern | Potential Solution |

| Ownership disputes | No central entity to claim IP | Register IP under a legal entity |

| Licensing issues | Enforceability of smart contracts | Hybrid legal + smart contract model |

| DAO forks and splits | Who retains rights to IP? | Predefined IP governance rules |

Case Studies of IP Conflicts in DAOs

- NFT DAOs: Projects like Nouns DAO face challenges in maintaining IP rights over collective artwork.

- Software DAOs: Decentralized development teams struggle with licensing models that protect contributions.

6. Taxation and Financial Reporting Challenges

Tax authorities worldwide struggle to classify DAO revenue and transactions. Major taxation concerns include:

- Unclear Corporate Tax Status: Without legal entity status, DAOs lack defined tax obligations.

- Cross-Border Taxation: DAOs operate globally, leading to jurisdictional conflicts in tax liabilities.

- Crypto Transactions & Reporting: Most DAOs transact in crypto, requiring complex reporting mechanisms.

| Tax Challenge | Legal Implication | Potential Solution |

| Undefined tax status | Risk of double taxation | Register as an LLC in a favorable jurisdiction |

| Crypto earnings & payroll | Difficulty in reporting | Adopt DAO treasury management tools |

| Global income regulations | Jurisdictional tax conflicts | Seek regulatory clarity per region |

Financial Transparency vs. Anonymity

- Anonymous DAO Treasuries: Regulatory bodies push for financial transparency, conflicting with the decentralized ethos.

- Treasury Management Risks: Mismanaged funds can lead to legal disputes or regulatory crackdowns.

7. Legal Risks of Token Issuance and Fundraising

The SEC and global regulators closely scrutinize DAO tokens, leading to concerns over:

- Securities Classification: Many governance tokens may fall under securities laws, requiring compliance.

- Unregistered Offerings: DAOs conducting Initial Coin Offerings (ICOs) or Token Generation Events (TGEs) risk legal action.

- Investor Protection Laws: DAOs must ensure legal safeguards for token holders.

| Fundraising Model | Legal Concern | Potential Solution |

| ICOs & IDOs | Securities law issues | Follow registered token frameworks |

| DAO governance tokens | Risk of SEC oversight | Ensure legal disclosures |

| Crowdfunding | Investor protections | Implement DAO legal wrappers |

Navigating Fundraising Laws

To comply with fundraising regulations, DAOs should:

- Structure token issuance legally, ensuring transparency.

- Adopt clear governance structures that protect investors.

- Work with regulators to prevent future legal action.

These blockchain-powered entities operate without centralized control, enabling community-driven initiatives across finance, social projects, and Web3 ecosystems. However, despite their growing adoption, DAOs and decentralized platforms face significant legal challenges.

Wrap Up

As DAOs and decentralized platforms continue to evolve, addressing legal challenges is crucial for long-term sustainability. Without clear regulatory frameworks, DAOs face risks ranging from liability issues to compliance challenges.

To navigate these obstacles, DAOs should:

- Register in favorable jurisdictions.

- Implement legal governance frameworks.

- Ensure smart contract audits and legal compliance.

- Stay updated with evolving regulatory trends.

While the legal landscape for DAOs remains uncertain, proactive compliance and strategic structuring can help decentralized projects thrive in an increasingly regulated world.