Curious about Larry Fink net worth and how he compares to names like Elon Musk or Jeff Bezos? Larry Fink, the CEO of BlackRock, is a billionaire with a wealth tied to managing trillions in assets.

In this post, you’ll learn what drives his success and why he’s one of the most influential figures in finance. Keep reading—his story might surprise you!

Key Takeaways

- Larry Fink net worth of $1.3 billion and ranks #2502 globally, far behind Elon Musk ($250+ billion) and Jeff Bezos ($150+ billion).

- He is the CEO of BlackRock, which manages over $10 trillion in assets as of 2025, making it the largest asset management firm worldwide.

- BlackRock earns revenue from fees, ETFs (iShares holds $3 trillion), and advisory services. The company made over $20 billion in revenue in 2023.

- Larry Fink’s influence extends to global markets through tools like Aladdin, which oversees $20 trillion in risk management for governments and funds.

- Despite being less wealthy than tech moguls, Fink shaped global finance by stabilizing economies during crises like 2008 and COVID-19.

Larry Fink Net Worth and Global Ranking

Larry Fink net worth wealth stands as a testament to his financial genius. His position among the richest highlights his impact in managing vast fortunes globally.

Current estimated net worth and comparison to Elon Musk and Jeff Bezos

When it comes to extreme wealth, Larry Fink’s position is less eye-catching than Elon Musk or Jeff Bezos. Still, his fortune is nothing to sneeze at. Below is a quick comparison that tells the story of their financial standings.

| Name | Estimated Net Worth (2025) | Global Wealth Rank (2025) | Notable Position |

|---|---|---|---|

| Larry Fink | $1.3 Billion | #2502 | CEO of BlackRock |

| Elon Musk | $250 Billion+ | #1 | CEO of Tesla, SpaceX |

| Jeff Bezos | $150 Billion+ | Top 5 | Founder of Amazon |

Fink’s fortune, while significant, pales in comparison. Musk has more zeros in his bank account than most can dream of. Bezos, though no longer the richest, still dwarfs Fink’s wealth by over 100 times.

Key Factors Behind Larry Fink’s Wealth

Larry Fink’s fortune stems mostly from leading BlackRock, the largest asset management firm, controlling trillions in assets worldwide; read on to uncover how he built such massive wealth.

BlackRock’s assets under management and revenue streams

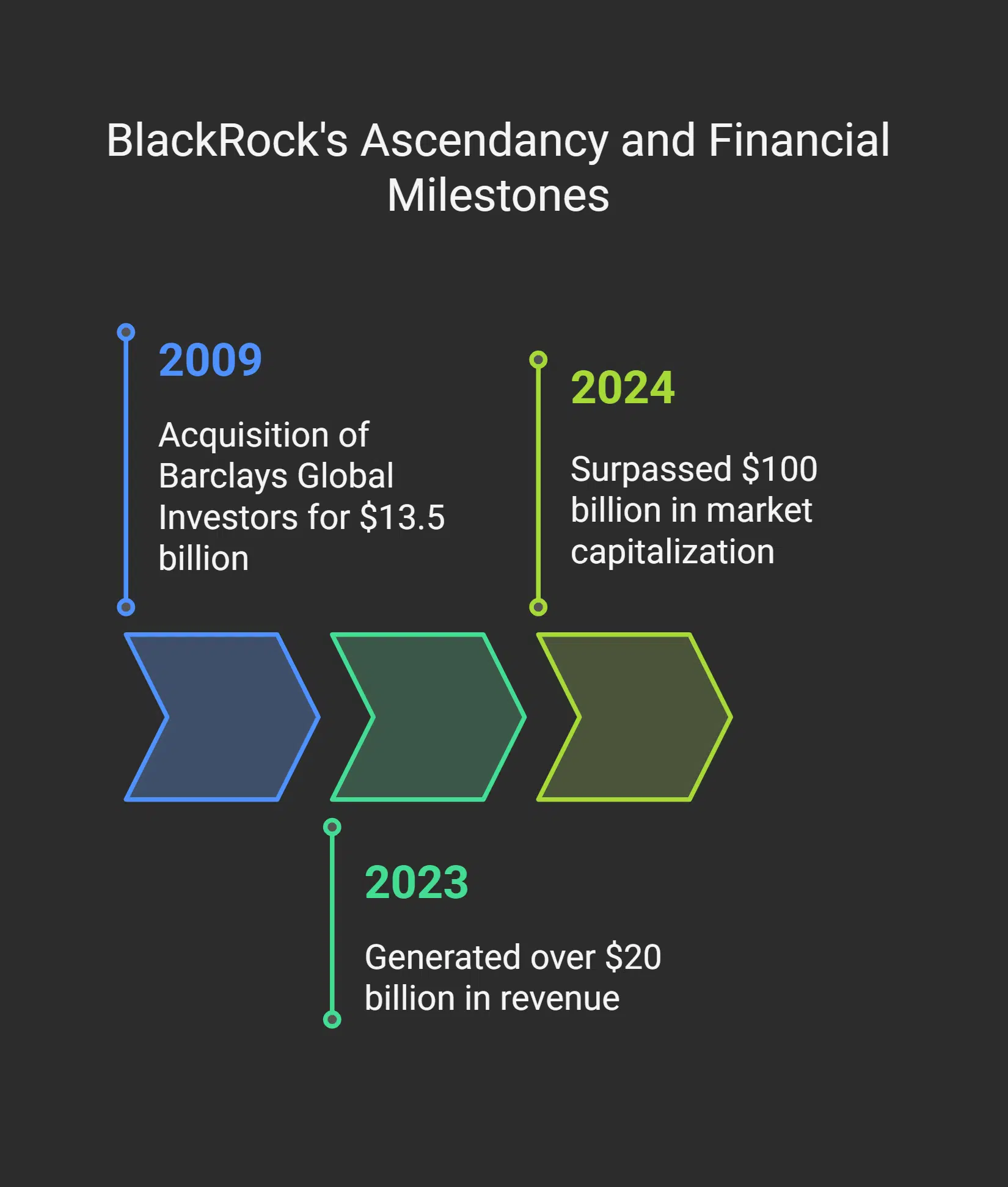

BlackRock controls about $10 trillion in assets as of 2025, making it the largest asset management firm globally. From pension funds to sovereign wealth funds, their reach spans almost half of U.S. households’ investments.

They generate cash from management fees, advisory services, and performance-based earnings, raking in over $20 billion in revenue during 2023.

The company’s iShares platform alone handles more than $3 trillion worth of exchange-traded funds (ETFs). After acquiring Barclays Global Investors for $13.5 billion in 2009, BlackRock solidified its position in the financial world.

Its market capitalization surpassed $100 billion by 2024 and saw a share price growth of 15% last year due to steady client trust and strong profits.

Influence of Larry Fink in the Financial World

Larry Fink leads BlackRock, shaping global money decisions. His strategies influence markets and guide nations on financial policies.

Leadership at BlackRock and global economic impact

Fink shaped BlackRock into a global financial giant, managing assets worth over $7.4 trillion. His vision brought Aladdin, a risk management tool handling $20 trillion worldwide. This system runs 200 million calculations weekly, aiding governments and pension funds alike.

During the 2008 crisis, he guided markets toward stability. In COVID-19’s wake, BlackRock led emergency funding programs to calm economies. Through annual letters to CEOs, Fink champions stakeholder capitalism.

His influence touches interest rates, monetary policy decisions at central banks like the Federal Reserve, and even emerging sectors like Bitcoin and Ethereum investments.

Takeaways

Larry Fink net worth story is a mix of grit, smarts, and big wins. From co-founding BlackRock in 1988 to managing over $10 trillion today, his impact is massive. While his net worth of $1.3 billion may not match Musk or Bezos, it speaks volumes about his steady leadership.

Through setbacks and triumphs, he built the world’s largest asset manager and shaped global finance like few others have.

FAQs

1. Who is Larry Fink, and why is he considered a global leader in investment?

Larry Fink is the chairman and CEO of BlackRock, the world’s largest asset management firm with trillions in assets under management. His visionary leadership has shaped the financial market, making him an icon in investment and technology solutions.

2. What is Larry Fink’s estimated net worth?

Larry Fink’s net worth is estimated at around $1.2 billion. His role as co-founder of BlackRock in 1988 and his influence on Wall Street have significantly contributed to his wealth.

3. How does Larry Fink compare to other wealthy individuals like Elon Musk or Jeff Bezos?

While not as wealthy as Elon Musk or Jeff Bezos, Larry Fink holds immense power through BlackRock’s control over $11 trillion in assets—nearly equal to the GDP of many nations—giving him unparalleled influence across global financial services.

4. What are some key milestones from Larry Fink’s career?

Fink earned a BA from UCLA in 1974 before completing an MBA at UCLA Anderson School of Management. He started at First Boston, later co-founding BlackRock in 1988, which became the largest asset manager globally by managing public fund pools and corporate investments.

5. What roles outside finance has Larry Fink taken on?

Beyond finance, he serves on boards like NYU Langone Health and the Museum of Modern Art while also participating with organizations such as the International Rescue Committee and Tsinghua University School of Economics and Management.

6. Why does Bernie Sanders criticize figures like Larry Fink for their wealth?

Critics like Bernie Sanders argue that individuals controlling vast sums—like half of America’s wealth through firms such as BlackRock—create economic inequality by centralizing power within a small group rather than distributing it more broadly among millions of Americans.