Ever get stuck in a long line just to pay for gum or coffee? Maybe your card declined, or the store only took cash. That can be annoying and slow things down. People all over want faster, easier ways to buy what they need at stores, restaurants, and even buses.

In South Korea, qr code payments exploded by 300% in just three years. More people there use their smartphones for digital payments than ever before.

This blog post will show you why qr codes are winning over old school payment cards and near-field communications tech like nfc. You’ll learn how local wallets such as KakaoPay and Naver Pay made shopping quick and simple with a scan of your phone.

Curious why Korea’s shops love these little black-and-white squares? Stick around; you’ll find out soon enough!

Key Factors Driving QR Code Payment Growth in Korea

Smartphones are everywhere in Korea. Almost everyone has one now, making it easy to use QR codes for payments. High-speed internet helps too. It’s fast and reliable, so people can pay with just a scan.

The government supports cashless payments as well. They want to make buying and selling easier without cash. Many shoppers prefer contactless options too. It’s quick and safe, which keeps them coming back for more!

Widespread smartphone adoption

Nearly 98% of South Koreans own a smartphone. Smartphones are everywhere, almost like an extra hand. KakaoPay and Naver Pay work on both iPhones and Android devices, so anyone can scan QR codes at stores or subway gates with just one tap.

A 2022 survey showed about 91% already used QR code payments. Even grandmas at corner shops use their phones for digital wallet payments instead of cash.

High smartphone penetration links everyone across cities and small towns alike. With platforms such as Toss making mobile payment easy as pie, people swapped debit cards for phone taps in record time.

Most folks keep their “mobile wallets” ready inside apps like Samsung Wallet, ditching loose change or even traditional credit cards faster than you can say “payment digitalization.” QR codes became part of daily life in line with rapid adoption.

“These days, it’s stranger to see someone pull out coins than flash a QR code.”

High-speed internet infrastructure

Fast wifi and mobile broadband reach almost every corner of Korea. Payment platforms, like KakaoPay and Naver Pay, run smooth because this digital backbone keeps connections stable and quick.

Secure internet links help digital wallets process QR code payments in a flash. People can scan dynamic QR codes to pay for snacks or train rides, even on busy streets or packed subway cars.

Mobile payment systems feed off strong payment infrastructure too. Over 99% of households have access to high-speed broadband since 2022. This makes wallet-based payments easy whether you shop at retail stores or buy tickets online.

Point-of-sale terminals across the country use big data analytics over secure networks to stop fraud dead in its tracks. High-speed connectivity lifts financial inclusion; more folks join the cashless economy each year thanks to fast, safe transactions wherever they go.

Government support for cashless payments

High-speed internet makes QR code payments work fast, but strong government help gives the real push. The South Korean government has bet big on digital payments. It gave subsidies to stores and users for using mobile payments with QR codes.

Over three years, $207 million went into 85 fintech startups. These funds helped small shops pay less for payment terminals and get better technology.

Laws make it easier for people to pick contactless solutions like NFC payments or wallet-based options such as KakaoPay and Toss. Korea’s rules now promote a cashless economy by making transaction standards clear and safe for everyone.

This support helps local wallets grow in the retail sector, online shopping, even buses and trains—giving digital wallets more places to shine every day.

Consumer preference for contactless solutions

More South Koreans prefer contactless payment solutions. About 53.8% like digital payments because they do not have to carry cash or cards. People find this method easier and safer.

In fact, 82.69% say digital payments are convenient. With the rise of smartphones, using QR codes for transactions makes shopping quick and simple.

This shift in preference shows strong support for contactless methods in daily life. As more people choose these options, businesses adapt quickly to meet demands for easy ways to pay.

The trend is changing how consumers interact with money and services every day, paving the way for new technologies ahead.

“Convenience is key; today’s consumer wants speed.”

Leading Fintech and Mobile Payment Platforms

Korea’s mobile payment scene is buzzing with platforms like KakaoPay, Naver Pay, and Toss. These apps make transactions easy and quick. People love using them for shopping and paying bills.

With so many folks on smartphones, it’s no wonder these services are thriving! Want to learn how they work their magic? Stick around!

KakaoPay

KakaoPay launched in 2014 and quickly grew popular. It is part of KakaoTalk, a messaging app many people in Korea use every day. With over 40 million users, it has become a key player in digital payments.

People love how easy it is to pay with their smartphones.

The platform allows foreign tourists to make payments without needing to exchange currency. This feature makes travel smoother for visitors. Many local wallets also support QR code payments through KakaoPay, giving users more options and flexibility at stores and online shops.

Naver Pay

KakaoPay connects nicely with Naver Pay, another important payment tool in Korea. Launched in June 2015, Naver Pay lets users make payments, transfer money, and access buy now pay later (BNPL) options.

It also offers cashback rewards to users.

In 2023, Naver Shopping held a strong 22% market share in South Korea’s e-commerce market. This shows how popular it has become among shoppers. With the rise of smartphone penetration and demand for contactless payments, Naver Pay fits right into the growing digital payments landscape.

Its easy-to-use design helps improve customer experience while making transactions faster at stores and online platforms.

Toss

Toss launched its online-offline QR code payment in May 2018. It provides banking, securities, and digital payments all in one place. This includes QR code payments that make transactions quick and easy.

Users can pay with their smartphones using a simple scan. Toss is popular among Koreans for its user-friendly design. It helps people manage their money well.

The platform also supports cashless transactions, fitting into Korea’s move towards contactless solutions. Toss uses advanced technology to keep transactions safe. This approach attracts even more users looking for convenience and security in digital payments.

The growing trend of local wallets plays a big role here too. Now, let’s examine how innovations in QR code payment technology are changing the game!

Innovations in QR Code Payment Technology

Innovations in QR code payment technology are changing how we shop. With better security features, users feel safer when making purchases. Many platforms now let you earn rewards through loyalty programs too.

This makes using QR codes not just easy, but also fun!

Integration with e-commerce platforms

QR code payments blend seamlessly with e-commerce platforms. KakaoPay and Naver Pay lead the way in this space. They make it easy for shoppers to pay online using QR codes. This integration boosts convenience for users.

Customers can quickly scan a code and complete their transaction.

The rise of these digital wallets connects shopping to payment methods such as static and dynamic QR codes. As a result, the retail sector benefits from faster checkouts and fewer errors at point-of-sale (POS) systems.

With growing smartphone penetration, more people adopt cashless solutions, which improves the user experience in online retail settings.

Enhanced security features

Security is key in digital payments. Advanced technologies keep users safe while using QR code payments. Biometric authentication helps to verify users quickly and accurately. This makes it hard for fraudsters to get access to accounts.

Real-time notifications also play a big role in security. Users receive instant alerts about transactions, which boosts transparency. When you make a payment or receive cash back, you know right away what happened.

These features build trust among customers and encourage more people to use contactless solutions like KakaoPay and Toss. Next up, let’s look at how these changes impact retail and consumer behavior.

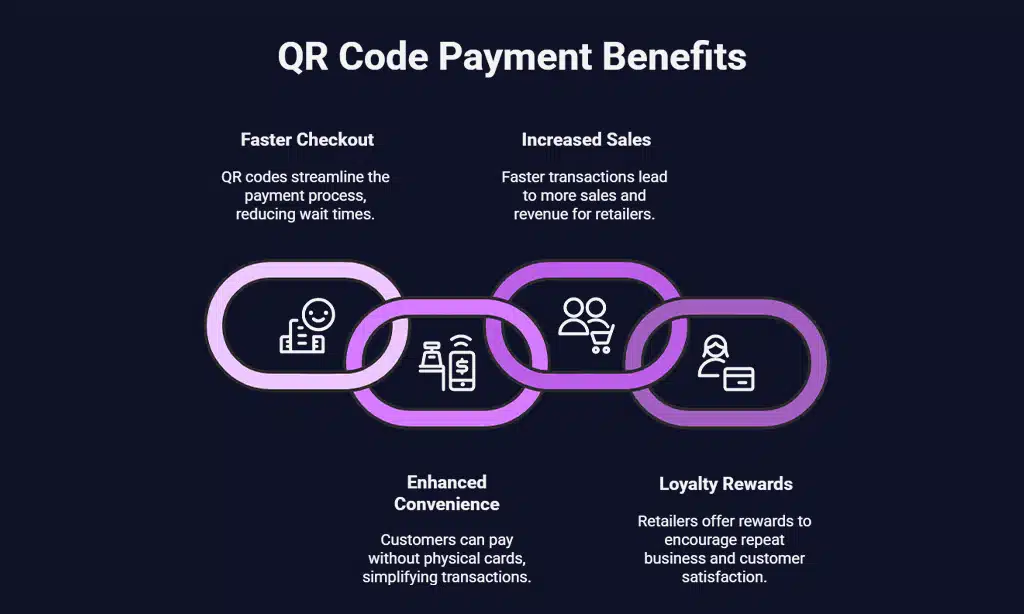

Rewards and loyalty programs

Rewards and loyalty programs are growing fast in South Korea. The loyalty market is set to reach $1.83 billion by 2025. Programs like “OK Cashback,” “Lotte,” “CJ One,” and “Happy Point” keep customers coming back.

These programs let users earn points or cash back for every purchase.

QR code payments pair well with these rewards. They make it easy to collect points while shopping. Customers enjoy the perks, like discounts and special offers. This system boosts sales for retailers too, making everyone happy!

Impact on Retail and Consumer Behavior

QR code payments change how people shop. They make checkout faster and easier. Customers can pay with a quick scan, no cards needed. This speed boosts sales for stores too.

Retailers like Samsung Pay and KakaoPay help in this shift. With loyalty rewards, shoppers feel valued and return often. A happy customer is always good for business!

Faster transaction processing

Payments happen fast with QR codes. They speed up the process for shoppers. In South Korea, this system processed 9.1 billion transactions in 2023 alone. Consumers enjoy quick checkouts at stores and online shops alike.

This swift processing leads to happier customers and more sales for businesses. No one likes waiting when they shop, right? QR codes make life easier by streamlining how we pay; it’s as simple as scanning a code with your phone! As technology grows, so does its impact on how people shop and pay every day.

Improved customer experience

QR code payments make buying easier and faster. Customers can complete transactions with a simple scan using their smartphones, thanks to the rise of digital wallets. This touch-free option cuts down wait times and makes shopping more enjoyable.

In stores, QR codes speed up checkout lines. Shoppers prefer this method for its convenience. They feel safer when paying without handling cash or cards. Enhanced customer satisfaction drives more people to use these solutions in everyday purchases.

Next, let’s look at the leading fintech and mobile payment platforms contributing to this growth.

Challenges and Future Outlook

Korea faces tough competition from global payment giants like Apple Pay and WeChat Pay. Regulatory changes may also change the game for QR code payments, shaping how locals use digital wallets in the future.

Competition with global payment platforms

Global payment platforms are big players in the digital payments game. Apple Pay and Samsung Pay compete for users here. In 2024, Samsung Pay had an 18% market share, while Apple Pay lagged behind with only 1%.

Many people prefer local wallets like KakaoPay and Naver Pay over these big names.

Local fintechs offer features that match or beat what global brands provide. They focus on user experience and security. This competition fuels innovation, making QR code payments more attractive to Korean consumers.

As traditional cash use declines, local apps thrive by meeting shopper needs quickly and safely.

Regulatory considerations

Regulations play a significant role in the rise of QR code payments in Korea. The South Korean government supports innovation in finance, which helps local companies compete with global giants.

They aim to make payment processes smooth for customers. This support has led to more cashless transactions and a shift to digital wallets.

Strong rules about security also help establish confidence among users. Many people feel secure using different payment methods, like KakaoPay or Toss. These platforms use enhanced safety features to protect user data.

As regulations become stricter, it becomes easier for everyone to enjoy seamless and secure QR code payments across various sectors, including retail and transportation.

Takeaways

Korea’s QR code payments have seen a huge jump. They grew by 300% in just three years. This surge is due to many reasons, like our love for smartphones and quick internet. People like using contactless options too.

With apps like KakaoPay, Naver Pay, and Toss leading the charge, it’s clear that these tools make life easier.

Think about how you could use these apps today! Going digital can save time. QR codes speed up payment processes at stores and help enhance customer experiences everywhere from supermarkets to cafes.

This growth matters because it shows how we can shift from cash to digital methods smoothly. Want more info on this topic? Check out online resources or articles that dive deeper into mobile payments.

Embrace the change; it makes life simpler!