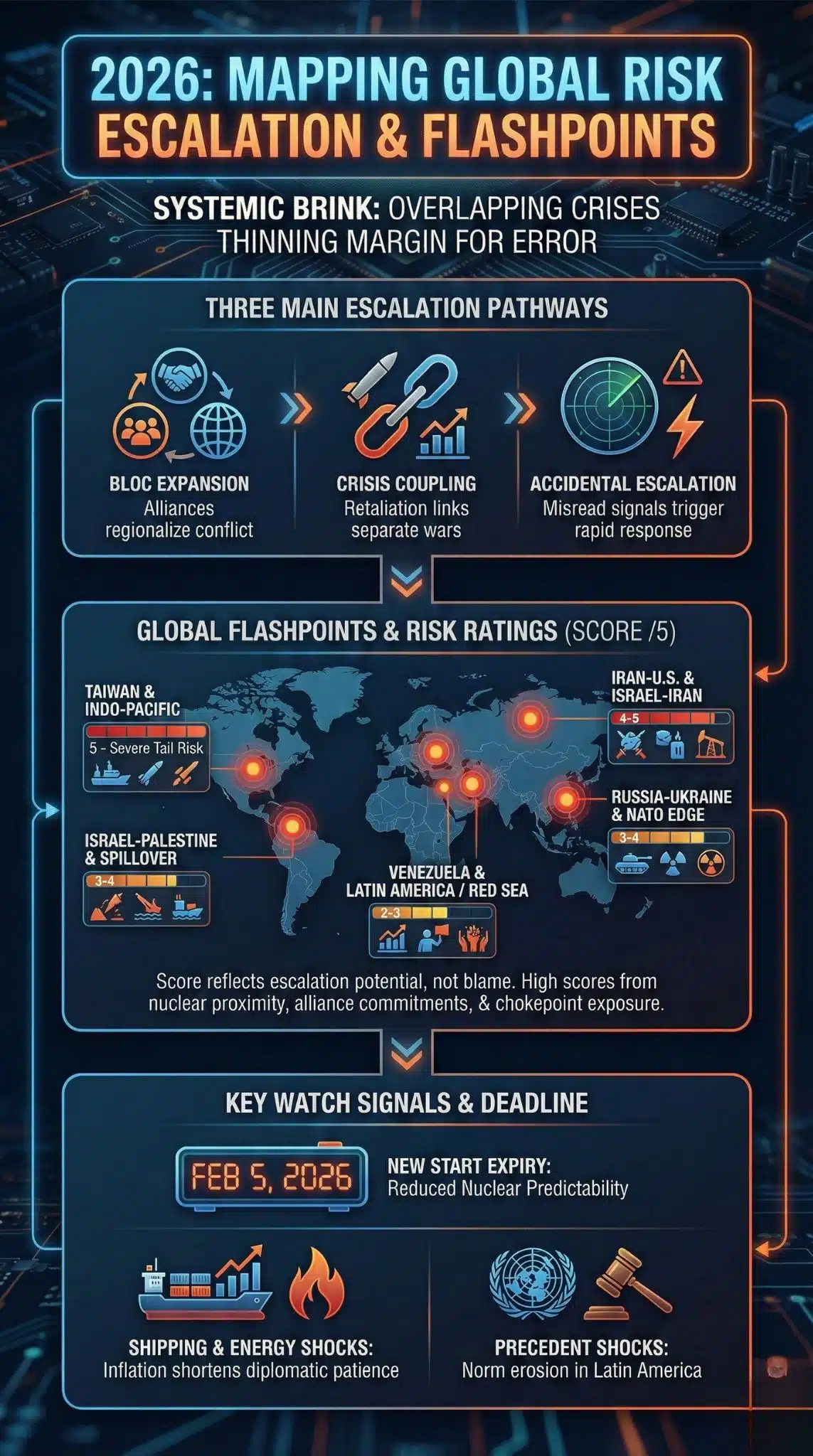

In early 2026, the risk debate is less about whether any leader wants a world war and more about whether overlapping crises can cascade. Arms-control uncertainty, repeated military rehearsals, and spillovers from wars into shipping and markets have thinned the system’s margin for error.

Reader Cheat Sheet

| What People Mean | What It Looks Like In Practice | Why It Matters | 2026 Watch Signals |

| “World War III” | A cascade across regions that forces major-power choices | Big wars often spread via entanglement | Cross-theater retaliation, alliance activation |

| “Nuclear risk” | Higher alert postures, weaker predictability | Deterrence works until it fails fast | New START expiry Feb 5, 2026; sharper alert messaging |

| “Economic spillover” | Sanctions, shipping shocks, debt increases, and inflation spikes are all contributing factors. | Markets can force political escalation | Red Sea risk premiums and freight shocks |

| “Flashpoints” | Taiwan Strait, Ukraine, Israel–Palestine, Iran–U.S. | These hubs can pull in allies and rivals | Biggest Taiwan drills, Iran unrest, Gaza-linked spillovers |

| “Periphery shocks” | Precedent events in Latin America, state fragility | Norm erosion makes crises harder to contain | Venezuela capture legality debate, asset freezes |

Risk Score Formula With Ratings

This score estimates escalation potential, not moral blame or certainty. It stays simple and readable. Score = Nuclear Proximity (0–2) + Alliance Entanglement (0–1) + Chokepoint And Market Exposure (0–1) + Incident Tempo And Operational Pressure (0–1)

Scoring Rubric

- Nuclear Proximity

- 0: No meaningful nuclear-power involvement

- 1: Nuclear powers involved indirectly or as backers

- 2: Direct standoff risk between nuclear powers or their core security interests

- Alliance Entanglement

- 0: Limited alliance commitments

- 1: High credibility stakes for alliances or major patrons

- Chokepoint And Market Exposure

- 0: Mostly local economic effects

- 1: Likely to hit global trade routes, energy, or major financial channels

- Incident Tempo And Operational Pressure

- 0: Lower frequency of high-risk encounters

- 1: Repeated drills, intercepts, protests, or tit-for-tat cycles that compress decision time

Risk Ratings By Flashpoint

| Flashpoint | Component Breakdown | Total | Rating Band |

| Taiwan And Indo-Pacific | Nuclear 2 + Alliance 1 + Chokepoint 1 + Tempo 1 | 5 | Severe Tail Risk |

| Iran–U.S. And Israel–Iran | Nuclear 2 + Alliance 1 + Chokepoint 1 + Tempo 0–1 | 4–5 | Very High |

| Israel–Palestine And Spillover | Nuclear 1 + Alliance 1 + Chokepoint 1 + Tempo 0–1 | 3–4 | Elevated |

| Russia–Ukraine And NATO Edge | Nuclear 2 + Alliance 1 + Chokepoint 0 + Tempo 0–1 | 3–4 | Elevated |

| Red Sea And Maritime Disruption | Nuclear 0–1 + Alliance 0 + Chokepoint 1 + Tempo 1 | 2–3 | Moderate |

| Venezuela And Latin America Precedent Shocks | Nuclear 0 + Alliance 1 + Chokepoint 0–1 + Tempo 0–1 | 2–3 | Moderate |

Why these Scores Are Grounded in Current Signals

- Taiwan tempo and rehearsal: Reuters described late-2025 drills as the largest to date with blockade-like elements and live firing.

- Iran volatility: Reuters reported at least 16 deaths in a week of protests in Iran in early January 2026, raising uncertainty in a region tied to shipping and escalation ladders.

- Chokepoint spillover: Reuters reported war-risk insurance premiums rising sharply after deadly Houthi attacks in the Red Sea.

- Latin America precedent shock: Reuters reported UN scrutiny of the legality of the U.S. capture of Venezuela’s leader, plus follow-on market and asset actions.

- Nuclear context: SIPRI estimates about 12,241 nuclear weapons at the start of 2025, with about 2,100 on high operational alert, mostly in the U.S. and Russia.

- Arms-control cliff: New START expires February 5, 2026.

How We Got Here

The modern risk is systemic. Multiple conflicts run in parallel, several touch nuclear powers, and decision cycles move faster than diplomacy. ACLED recorded more than 185,000 violent events worldwide in 2025, which points to a high baseline of instability that can overwhelm crisis management.

At the same time, guardrails are weaker. New START expires February 5, 2026, and it has been the main bilateral framework shaping predictability in U.S.–Russia strategic forces.

What World War III Would Look Like in 2026

A global war in 2026 does not have to mirror the total war of the 1940s. A modern “world war” is more likely to emerge as a linked escalation:

| Pathway | What It Looks Like | How It Spreads |

| Bloc Expansion | A big conflict pulls in treaty allies | Alliance credibility turns regional into system-wide |

| Crisis Coupling | Separate wars become linked via retaliation or sanctions | Leaders trade escalation in one arena for leverage in another |

| Accidental Escalation | Encounters, cyber, or misread signals trigger rapid retaliation | Decision windows shrink and mistakes compound |

Scenario Forecast Box: Lower, Mid, Higher Escalation Paths

These are conditional pathways analysts watch. They are not certainty claims.

| Flashpoint | Lower Escalation Path | Mid-Escalation Path | Higher Escalation Path | 2026 Triggers To Watch |

| Israel–Palestine | Stop-start ceasefires and localized flare-ups | Ceasefire collapse plus wider strikes | Regional spillover plus sustained maritime shock | Hostage process, aid access, Red Sea spillovers |

| Iran–U.S. | Sanctions and proxy friction contained | Proxy attacks rise, limited strikes | Direct exchange plus chokepoint crisis | Domestic unrest, U.S. signaling, shipping attacks |

| Taiwan | Coercion without kinetic clash | Quarantine-style enforcement, dangerous intercepts | Major conflict pulling in allies | Scale of drills, exclusion-zone behavior, near-collisions |

| Venezuela | Political turmoil and legal battles | Internal fragmentation and regional crisis | Precedent hardens global confrontation patterns | The UN’s positioning, shifts in sanctions, and actions related to markets and assets are all contributing factors. |

Taiwan and Indo-Pacific Pressure

Reuters described China’s late-2025 Taiwan-area drills as the most extensive to date, including live-fire and blockade-like signals. This pushes risk higher in two ways.

First, it normalizes a crisis posture. When militaries repeat a behavior often, they can later frame it as routine. Second, it compresses warning time. Bigger drills create more encounters, more intercepts, and more chances for a pilot or commander to misread intent.

| Escalation Path | What It Looks Like | Why It Spreads |

| Gray-zone pressure | Coast guard pressure and cyber activity | Misattribution risk and steady escalation |

| Quarantine or blockade | “Inspections” and denial zones | Forces third parties to decide whether to break it |

| Limited strikes | Targeted attacks on key capabilities | Credibility contests accelerate retaliation |

| Full invasion | High-intensity conflict | Highest chance of allied involvement |

Prediction: A blockade-like coercion episode is a higher near-term risk than a full invasion because it tests responses while keeping ambiguity. That ambiguity can still produce rapid escalation.

Europe’s Escalation Edge Around Ukraine

Europe remains a major escalation hub because it combines large conventional forces, alliance credibility, and nuclear arsenals. The global rearmament context matters. SIPRI reports world military spending hit $2.718 trillion in 2024, and IISS also documents historically high totals using a different methodology.

| Spillover Pressure | Why It Matters | What Lowers Risk |

| Incident risk | A single event can force alliance consultations | Deconfliction channels and incident protocols |

| Credibility politics | Leaders fear appearing weak | Clear objectives and phased commitments |

| Arms-control uncertainty | More worst-case planning | Stabilizing transparency measures and talks |

Prediction: The most plausible widening pathway is an incident chain rather than a deliberate decision to fight a direct NATO war.

Israel–Palestine And Regional Spillover

Ceasefire politics remain fragile because hostage and prisoner issues, aid access, and competing end states collide. CSIS has described these arrangements as phased with built-in friction points, and reporting has highlighted recurring roadblocks.

Spillover also matters. Reuters reported war-risk insurance premiums jumped after deadly Houthi attacks in the Red Sea, a channel that can export conflict into global inflation and politics.

| Risk Variable | Raises Risk | Lowers Risk |

| Hostage and prisoner process | Stalls trigger political rupture | Sequenced swaps with verification |

| Humanitarian access | Restrictions fuel instability | Predictable, monitored corridors |

| Regional spillover | Maritime and militia escalation | Coordinated diplomacy and restraint |

Prediction: Expect cycles in 2026 rather than a decisive settlement, with periodic spillover into shipping and regional posture.

Iran–U.S. and Israel–Iran Escalation Ladder

Reuters reported at least 16 deaths in Iran during a week of protests in early January 2026 tied to inflation and economic conditions. Domestic stress can make leaders more risk-tolerant or more fearful of appearing weak.

A UK House of Commons Library briefing on the June 2025 Israel–Iran conflict period matters because repeated direct exchange lowers the psychological barrier to future limited strikes.

| Escalation Step | What It Could Look Like | Why It Can Spread |

| Rhetoric and sanctions | Hardening threats and pressure | Locks leaders into credibility contests |

| Proxy intensification | More attacks on bases or shipping | Pulls outside powers into retaliatory cycles |

| Direct limited strikes | Targeted hits on facilities | Rapid retaliation and miscalculation risk |

| Chokepoint crisis | Maritime disruption at scale | Immediate global economic shockwaves |

Prediction: Risk peaks when domestic unrest, perceived coercion, and proxy-linked maritime incidents overlap because decision time collapses.

Energy and Shipping as Escalation Multipliers

Reuters reported on January 5, 2026, that analysts forecast Brent averaging $61.27 in 2026 under ample supply. A calm baseline can coexist with severe tail shocks when a chokepoint event hits.

A World Bank report noted the Drewry World Container Index surged about 170% from Nov 2023 to a Jan 2024 peak near $4,000 per 40-foot container during Red Sea disruptions. Reuters reported war-risk premiums more than doubled after deadly attacks, raising the cost of operating through the route.

| Transmission Channel | What Recent Evidence Shows | Why It Raises Risk |

| Oil volatility | Low averages can mask spike risk | Political backlash grows fast |

| Freight shock | Container costs can surge sharply | Inflation squeezes governments |

| Insurance premiums | War-risk pricing jumps | More naval posture and confrontation |

Prediction: Multi-front escalation becomes more plausible when shipping and energy shocks overlap because inflation shortens diplomatic patience.

Latin America and Precedent Shocks

Latin America matters in this risk map less as an interstate battlefield and more as a precedent engine and financial spillover channel.

Reuters reported UN scrutiny over the legality of the U.S. capture of Venezuela’s leader, and Reuters also reported Venezuela’s bonds surged after the capture as markets reassessed restructuring possibilities. Reuters further reported Switzerland froze assets linked to Maduro and associates.

| Spillover Vector | Why It Matters | 2026 Watch Signals |

| Intervention precedent | Weakens containment norms | UN reactions and copycat logic elsewhere |

| Market shock | Debt and asset shifts ripple | Bond negotiations and sanctions clarity |

Prediction: The region’s main global risk is norm erosion plus financial shock transmission, not conventional war.

Bottom Line

If “likely” means “more probable than not,” a full global war remains unlikely. Nuclear deterrence and mutual economic exposure still restrain deliberate escalation.

If “likely” means “risk is higher than a decade ago,” the answer is yes. The system is running hotter and has fewer buffers. The new START’s Feb 5, 2026, expiry matters because predictability reduces worst-case planning.

The physical battlefield is only half the story. In Part 2, we move from the front lines to the “Gray Zone”, analyzing how Cyber warfare, AI escalation, and Economic sieges could trigger a systemic collapse before a single missile is fired.