We have all received those annoying robocalls about our vehicle’s coverage about to expire. They are frustrating, intrusive, and often scams. But behind the nuisance lies a genuine financial question that every driver faces as their vehicle ages: Is an extended car warranty worth it in the current automotive landscape?

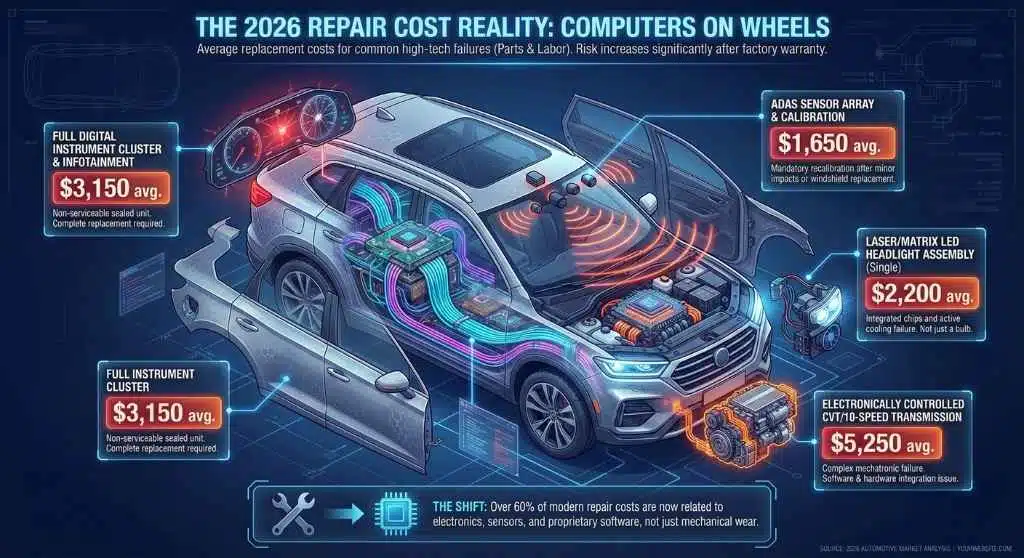

As we move into 2026, the answer is no longer a simple “yes” or “no.” Vehicles have effectively become supercomputers on wheels, and the cost of repairing them has outpaced general inflation. Mechanics are now charging upwards of $180 to $200 per hour in labor rates alone. If you are driving a car that has just passed its factory warranty period, you are statistically entering the “danger zone” where major components, specifically complex electronics, are most likely to fail.

This guide will strip away the marketing fluff and dive deep into the math, the risks, and the fine print. We will analyze whether a Vehicle Service Contract (the technical term for an extended warranty) is a smart financial hedge for 2026 or just an unnecessary monthly expense.

Key Takeaways

-

Assess Reliability: If you drive a Toyota or Honda, “Self-Insurance” (saving money monthly) is statistically the better financial move.

-

Assess Tech: If you drive a car laden with screens and sensors (or a luxury European brand), a warranty is a smart hedge against $3,000+ repair bills.

-

Timing Matters: Don’t buy an extended warranty when your car is brand new. Wait until the factory warranty is roughly 6 months from expiring.

-

Read the Fine Print: Always opt for “Exclusionary” coverage and ensure you understand the “Wear and Tear” exclusions.

-

Negotiate: Warranty prices are not fixed. You can often negotiate $500 to $800 off the initial price quoted by a dealer or phone rep.

What Actually is an “Extended Warranty”? (VSC Explained)

Before we can decide if it is worth your money, we need to clarify what you are actually buying. Technically, you are not buying a “warranty.” A warranty is a guarantee provided by a manufacturer at no extra cost when you buy a product.

What you are purchasing is a Vehicle Service Contract (VSC). This is a paid agreement between you and a provider (either the automaker or a third-party company) that agrees to pay for specific repairs for a set period or mileage.

The Two Main Types of Coverage

Understanding the difference between these two is critical to avoiding a denied claim.

| Coverage Type | What It Covers | What It Excludes | Best For |

| Powertrain | The parts that make the car move: Engine, Transmission, Drive Axles. | Air conditioning, electrical systems, suspension, steering, brakes, sensors. | High-mileage used cars, where the main concern is a catastrophic engine failure. |

| Exclusionary (Bumper-to-Bumper) | Everything in the car except a specific list of excluded items. | Routine maintenance (oil, tires, brake pads), cosmetic damage, and specific wear items. | Newer cars with complex tech, touchscreens, and ADAS sensors. |

Pro Tip: In 2026, a Powertrain warranty is rarely enough. The most common failures today are not engines blowing up; they are $3,000 infotainment screens going black or $1,500 sensors failing. Always aim for “Exclusionary” coverage if you can afford it.

The Financial Landscape: Repair Costs in 2026

To determine if the warranty cost (typically $1,500 to $3,500 total) is justified, we must look at the potential liability. Repair costs have surged due to the complexity of parts and the scarcity of skilled technicians.

Here is a breakdown of average repair costs for common failures in 2026 for a standard mid-size SUV:

| Component Failure | Average Repair Cost (Parts + Labor) | Probability of Failure (5-7 Year Mark) |

| Digital Instrument Cluster | $2,800 – $3,500 | Medium |

| Transmission Replacement | $4,500 – $6,000 | Low-Medium |

| AC Compressor | $1,200 – $1,800 | High |

| LED Headlight Assembly | $1,500 – $2,500 | Medium |

| Suspension Air Struts (Luxury) | $2,000 – $4,000 | High |

| Timing Chain/Belt | $1,500 – $2,200 | Medium |

If you encounter just one of these major issues, the warranty often pays for itself instantly. However, if you drive a reliable vehicle and only face minor issues, you may lose money.

5 Reasons You SHOULD Buy an Extended Warranty

For many drivers, particularly those without a massive emergency fund, a warranty is a financial safety net.

1. Protection Against “High-Tech” Failure

The days of fixing a car with a wrench and a screwdriver are over. Modern vehicles rely on LiDAR, radar, cameras, and massive touchscreens.

-

The Risk: A single dead pixel on your infotainment screen often requires replacing the entire unit.

-

The Reality: These components are rarely serviceable. They are “replace-only” parts, and they are incredibly expensive. An extended warranty acts as insurance for your car’s brain, not just its brawn.

2. The Inflation Hedge

Repair costs increase every year. Labor rates at dealerships have risen roughly 5-10% annually over the last few years.

-

By purchasing a warranty today, you are effectively locking in today’s repair prices. If your transmission fails in 2028, you won’t care that labor rates have jumped to $250/hour. Your $100 deductible remains the same.

3. Peace of Mind for Used Luxury Cars

If you are buying a used BMW, Audi, Range Rover, or Mercedes-Benz, an extended warranty is almost mandatory.

-

The “German Tax”: Parts for European cars can cost 3x to 4x more than equivalent parts for a Toyota or Ford.

-

One-Repair Breakeven: On a Range Rover, a single air suspension failure can cost more than the entire 3-year warranty policy. In this specific scenario, the question “Is an extended car warranty worth it?” is almost always a resounding yes.

4. Perks Beyond Repairs

Top-tier providers (like Endurance, Carchex, or factory extensions) have evolved to offer lifestyle perks that add genuine value:

-

24/7 Roadside Assistance: Towing, battery jumps, and lockouts.

-

Rental Car Reimbursement: If your car is in the shop for 5 days, the warranty pays for your rental (usually up to $40-$50/day).

-

Trip Interruption: If you break down more than 100 miles from home, they reimburse you for hotels and meals while you wait for repairs.

5. Boosted Resale Value

Most reputable extended warranties are transferable for a small fee (usually $50).

-

When selling your car privately, being able to list it as “Warranty Valid until 2028” creates massive trust.

-

It differentiates your car from the dozens of others on the market. A buyer will happily pay $1,000 more for your car knowing they won’t face surprise repair bills for the next two years.

5 Reasons You SHOULDN’T Buy an Extended Warranty

Despite the benefits, the industry has a dark side. For financially disciplined drivers with reliable cars, a warranty is often a losing bet.

1. The “Bank Account” Strategy (Self-Insurance)

The mathematical reality is that warranty companies are in business to make a profit. They calculate that the average driver will pay more in premiums than the company pays out in claims.

-

The Strategy: Instead of paying $120/month for a warranty, put that $120 into a high-yield savings account.

-

The Result: If your car breaks, you have the cash. If it doesn’t break, you keep the money. With a warranty, if the car doesn’t break, that money is gone forever.

2. Duplicate Coverage Risks

Dealers are trained to sell you everything in the “Finance Box” before you leave the lot.

-

The Trap: Buying an extended warranty on a brand-new car. Your new car already has a 3-year/36,000-mile comprehensive warranty (and often a 5-year/60,000-mile powertrain).

-

Why wait: If you buy a 7-year extended warranty on day one, the first 3 years are essentially overlapping with coverage you already have for free. You are paying interest on coverage you can’t use. Wait until your factory warranty is nearing expiration to buy the extension.

3. The “Wear and Tear” Trap

This is the #1 source of consumer complaints. You must understand the difference between Mechanical Breakdown and Wear and Tear.

-

Covered: The alternator stops spinning internally.

-

Not Covered: The brake pads wear down, the clutch burns out, or the shocks leak due to age.

-

Many budget warranties have clauses that deny claims if a part failed due to “normal wear.” If your engine overheats because a rubber hose cracked (a wear item), the warranty might deny the entire engine claim.

4. Repair Delays & Pre-Authorization

With a factory warranty, you drop the key at the dealer and leave. With a third-party VSC, the process is slower.

-

The Process: The mechanic must diagnose the car, call the warranty company, wait on hold, and submit a claim.

-

The Inspection: For expensive repairs (like a transmission), the warranty company may send an independent inspector to physically look at the car to ensure the damage wasn’t caused by neglect. This can add 2-4 days to your repair timeline.

5. Scams and Fly-by-Night Providers

The industry is rife with aggressive telemarketing and “spoofed” calls.

-

The Risk: If you buy a warranty from a small, unrated company and they go bankrupt (which happens frequently), your contract becomes a worthless piece of paper. You lose your coverage and your money instantly.

The DIY Warranty Fund Calculator

If you decide to self-insure, do not just hope for the best. Use this simple 2026 formula to build your own safety net.

The “10 Cent” Rule: Financial experts recommend saving $0.10 for every mile you drive.

-

Math: If you drive 12,000 miles a year, that is $1,200/year.

-

Action: Set up an automatic transfer of $100/month into a high-yield savings account (HYSA) labeled “Car Repair.”

-

Why it wins: If your transmission fails, the money is there. If it doesn’t fail by the time you sell the car, you have a $5,000 cash bonus for your next down payment. A warranty company would have kept that money.

The “Betterment” Clause Trap (Must Read)

One of the nastiest surprises in the fine print is the “Betterment Clause.” This allows the warranty company to charge you for a portion of the repair if the new part increases your car’s value.

-

The Scenario: You have an old car with 90,000 miles. The engine blows. The warranty approves a replacement, but they can’t find a used engine, so they install a brand new crate engine.

-

The Trap: Because a new engine makes your 90,000-mile car worth more than it was before the failure, the warranty company argues they have “bettered” your vehicle.

-

The Bill: They might cover the labor, but ask you to pay 20-30% of the parts cost. Always search your contract for the word “Betterment” before signing.

Manufacturer vs. Third-Party Warranty: Which is Better?

When you decide to buy, you have two distinct choices. Here is how they stack up in 2026.

| Feature | Manufacturer Warranty (Ford, Toyota, etc.) | Third-Party Warranty (Endurance, Carshield, etc.) |

| Where to Buy | Only at the dealership (usually before the factory warranty expires). | Online or over the phone at any time. |

| Where to Repair | Only at authorized brand dealerships. | Any ASE-certified mechanic (Dealerships or Independent shops). |

| Cost | Generally more expensive upfront. | More competitive pricing and monthly payment options. |

| Parts Used | 100% Genuine OEM parts guaranteed. | May use “Like Kind and Quality” (refurbished or aftermarket) parts. |

| Approval Speed | Instant. | Requires pre-authorization (24-48 hours). |

| Best For | Newer cars, drivers who want the “VIP” dealer experience. | Used cars, older cars; drivers who have a trusted local mechanic. |

The Cheaper Secret: “Mechanical Breakdown Insurance” (MBI)

Before you spend $3,000 on a Vehicle Service Contract, check your car insurance policy. Major providers like GEICO and Progressive offer something called Mechanical Breakdown Insurance (MBI).

-

The Cost Difference: While a third-party warranty might cost $100–$150/month, MBI is often added to your standard insurance premium for just $30–$50/year.

-

The Catch: You must act fast. Most insurers only allow you to add MBI if you are the original owner and the car is less than 15 months old or has fewer than 15,000 miles.

-

The Verdict: If your car is brand new, skip the dealer warranty and add MBI to your auto insurance immediately. It is mathematically the cheapest coverage available.

How to Negotiate the Price (They Will Drop It)

Extended warranties are high-margin products. Dealers and phone sales reps often have a 100% to 200% markup built into the initial price. Never pay the first number they show you.

Use this Negotiation Script:

-

The “Check” Move: “I have a quote here from [Competitor Name] for similar coverage at $1,800. You are asking $2,800. Can you match their price, or should I just sign with them?”

-

The “Finance Office” Move: If you are at a dealership, look at the Finance Manager and say: “I am interested in the protection, but I will not finance it into the loan and pay interest on it. I will pay $1,500 cash for the warranty right now, take it or leave it.”

-

The Result: They will often “suddenly remember” a coupon or a manager’s special that drops the price by $500–$800 instantly.

How to Spot a Reputable Provider (Avoid the Scams)

If you decide the answer to “Is an extended car warranty worth it?” is yes, you must buy safely. Follow this checklist before signing anything.

- Check the Underwriter:Legitimate warranty companies are “Administrators,” but the money is backed by an “Underwriter” (an insurance company). Ensure the policy is backed by a major insurer with an A.M. Best rating of “A” (Excellent). If they won’t tell you who the underwriter is, hang up.

- Read the “Exclusions” List First:Do not read what is covered; read what is not covered. A reputable contract will have a clear section titled “What Is Not Covered.” If this section is vague or missing, it is a red flag.

- Look for “Direct” Providers:Avoid brokers who just sell your info. Go to direct providers who handle their own claims. Companies like Endurance, CARCHEX, and Olive are generally regarded as the industry leaders with established track records.

- The 30-Day Money-Back Guarantee:By law, you typically have a “review period” (usually 30 days). If you buy a policy, read the thick booklet they mail you. If you don’t like the fine print, cancel it immediately for a full refund.

Frequently Asked Questions (FAQ)

1. Does an extended warranty cover the engine if I miss an oil change?

No. Nearly every contract requires you to maintain the vehicle according to the manufacturer’s recommended schedule. You must keep receipts for all oil changes and services. If your engine fails and you cannot prove you changed the oil, the claim will be denied due to “neglect.”

2. Can I cancel my extended car warranty if I sell the car?

Yes. This is a little-known benefit. If you sell your car or trade it in, you can cancel the remaining portion of your warranty. You will receive a prorated refund for the unused time or mileage (minus a small administrative fee).

3. Is it better to buy from the dealer or online?

Dealers often mark up the price of warranties by 50% or more to make a profit. However, dealer warranties are often easier to use. Strategy: Get a quote from a third-party provider before you go to the dealership. Use that quote to negotiate the dealer’s price down.

4. What does “deductible” mean in a car warranty?

Just like health insurance, this is the amount you pay out of pocket per visit. Common deductibles are $100 or $200. Tip: Look for a “disappearing deductible” option. Some policies waive the deductible if you get the repair done at a specific network of shops.

5. Do extended warranties cover electric vehicle (EV) batteries?

Usually, no. The high-voltage battery pack in an EV is typically covered by the manufacturer for 8 years/100,000 miles. Most extended warranties exclude the main battery pack but will cover the electric motors, charging modules, and the massive infotainment screens inside the EV.

Final Thoughts: The “Sleep at Night” Factor

Ultimately, asking “Is an extended car warranty worth it?” is less about cars and more about your psychology.

If a surprise $2,500 repair bill would ruin your month or put you into credit card debt, an extended warranty is a valuable financial tool. It converts an unpredictable, scary expense into a predictable, manageable monthly payment. However, if you are financially disciplined enough to build your own repair fund, you will likely save money in the long run by skipping the warranty.

In 2026, with repair costs higher than ever, the protection is valuable, but only if you buy the right plan for the right car.