As risks evolve, so should the way financial institutions approach risk management. Cyber threats, regulatory pressure, operational disruption, and third-party exposure are pushing risk out of its traditional silos and into the center of strategic planning. For banks and other financial institutions, the question is no longer whether to modernize risk management but how to do it effectively.

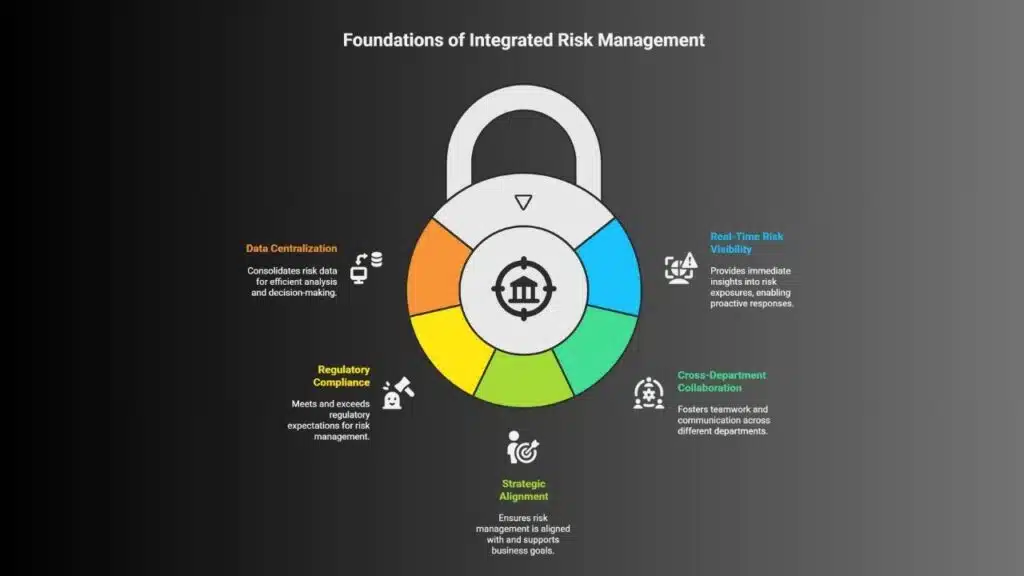

Enter Integrated Risk Management (IRM), a risk management approach that considers and combines risk data, processes, and decision-making across departments and functions. IRM isn’t just another framework; it’s a shift in how banks and other financial institutions identify, assess, and respond to their risks.

If your bank still relies on a disconnected approach to risk management, chances are you’re missing existing or emerging risks. In today’s dynamic regulatory environment, how institutions identify, manage, and respond to risk will remain a focal point for examiners. With that in mind, let’s take a closer look at IRM and how your institution can implement it effectively.

Why IRM Matters

IRM moves beyond the regulatory checkbox approach to governance, risk, and compliance (GRC) risk management by giving banks real-time risk visibility, driving collaboration across departments, and tying directly into business strategy. That’s essential in an interconnected environment because operational missteps can quickly spiral into reputational damage, and a compliance failure can derail strategic goals. IRM helps banks see how risks are connected and what that means for the organization as a whole.

Regulators are also shifting focus. They now expect integrated risk frameworks, from enterprise-wide accountability to board-level oversight and effective controls — areas where IRM excels. Moreover, with integrated risk management solutions, banks and other financial institutions can centralize risk data, streamline assessments, and surface insights at scale — resulting in a smarter, more agile approach to risk that enables confident decision-making and calculated growth.

IRM’s Key Components

IRM is built on six key components that bring structure, visibility, and strategy to an institution’s risk view:

- Strategy: A risk management approach should align with an institution’s size, resources, and market footprint. Strategic plans should be realistic and scalable, not simply aspirational documents that only stall progress.

- Assessment: Identifying and prioritizing risks is foundational. Effective risk assessments go beyond regulatory checklists, drawing in insights from compliance, audit, and front-line functions to uncover less obvious issues and vulnerabilities.

- Response: Once risks are identified, institutions should develop tailored response plans based on their business model and risk appetite. This process may include enhancing vendor oversight or addressing portfolio concentrations.

- Communication: IRM is a team effort that requires cross-departmental collaboration. Risk policies and expectations should be communicated across business lines to break down silos and create shared accountability across all levels of the organization.

- Monitoring: Clear ownership and consistent tracking are critical to ensuring risk strategies are followed. Ongoing monitoring supports accountability and keeps mitigation efforts aligned with institutional goals.

- Technology: Manual processes can slow down risk visibility. Automated governance, risk and compliance software helps empower institutions with timely insights, streamlines reporting, and enables a comprehensive view of risk.

IRM unifies fragmented efforts across departments — linking strategy, communication, monitoring, and technology — to give banks the visibility they need to manage risk proactively.

Implementing IRM: Best Practices for Banks

Understanding IRM’s components is only the beginning. Putting them into practice is what drives real value. Consider the following steps when implementing IRM across your institution:

- Break down silos. Encourage open communication between your institution’s risk, compliance, IT, audit, and business units. A shared platform for risk data can help streamline the collaboration process and ensure all shareholders are aware of updates and changes.

- Create a common risk language. Often, departments will use different words or categories to describe risk levels. Standardize risk categories, metrics, and reporting to ensure consistency across departments and meaningful analysis at the enterprise level.

- Link risk to strategy. Risk management should support, not hinder, your institution’s strategic objectives. Map risks to your organization’s key goals so leadership can see the bigger picture and make informed decisions.

- Automate the manual. Free up your colleagues’ time and reduce errors by automating tasks, such as risk assessments, control testing, and issue tracking.

- Monitor continuously. Risk isn’t static — it’s dynamic. Use real-time dashboards and alerts to detect emerging threats before they snowball.

- Engage leadership. Executive teams and board members want clear, timely risk information. IRM provides the transparency required for effective governance.

- Build a risk-aware culture. Everyone has a role in managing risk. Invest in employee training and communication to ensure risk thinking stays top of mind in daily operations.

The Competitive Edge of IRM

Banks that adopt IRM aren’t just managing risk better. They’re becoming more agile, resilient, and growth oriented. With a potential crisis always around the corner, IRM empowers institutions to make informed decisions and respond more effectively.

The shift to IRM won’t happen overnight, but for banks and other institutions willing to make the move, the benefits are clear: improved compliance, stronger governance, and the ability to turn risk into a competitive advantage.