Need funds fast? Whether it’s an unexpected expense or a planned purchase, an instant personal loan can be a lifesaver. But while these loans promise quick disbursal, not everyone gets approved right away. Lenders assess multiple factors before granting approval, and even minor mistakes can cause delays.

Want to boost your chances of getting your loan approved without hassles? In this guide, we’ll walk you through the essential steps to speed up the process and secure your funds in no time. Let’s dive in!

Eight steps to ensure instant approval for your personal loan

Digital personal loans get approved instantly since the process is completely online. However, you must consider a few factors to make the process smooth as such as:

1. Check your eligibility

Before applying, review the eligibility criteria set by the lender. This includes factors like age, income, employment stability, and credit score. Ensure that you meet the eligibility criteria beforehand to avoid disappointments later.

With FIRSTmoney smart personal loans by IDFC FIRST Bank, you can easily check your eligibility along the application process and get approved of loan amounts up to ₹10 lakhs instantly. The loans are available to both salaried and self-employed individuals.

2. Maintain a good credit score

A high credit score, typically above 700, signals creditworthiness and that you can repay your loan easily. If your credit score is low, work on improving it by clearing existing debts and ensuring timely payments. A good credit score not only improves approval chances but may also help you secure a lower interest rate.

3. Choose the right loan amount

Assess your financial needs and apply for a loan amount you can comfortably repay. Overestimating your requirement can increase the chances of rejection. Use the IDFC FIRST Bank personal loan EMI calculator to determine a suitable loan amount and repayment tenure that fits your budget.

4. Provide accurate and complete information

Ensure that all details you provide during the application process are accurate and match your official documents. Any discrepancies can lead to unnecessary delays or rejection.

5. Prepare required documents

Lenders require certain documentation pertaining to your identity, address, and income for loans approvals. Having these documents handy expedites the application process.

6. Select a suitable tenure

Choosing the right repayment tenure is crucial. A shorter tenure means higher EMIs but lower interest, while a longer tenure reduces monthly EMIs but increases overall interest.

7. Maintain a stable income and employment history

Lenders prefer applicants with stable employment and a consistent income source. A steady financial background assures them of your ability to repay the loan. If you are self-employed or a freelancer, demonstrate consistent earnings with bank statements or tax filings.

8. Apply with a trusted lender

Choose a lender known for its transparent processes and customer-friendly policies. IDFC FIRST Bank FIRSTmoney smart personal loan is a reliable option, offering competitive interest rates starting at just 10.99% per annum, instant disbursal, and zero foreclosure charges. This means that you get a cost-effective loan which you can close your loan anytime without any charges. Its quick and transparent online journey ensures a smooth experience from application to approval.

Why choose FIRSTmoney by IDFC FIRST Bank for an instant personal loan?

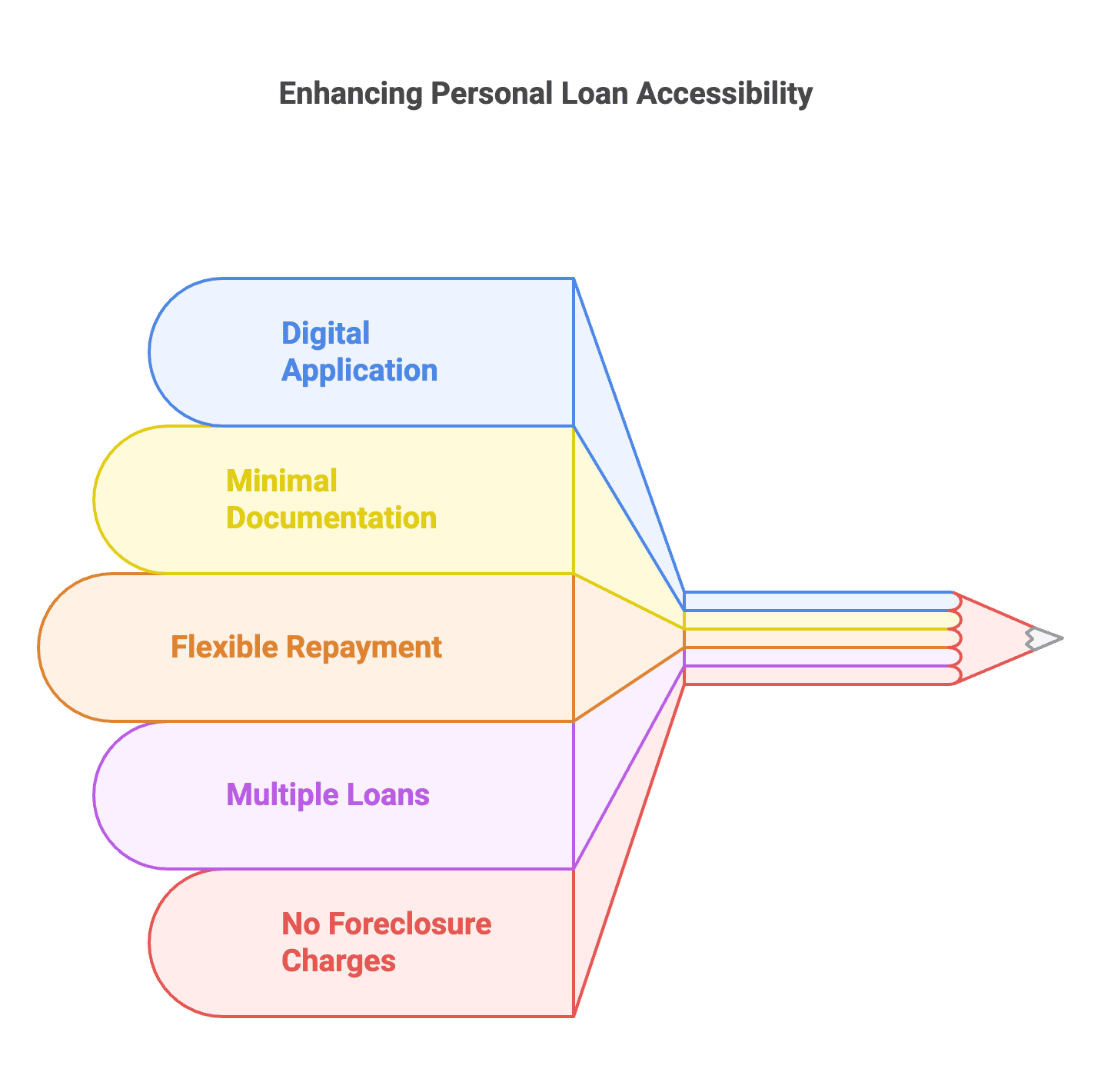

Opting for a convenient and transparent process is crucial, which makes IDFC FIRST Bank’s FIRSTmoney smart personal loan is an ideal solution. FIRSTmoney simplifies your loan journey with features including:

- Fully digital application process: FIRSTmoney has a completely online and DIY application process, allowing you to input and verify your details conveniently along the process.

- Minimal documentation: With FIRSTmoney, when applying for a personal loan, you only need your PAN card during the video KYC process, ensuring a hassle-free process.

- Flexible repayment tenure: FIRSTmoney offers flexible tenures ranging from 9 to 60 months, allowing you to pick one that aligns with your repayment capacity.

- Multiple loans on-demand: Once approved, you can obtain multiple loans, without starting the application process from scratch.

- Zero foreclosure charges: You can repay and close your personal loan anytime without incurring any fees or penalties.

To apply for the FIRSTmoney smart personal loan, you need to meet the following eligibility criteria:

- Have a credit score of 730 or higher

- Be salaried or self-employed

- Age between 21 to 60 years

Takeaways

Securing a quick approval for your personal loan is a matter of preparation and choosing the right lending partner. The steps outlined above can help you get a quick approval for your loan. Opting for a customer-centric solution like a FIRSTmoney smart personal loan can ensure a hassle-free experience and timely access to funds. With features like instant approval, competitive rates, and flexible tenures, FIRSTmoney gives you the freedom to meet your financial goals efficiently.

Take the step toward financial ease with FIRSTmoney and enjoy a seamless loan application process!