The crypto landscape of 2026 bears little resemblance to the “Wild West” of 2021. With the approval of spot ETFs for major assets, the integration of AI agents on-chain, and the passing of global regulatory frameworks like the CLARITY Act, the market has matured. But maturity hasn’t killed volatility.

As we move through Q1 2026, the signal-to-noise ratio on platforms like X (formerly Twitter) and Farcaster has become the investor’s biggest enemy. Deepfake scams are rampant, and “engagement farming” bots drown out legitimate analysis.

To survive and thrive this cycle, you need to curate a feed of builders, data scientists, and macro-economists—not just hype-men.

This guide profiles the 10 most influential crypto voices defining the 2026 narrative. These aren’t just accounts with high follower counts; they are the architects, watchdogs, and analysts who are actually shaping the future of Web3.

Why Following the Right Influential Crypto Voices Matters in 2026

In 2026, “Alpha” (information that gives you a trading edge) doesn’t come from finding a meme coin 10 minutes early. It comes from understanding three converging trends:

- The AI x Crypto Intersection: Autonomous agents are now managing portfolios. You need experts who understand this code-level shift.

- Institutional Flows: With pension funds and sovereigns buying Bitcoin, on-chain data matters more than chart patterns.

- Regulatory Reality: Compliance is no longer optional. Following voices who understand policy is as important as following developers.

Pro Tip: Don’t just follow these accounts on X. Subscribe to their newsletters or Farcaster feeds. In 2026, decentralized social media is where the real technical alpha is shared first to avoid bot-scraping.

10 Most Influential Crypto Figures (Categorized)

We have categorized these influencers by their “Value Add”—whether you need macro analysis, technical data, or safety alerts.

1. The Visionary: Vitalik Buterin

- Role: Co-Founder of Ethereum

- Focus: Blockchain Philosophy, Scaling (Layer 3), Bio-hacking

- Handle: @VitalikButerin (X/Farcaster)

Why Follow in 2026

Vitalik remains the moral and technical compass of the industry. In 2026, his focus has shifted from simple scaling to “The Scourge”—addressing centralization risks in Ethereum’s staking layer. His blog posts are often the leading indicator for where developer attention will flow next. If Vitalik writes about “ZK-EVMs” or “Pop-up Cities” today, a dozen startups will launch around those concepts tomorrow.

- Best For: Deep technical understanding and long-term industry direction.

2. The Macro Bull: Michael Saylor

- Role: Executive Chairman, MicroStrategy

- Focus: Bitcoin Corporate Strategy, Macro-economics

- Handle: @saylor

Why Follow in 2026

With corporations now standardizing “Digital Asset Treasuries” (DAT), Saylor is the playbook author they all read. His influence has transcended “Bitcoin maxi” rhetoric; he now advises nation-states and Fortune 500 boards on integrating BTC as a reserve asset. Follow him to gauge the temperature of institutional adoption. When Saylor speaks, Wall Street listens.

- Best For: Bitcoin conviction and institutional market sentiment.

3. The On-Chain Sleuth: ZachXBT

- Role: Independent Blockchain Investigator

- Focus: Security, Scam Exposure, Accountability

- Handle: @zachxbt

Why Follow in 2026

In an era of AI-driven phishing and complex DeFi hacks, ZachXBT is the most important “safety” follow on your list. He has single-handedly recovered millions in stolen funds and exposed bad actors before they could rug-pull new projects. His alerts are essentially the “air raid sirens” of the crypto world—if he posts about a protocol you are using, you withdraw first and ask questions later.

- Best For: Protecting your capital and avoiding scams.

4. The Data Scientist: Benjamin Cowen

- Role: Founder, Into The Cryptoverse

- Focus: Quantitative Analysis, Logarithmic Regression

- Handle: @intocryptoverse

Why Follow in 2026

While others draw random triangles on charts, Cowen brings an engineering mindset to market cycles. His analysis of “diminishing returns” and “lengthening cycles” has proven accurate through the volatility of 2024-2025. He avoids “hopium” (false hope) and focuses strictly on what the math says. In the uncertain market of early 2026, his cool-headed, data-first approach is a necessary counterweight to hype.

- Best For: Realistic, math-based market outlooks (No hype).

5. The Network Architect: Balaji Srinivasan

- Role: Investor, Author of “The Network State”

- Focus: Parallel Societies, AI Governance, Decentralized Science (DeSci)

- Handle: @balajis

Why Follow in 2026

Balaji predicts societal shifts before they happen. In 2026, as “Network States” (digital-first communities gaining physical recognition) become a reality, his theories are being put into practice. He is currently heavily focused on the intersection of AI and Crypto—specifically how blockchain can prove “humanhood” in a world flooded with AI content.

- Best For: Big-picture trends 5–10 years out.

6. The Educator: Guy Turner (Coin Bureau)

- Role: Host of Coin Bureau

- Focus: Fundamental Analysis, Project Deep Dives, News

- Handle: @coinbureau

Why Follow in 2026

For the average investor, keeping up with Layer 3 interoperability or Zero-Knowledge proofs is impossible. Guy Turner excels at translating this complex jargon into digestible, unbiased education. Unlike many influencers who sell their audience to the highest bidder, Coin Bureau has maintained a high standard of disclosure and research rigor.

- Best For: Beginners to Intermediates needing clear explanations of new tech.

7. The On-Chain Analyst: Will Clemente

- Role: Co-Founder of Reflexivity Research

- Focus: Supply Dynamics, Whale Movements, ETF Flows

- Handle: @WClementeIII

Why Follow in 2026

Price action tells you what happened; on-chain data tells you why. Will Clemente specializes in tracking the movement of coins from exchanges to cold storage (a bullish signal) or vice-versa. In 2026, his analysis of ETF inflows vs. miner selling pressure is one of the most accurate ways to predict short-term price movements without staring at charts all day.

- Best For: Understanding the “plumbing” of market supply and demand.

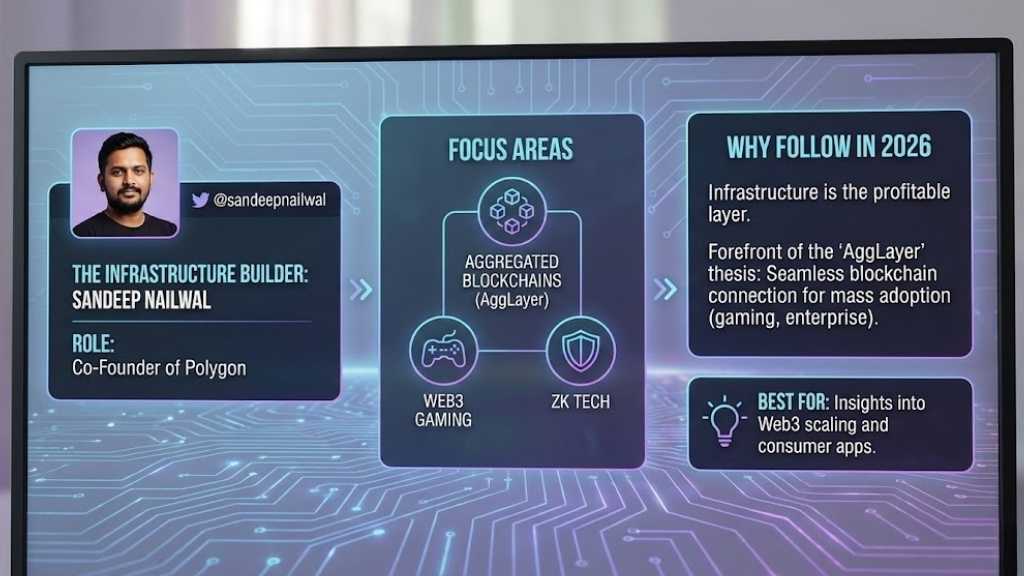

8. The Infrastructure Builder: Sandeep Nailwal

- Role: Co-Founder of Polygon

- Focus: Aggregated Blockchains, Web3 Gaming, ZK Tech

- Handle: @sandeepnailwal

Why Follow in 2026

Infrastructure is the boring but profitable layer of crypto. Sandeep is at the forefront of the “AggLayer” thesis—the idea that all blockchains should connect seamlessly so users don’t know which chain they are on. Following him gives you a front-row seat to the mass adoption phase of Web3, particularly in gaming and enterprise apps.

- Best For: Insights into Web3 scaling and consumer apps.

9. The Institutional Voice: Cathie Wood

- Role: CEO, ARK Invest

- Focus: Disruptive Innovation, ETF Strategy

- Handle: @CathieDWood

Why Follow in 2026

Cathie Wood remains the primary bridge between traditional finance (TradFi) and the crypto ecosystem. Her firm’s research papers on “Bitcoin as an Asset Class” are essential reading. In 2026, watch her feed for insights on how pension funds and insurance giants are thinking about their 1-3% allocation to crypto assets.

- Best For: Understanding how Wall Street views crypto.

10. The DeFi Strategist: The Bankless Team (Ryan & David)

- Role: Hosts of Bankless Podcast

- Focus: Ethereum Ecosystem, DeFi Yields, Layer 2s

- Handle: @BanklessHQ

Why Follow in 2026

If you want to actually use crypto rather than just trade it, Bankless is the guide. They cover the newest yield opportunities, airdrop strategies, and DAO governance updates. In 2026, their coverage has expanded to include “Regenerative Finance” (ReFi) and how crypto protocols are funding real-world public goods.

- Best For: Actionable guides on using DeFi protocols.

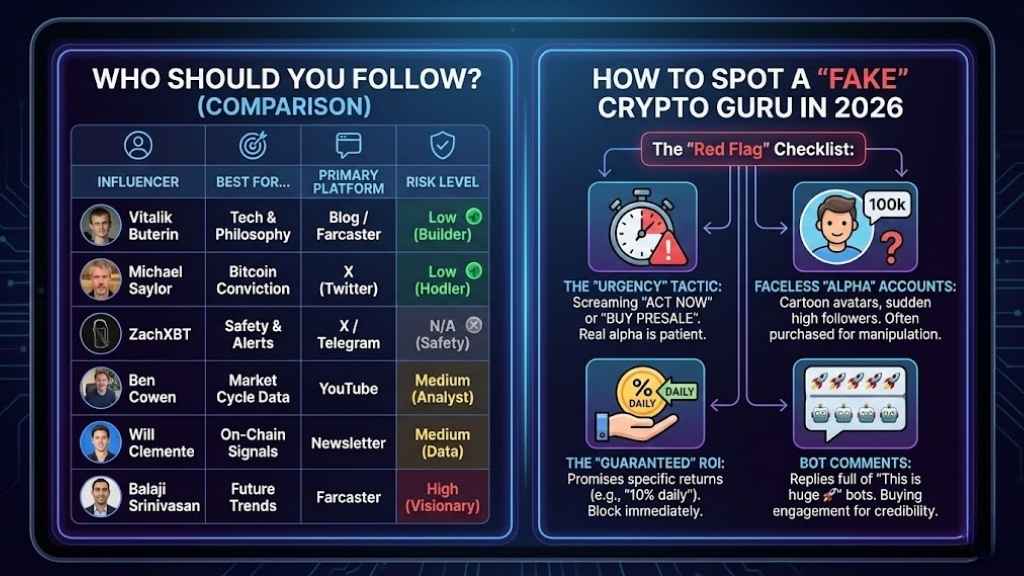

Who Should You Follow?

| Influencer | Best For… | Primary Platform | Risk Level |

| Vitalik Buterin | Tech & Philosophy | Blog / Farcaster | Low (Builder) |

| Michael Saylor | Bitcoin Conviction | X (Twitter) | Low (Hodler) |

| ZachXBT | Safety & Alerts | X / Telegram | N/A (Safety) |

| Ben Cowen | Market Cycle Data | YouTube | Medium (Analyst) |

| Will Clemente | On-Chain Signals | Newsletter | Medium (Data) |

| Balaji Srinivasan | Future Trends | Farcaster | High (Visionary) |

How to Spot a “Fake” Crypto Guru in 2026

The scammers have evolved. In 2026, you won’t just see “Send 1 ETH get 2 ETH” scams. You will see AI-Deepfakes of Michael Saylor livestreaming on YouTube.

The “Red Flag” Checklist:

- The “Urgency” Tactic: Any influencer screaming that you must “ACT NOW” or “BUY THIS PRESALE” is likely dumping on you. Real alpha is patient.

- Faceless “Alpha” Accounts: Be wary of cartoon-avatar accounts that popped up last month with 100k followers. These are often purchased accounts used for market manipulation.

- The “Guaranteed” ROI: If anyone promises a specific percentage return (e.g., “10% daily”), block them immediately.

- Bot Comments: Check the replies under their posts. If it’s just 500 bots saying “This is huge ,” the influencer is likely buying engagement to look credible.

Final Thoughts

Navigating the complex crypto market of 2026 requires more than just luck; it demands a high-quality information diet. The era of blind speculation is effectively over, replaced by a mature landscape driven by institutional adoption, AI integration, and strict regulatory clarity. In this environment, the voices you allow into your daily feed act as your personal investment committee. If your timeline is cluttered with hype, bots, and anonymous shills, your portfolio will likely suffer from the chaos.

By consciously curating your social media with these ten influential crypto voices, you shift from reacting to market noise to anticipating genuine trends. Whether you rely on the macro stability of figures like Michael Saylor or the on-chain precision of analysts like Will Clemente, these experts offer the critical “signal” necessary to thrive.

Don’t let an algorithm decide your financial future. Take five minutes right now to audit your following list. Unfollow the noise, block the engagement farmers, and commit to learning from the builders and educators who prioritize long-term truth over short-term clicks. Your 2026 portfolio will thank you for the upgrade.