Fintech has spent the last decade unbundling the bank. Now, central banks are preparing to unbundle the money itself. Central Bank Digital Currencies (CBDCs) represent the most significant upgrade to the sovereign money stack since the abandonment of the gold standard. For neobanks—Challenger Banks like Monzo, Nubank, Revolut, and Chime—CBDCs are an existential paradox.

They are simultaneously a mechanism that could bypass the neobank’s primary revenue engines (deposits and interchange) and a massive infrastructure upgrade that could finally allow fintechs to break free from legacy correspondent banking rails.

For neobanks, the “move fast and break things” era is colliding with the “move slowly and stabilize things” mandate of central bankers. The risk isn’t just about technology; it is about the fundamental reshaping of the balance sheet. If the Central Bank offers a risk-free digital wallet, why would a customer keep their savings in a startup bank during a recession?

This analysis cuts through the breathless hype to examine the mechanical impact of CBDCs on neobank P&L, operations, and product strategy.

CBDCs In Plain English (And Why They’re Different From Crypto)

To understand the threat, we must first strip away the jargon. A CBDC is not a cryptocurrency, nor is it a stablecoin. It is simply cash that lives on a database (or ledger) rather than in a leather wallet.

What A CBDC Is (Retail vs. Wholesale)

There are two distinct flavors of CBDC, and they affect neobanks differently:

- Retail CBDC (The “Digital Dollar” in your pocket): This is digital cash issued by the central bank directly to the general public. It is a direct claim on the central bank, meaning it is risk-free.

- Neobank Impact: High. This competes directly with the checking accounts and payment wallets neobanks offer.

- Wholesale CBDC (The “backend” upgrade): This is restricted to financial institutions (banks and fintechs) to settle trades and transfers between themselves.

- Neobank Impact: Positive. This replaces clunky systems like SWIFT or local RTGS (Real-Time Gross Settlement) systems, making settlement instant and cheaper.

CBDC vs. Bank Deposits vs. Stablecoins

Neobanks currently hold customer funds as “commercial bank money” (deposits). These are technically liabilities—promises to pay you back. A CBDC is not a promise; it is the asset itself.

| Feature | Commercial Bank Deposit (Current Neobank Model) | Retail CBDC (The New Entrant) | Stablecoin (e.g., USDC, USDT) |

| Issuer | Commercial Bank / Neobank Partner | Central Bank (Govt) | Private Company |

| Liability | Liability of the private bank (Risk: Bank Failure) | Liability of the Central Bank (Risk: State Failure) | Liability of the issuer (backed by assets) |

| Safety | Insured up to a limit (e.g., FDIC/FSCS) | Risk-free (in local currency terms) | Varies based on reserves |

| Interest | Yes (banks pay interest to attract funds) | Likely 0% (to prevent draining banks) | Varies (via lending/staking) |

| Privacy | Data owned by Bank/Neobank | Data visible to Central Bank/Intermediary | Public ledger (pseudonymous) |

| Settlement | T+1 or T+2 (often batched) | Instant / Near-instant | Instant (block time) |

How Neobanks Make Money Today (So You Can See What CBDCs Disrupt)

Before analyzing the disruption, we must look at the neobank P&L. Most neobanks operate on a “thin” margin model heavily dependent on volume.

Neobank Revenue Streams

- Interchange Fees: Every time a user swipes their neon-colored debit card, the neobank earns a small percentage (e.g., 0.2% in Europe, up to 1%+ in the US). This is the lifeblood of many early-stage neobanks.

- Net Interest Margin (NIM): Neobanks take customer deposits and lend them out (or park them in safe government bonds). The difference between the interest they pay users and the interest they earn is the NIM.

- Fees & Subscriptions: Premium accounts (Metal cards), foreign exchange (FX) markups, and instant transfer fees.

- Marketplace/Partnerships: Referral fees for insurance, loans, or wealth management products embedded in the app.

The Hidden Dependency: Deposits + Payment Rails

Neobanks are structurally dependent on two things:

- Sticky Deposits: They need users to keep money in the account to fund loans and earn interest.

- Card Rails: They rely on Visa/Mastercard networks to process payments and generate interchange revenue.

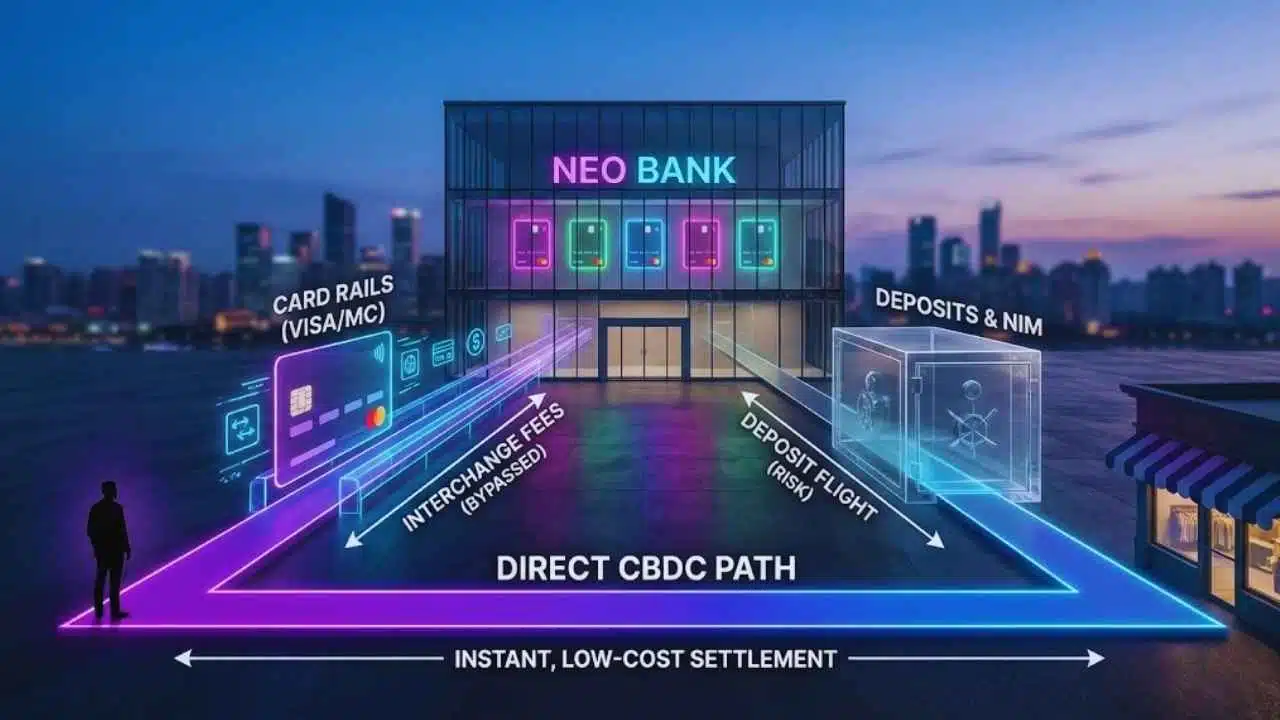

The CBDC Threat: A well-designed retail CBDC can bypass both the card networks (killing interchange) and the commercial bank balance sheet (killing deposits).

The Biggest Mechanism: Disintermediation Risk (Slow And Fast)

This is the single most critical section for neobank strategists. Central banks call it “disintermediation”; neobanks should call it “losing the customer balance.”

Slow Disintermediation (Everyday Deposit Substitution)

In a “slow bleed” scenario, consumers decide that holding a risk-free CBDC is preferable to holding a deposit at a fintech startup, especially if the CBDC wallet offers similar UX.

If a digital Euro or Dollar is seamlessly integrated into a phone, users might keep their “spending money” in CBDC rather than a neobank current account.

- The Impact: Neobanks lose their cheapest source of funding (low-cost deposits). To fund their lending operations, they would have to raise money from wholesale markets (e.g., issuing bonds), which is significantly more expensive.

- The Result: Higher costs of capital, lower Net Interest Margins, and a forced retreat from “free banking” models.

Fast Disintermediation (Stress Events And Digital Bank Runs)

This is the nightmare scenario. In times of financial panic (like the SVB collapse in 2023), depositors flee to safety. Currently, “flight to safety” means moving money from a small bank to a “Too Big To Fail” bank (like JP Morgan).

In a CBDC world, the “flight to safety” is a single swipe into the Central Bank’s wallet.

- Digital Bank Runs: Because CBDC transfers are instant and 24/7, a neobank could lose 50% of its deposit base in minutes, not days.

- Neobank Vulnerability: Neobanks are perceived as riskier than incumbents. They would be the first victims of a digital bank run if users can instantly move funds to a risk-free government ledger.

Design Safeguards: Holding Limits, Remuneration, Tiering

Central banks are aware of this risk and do not want to destroy the banking sector. They are proposing safeguards that neobanks must monitor:

| Safeguard | Mechanism | Impact on Neobanks |

| Holding Limits | Users can only hold a max amount (e.g., €3,000 for Digital Euro). | High Protection. Prevents large deposit flight. Neobanks keep the “savings” portion of the wallet. |

| Zero Remuneration | CBDCs pay 0% interest. | Moderate Protection. Neobanks can compete by offering high-yield savings accounts (e.g., 4% APY). |

| “Waterfall” Accounts | Any funds received above the limit (e.g., €3,000) automatically overflow into the linked commercial bank account. | Critical Win. This effectively forces the CBDC to be a “wallet” while the neobank remains the “vault.” |

CBDCs As A New Payments Rail: Threat Or Tailwind?

If the “Deposit” side of the equation is a threat, the “Payments” side is a double-edged sword.

CBDC As A Payment Instrument (The “Visa Killer”?)

If a retail CBDC allows Peer-to-Peer (P2P) and Peer-to-Merchant (P2M) payments at near-zero cost, the card network model collapses.

- The Threat: If a merchant can accept a “Digital Dollar” payment via QR code with a 0.1% fee, they will stop accepting debit cards with a 1.5% fee.

- Neobank Reality: Neobanks that rely 80% on interchange revenue (common in the US and Latin America) will see their revenue evaporate overnight. They will be forced to charge monthly subscription fees to survive.

CBDC As A Platform (New Intermediaries, New Moats)

However, central banks (like the ECB and Federal Reserve) have explicitly stated they do not want to manage customer support, app interfaces, or KYC checks. They want to be the backend.

- The Opportunity: Neobanks can become the “interface layer” for CBDCs. Just as they built better interfaces for traditional banking, they can build the best “Digital Euro Wallet.”

- New Moats: The winners will be neobanks that build “Smart Routing.” Imagine an app that auto-switches: “Pay this coffee with CBDC (zero fees)” vs. “Pay this flight with Credit (insurance + rewards).”

What Changes For Wallet Economics

The economic model shifts from Transaction-based (interchange) to Value-added services.

- Data Monetization: CBDC transactions settle instantly and carry rich data (unlike ISO 8583 card messages). Neobanks can use this granular data to offer better credit scoring or hyper-personalized offers.

- Programmability Fees: Charging users for “smart” features—e.g., “Only release this payment to my landlord if the smart lock verifies the apartment is unlocked.”

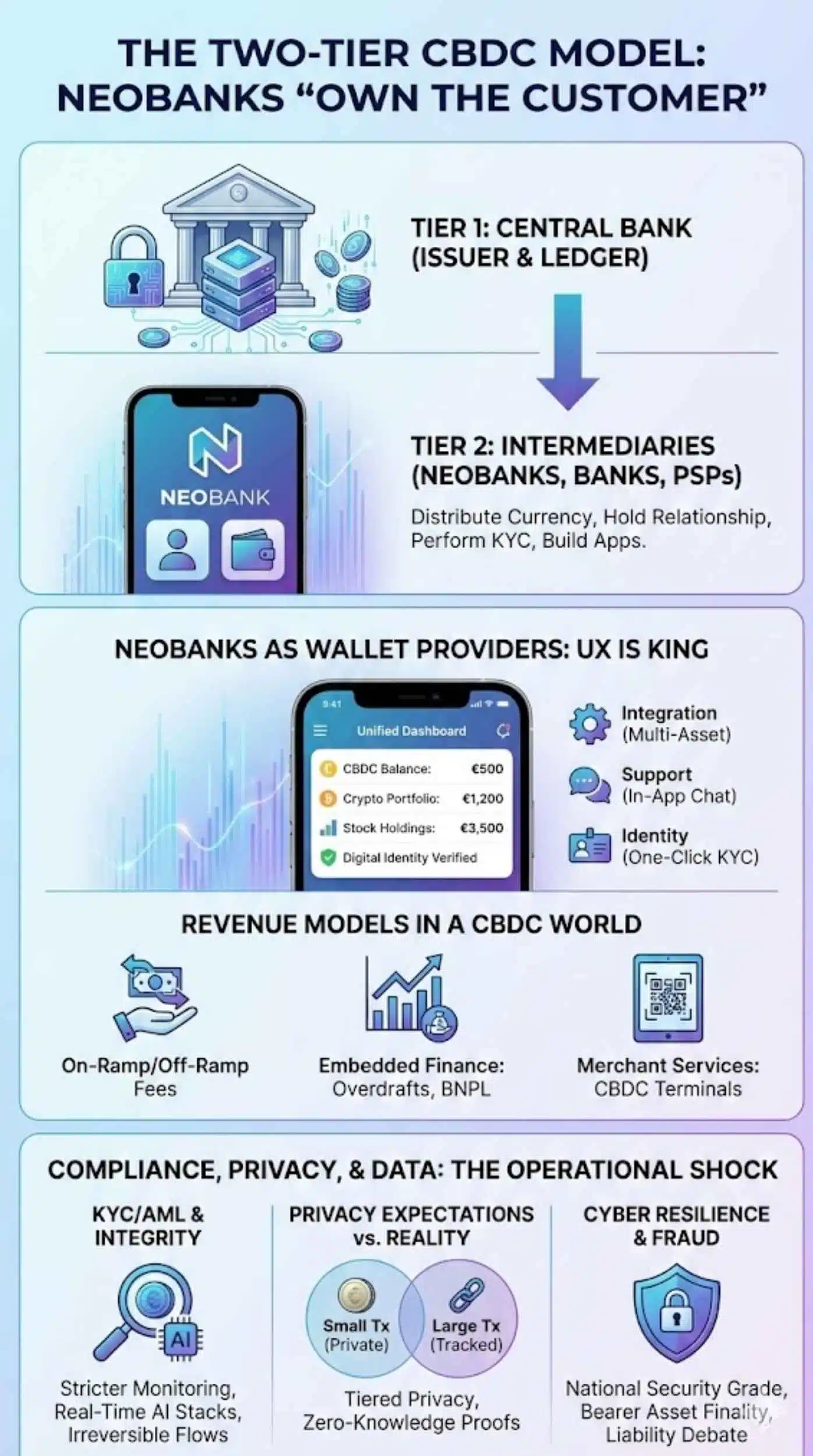

The Two-Tier Model: Why Neobanks Might Still “Own The Customer”

Virtually every major central bank pilot (including the Digital Euro, UK Digital Pound, and Brazil’s Drex) has settled on a Two-Tier (Intermediated) Model.

Intermediated CBDC

- Tier 1 (Central Bank): Issues the currency, maintains the central ledger, ensures stability.

- Tier 2 (Intermediaries): Neobanks, Banks, and Payment Service Providers (PSPs) distribute the currency, hold the relationship, perform KYC, and build the apps.

This is the “save” for neobanks. The Central Bank is outsourcing the hard work (customer acquisition and compliance) to them.

Neobanks As Wallet Providers: UX Is King

Neobanks are better at UX than incumbents. In a Two-Tier world, the currency is a commodity (a digital Euro is a digital Euro), so the differentiator becomes the experience.

- Integration: Can I see my CBDC balance next to my Crypto balance and my Stock portfolio?

- Support: When I lose my private key or get scammed, who helps me? (The Central Bank won’t).

- Identity: Neobanks can bundle “Digital Identity” with “Digital Money,” allowing one-click KYC for other services.

Revenue Models In A CBDC World

If interchange dies and deposits shrink, where does the money come from?

- On-Ramp/Off-Ramp Fees: Charging for moving between Commercial Bank Money and CBDC (though regulators may cap this).

- Embedded Finance: Using the CBDC wallet as a hook to sell high-margin lending products (Overdrafts, BNPL).

- Merchant Services: Selling “CBDC Acceptance Terminals” (software-based) to gig-economy workers and SMEs.

Compliance, Privacy, And Data: The Operational Shock

This is the section where the “tech” meets the “regulator.” CBDCs introduce a massive new compliance burden.

KYC/AML And Financial Integrity

In a Two-Tier model, the Neobank is responsible for Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) checks.

- The Burden: Central banks will likely require stricter monitoring for CBDC transactions because the settlement is final (no chargebacks).

- The Challenge: Neobanks often struggle with false positives in AML. Managing real-time, irreversible CBDC flows will require AI-driven compliance stacks, not manual review teams.

Privacy Expectations vs. Regulation Reality

Users want cash-like anonymity. Governments want traceability. Neobanks are caught in the middle.

- The “Middle Ground”: Most CBDCs (like the ECBs proposal) suggest “Tiered Privacy.”

- Small transactions (e.g., under €50): totally private/offline.

- Large transactions: fully tracked.

- Neobank Role: The neobank effectively becomes the “Privacy Guardian,” managing the cryptographic keys that prove a user is compliant without revealing all their data to the state (using Zero-Knowledge Proofs).

Cyber Resilience And Fraud

If a neobank’s app is hacked today, money is stolen from a ledger that can be rolled back. If a neobank’s CBDC wallet is hacked, the money is gone (bearer asset finality).

- New Attack Surface: Neobanks will need to upgrade security from “Bank Grade” to “National Security Grade.” The liability framework (who pays if the app is hacked?) is still being debated, but neobanks will likely bear the first loss.

Lending And Balance Sheet Impacts

If deposits leave the ecosystem to sit in CBDC wallets, how do neobanks fund loans?

Funding Cost Scenarios

- Best Case (Waterfall Model): Users keep their “excess” savings in the neobank to earn interest. The neobank retains its deposit base.

- Worst Case (Flight to CBDC): Users prefer safety over yield. Neobanks lose 20-30% of deposits.

- Result: Neobanks must offer higher interest rates to attract deposits back, crushing their margins. This forces them to lend at higher rates, potentially making their credit products (personal loans, mortgages) uncompetitive vs. big banks with diversified funding.

Credit Availability And Risk Pricing

- Data Advantage: While funding gets harder, underwriting gets easier. A neobank with visibility into a user’s CBDC transaction history (which settles instantly and carries metadata) has a real-time view of cash flow.

- Smart Lending: Neobanks can offer “Programmable Loans.” Example: A micro-loan that is automatically disbursed in CBDC when a user enters a specific geo-location (e.g., a supplier warehouse) and automatically repaid when the user receives a CBDC payment from a customer.

Cross-Border And Remittances: A Potential Growth Engine

This is the strongest “bull case” for neobanks.

Why Cross-Border Is A Priority

Current cross-border payments (SWIFT) are slow (2-5 days), expensive (5-7%), and opaque. Neobanks like Wise and Revolut disrupted this with “pre-funding” (holding pools of money in different countries). But that is capital inefficient.

CBDC projects like mBridge (connecting China, UAE, Thailand, Hong Kong) allow for “atomic settlement.” Banks can swap digital currencies directly without a correspondent bank in New York.

Where Neobanks Can Win

- SME Remittances: Neobanks can offer instant settlement for importers/exporters using wholesale CBDC rails, undercutting traditional banks by days and percentage points.

- Compliance Automation: “Programmable Compliance” can be embedded in the token. The CBDC itself checks if the transfer violates capital controls before it moves. Neobanks can build the dashboard that manages this for SMEs.

- FX UX: Neobanks can offer a “Multi-CBDC Wallet” where a user holds e-CNY, Digital Euro, and Digital Real in one app, swapping them instantly with low spreads.

Real-World CBDC Progress: What Neobanks Should Watch

Don’t guess; look at the pilots.

What Central Banks Are Actually Doing

- Brazil (Drex): A wholesale CBDC used to settle tokenized bank deposits.

- Significance: It allows neobanks (like Nubank) to tokenize assets (cars, real estate) and settle them instantly against the Digital Real. It’s a massive innovation unlocks for “Smart Contract” banking.

- Eurozone (Digital Euro): Retail focused. Strong emphasis on holding limits (€3k) and privacy.

- Significance: It is designing a standard that effectively forces banks to build the frontend. It validates the “Two-Tier” model.

- India (e-Rupee): Pilot ongoing with specific use cases like “purpose-bound money” (e.g., agricultural subsidies that can only be spent on fertilizer).

- Significance: Shows the power of programmability. Neobanks can offer “Parental Control” wallets where pocket money is locked to specific merchant codes.

“Signals” That Matter

When reading central bank whitepapers, look for these three terms:

- Remuneration: If they pay interest, it’s a threat to deposits. (Most currently say No).

- Offline Capability: If they support offline payments, it replaces cash (and requires hardware integration in the neobank app).

- Access Criteria: Can fintechs hold a CBDC account directly at the Central Bank, or must they go through a “Sponsor Bank”? (Direct access is the holy grail for neobanks).

Strategic Playbook For Neobanks

The “wait and see” approach is a losing strategy. Here is how to prepare.

1. Product Strategy: The “Super-Wallet” Pivot

Stop thinking of the app as a “Bank Account” and start building a “Digital Asset Wallet.”

- Action: Build infrastructure to hold and display CBDC balances alongside fiat and crypto.

- Feature: Create “Auto-Sweep” tools. “Keep €2,500 in my Digital Euro wallet for safety, sweep everything else into my high-yield Neobank savings account.”

2. The API Play: Programmability

The real money isn’t in moving the CBDC; it’s in programming it.

- Action: Develop “If This Then That” (IFTTT) logic for money.

- Example: A neobank for gig workers could offer: “Instant tax separation.” When a CBDC payment arrives, the smart contract automatically splits 20% to a tax pot and 80% to the user, completely automating tax compliance.

3. Merchant Strategy: Bypass the Card Networks

- Action: If you serve business customers (SMEs), build CBDC POS (Point of Sale) acceptance into their app.

- Pitch: “Accept payments for free using our CBDC QR code. Stop paying 2% to Visa.”

4. Lobbying: Fight For Direct Access

- Action: Neobank coalitions must lobby regulators to ensure non-bank PSPs (Payment Service Providers) have direct access to the CBDC settlement rail.

- Risk: If neobanks have to go through a “Sponsor Bank” (like JP Morgan) to access the CBDC rail, they remain second-class citizens.

Final Thought

CBDCs are not the asteroid that kills the dinosaurs; they are the climate change that forces evolution. The neobanks that view CBDCs as a new “rail” to build upon—rather than a competitor to fear—will become the dominant financial interfaces of the next decade.