Your credit score dropped, and now you feel stuck. Maybe late payments or high credit card balances are holding you back from getting a loan for something important, like a car or house. You want answers that actually work to help improve your financial health. A simple fact: a 2024 investigation by Consumer Reports found that 44% of participants found errors on their credit reports. Fixing even one mistake can start lifting your score fast.

Financial stress disrupts personal balance. But here is the good news: repairing your credit is just a series of small, consistent habits.

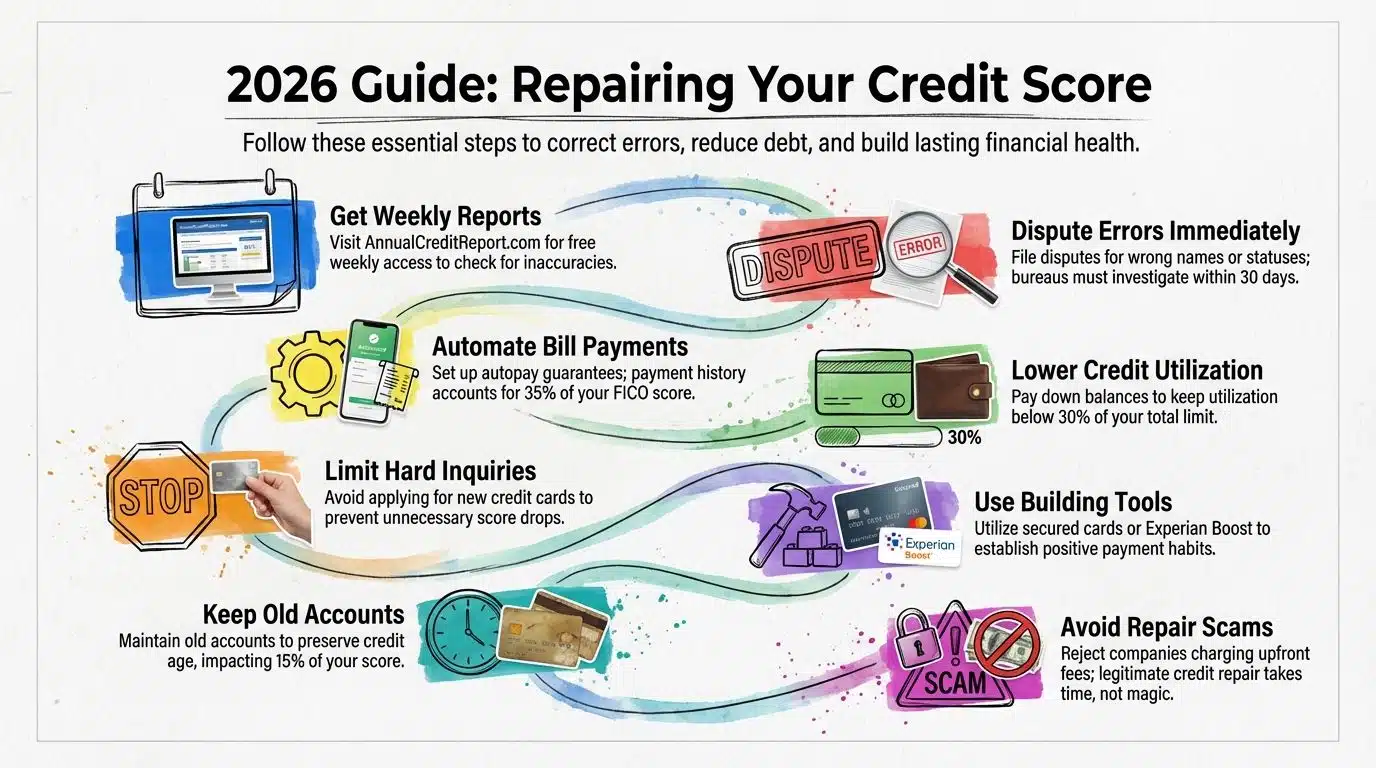

How To Repair Credit Score: A 2026 Guide walks you through each step. We will cover checking reports, fixing mistakes, lowering debt, and smart habits for lasting change. Stick around for tips that make better scores possible!

How To Repair Credit Score: Check Your Credit Report

Your credit report is like a school report card, but for grown-ups. Spotting mistakes in it can save you from big headaches down the road. With the average U.S. FICO score sitting at around 715 in early 2026, knowing exactly where you stand is the first step to beating the average.

Access free annual credit reports

Checking your credit report is the first big step. While the name says “Annual,” you can actually check your reports much more frequently now.

- Visit AnnualCreditReport.com: This is the only official website to request free credit reports in the U.S. authorized by federal law.

- Know your rights: You can get free reports from Equifax, Experian, and TransUnion. In 2026, you can typically access these weekly online, a permanent upgrade from the old “once a year” rule.

- Check all three: Use this chance to check all three reports because each bureau might show different details.

- Review the details: Reports include payment history, late payments, and credit card balances for up-to-date financial health tracking.

- No score impact: Getting your own report does not affect your scoring model or lower your score.

- Verify personal data: Information like your name, addresses, current loans, and past debts helps you spot errors easily.

- Spot identity theft early: Watch out for wrong details or signs of identity theft. These can damage your creditworthiness and loan approval chances if not fixed quickly.

- It is free: You do not have to pay anyone to access these reports. This right is protected under federal law since the Fair Credit Reporting Act (FCRA).

- Take notes: After reviewing all reports, note any mistakes or unfamiliar accounts and be ready to fix them as needed.

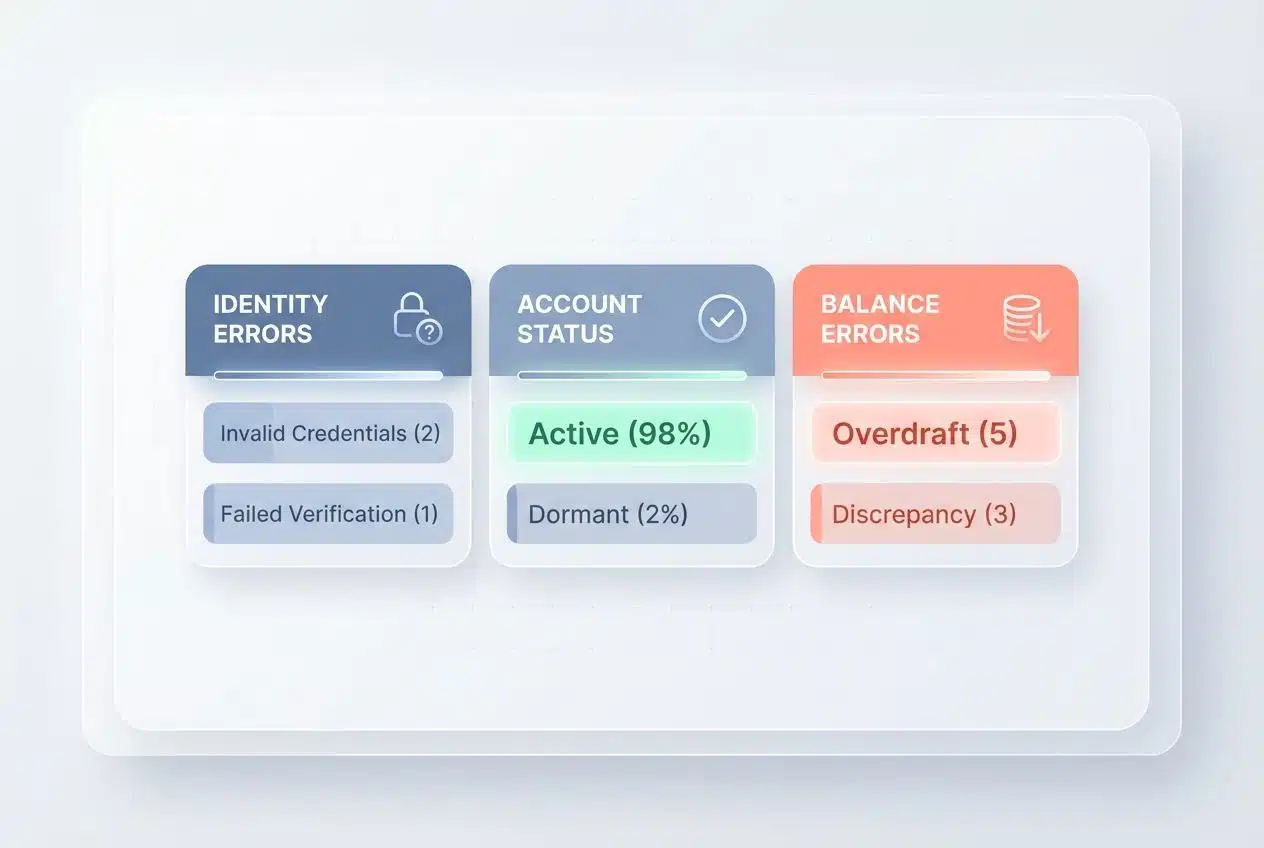

Identify and dispute errors

Mistakes on your credit report can hurt your score. Fixing them boosts creditworthiness and helps with loan approval.

Common errors to watch for:

| Error Type | What to Look For | Why It Matters |

|---|---|---|

| Identity Errors | Wrong name spellings, old addresses, or accounts belonging to someone with a similar name. | Can mix your file with someone else’s bad credit history. |

| Account Status | Closed accounts reported as open, or accounts incorrectly listed as “late” or “delinquent.” | Directly lowers your score by suggesting current debt or missed payments. |

| Balance Errors | Credit card balances that appear higher than what you actually owe. | High utilization ratios are a major factor in scoring models. |

- Read every line of your free credit report. Look out for wrong names, old addresses, or accounts you never opened.

- Spotting a late payment that is not yours? Mark it down. Incorrect late payments drag down your FICO score and hurt your financial health.

- Make a note of any unpaid bills that you already settled. Every error could lower your chances of getting better interest rates.

- Send a dispute letter to the credit bureau if you see anything off. Use simple words. Explain what is wrong with clear facts or papers.

- The main bureaus, Experian, Equifax, and TransUnion, must check these errors within 30 days by law.

- Snap photos or scan proof like paid statements or letters from lenders to back up your claim.

- Keep copies of everything you send and get during this process for safe record-keeping.

- After fixing errors, see if the report now shows accurate payment history and correct credit card balances.

- A clean credit report supports good financial management and makes future budgeting strategies easier.

- Stay alert for new mistakes so you can keep scoring model changes from affecting your loan eligibility later on.

Pay Bills on Time

Late payments can sneak up on anyone, but they put a dent in your credit score faster than a dropped ice cream melts on hot pavement. Even one missed due date can make lenders think twice about offering you better loan rates. In fact, a single payment missed by 30 days can drop a good score by over 100 points.

Set up payment reminders or autopay

Life gets busy. Missing payments hurts your credit score and makes loan approval harder. The key is to remove the need for willpower.

- Use digital tools: Set up payment reminders on your phone, calendar, or budgeting app. Apps like Rocket Money or YNAB (You Need A Budget) can track due dates for you.

- Automate the basics: Autopay is a lifesaver for bills like credit cards or loans. Your payment is sent each month.

- Understand the impact: Payment history counts for 35% of your FICO score. Even one late payment causes big drops.

- Enroll easily: Most banks and lenders offer free autopay options online. It takes just a few minutes to enroll.

- Use visual cues: Use sticky notes on your fridge if tech is not your thing. Old-school methods still work wonders.

- Confirm funds: Check that you have enough funds before the due date to avoid overdrafts or missed payments.

- Ask for guidance: Contact your financial institution if you need help setting up these features. They often guide you step-by-step.

- Build consistency: Consistent, timely payments boost creditworthiness over time and build better financial health.

Lower Your Credit Utilization

Try to keep your credit card balances low, as this makes lenders smile and boosts your financial health. Stick around for more tips!

Aim for a utilization rate below 30%

Keep your credit card balances low. Never let them take up more than 30% of your limit. If you have a $1,000 card, spend under $300. Lenders use this rate in their scoring model to check how you handle debt management.

“A high utilization tells lenders you may struggle with money or could miss payments. With average credit card interest rates hovering around 22% in 2026, carrying a balance is also an expensive habit.”

Paying down debt helps boost your credit score right away. Even if paying off everything each month seems tough, making extra payments on higher balances can help a lot. Some experts on forums like r/CRedit suggest the “AZEO” method (All Zero Except One), where you pay off all cards but one small balance to maximize your score.

Small steps go far for financial health and loan approval chances. Keeping an eye on new applications is just as important for protecting your payment history and creditworthiness.

Avoid Applying for New Credit

Every extra credit check can tip the scales against you. Give your score space to breathe by holding off on new cards or loans for now.

Limit hard inquiries on your credit report

Each time you apply for a new credit card or loan, your credit report gets a hard inquiry. Too many of these can lower your FICO score by several points and may look risky to lenders. Aim to keep hard inquiries below two per year for good financial health.

Only apply for credit if you truly need it. For example, say no to store cards offered at checkout unless it fits into your plan. Lenders use scoring models that notice frequent requests. Spread out applications over time.

Less is more here. Protect your score by being selective about new credit offers.

Use Credit-Building Tools

Some tools act like training wheels for your credit score, giving it steady support as you improve. Grab opportunities that help grow positive payment habits, just like planting seeds for a solid financial future.

Consider secured credit cards or credit-builder loans

Building your credit can feel like planting seeds. Good tools help those seeds grow into a strong score. In 2026, you have more options than ever.

| Tool Name | Best Feature | Who It Is For |

|---|---|---|

| Discover it Secured | Earns cash back rewards (2% on gas/dining) and has no annual fee. | People who want rewards while rebuilding. |

| Self Credit Builder | A loan that forces you to save; you get the money back at the end. | People who struggle to save money. |

| Experian Boost | Adds on-time utility, phone, and streaming payments to your report for free. | Renters with bills in their own name. |

- Secured cards work: Secured credit cards ask for a deposit, often $200 to $500, which becomes your limit. This lowers risk for banks and helps people with low scores start fresh.

- Loans build trust: Credit-builder loans set the loan money aside in a safe account until payments are made. Paying on time each month grows trust with lenders and boosts your payment history.

- Reporting matters: Lenders report good habits to the three big credit bureaus: Experian, TransUnion, and Equifax. These reports shape your creditworthiness over time.

- Save on fees: Many secured cards now have no annual fee, so you can save money as you work on credit improvement.

- Automate success: Late payments hurt, so setting up automatic payments for your card or loan keeps your record spotless.

- Manage balances: Using these tools while keeping balances low (under 30% of the limit) also models smart financial management.

- Wait for results: Some people see a jump in their FICO score after six months of good use, but patience pays off as results show better after one year.

- Prove responsibility: People with little or bad credit history benefit most from these options because they show banks you can handle responsibility.

- Graduate to better cards: Some banks review accounts after six months to one year and return deposits if payments stay on track. Then that secured card becomes an unsecured one.

- Avoid scams: Choosing trusted companies is vital. Scams promise fast results but instead steal money or trick people who want quick fixes.

Keep Old Credit Accounts Open

Holding onto your old credit cards, even if you rarely use them, helps show lenders that you have a long history with money. Curious how else your credit age shapes your score?

Maintain a longer credit history

A longer credit history can help your credit score. Keep old accounts open, even if you rarely use them. Lenders like to see a long payment history on your credit report because it shows how well you handle money over time.

A card from five or ten years ago adds depth to your financial story and helps boost your score with most scoring models. This factor makes up 15% of your total FICO score.

Closing an old account may shorten your credit history and hurt your chances for loan approval or good rates later. Even using a card only once every few months keeps the account active. Many experts call this “sock-drawering” the card. You put it away but use it for one small subscription, like Netflix, to keep it active.

This simple habit supports both creditworthiness and financial health without extra effort.

Seek Professional Help if Needed

Sometimes, fixing your credit feels like running in circles on a hamster wheel. If you feel lost or overwhelmed, reach out to a pro who can help with steady hands and sharp eyes.

Work with a credit counselor or trusted advisor

Credit problems can feel heavy, but you do not have to fix them alone. A credit counselor or a trusted advisor can guide you step by step.

- Credit counselors know the scoring model and how it affects your loan approval chances.

- These experts review your credit report for errors and offer advice about disputing inaccuracies.

- Many counselors help you set up a realistic budget, so you avoid new debt and manage payment history better.

- They teach the basics of financial literacy, showing you how late payments impact your financial health.

- Some may set up a debt management plan (DMP), which can lower interest rates, so paying off balances gets easier.

- Reputable services give open and clear information about their fees before any money changes hands.

- Working with a professional protects you from credit repair scams that promise quick fixes but only take your cash.

- Advisors often keep in touch, checking on your progress with timely payments and helping you stay on track with credit score improvement goals.

- Trustworthy groups like the National Foundation for Credit Counseling (NFCC) or HUD-approved agencies offer safe, proven help as you work toward better creditworthiness.

- Sharing your worries with someone who understands debt management takes stress off your shoulders and makes each small win sweeter.

Monitor Your Progress

Keep an eye on your credit score, like you would watch soup simmer, to avoid surprises. Track changes over time, so you can spot problems before they boil over.

Regularly track your credit score

Checking your credit score often helps you spot changes fast. Small habits here can make a big difference in your financial health.

- Use free tools: Use free tools like Credit Karma or AnnualCreditReport.com to view your credit report. Credit Karma uses the VantageScore model, which is slightly different from FICO but still useful for tracking trends.

- Watch for swings: Watch for big drops or jumps in your FICO score, which can signal errors or fraud.

- Review personal data: Review each part of your report, such as name, addresses, and accounts, to find mistakes early.

- Observe trends: Track how timely payments and debt reduction affect your scoring model over time.

- Act fast. Catching late payments quickly can stop more damage to your creditworthiness.

- Monitor utilization: Notice shifts in credit utilization as you pay down card balances.

- Verify inquiries: Spot new hard inquiries that may come from recent loan approval checks.

- Check with your bank: Many banks now let you check your score with no cost, making it simple.

- Set alerts: Set reminders on your phone so you do not forget this monthly checkup.

- Build skills: Seeing regular updates builds smart financial management skills for life.

Spotting errors early is half the battle. Now it is wise to understand which services are helpful and which are scams.

Avoid Credit Repair Scams

Watch out for shady promises. Only work with real experts, and always check reviews before handing over your hard-earned cash. No one likes a wolf in sheep’s clothing! Want to know how else you can boost your financial health? Keep reading.

Verify legitimate services before paying

Some companies offer to fix your credit score, but not all are honest. In 2024 alone, consumers reported losing over $12.5 billion to fraud. Always check if a service is real before you give them any money.

- Check reviews: Check the company’s reviews on trusted sites like the Better Business Bureau or Trustpilot.

- Ask for credentials: Ask for their credit counseling certification and business license to make sure they are legal.

- Research history: Search online for complaints, lawsuits, or scams linked to their name.

- Avoid upfront fees: Be wary if they ask for upfront fees. The Credit Repair Organizations Act (CROA) makes it illegal for credit repair companies to request payment before they have completed the services promised.

- Know the limits: Federal law lets you fix errors on your own at no cost. No one has a magic formula to change your credit report overnight.

- Protect your ID: Never share your Social Security number unless you are sure the company is safe and uses secure methods to protect your data.

- Read the fine print: Read any contract closely before signing. Watch out for tricky terms that could hurt your finances later.

- Know your rights: Real services will explain your rights under the Credit Repair Organizations Act, passed in 1996.

- Trust your gut: If an offer sounds too good to be true, it probably is. Reliable help comes from certified counselors, not quick-fix promises.

Final Thoughts

You now have a simple path to credit score improvement. Check your credit report, spot mistakes, and dispute errors right away. Pay bills on time, keep balances low, and skip applying for new cards you do not need.

These steps are straightforward. Anyone can take charge of their financial health with a little effort each month. Have you checked your own score lately or thought about using a secured card?

Small smart moves today may help open doors to loan approval and better deals tomorrow. Why wait? Your future self will thank you!