In the ever-changing landscape of investing, one principle stands out as timeless: diversification. Known as the cornerstone of risk management, diversification is a strategic approach to spreading investments across different assets to reduce exposure to any single risk.

Do you know how to minimize risk and maximize returns in 2025? Investors can achieve a balanced portfolio that weathers market volatility and enhances potential gains.

In this comprehensive guide, we delve into the most effective diversification strategies to minimize risk and maximize returns, providing actionable insights for both novice and seasoned investors. Whether you’re building a portfolio from scratch or fine-tuning an existing one, these strategies will help you optimize your investments for the long term.

What Is Diversification in Investment?

Diversification is the practice of allocating investments across various financial instruments, industries, and geographic regions. The goal is simple: reduce the risk of significant losses by ensuring that your portfolio is not overly reliant on the performance of a single asset or market sector.

For example, imagine investing all your money in a single company’s stock. If that company faces financial trouble, your entire investment could plummet. By diversifying across multiple companies, industries, and asset types, you mitigate the risk and protect your portfolio.

Benefits of Diversification

- Minimized Market Volatility: Diversification reduces the impact of market fluctuations on your portfolio by balancing losses in one area with gains in another.

- Improved Long-Term Stability: A diversified portfolio is better positioned to achieve consistent growth over time.

- Broader Opportunity Exposure: Diversification allows investors to tap into various sectors and markets, increasing the chances of higher returns.

How to Minimize Risk and Maximize Returns: 10 Proven Strategies

Here are 10 proven strategies on how to minimize risk and maximum returns in 2025.

1. Asset Class Diversification

Allocating investments across different asset classes—such as stocks, bonds, real estate, and cash—is one of the most fundamental diversification strategies to minimize risk and maximize returns. This strategy ensures that your portfolio has exposure to a variety of financial instruments, each reacting differently to economic changes.

Key Asset Classes:

- Stocks: High growth potential but higher risk.

- Bonds: Stable returns and lower risk.

- Real Estate: Tangible assets offering income and appreciation.

- Cash: Safety and liquidity.

| Asset Class | Risk Level | Return Potential | Best Suited For |

| Stocks | High | High | Growth-focused investors |

| Bonds | Low | Moderate | Risk-averse investors |

| Real Estate | Moderate | High | Income-focused investors |

| Cash | Very Low | Low | Short-term needs |

By distributing your investments across these asset classes, you create a buffer against losses in any single category. For instance, if the stock market declines, gains in bonds or real estate can balance the impact.

2. Geographic Diversification

Investing in different geographic regions reduces the risks associated with local market downturns or economic instability. This strategy spreads your investments across various countries, ensuring that no single economy overly influences your portfolio.

Why Geographic Diversification Matters:

- Shield your portfolio from country-specific risks.

- Access growth opportunities in emerging markets.

- Benefit from currency diversification.

| Region | Key Benefits | Example Markets |

| North America | Stable growth and innovation | USA, Canada |

| Europe | Diversified industries | Germany, UK |

| Asia-Pacific | Rapidly growing economies | China, India |

| Emerging Markets | High growth potential but volatile | Brazil, South Africa |

Example: A portfolio with exposure to the U.S., Europe, and Asia offers better resilience against regional economic crises and allows you to capitalize on varied growth trends.

3. Sector Diversification

Economic cycles affect industries differently. Diversifying your investments across various sectors ensures that a downturn in one industry doesn’t devastate your portfolio. For example, while the energy sector might struggle during low oil prices, the technology sector could thrive due to innovation-driven growth.

Key Sectors to Consider:

- Technology: High growth potential.

- Healthcare: Resilient during economic downturns.

- Energy: Cyclical but essential.

- Consumer Goods: Steady demand.

| Sector | Risk Level | Example Companies |

| Technology | High | Apple, Microsoft |

| Healthcare | Moderate | Pfizer, Johnson & Johnson |

| Energy | Moderate-High | ExxonMobil, Chevron |

| Consumer Goods | Low-Moderate | Procter & Gamble, Nestle |

4. Time Diversification (Dollar-Cost Averaging)

Time diversification involves investing consistently over time rather than making lump-sum investments. This approach reduces the risk of poor timing and ensures disciplined investing, making it an effective method for both new and experienced investors.

How Dollar-Cost Averaging Works:

- Invest a fixed amount at regular intervals (e.g., monthly).

- Buy more shares when prices are low and fewer shares when prices are high.

| Scenario | Investment Amount | Share Price | Shares Purchased |

| Month 1 | $500 | $10 | 50 |

| Month 2 | $500 | $5 | 100 |

| Month 3 | $500 | $20 | 25 |

Over time, this strategy helps smooth out market volatility and builds a robust portfolio.

5. Diversifying Within an Asset Class

Within each asset class, spreading investments across different categories enhances diversification.

For example:

- Stocks: Invest in large-cap, mid-cap, and small-cap companies.

- Bonds: Choose a mix of government, corporate, and municipal bonds.

ETFs and Index Funds:

Exchange-Traded Funds (ETFs) and index funds are excellent tools for achieving broad diversification within asset classes. These funds track a basket of securities, providing instant diversification.

| Fund Type | Key Features | Best For |

| Index Funds | Low-cost, passive management | Long-term investors |

| ETFs | Tradable like stocks, diverse assets | Active investors |

6. Alternative Investments

Adding non-traditional assets like hedge funds, private equity, or collectibles can diversify your portfolio further. Alternative investments often perform differently than traditional assets, providing an additional layer of risk management.

Examples of Alternative Investments:

- Art and antiques

- Hedge funds

- Cryptocurrencies

| Investment Type | Risk Level | Potential Returns | Considerations |

| Art and Antiques | High | Moderate-High | Requires expertise |

| Cryptocurrencies | Very High | Very High | High volatility |

| Hedge Funds | High | Moderate | High fees, restrictions |

While these assets can enhance returns, they often carry higher risks and require careful consideration.

7. Diversification Through Fixed Income Securities

Fixed-income securities like bonds provide stability and predictable returns, making them ideal for balancing a high-risk portfolio.

Laddered Bond Portfolio:

Investing in bonds with staggered maturities ensures steady cash flow and minimizes reinvestment risk.

| Bond Type | Maturity Period | Risk Level | Return Potential |

| Government Bonds | 5-30 years | Low | Low-Moderate |

| Corporate Bonds | 1-10 years | Moderate | Moderate-High |

| Municipal Bonds | 10-30 years | Low-Moderate | Tax-advantaged |

8. Incorporating ESG Investments

Environmental, Social, and Governance (ESG) investments align with ethical values while diversifying your portfolio. These investments are gaining popularity due to their potential for sustainable growth.

Why ESG Matters:

- Reduced exposure to industries with declining prospects.

- Appeal to socially conscious investors.

| ESG Factor | Key Consideration | Example Sectors |

| Environmental | Renewable energy, carbon footprint | Solar, Wind Energy |

| Social | Employee welfare, community impact | Healthcare, Retail |

| Governance | Ethical management practices | Technology, Finance |

Investors looking to make a positive impact while earning competitive returns can benefit significantly from ESG-aligned portfolios.

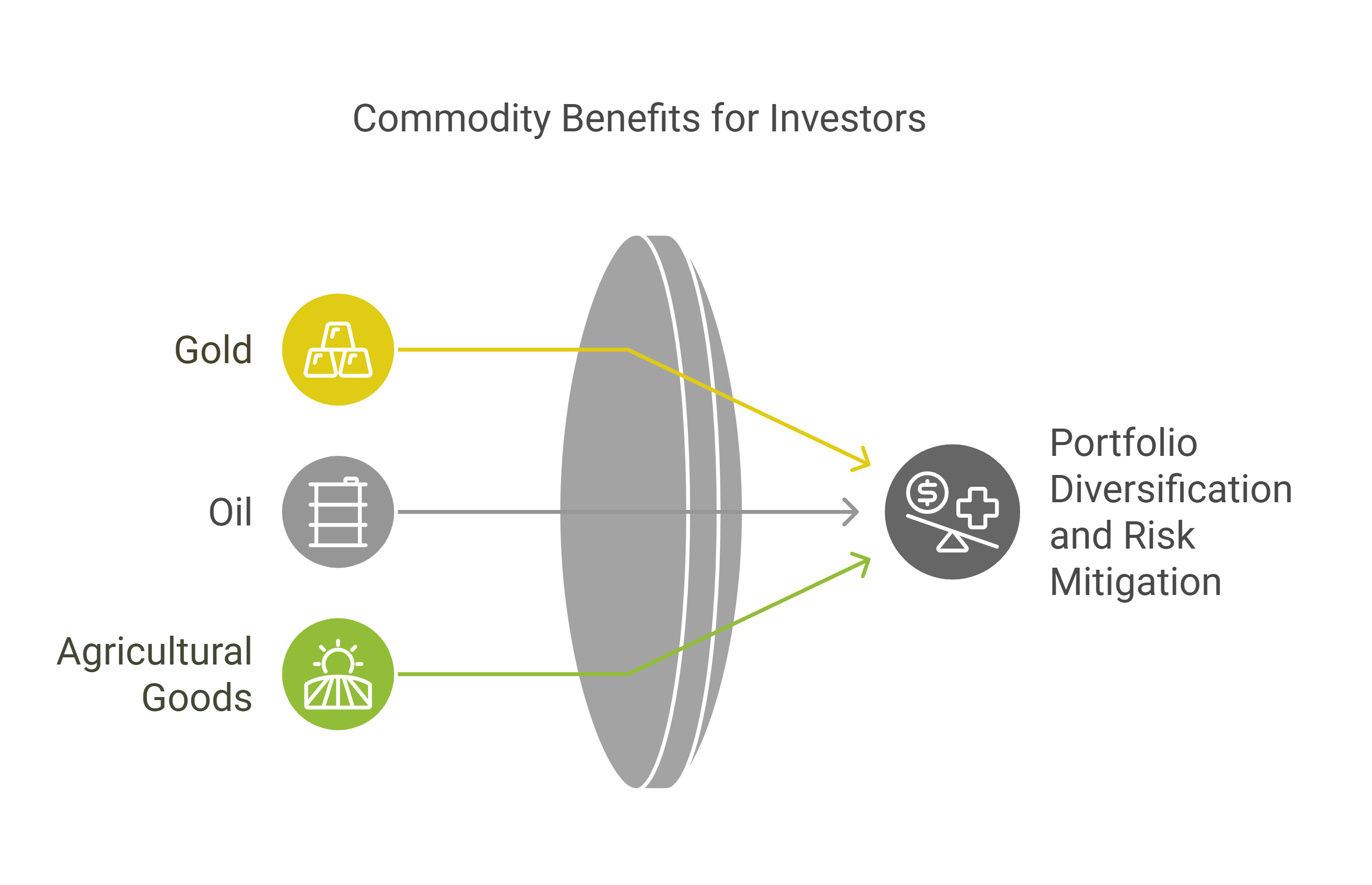

9. Investing in Commodities

Commodities like gold, silver, and oil act as a hedge against inflation and market volatility. By adding commodities to your portfolio, you gain exposure to assets that often move inversely to stocks.

Benefits of Commodities:

- Diversification from traditional assets.

- Protection during economic downturns.

| Commodity | Use Case | Market Dynamics |

| Gold | Inflation hedge | Prices rise in uncertainty |

| Oil | Industrial demand | Sensitive to supply issues |

| Agricultural Goods | Food security | Seasonal price variability |

10. Diversification Through REITs

Real Estate Investment Trusts (REITs) provide exposure to real estate markets without the need for direct property ownership. REITs are traded like stocks, offering liquidity along with diversification.

Advantages of REITs:

- Regular dividend income.

- Liquidity compared to owning physical real estate.

| REIT Type | Focus Area | Best For |

| Equity REITs | Property ownership | Long-term growth |

| Mortgage REITs | Real estate financing | High-income investors |

| Hybrid REITs | Mixed focus | Diversified strategies |

How to Monitor and Adjust Your Diversified Portfolio

- Regular Portfolio Reviews: Review your portfolio’s performance periodically to ensure it aligns with your financial goals and risk tolerance.

- Rebalancing Strategies: Rebalancing involves adjusting asset allocations to maintain your desired diversification. For instance, if stocks outperform and grow to occupy a larger share, reallocate some funds to bonds or other asset classes.

- Leveraging Technology: Numerous apps and platforms help monitor and adjust diversified portfolios, offering real-time insights and automated rebalancing.

Takeaways

Effective diversification is the key to building a resilient investment portfolio. By adopting these strategies on how to minimize risk and maximize returns, you can achieve a balanced approach that withstands market fluctuations and drives sustainable growth.

Regularly review and adjust your portfolio to stay aligned with your financial goals, and consider seeking professional advice for tailored strategies.

Start diversifying today to secure a more stable and prosperous financial future!