Hey there, are you tired of working long hours just to make ends meet? Many folks dream of earning money while they sleep, but finding a way to do that with crypto can feel like chasing a wild goose.

Here’s a neat fact, though, crypto offers tons of ways to build passive income, like staking and lending on blockchain networks. In this post, we’ll break down simple methods to earn with digital assets, from crypto staking to liquidity pools.

We’ll show you how to start, step by step, with easy tips to grow your financial growth. Keep reading to learn more!

Key Takeaways

- Staking lets you earn rewards by holding coins like Ethereum (ETH) or Cardano (ADA) in a wallet on platforms like Lido Finance or Binance.

- Crypto lending on sites like BlockFi or Aave helps you earn interest by lending digital coins to others.

- Yield farming in DeFi platforms like Uniswap offers high returns but comes with risks like market swings.

- Liquidity pools on exchanges like SushiSwap let you earn fees by adding tokens to trading pools.

- Dividend-paying tokens such as KuCoin Shares (KCS) give regular payouts just for holding them in a wallet.

Staking

Hey there, want to make your crypto work for you? Staking is a sweet way to earn rewards just by holding coins like Ethereum (ETH) or Cardano (ADA) in a digital wallet!

What is staking?

Staking is a cool way to earn crypto passive income. It means holding cryptocurrency in a wallet to help secure a blockchain network. Think of it like being a bank guard, but for digital assets.

By doing this, you support network security and get staking rewards in return. It’s mostly used in proof-of-stake (PoS) systems, like with Ethereum (ETH) or Cardano (ADA).

Now, let’s break it down a bit. Your returns depend on stuff like how many people are staking, which can lower your share. The longer you stake, the more you might earn, though market value swings can mess with that.

Plus, fees from platforms or pools can cut into your net gains. So, staking on Solana (SOL) or Polkadot (DOT) could be a neat gig, if you pick the right spot!

Platforms for staking rewards

Hey there, readers, let’s chat about some fantastic platforms where you can snag staking rewards with your crypto stash, like Ethereum 2.0, Cardano, or Polkadot, and watch your holdings grow!

| Platform | Supported Cryptos | Key Features | Why Pick This? |

|---|---|---|---|

| Lido Finance | Ethereum 2.0, Polkadot | Liquid staking, no minimum deposit, easy to use | Grab rewards without locking up your funds for ages, perfect if you’re antsy about flexibility. |

| Rocket Pool | Ethereum 2.0 | Decentralized staking, node operation options | Ideal for folks wanting to dip their toes into Ethereum staking with a community vibe. |

| Kraken | Cardano, Polkadot, Ethereum 2.0 | Simple interface, regular reward payouts | Suits beginners who want to set up a staking-compatible wallet, transfer crypto, and start earning fast. |

| Binance | Cardano, Polkadot, and more | Flexible staking, high reward rates | A one-stop shop to delegate tokens to a staking pool or go solo, plus claim rewards often. |

| Stake.Fish | Polkadot, Cardano, Ethereum 2.0 | Secure infrastructure, detailed guides | Great for those ready to lock tokens in a wallet, stake independently, and build passive income streams. |

Crypto Lending

Hey, wanna make your crypto work for you, even while you sleep? Stick around to see how lending your digital coins can earn sweet interest on platforms like Aave or Compound!

How crypto lending works

Crypto lending is a neat way to earn passive income with your digital assets. Think of it like lending money to a friend, but instead, you lend your crypto on special platforms. You earn interest rates based on the demand for your coins.

Pretty cool, right?

Here’s the deal, you deposit your cryptocurrency as collateral on lending platforms in decentralized finance (DeFi). Borrowers then use it, and you get returns without losing ownership.

Your earnings depend on interest rates, the platform’s reputation, and the borrower’s risk profile. Plus, the type of collateral and fees play a big role in your profits. Stick with trusted names to keep your funds safe!

Best platforms for crypto lending

Hey there, readers, let’s chat about some top-notch spots where you can dip your toes into crypto lending and watch your digital coins grow!

| Platform | Key Features | Why Pick This? |

|---|---|---|

| BlockFi | Offers competitive interest rates on crypto deposits, easy-to-use interface. | Perfect for beginners wanting a smooth start in lending their Bitcoin or Ethereum. |

| Celsius | No fees for lending, weekly payouts, supports a wide range of digital assets. | Great if you like seeing regular returns without sneaky charges eating your profits. |

| Nexo | Instant crypto-backed loans, high-yield savings, daily interest on holdings. | Ideal for folks looking to borrow against their stash while still earning. |

| Aave | Decentralized platform, flexible lending pools, flash loans for savvy users. | A go-to for those comfy with DeFi and craving control over lending terms. |

Wanna jump in? Pick a platform like BlockFi or Celsius, transfer your cryptocurrency over, set your lending terms like duration and amount, and start earning. Keep an eye on your account to stay in the loop. It’s like planting a seed and watching it sprout, no kidding! Which one catches your eye for lending your digital gold?

Yield Farming

Hey there, wanna grow your crypto stash while you sleep? Yield farming in DeFi can be your ticket, letting you earn sweet returns by lending your digital coins on platforms like Uniswap or Aave!

Understanding yield farming

Yield farming is a cool way to make passive income in the crypto world. It’s like planting seeds in a garden and watching them grow, but with digital assets. You put your crypto into DeFi platforms like Uniswap or Compound.

Then, you earn rewards, often in tokens or interest, just for lending or staking your coins.

Think of it as letting your money work for you. Start by picking a solid DeFi spot, say Aave, for good returns. Grab a safe crypto wallet like MetaMask or Trust Wallet, transfer your funds there, and connect to the platform.

Choose a liquidity pool, deposit your assets, and watch the annual percentage yield (APY) add up while you relax.

Risks and rewards of yield farming

Hey there, let’s chat about yield farming in the crypto space. It’s a hot way to earn passive income with your digital assets, often giving high potential returns. You can switch platforms for better yields, which is pretty neat.

Imagine planting seeds in a garden and watching them grow, that’s kinda how it feels when your crypto works for you in decentralized finance (DeFi).

Now, hold on, it’s not all sunshine. Yield farming comes with big risks like market volatility that can shake things up fast. Smart contract vulnerabilities might mess with your funds, and impermanent loss can cut into your gains.

Plus, yield rates change, fees bite, and time spent impacts your rewards. So, tread carefully in this wild field of crypto!

Liquidity Pools

Hey, wanna know a cool way to make some crypto cash? Liquidity pools on decentralized exchanges can be your ticket to passive income, so let’s chat about how they work!

How liquidity pools generate income

Let’s chat about liquidity pools and how they can put some extra crypto in your pocket. These pools are like a community pot on decentralized exchanges, often called DEXs. You toss in your digital assets, pairing them up, say, some Ethereum (ETH) with another token.

By doing this, you’re helping traders swap coins without a middleman. That’s the beauty of decentralized finance (DeFi) on a blockchain network.

Now, here’s the cool part, you earn a piece of the trading fees from every swap in that pool. The busier the trading volume, the more you can make. Plus, many DEXs throw in extra rewards to sweeten the deal.

Just know, the types of assets and fees play a big role in your returns. It’s like being a silent partner in a busy marketplace, watching your crypto grow with platforms like these supporting the whole system.

Top decentralized exchanges for liquidity pools

Hey there, readers, I’m thrilled to chat with you about some amazing spots to dip your toes into liquidity pools for passive crypto income, so let’s get rolling with a handy table!

| Decentralized Exchange | Why It Stands Out | Key Steps to Start |

|---|---|---|

| Uniswap | A pioneer in the DeFi space, Uniswap offers a vast array of token pairs for liquidity pools. | Pick Uniswap as your DeFi hub, link your wallet, choose tokens, deposit into a pool, and keep an eye on your rewards. |

| SushiSwap | Known for tasty returns, SushiSwap spices things up with extra incentives like SUSHI tokens. | Select SushiSwap, connect a wallet, drop your tokens in a pool, then regularly check performance and claim earnings. |

| Balancer | This gem lets you mix up to eight tokens in a single pool, balancing risk like a tightrope walker. | Go with Balancer, hook up your wallet, add tokens to a pool, and monitor results while snagging those rewards. |

See how easy that looks? These platforms, often called DeFi trading hubs, are your ticket to earning through liquidity pools. Uniswap, SushiSwap, and Balancer each bring something special to the table. You just connect a wallet, deposit tokens, and watch your passive income grow. Keep tabs on performance, claim those sweet rewards, and you’re golden. Think of it as planting seeds in a digital garden, watching them sprout over time. Which one catches your eye first?

Dividend-Paying Tokens

Hey there, want to make your crypto work for you, even while you sleep? Check out dividend-paying tokens like KuCoin Shares (KCS) and see how they can drop regular payouts right into your crypto wallet!

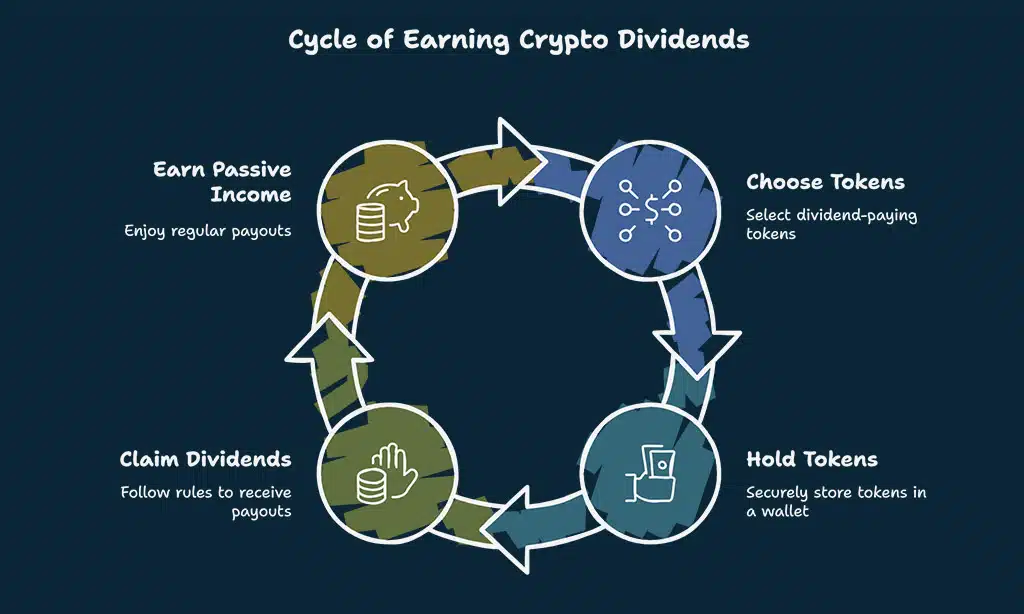

Earning dividends from cryptocurrency investments

Crypto dividends can be a sweet way to earn passive income, folks. Think of it as getting a slice of the pie just for holding certain digital assets. Some tokens, like KuCoin Shares (KCS), NEO (GAS), and VeChain (VTHO), pay regular dividends to their holders.

You don’t need to trade or hustle, just sit back and let your crypto wallet grow.

Here’s the game plan to start with dividend-paying tokens. First, pick the right ones that offer these perks. Next, hold them tight in a safe crypto wallet like Trust Wallet. Then, follow the specific rules to claim your share of the rewards.

It’s like planting a seed and watching it sprout, without lifting a finger!

Examples of dividend-paying tokens

Hey there, let’s talk about some exciting ways to earn passive income with crypto. I’ve got an awesome list of dividend-paying tokens that can help your digital assets grow!

- First up, KuCoin Shares, or KCS, offers a great opportunity with daily payouts from trading fees on the KuCoin exchange. Holding these tokens means you get a share of the platform’s success, almost like owning a small part of a thriving marketplace.

- Next, take a look at NEO, which rewards you with GAS just for storing it in your crypto wallet. Think of GAS as a nice perk for being part of the blockchain network, sorta like getting free coffee for spending time at a cafe.

- Then there’s VeChain, known as VTHO, where you earn additional tokens by simply keeping VET in your collection. It’s like planting a seed and seeing another plant grow right next to it, enhancing your financial progress.

- These tokens provide consistent dividends, so you’re not just holding crypto, you’re putting it to work for you. Imagine a piggy bank that keeps getting fuller on its own, thanks to your savvy choices in decentralized finance.

- Explore this area with a bit of research on platforms like Trust Wallet to keep your investments secure. It’s a simple move to protect your private keys while earning from these dividend-paying treasures in the cryptocurrency space.

Cloud Mining

Hey there, wanna mine crypto without the hassle of buying pricey gear? Jump into cloud mining, where you can rent power from big data centers and start earning digital coins right away!

How cloud mining works

Cloud mining lets you earn crypto without buying expensive gear. You rent computing power from providers like Genesis Mining, Hashflare, or NiceHash. They handle the hardware and maintenance, while you get a slice of the mined cryptocurrency.

It’s like hiring someone to dig for gold, and you just collect the nuggets.

Getting started is pretty simple, folks. Research providers and pick a mining plan that fits your budget. Register on their site, choose your plan, and track progress using their easy dashboards.

Once you’ve got some crypto, withdraw it to your crypto wallet. No sweat, no mess, just potential steady income from cryptocurrency mining.

Factors to consider before starting

Hey there, let’s chat about jumping into cloud mining for some crypto passive income. It’s tempting, but you’ve got to weigh a few things first.

- Check the Scam Risk: Watch out, folks, because cloud mining has a high scam risk. Many fake companies promise big returns but vanish with your cash. Always dig into reviews and avoid deals that sound too sweet. Stick to known providers like Genesis Mining, Hashflare, or NiceHash to lower your odds of getting burned.

- Look at the Fees: Don’t ignore the costs eating into your profits. Cloud mining often comes with hefty charges, slashing your earnings. Compare fees across platforms before you commit, as lower profitability due to fees is a real issue in this space.

- Study the Market Volatility: Crypto prices swing like a pendulum, my friends. Your mining rewards in Bitcoin (BTC) or other digital assets might drop in value overnight. Keep an eye on market trends, since this can mess with your financial growth plans.

- Think About Energy Consumption: Mining cryptocurrency, even through cloud services, guzzles power. Some providers might not be upfront about their energy costs, which can hit your returns. Ask questions about their setup to avoid surprises down the road.

- Pick a Trusted Crypto Wallet: You’ll need a safe spot for your earnings, right? A solid option like Trust Wallet helps protect your private keys. Don’t skimp here, as losing access to your crypto assets is a nightmare you don’t want.

- Understand Tax Implications: Heads up, earning through cloud mining can trigger taxable events. Those capital gains taxes might sneak up on you when you cash out. Chat with a tax pro to stay on top of any rules tied to your crypto mining gains.

- Assess Counterparty Risk: You’re relying on a third party with cloud mining, and that’s risky. If the provider goes bust or gets hacked, your money could disappear. Research their track record, like checking Genesis Mining’s history, to feel more secure.

- Grasp Regulatory Uncertainty: Laws around crypto mining shift fast across blockchains. Governments might crack down, impacting your operation. Stay updated on rules for decentralized finance (DeFi) to dodge legal headaches.

- Evaluate Mining Rigs: Even if it’s cloud-based, know what kind of mining rig tech they use. Outdated setups mean less efficiency and smaller rewards. Probe providers like Hashflare for details on their hardware to gauge potential returns.

- Consider Annual Percentage Yield (APY): Finally, crunch the numbers on your expected APY. High fees or low crypto prices can tank your returns on this fixed income idea. Be real about what you might earn before handing over your hard-earned cash.

Play-to-Earn Games

Hey there, wanna earn crypto while having a blast? Check out play-to-earn games on blockchain platforms like Axie Infinity and The Sandbox, where your gaming skills can stack up real digital coins!

Using blockchain games to earn crypto

Blockchain games are a fun way to make crypto passive income. You play, complete tasks, and earn digital assets like NFTs or tokens. These games, often called play-to-earn platforms, run on blockchain technology.

Think of it as getting paid to have a good time, kind of like winning a prize at a fair.

Many popular play-to-earn games offer real rewards. They fall into the medium difficulty range for earning crypto, so you don’t need to be a tech wizard. Just grab a crypto wallet, like Trust Wallet, to store your earnings.

Jump in, play a bit, and watch those tokens stack up!

Popular play-to-earn platforms

Hey there, readers, let’s talk about making some crypto cash while having fun! Play-to-earn games are a fantastic way to secure passive income with blockchain excitement.

- Axie Infinity: This game’s a major player in the play-to-earn arena, built on Ethereum (ETH). You collect, breed, and battle adorable creatures called Axies to earn crypto tokens. It’s a bit like owning digital pets that reward you, isn’t that awesome? Explore this decentralized app, handle your crypto wallet, and watch those digital assets increase. Just be cautious of gas fees, they can surprise you!

- The Sandbox: Envision a virtual space where you create and own things, all on a blockchain network. The Sandbox uses Ethereum too, allowing you to earn SAND tokens by building or playing. It’s like being a digital property owner, bringing in crypto passive income. Join this decentralized platform, link your Trust Wallet, and start building your empire. Market ups and downs are real, so stay alert!

- Decentraland: Enter a virtual reality powered by Ethereum (ETH), where you purchase land and earn MANA tokens. It’s an exciting journey, like owning a part of an online metropolis. Play games, host events, and generate crypto with decentralized finance (DeFi) energy. Secure your private keys, step into this space, and witness financial progress. Stay aware of smart contract risks, though!

- Splinterlands: This one’s a card-battling game on a blockchain, sorta like a digital card night with prizes. Earn crypto tokens by winning matches on this decentralized protocol. It’s connected to networks like Solana (SOL) for fast gameplay. Set up with a crypto wallet, trade on cryptocurrency exchanges, and build up those earnings. Be mindful of pump-and-dump schemes, they can hurt!

- Gala Games: Here’s a platform offering plenty of games to earn crypto, all on blockchain tech. Play titles like Town Star and collect GALA tokens as passive income. It’s like striking gold while relaxing with a controller. Use centralized exchanges to convert to cash, and check out this decentralized autonomous organization. Stay informed about tax implications, don’t get caught by surprise!

Takeaways

Wrapping up, crypto presents an interesting opportunity for passive income through methods like staking and lending. Explore this area, and you could discover a great fit for your finances.

Just stay aware of the risks, alright? Feel free to reach out if you have questions, I’m here to help!

FAQs on How to Earn Passive Income with Crypto

1. What’s the simplest way to start earning crypto passive income?

Dive right into crypto staking with coins like Ethereum (ETH) or Cardano (ADA). It’s like planting a seed in a blockchain network and watching staking rewards grow through proof-of-stake (POS) systems.

2. How does crypto lending work for passive income?

With crypto lending, you loan out digital assets on lending platforms or centralized exchanges. You’ll earn interest, often at a solid annual percentage rate (APR), kinda like being a mini-bank for other traders.

3. Can I make money with liquidity pools in decentralized finance (DeFi)?

Absolutely, by becoming one of the liquidity providers in liquidity pools on decentralized protocols, you can earn fees. Just watch out for impermanent loss, which can sneak up like a thief during market volatility. It’s a gamble, but the annual percentage yield (APY) can be sweet on platforms supporting Solana (SOL) or Polkadot (DOT).

4. Is yield farming a good bet for financial growth?

Yield farming in decentralized finance (DeFi) lets you lock up funds in smart contracts for juicy returns. But, hey, beware of smart contract vulnerabilities and gas fees that can nibble at profits. It’s a wild ride, often tied to automated market makers and ERC-20 tokens.

5. What risks should I know about before jumping into crypto savings accounts?

Crypto savings accounts on platforms like Trust Wallet sound cozy, but regulatory uncertainty and tax implications can bite. Plus, market swings with Bitcoin (BTC) or Tezos (XTZ) might jolt your plans. Always guard those private keys like treasure!