Life Insurance is a contract entered between a policyholder & the insurance provider company. In this contract, an insurance provider agrees to provide financial protection in certain unfortunate events like the death of the policyholder. So, Life insurance is a contract entered between a policyholder & an insurance provider company, where the insurer promises to pay the money in exchange for a certain premium in the event of the demise of the insured.

A Term Plan for NRI can be bought for the family & the self to fulfil the financial requirements irrespective of the place of residence. In this plan, the policyholder is required to pay the premium amount to get themselves covered. In any unfortunate event, the beneficiary will receive the death benefit to repay their debts or liabilities, if any. The amount of coverage received can be used to make payments in order to maintain the standard of living.

Features of Life Insurance Plan for NRI

Provided below are the salient features of the Life Insurance plan for NRI:

- Depending on the different types of life insurance plans available, NRIs can choose an appropriate policy.

- The premium amount can be paid in Indian currency.

- The premium amount can be paid either monthly, quarterly, semi-annually, or yearly based on the type of plan chosen.

- Also, many life insurance plans offer additional riders that can be opted for at an additional premium.

Eligibility Criteria

The mentioned category of individuals can avail life insurance plans for NRIs:

NRIs

An Indian citizen with a valid passport who is residing in another country.

Foreign Nationals

They are citizens of a foreign country residing in India, i.e. an individual who is not an Indian citizen.

Person of Indian Origin or Overseas Citizen of India

[a] Any person of full age & capacity,

- who is a citizen of another country but was a citizen of India at the time of, or at any time after the commencement of the Constitution or

- who is a citizen of another country but was eligible to become a citizen of India at the time of the commencement of the Constitution or

- who is a citizen of another country but belonged to a territory that became part of India after the 15th day of August 1947 or

- who is a child or a grandchild or a great-grandchild of such a citizen, or

[b] A person who is a minor child of a person as mentioned in point [a] or

[c] A person who is a minor child whose both or any one of the parents are Indian citizens or

[d] Spouse of foreign origin of a citizen of India or spouse of foreign origin of an Overseas Citizen of India Cardholder registered under section 7A.

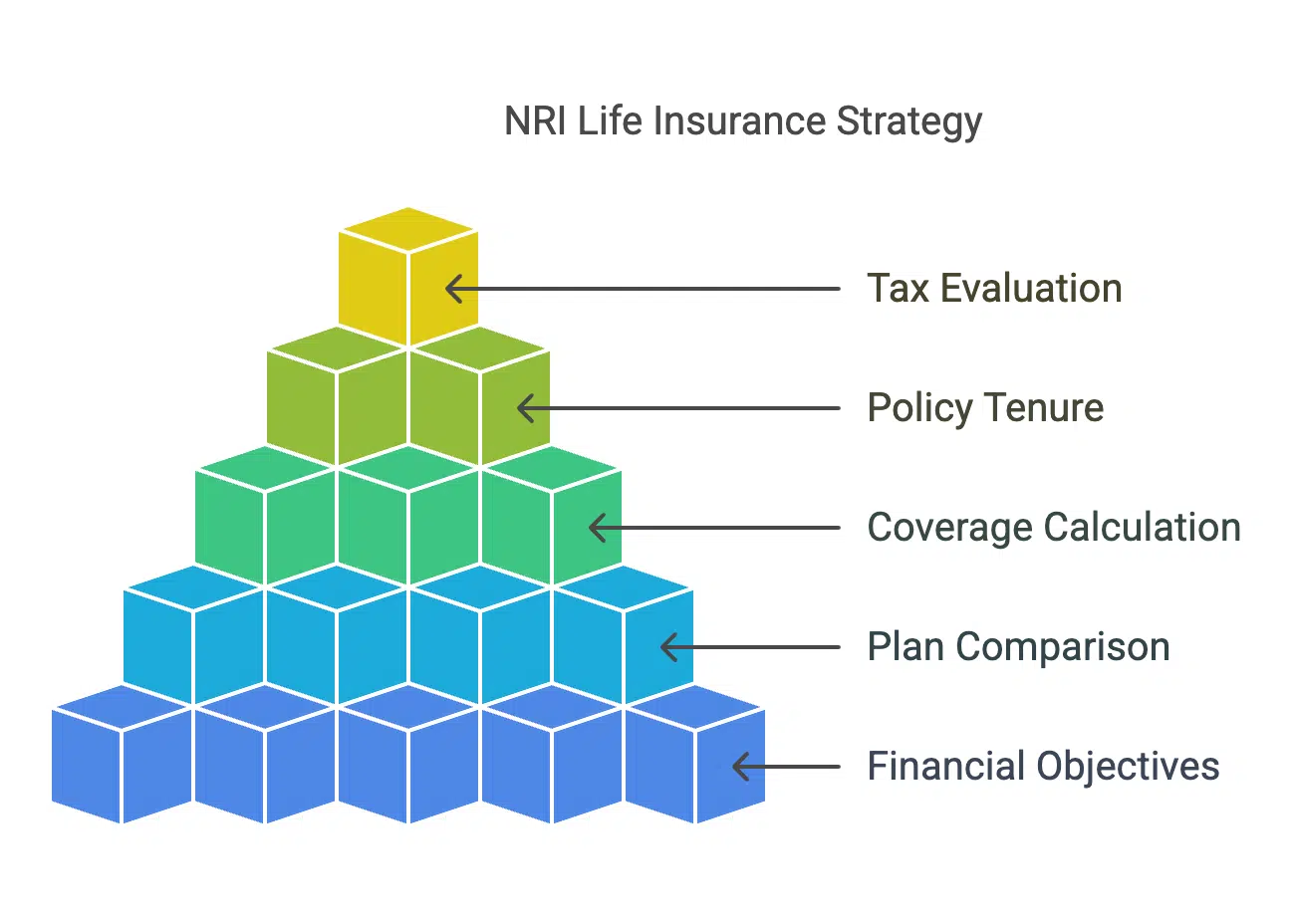

How to Choose the Right Life Insurance Plan for NRI?

Provided are the steps to be followed to choose the right Life Insurance for NRI:

Step 1: Assess the Life Insurance Objectives

As there are many different life insurance plans designed to meet different financial objectives, it becomes important to assess your requirements. Hence, analyse your financial objectives, i.e. requirements from the plan, which will help protect your loved ones & further achieve financial goals.

Step 2: Compare Plans

Once you have assessed our objectives, compare the different plans available based on the cost, tenure, features, etc. This comparison will help you choose a plan that offers the best combination of advantages as per your requirements.

Step 3: Calculate the Optimal Insurance Cover

Calculate the appropriate amount of insurance coverage that would be enough to meet the financial requirements of the family. While choosing the right coverage amount, consider factors such as outstanding loans or debts, financial objectives or obligations, lifestyle patterns, etc.

Step 4: Choose the Appropriate Policy Tenure

Next, select the appropriate life insurance policy tenure to protect the family against difficult situations. To choose the desired policy tenure, consider the age of self & dependent family members.

Step 5: Evaluate Tax Implications

Lastly, evaluate the tax implications that the chosen life insurance plan will provide, ensuring optimal financial planning.

Buying Guidelines

Provided below are some guidelines that an NRI should follow while buying to make the process simple & convenient:

- There are two modes available for buying a life insurance plan by NRI.

- The first option available is to buy a life insurance plan when you visit India, following the same process as followed by Indian citizens.

- Alternatively, buy a life insurance plan from the country of residence through mail order, following a detailed verification.

- The terms & conditions to be followed by NRI are flexible.

- The sum assured ranges from INR 2 lakhs to INR 1 crores, where the premium to be paid depends upon the terms of the policy, frequency, age, & health conditions.

- The policy tenure also ranges from 5 years to 30 years.

- An individual aged between 18 & 65 is eligible to buy a life insurance plan.

- Payment towards the premium amount can be made online, but the NRI policyholder should hold a bank account with the bank mentioned in the policy.

- The payment can be made in the form of a remittance in a foreign country through a Non-Resident Ordinary account (NRO) or a Non-Resident External account (NRE).

- If the risk involved is the same, the premium will remain the same in the case of resident Indians & NRIs.

- No additional premium would be charged for an NRI applicant.

- The amount of the death benefit will be credited to the bank account specified in the insurance plan.

Conclusion

The NRIs can buy a life insurance plan to avail themselves of wealth creation benefits & provide financial security to their family members. Before buying a life insurance plan, you should analyse the requirements of the plan, assess the financial objectives & compare different plans available on the basis of premium, sum assured, CSR, policy tenure, & benefits offered.