The financial industry has undergone a massive transformation in the past decade, thanks to the rise of financial technology, commonly known as fintech. One of the most significant impacts of fintech has been the way it has democratized investing, breaking down barriers that previously prevented small investors from participating in the financial markets.

Traditionally, investing was reserved for high-net-worth individuals with access to financial advisors, expensive brokerage services, and in-depth market knowledge. However, fintech has leveled the playing field, making investing more accessible, affordable, and transparent than ever before.

Fintech platforms and services have enabled anyone with an internet connection to invest in stocks, bonds, real estate, and even cryptocurrencies without the need for large capital or professional guidance. The barriers to entry, such as high fees, complex investment procedures, and limited market access, are being removed, empowering retail investors worldwide.

This article explores how fintech democratizes investing: breaking barriers for small investors, covering key innovations such as zero-commission trading platforms, fractional investing, robo-advisors, cryptocurrency, and crowdfunding. We will also examine the future of fintech investing, potential risks, and how small investors can take advantage of these opportunities to grow their wealth.

Understanding Fintech’s Role in Investment Democratization

Fintech has emerged as a game-changer in the world of investing, bridging the gap between traditional finance and cutting-edge technology. By introducing automation, artificial intelligence, blockchain, and mobile applications, fintech companies have made it possible for individuals to invest seamlessly from anywhere in the world.

This transformation has significantly improved financial inclusion, allowing small investors to access global markets with ease. Additionally, fintech platforms provide extensive educational resources, enabling novice investors to make informed decisions without requiring professional financial advisors.

What Is Fintech and How It Reshapes Investing??

Fintech refers to the integration of cutting-edge technology into financial services, aimed at improving accessibility, efficiency, and affordability for investors of all backgrounds. This digital revolution has significantly transformed traditional investing by eliminating intermediaries, reducing costs, and simplifying complex investment processes.

Through mobile applications, AI-driven analytics, and blockchain-based transactions, fintech empowers individuals to manage their investments with greater transparency and control.

By leveraging data-driven insights, automation, and decentralized platforms, fintech not only enhances investment accessibility but also fosters financial literacy, making it easier for small investors to participate in wealth-building opportunities that were once reserved for institutional players.

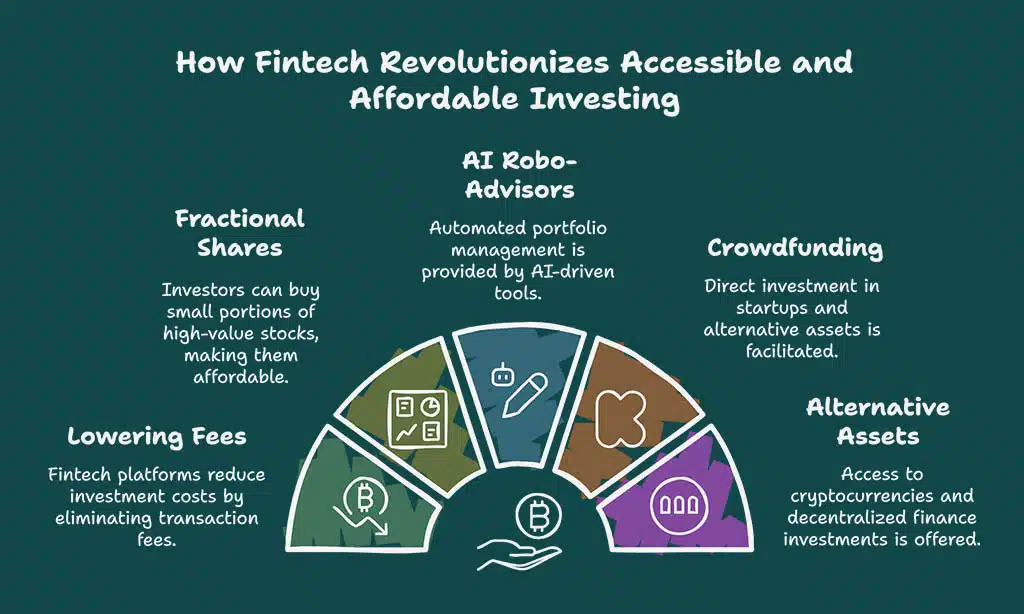

Key ways how fintech democratizes investing: breaking barriers for small investors include:

- Lowering transaction fees through zero-commission trading platforms.

- Providing access to fractional shares, making high-value stocks affordable.

- Utilizing AI-driven robo-advisors to automate portfolio management.

- Enabling direct investment in startups and alternative assets via crowdfunding.

- Offering alternative assets like cryptocurrency and decentralized finance [DeFi] investments.

- Providing education and investment tools for beginners through fintech apps.

Growth of Fintech Investing Over the Years:

| Year | Global Fintech Investment [USD Billion] | Number of Fintech Startups |

| 2015 | 46.7 | 8,000 |

| 2018 | 112.0 | 12,000 |

| 2021 | 210.1 | 26,000 |

| 2023 | 305.0 | 35,000+ |

The continued expansion of fintech highlights its growing influence in making investing more inclusive and accessible to retail investors.

Key Barriers Small Investors Faced Before Fintech

Before fintech innovations, small investors struggled with several challenges:

| Barrier | Description | Impact on Small Investors |

| High Fees | Traditional brokerages charged high commissions and account maintenance fees. | Reduced potential returns and discouraged frequent trading. |

| Large Minimum Investments | Many stocks, mutual funds, and ETFs required significant capital. | Limited participation for those with small savings. |

| Complexity | Market research and portfolio management required expert knowledge. | Made investing intimidating for beginners. |

| Limited Access | Retail investors were often excluded from high-yield investment opportunities. | Created income inequality in wealth-building. |

Fintech has dismantled these barriers, empowering everyday investors to participate in wealth-building strategies that were once reserved for financial elites.

How Fintech Democratizes Investing for Small Investors

The emergence of fintech has fundamentally transformed the investment landscape, enabling small investors to access financial markets with greater ease and affordability. With innovative digital platforms, fintech removes traditional barriers that once restricted market entry, offering cost-effective, user-friendly solutions tailored to investors with limited capital.

From commission-free trading to AI-driven portfolio management, fintech is reshaping wealth-building opportunities, making investing more inclusive and accessible than ever before.

Zero-Commission Trading Platforms

One of the most significant changes fintech has brought to investing is the rise of commission-free trading platforms. Traditionally, stock trades involved hefty fees that could eat into small investors’ profits, making frequent trading and portfolio diversification costly.

However, fintech firms like Robinhood, Webull, and eToro have eliminated commissions, allowing users to buy and sell stocks without additional costs. This shift has particularly benefited new investors and those with limited capital, as they can now trade as frequently as needed without worrying about eroding their returns due to excessive fees.

Additionally, these platforms have introduced user-friendly interfaces, educational resources, and seamless mobile access, further encouraging retail investors to engage actively in the stock market. As a result, commission-free trading has become a game-changer in democratizing investment opportunities for millions worldwide.

Comparison of Popular Zero-Commission Trading Platforms

| Platform | Key Features | User Base |

| Robinhood | Zero-commission trades, fractional investing, cryptocurrency trading | 22 million+ users |

| Webull | Advanced charting tools, extended trading hours, commission-free options trading | 10 million+ users |

| eToro | Social trading features, copy trading, global stock access | 27 million+ users |

By eliminating fees, fintech ensures that small investors can trade as frequently as they like without worrying about cost-prohibitive commissions.

Fractional Investing – Making Stocks Affordable

In the past, buying shares of expensive stocks like Amazon, Tesla, or Google required thousands of dollars, making them inaccessible to many retail investors. This limitation prevented small investors from diversifying their portfolios with high-growth stocks. Fintech has introduced fractional investing, allowing investors to purchase small portions of these high-priced stocks with as little as $1.

This innovation has made investing more inclusive, enabling individuals to allocate funds across multiple assets, benefit from long-term capital appreciation, and participate in blue-chip stock ownership without needing substantial capital.

Additionally, fractional investing promotes better risk management by allowing small investors to spread their investments across various sectors and companies.

Benefits of Fractional Investing:

| Advantage | Explanation |

| Diversification | Enables small investors to spread risk across multiple assets. |

| Accessibility | Allows ownership of high-value stocks without significant capital. |

| Flexibility | Investors can contribute small amounts regularly, making investing seamless. |

Robo-Advisors and AI-Driven Investment Strategies

Robo-advisors leverage AI and machine learning to provide automated, algorithm-driven financial planning services, revolutionizing investment management for retail investors. Unlike traditional financial advisors who often require high account minimums and charge steep advisory fees, robo-advisors offer an affordable alternative with algorithm-based portfolio allocation tailored to an individual’s risk tolerance and financial goals.

These platforms continuously monitor and rebalance portfolios, ensuring optimal asset allocation based on market conditions. Many robo-advisors also integrate tax-loss harvesting, personalized goal setting, and diversified investment strategies, making them a powerful tool for both beginners and seasoned investors. By eliminating human bias and reducing overhead costs, robo-advisors make investing more accessible, efficient, and data-driven.

Top Robo-Advisors for Small Investors:

| Robo-Advisor | Features | Cost |

| Betterment | Automated rebalancing, tax-loss harvesting, goal-based investing | 0.25% annual fee |

| Wealthfront | AI-driven portfolio management, tax-efficient investing | 0.25% annual fee |

| M1 Finance | Hybrid robo-advisor with customizable portfolios | No management fees |

These platforms make investing seamless, especially for those with little financial expertise.

Crypto and Blockchain – Expanding Investment Opportunities

The rise of cryptocurrency and blockchain technology has further democratized investing by providing small investors with new opportunities beyond traditional markets. Through decentralized finance [DeFi], initial coin offerings [ICOs], and tokenized assets, investors can access financial products without intermediaries, often with lower costs and greater transparency.

DeFi platforms enable peer-to-peer lending and borrowing, allowing individuals to earn interest on their assets without relying on banks. ICOs give investors the chance to buy into early-stage blockchain projects, similar to venture capital funding but on a decentralized scale.

Tokenized assets convert real-world assets—such as real estate, art, and stocks—into digital tokens that can be traded in fractions, making them accessible to small investors who may not have the capital to buy whole shares or properties. These innovations are significantly lowering entry barriers, increasing market participation, and redefining how individuals build wealth.

| Crypto Trend | Explanation |

| DeFi Lending | Allows investors to earn interest on crypto assets without banks. |

| Tokenized Assets | Enables fractional ownership of real estate, art, and venture capital. |

| NFT Investments | Gives investors access to digital art and blockchain-based assets. |

The Future of Fintech and Small Investors

As fintech continues to evolve, it is shaping the future of investing in profound ways. The increasing adoption of artificial intelligence, blockchain technology, and decentralized finance [DeFi] is expanding investment opportunities while reducing costs and improving efficiency.

Investors now have access to highly personalized financial tools that were once available only to institutional players.

Moreover, as regulatory frameworks develop, fintech companies will need to strike a balance between innovation and compliance to ensure security and transparency for users. The future of fintech investing looks promising, with a shift toward more automation, inclusivity, and global accessibility.

Trends Shaping the Next Generation of Fintech Investing

Fintech continues to evolve, offering new possibilities for small investors. Some key trends include:

- AI-powered investment advisors that offer even more personalized insights.

- DeFi [Decentralized Finance] platforms replacing traditional banking systems.

- Tokenization of assets, allowing fractional ownership of real estate, art, and other high-value assets.

- Metaverse Investments, where users can buy digital real estate and virtual assets.

Takeaways

Fintech has revolutionized the investment landscape, granting small investors unprecedented access to financial markets that were once dominated by institutional players and high-net-worth individuals. By lowering costs, simplifying processes, and expanding investment opportunities, fintech has empowered individuals to take control of their financial futures.

From zero-commission trading and robo-advisors to cryptocurrency and crowdfunding, fintech continues to evolve, making wealth-building more inclusive than ever.

By understanding how fintech democratizes investing: breaking barriers for small investors, individuals can leverage these tools and innovations to grow their assets and navigate the complexities of the financial world with confidence.