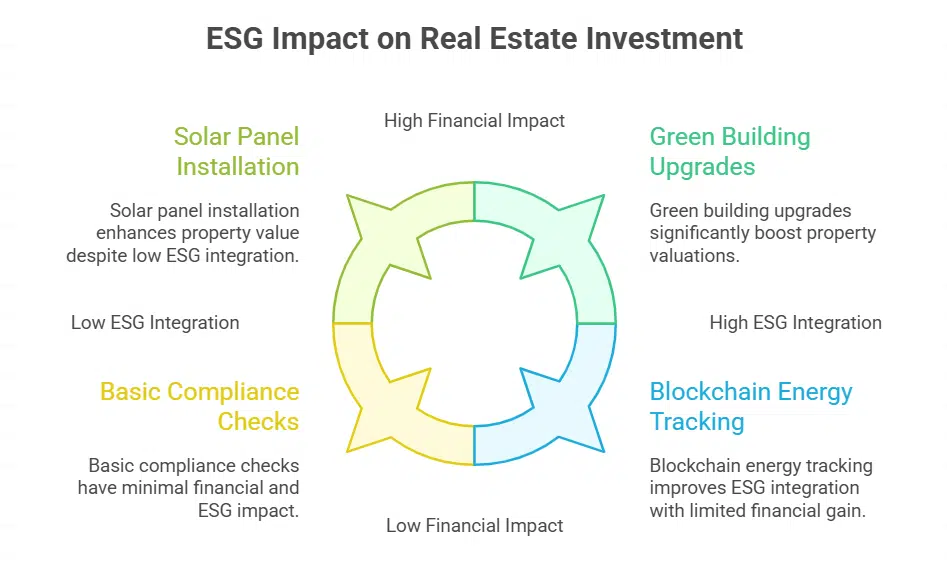

Many real estate investors feel lost when they choose tech that claims to be green. EY finds that green building investments bring higher rent and fewer empty units. This post will show how environmental, social, and governance factors steer money to energy-efficient buildings, solar panels, and IoT devices that cut energy use.

Read on.

Key Takeaways

- An EY 2023 study shows that LEED- or BREEAM-certified green buildings yield 10% higher rents and 15% fewer vacancies, boosting property valuations.

- Investors deploy smart building platforms—IoT sensors, building information modeling, and digital twins—to monitor energy use, cut carbon footprints, and drive about 25% efficiency gains.

- They install solar panels, heat pumps, and battery storage and use blockchain-based ledgers to reduce carbon output, track sustainable materials, and meet EU Taxonomy rules.

- Firms use prefab systems and machine-learning tenant models to slash construction waste, forecast tenant behavior, and uphold governance, which raises rents and shrinks vacancies.

- Cloud-based governance dashboards help track ESG factors across portfolios, flag non-compliance, and enhance transparency in net assets and supply chains.

The Role of ESG in Shaping Real Estate Tech Investments

Real estate investors now demand transparency and action on ESG issues. They no longer stick their heads in the sand. Data analytics and digital twins help them track climate risks and energy use.

Smart building technology cuts waste, boosts energy efficiency, and helps meet net zero goals. EY highlights that green building upgrades can raise rents and lower vacancies, lifting property valuations.

ESG risk now shapes the landscape of green investment. Governance practices sit at the heart of due diligence. Real estate investors set clear ESG criteria, making supply chain checks and risk management tools crucial for regulatory compliance.

They pull out all the stops by adding solar panels, heat pumps, and renewable power to reduce carbon output. Tech firms build blockchain ledgers to track each energy source.

Key ESG Trends Driving Innovation in Real Estate Technology

Capital markets now hinge on environmental, social, and governance factors, pushing proptech forward. Investors demand accountability, they seek resilience against climate change.

- Smart building platforms link IoT sensors and building information modeling to deliver real time energy use data, cut carbon footprints, and boost energy efficiency.

- Distributed ledger tools track sustainable materials and verify solar panels origin, support regulatory compliance, and meet ESG goals.

- Digital twin software runs scenario analysis for floods, hurricanes, and rising sea levels, guiding long-term planning and climate resilience.

- Data analytics platforms drive circular economy efforts, monitor waste reduction, and shape investment strategies in affordable housing and green buildings.

- Prefab systems use sustainable development designs and net-zero emissions targets to slash construction waste and speed delivery of ESG-compliant properties.

- Machine learning models forecast tenant behavior, curb under-performance, and uphold corporate social responsibility, which boosts rental rates and cuts vacancies.

- Integration of solar panels and renewable energy sources lowers energy use, advances carbon reduction, and raises property valuations.

- Cloud-based governance systems track ESG factors across portfolios, enhance transparency in net assets, and flag non-compliance before it hits financial position.

The Future of ESG-Driven Investments in Real Estate Tech

Investors will use IoT sensors and big data analytics to track energy consumption in office markets and malls. Blockchain will verify environmental, social, and governance scores and log renewable energy credits.

An EY 2023 study shows green buildings with LEED or BREEAM labels can fetch rental rates 10% above market average and cut vacancy by 15%. Battery storage systems will join solar panels and wind turbines on rooftops to boost onsite clean energy.

Such tools will cut waste and ease regulatory compliance under the EU taxonomy for sustainable activities.

PropTech firms will blend smart building technology with sustainability metrics on real-time dashboards. Smart thermostats and room-level lighting controls will drive energy efficiency gains near 25%, lowering operating costs.

Strong ESG practices will attract high-quality tenants and cut rent reduction requests. Investors will pay a premium for ESG-compliant properties, locking in long-term value. This shift will shape future real estate investments toward resilience and ethical investments.

Takeaways

Green tech draws fresh capital in property markets. Firms adopt smart building systems and renewable energy devices. They cut waste, boost energy efficiency, and meet environmental sustainability goals.

Stakeholders plan for long term value. Strong governance and social focus shape smarter projects.

FAQs on How ESG Is Shaping Investment in Real Estate Tech

1. What is ESG in real estate tech?

ESG stands for environmental, social, and governance. It is a set of rules for ethical investments. In the real estate sector, investment managers use ESG scores to shape investment strategies and pick tech for sustainable development.

2. How do renewable energy sources and sustainable materials shape new buildings?

Developers add wind turbines on roofs, and use hemp panels or bamboo floors. These moves cut energy consumption, fight climate change, and boost environmental sustainability.

3. Why do investors value smart building technology?

Smart building technology acts like a brain for buildings. It tracks energy use, boosts energy efficiency, and links to workplace wellness sensors. Investors love this for lower costs and happier tenants.

4. How does ESG compliance boost property valuations?

ESG-compliant properties often get higher property valuations. Regulators reward waste reduction, green finance, and strong regulatory compliance. This boosts long-term value for owners.

5. What role do governance practices and social criteria play for developers?

Developers follow corporate governance and corporate social responsibility rules. They pick suppliers and outsourcing services that meet social and governance criteria. This builds market trust and meets CSR goals.

6. How does ESG investing drive long-term success?

ESG investing uses ethical investments and sustainable practices. Real estate investors focus on sustainable development and risks from climate change. This approach drives real estate sustainability, cuts waste, lowers bills, and boosts income over time.