Hey there, first-time health insurance buyer! Are you feeling lost about picking the right plan, or worried about the high costs of medical expenses? I get it, buying health insurance can feel like solving a tricky puzzle, especially when terms like premiums and deductibles pop up.

Here’s a key fact to chew on, health insurance helps cut down the heavy load of healthcare costs by paying for part or all of your doctor visits and treatments. Pretty neat, right? In this blog, we’ll break down the basics of health insurance coverage, guide you through key factors like choosing between HMOs and PPOs, and share handy tips for keeping out-of-pocket costs low.

Stick with me to learn more!

Key Takeaways

- Health insurance covers costs like doctor visits and hospital stays, protecting your savings.

- You pay a monthly premium and a deductible before coverage starts, with a yearly out-of-pocket maximum limit.

- Compare plans like HMOs for lower costs or PPOs for more provider choices on the Health Insurance Marketplace.

- Open Enrollment runs from November 1 to January 15 in most states; don’t miss it.

- Check subsidies or tax credits through the Affordable Care Act to lower your costs.

What is Health Insurance?

Health insurance is like a safety net for your wallet when medical bills pile up. It helps cover costs for doctor visits, hospital stays, and even prescription drugs. Think of it as a buddy that steps in to ease the load of healthcare expenses, paying all or part of your treatment.

Without it, a single trip to the hospital could wipe out your savings, but with it, you’ve got financial security.

Now, let’s break it down a bit. You pay a monthly fee, called a premium, to keep your insurance active. Then, there’s a deductible, which is the amount you shell out before your plan kicks in.

After that, you might have a copay, say $20 for a checkup, or coinsurance, where you cover a percentage of the bill. Don’t fret, though, because there’s an out-of-pocket maximum, a yearly limit on what you pay.

Once you hit that cap, your insurance company takes over 100% of covered costs. Basic plans often include hospitalization, preventive care, and more, keeping you protected.

Key Factors to Consider When Buying Health Insurance

Hey there, let’s chat about picking the right health insurance. It’s a big step, but I’ve got your back with some key tips.

- First up, look at the insurance premiums and out-of-pocket costs. These are the amounts you pay monthly and what you shell out for doctor visits or meds before coverage kicks in. Plans differ a lot in these costs, so check if the monthly fee fits your budget and if you can handle the deductibles for medical expenses.

- Next, think about your personal needs for health services. Do you need frequent doctor visits, prescription drug coverage, or care for chronic conditions? Picking a plan that matches your lifestyle, like one covering mental health services, can save you a ton of hassle down the road.

- Also, scope out the type of plan, like HMOs or PPOs. Health Maintenance Organizations (HMOs) often limit you to in-network providers and need referrals, while Preferred Provider Organizations (PPOs) give more freedom to see different healthcare providers. Each has its own rules, so see which fits your vibe.

- Don’t skip checking the provider network. Are your favorite doctors or nearby hospitals in the plan’s list of in-network providers? If not, you might face higher out-of-pocket maximum fees, and nobody wants that surprise bill.

- Ponder your age, location, and health status too. These things, along with stuff like smoking habits or pre-existing issues, can bump up health insurance costs. A young, active person might grab a cheaper plan than someone older with ongoing medical care needs.

- Finally, dig into subsidies or tax credits from places like the Affordable Care Act marketplace. These can lower your costs big time if you qualify, making health coverage more doable. Always peek at these options for extra financial security.

Tips for First-Time Health Insurance Buyers

Getting health insurance for the first time can feel like a big step, but I’ve got your back. Let’s break this down with some handy tips to guide you, first-time buyers, through the process.

- Start by knowing your needs for health coverage. Look at your lifestyle and medical expenses. Do you often need doctor visits? Maybe you take meds regularly. Figure out if you want coverage for mental health services or prescription drug coverage. This helps you pick a plan that fits like a glove.

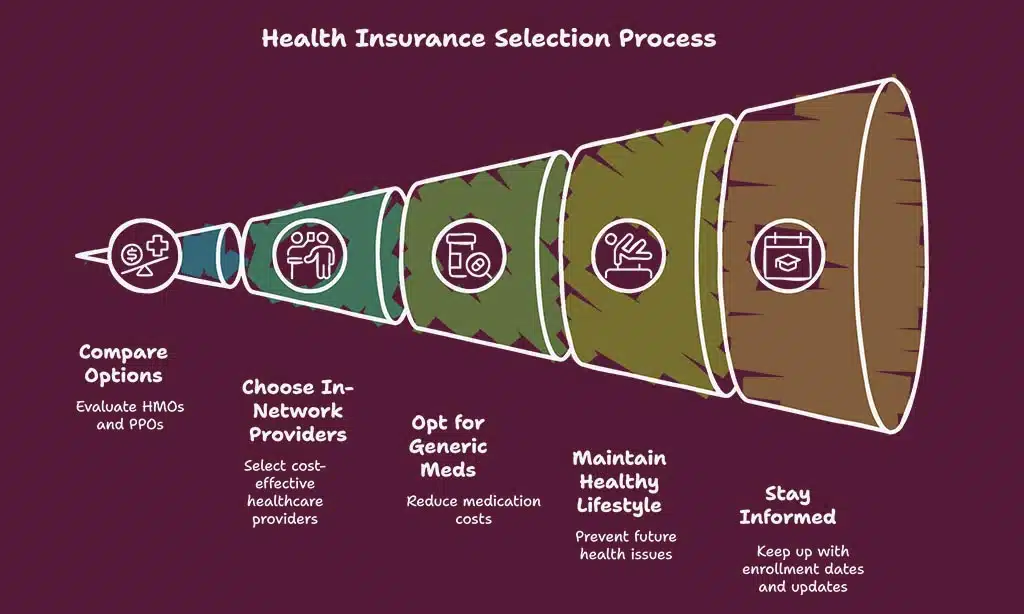

- Always compare coverage options before you decide. Check out plans on the Health Insurance Marketplace. Look at HMOs, which are Health Maintenance Organizations, for lower costs with in-network providers. Or consider PPOs, Preferred Provider Organizations, for more choice in healthcare providers. Dig into insurance premiums and out-of-pocket costs to avoid surprises.

- Stick to in-network providers to save cash. Using doctors and hospitals in your plan’s network cuts down on out-of-pocket maximum fees. It’s a simple trick, like picking the cheapest gas station, but for medical care.

- Opt for generic meds when you can. They work just as well as brand names but cost way less. This small swap can shrink your healthcare service bills without a hassle.

- Keep up a healthy lifestyle to dodge extra costs. Eat well, move your body, and get preventive care checkups. It’s like putting oil in your car; it keeps things running smooth and saves money on bigger fixes later.

- Mark your calendar for enrollment dates. The Open Enrollment Period runs from November 1 to January 15 in most states. Miss it, and you might need a Special Enrollment Period for big life changes like marriage or moving. Don’t sleep on these deadlines, or you’ll be left uninsured.

- Gather your personal info before applying. Have your ID, income details, and address ready. Then, compare plans, pick the best insurance policy, and submit your application with all documents by the deadline. Review your choice before it’s final to avoid slip-ups.

- Explore financial help if money’s tight. Check subsidies on Marketplace plans or ask about employer-sponsored plans for contributions. These can ease the sting of insurance premiums and give you financial security.

- Chat with an insurance agent for clarity. They can explain tricky terms and point you toward affordable Care Act options. Think of them as a friend who knows the ins and outs of health insurance.

- Stay active on social media for updates. Follow pages on Twitter or Facebook for tips on healthcare services. Adjust privacy settings to keep your info safe while browsing on tools like Microsoft Edge. It’s a quick way to stay in the loop.

Takeaways

Hey there, first-time buyers, let’s wrap this up with a quick nudge! Picking health insurance might feel like a tightrope walk, but you’ve got the basics now. Take a deep breath, chat with an agent if needed, and grab a plan that fits your life.

Ain’t no shame in asking questions to secure your financial peace. Stick with it, and you’ll sleep easy knowing medical bills won’t knock you down!

FAQs

1. What’s the big deal about health insurance for first-time buyers?

Hey, stepping into the world of health coverage can feel like jumping into a cold pool, but it’s your safety net! Health insurance shields you from huge medical expenses, covering stuff like doctor visits and even mental health services. For first-time buyers, grasping this financial security is key to dodging nasty out-of-pocket costs.

2. How do I pick between HMOs and PPOs in my insurance policy?

Listen up, picking between HMOs, or Health Maintenance Organizations, and PPOs, known as Preferred Provider Organizations, is like choosing between a strict diet and a buffet. HMOs often mean lower insurance premiums but stick you with in-network providers, while PPOs give more freedom to see various healthcare providers at a higher cost.

3. What’s this out-of-pocket maximum I keep hearing about?

Think of the out-of-pocket maximum as your “stop-loss” line in the sand. It’s the most you’ll pay for covered services in a year before your insurance coverage kicks in fully for medical expenses.

4. Does health insurance cover stuff like pills and therapy under the Affordable Care Act?

Absolutely, most plans under the Affordable Care Act include prescription drug coverage and mental health services, so you’re not left high and dry. It’s like having a trusty sidekick for both body and mind. Check your policyholder details to see what’s included with employer-sponsored plans or individual health coverage.

5. Why should I care about preventive care and managed care options?

Well, buddy, preventive care is your ounce of prevention worth a pound of cure, catching issues early through regular checkups with in-network providers. Managed care, like in many plans, keeps costs down by guiding you to specific healthcare providers. Ignoring this could hit you with bigger out-of-pocket bills, so don’t sleep on it!