Health insurance is important for managing medical expenses. But choosing the right type of plan can feel confusing, especially in India. Many people wonder if they should pick group health insurance or individual health insurance.

Group health insurance is often provided by employers and covers many people under one policy. On the other hand, individual plans offer coverage that’s more personalized but come with higher premiums.

This blog will explain these differences clearly, helping you decide what suits your needs best.

Keep reading to make an informed choice!

What is Group Health Insurance?

Group health insurance covers a group of people under one policy. Employers often provide it to their employees as part of employee benefits.

The insurer sets lower premiums because the risk gets spread across many individuals in the group. This makes it more affordable than individual policies. These plans may include coverage for medical expenses, maternity benefits, and pre-existing conditions without a waiting period.

What is Individual Health Insurance?

Individual health insurance is a plan you buy for yourself or your family. It covers medical expenses like hospital stays, doctor visits, and treatments. Policies can offer personalized coverage based on your needs.

Critical illness cover, maternity benefits, or preventive care may be added.

You pay the full premium directly to the insurer. Unlike corporate health insurance provided by employers, this policy remains with you even if you change jobs. The sum insured and premiums are decided based on factors like age and health risks.

Lifetime renewability is often available, giving lasting protection against medical inflation and unexpected costs.

A personal health policy gives freedom to choose what fits best while securing your future.

Key Differences Between Group Health Insurance and Individual Policies

Group health insurance and individual policies vary in coverage, costs, eligibility, and flexibility—learn what sets them apart!

Coverage and Benefits

Group health insurance offers financial coverage to many people under one plan. It often includes benefits like lower premiums, maternity benefits, and coverage for pre-existing conditions.

Employers usually pay the full premium cost, reducing the burden on employees. These policies also provide access to a wide network of hospitals.

Individual health insurance focuses on personalized coverage. It allows policyholders to choose specific add-ons like critical illness cover or family health insurance. The insured pays premiums directly to the insurer.

Unlike group plans, this type of medical insurance offers lifetime renewability and continues even if you change jobs or are laid off.

Premium Costs

Insurance premiums for group health insurance are often lower than individual policies. Employers usually pay the entire premium or a big part of it as part of employee benefits. This makes corporate health insurance more affordable for workers.

In contrast, individuals bear full premium costs when buying personal health insurance. These plans can be more expensive but offer personalized coverage and flexibility. Group medical insurance pools risks across members, reducing costs for each person while ensuring financial coverage for medical expenses.

Eligibility Criteria

Group health insurance is for employees of a company or members of an organization. Companies offer these plans as part of employee benefits. Small businesses, start-ups, and large corporations can all provide such coverage.

Individual health insurance can be bought by anyone meeting the insurer’s age and medical requirements. Applicants may need to go through medical underwriting or meet specific health criteria set by insurers.

Policy Customization

Policy customization is more flexible in individual health insurance. It allows you to choose plans based on personal needs like maternity benefits or critical illness cover. You can also adjust the sum insured, add family members, or include riders for extra protection.

Group health insurance offers limited options. The employer decides benefits and coverage levels for employees. Employees cannot modify terms or add specific features. This makes group medical insurance less personalized but simpler to manage as part of employee benefits.

Continuity of Coverage

Group health insurance often ends if you leave the job. This can disrupt your health insurance coverage. Individual health plans, however, offer lifetime renewability. These policies ensure long-term protection and avoid breaks in coverage.

Insurance portability helps transfer individual plans between providers without losing benefits or waiting periods. Group insurance may lack this flexibility, leaving gaps in financial coverage for medical expenses during transitions.

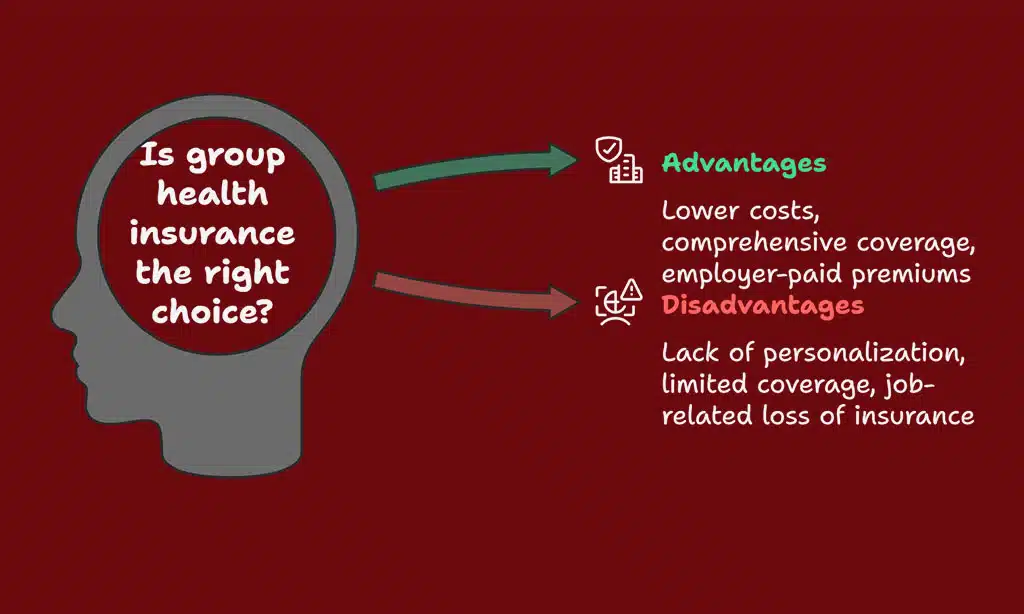

Pros and Cons of Group Health Insurance

Group health insurance offers many benefits but also has its limits—find out what works best for you.

Advantages

Employers often pay the health insurance premiums for group health policies. This lowers costs for employees while offering financial coverage for medical expenses. These plans also cover pre-existing conditions, making them helpful for many workers.

Group insurance usually comes with lower premium costs compared to individual policies. It provides comprehensive coverage to include maternity benefits, critical illness cover, and other essential needs without extra charges.

Disadvantages

Group health insurance often lacks personalized coverage. The plan focuses on the group’s needs, so individual preferences may be ignored. Employees can lose coverage when leaving a job, creating gaps in protection.

Pre-existing conditions might not get full benefits under some group policies.

The sum insured is usually limited in these plans. This amount may not cover high medical expenses during severe illnesses or emergencies. Policy customization is minimal, leaving little room for specific add-ons like critical illness insurance or extended maternity benefit options.

Pros and Cons of Individual Health Insurance

Individual health insurance gives you more control over your coverage. It is bought directly by a person, not through an employer.

- You can choose a policy that fits your needs completely. This includes maternity benefits, critical illness insurance, and family health insurance.

- Premiums are higher compared to group medical insurance. The insured person pays the full cost.

- Plans come with lifetime renewability. This ensures continued health insurance coverage even in old age.

- Individual policies cover pre-existing conditions after a waiting period. This can range from 2 to 4 years.

- Tax benefits under the Income Tax Act are available on premiums paid for personal health insurance.

- There is no dependency on an employer for financial coverage or employee wellness plans.

- Claims are easier to process since they only involve the policyholder and the insurance company.

- Medical expenses caused by job changes or retirement are covered if the policy is maintained regularly.

- Insurance portability allows you to switch between health insurers without losing benefits like no claim bonus.

- Plans offer personalized coverage but can be costly during medical inflation periods if not reviewed often enough.

Takeaways

Group health insurance and individual policies are very different. Group plans cover employees together, often at lower costs. Individual plans offer more flexibility but can be expensive.

Each option has its own perks and challenges based on needs. Choose wisely to protect yourself from rising medical costs.

FAQs

1. What is the main difference between group health insurance and individual health insurance?

Group health insurance is provided by employers to cover employees under one policy, while individual health insurance is purchased personally for a single person or family.

2. Does group health insurance offer tax benefits?

Yes, employer-sponsored group health plans often provide tax benefits to both employers and employees under the Income Tax Act in India.

3. Can pre-existing conditions be covered under a group policy?

Group medical insurance usually covers pre-existing conditions from day one, unlike personal policies that may have a waiting period.

4. Is lifetime renewability available in group health plans?

No, most corporate health policies are valid only as long as you are employed with the company, whereas individual policies offer lifetime renewability.

5. Are maternity benefits included in both types of plans?

Maternity benefit coverage is more commonly included in corporate insurance but might require an additional premium for personal or family plans.

6. Which type of plan offers better financial coverage against critical illnesses?

Individual critical illness cover provides personalized coverage tailored to specific needs, while group policies may offer limited sums insured for such conditions.