For nearly three years, “ChatGPT” was effectively a synonym for “Artificial Intelligence.” It was the Xerox, the Kleenex, the Google of the generative AI revolution. That era is officially over. Data emerging from late 2025 and solidifying in early January 2026 confirms a massive, structural restructuring of the artificial intelligence landscape.

While ChatGPT remains the market leader in terms of total registered users, its monolithic dominance has cracked under the immense pressure of Google’s ecosystem distribution and a series of highly successful model updates. The headline statistics are stark and paint a picture of a market in rapid correction. ChatGPT’s market share of web traffic has plummeted from a near-monopolistic ~87% to roughly ~64-68% year-over-year. In contrast, Google Gemini has surged from a niche player hovering around 5% to capturing over 21% of the market.

This shift has effectively broken OpenAI’s stranglehold on the industry, establishing a true duopoly—and perhaps, as we will explore, a complex triopoly. This in-depth analysis dissects the data behind this Google Gemini vs ChatGPT Market Shift, the viral “Nano Banana” catalyst, the invisible war of unit economics, and why OpenAI has declared a continued “Code Red” for 2026.

Key Takeaways

Before diving into the deep analysis, here are the critical signals defining the current state of the AI industry.

-

The Market Shift is Structural: ChatGPT’s market share drop (~87% to ~68%) and Gemini’s triple-digit growth (~5% to ~21%) is not a seasonal fluctuation; it is a permanent correction driven by availability.

-

The “Convenience” Split: ChatGPT is losing the “casual” user (students, general queries) to Gemini’s seamless mobile integration, while largely retaining the “pro” user (coders, writers).

-

Product Catalysts: The release of the “Gemini 3” model and the viral “Nano Banana” image generator provided the necessary quality and cultural relevance to drive Q4 2025 growth.

-

The Distribution Moat: Google’s “Passive Distribution” via Android and Workspace (Docs/Gmail) has proven to be an insurmountable advantage for acquiring non-technical users.

-

The “Sandwich” Threat: OpenAI is not just fighting Google; it is being squeezed from the top by Anthropic’s Claude (favored by coders) and from the bottom by Gemini (favored by general users).

The Data Dive: Anatomy of a Surge

The numbers do not lie: the final quarter of 2025 was the pivotal moment where “first-mover advantage” gave way to “ecosystem advantage.” According to cross-referenced reports from major analytics firms like Similarweb and Sensor Tower, the traffic patterns reveal a distinct migration.

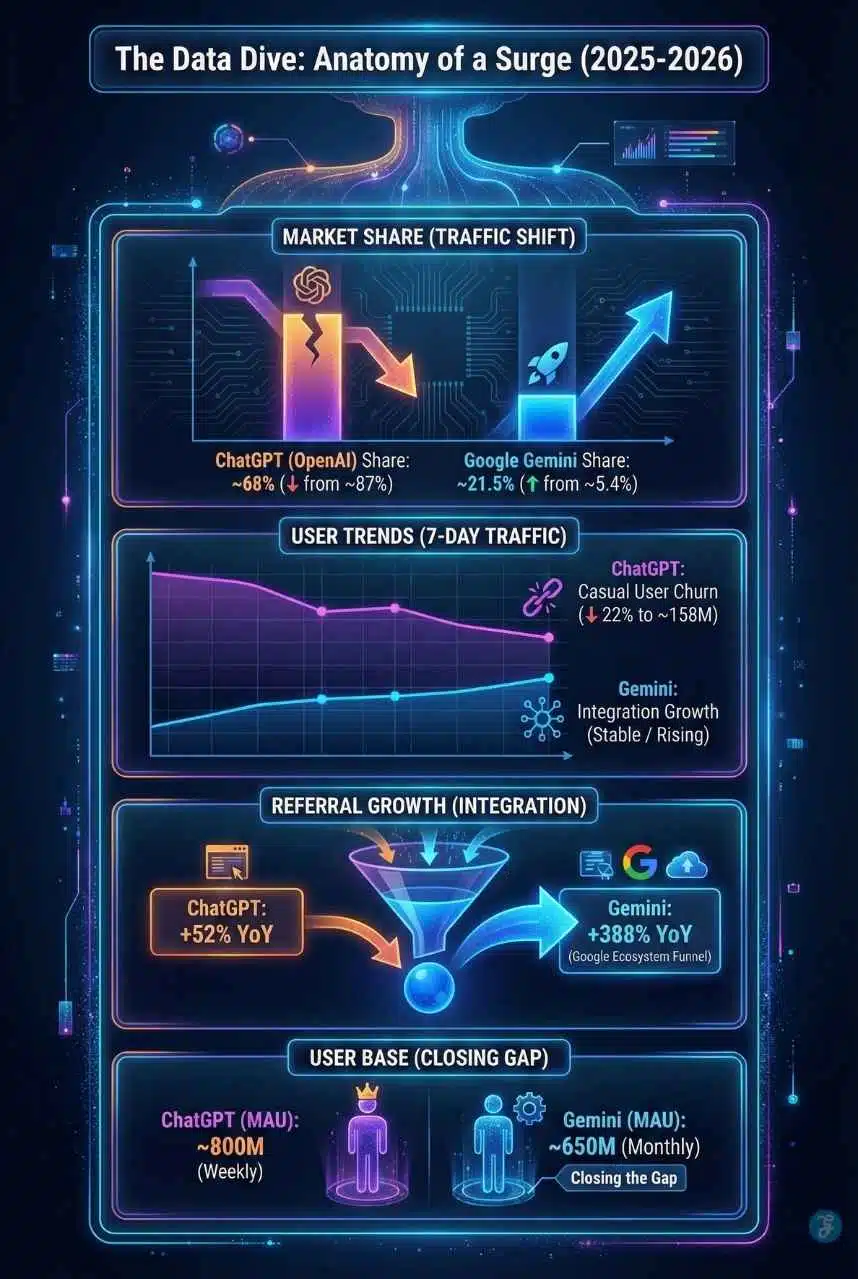

Traffic & Market Share Shifts [Jan 2025 – Jan 2026]

The following table illustrates the dramatic redistribution of user attention across the two major platforms:

| Metric | ChatGPT (OpenAI) | Google Gemini | The Trend Analysis |

| Market Share (Web) | 68% (↓ down from 87%) | 21.5% (↑ up from 5.4%) | Correction: The market is diversifying; the “default” option is no longer the only option. |

| 7-Day Traffic Avg | 158M (↓ down from 203M) | Stable / Rising | Churn: Casual users are abandoning the standalone app habit for integrated solutions. |

| Referral Growth | +52% YoY | +388% YoY | Integration: Google is funneling massive traffic from its other services (Search, Drive). |

| User Base (MAU) | ~800M (Weekly) | ~650M (Monthly) | Closing Gap: Gemini is catching up at a velocity OpenAI cannot match organically. |

The “Loyalty Gap” and User Archetypes

A critical nuance in this data is retention. While ChatGPT’s raw visitor numbers dropped by approximately 22% in Q4 2025, the churn was not evenly distributed.

-

The Power Users: Coders, long-form writers, and prompt engineers remained highly loyal to ChatGPT. Their workflows are “sticky,” and they have built custom GPTs and archives that are hard to migrate.

-

The Casual Majority: The users leaving ChatGPT appear to be the “casual majority”—students asking for homework help, people looking for quick recipes, or users generating fun images. These users have found an easier alternative that is already installed on their phones via Android updates, removing the need for a separate app.

The Product Catalysts: “Nano Banana” & Gemini 3

For a long time, Google’s AI products suffered from a reputation of being “good, but not GPT-4.” In late 2025, that narrative shattered due to two specific product launches.

The “Gemini 3” Leap

Google launched Gemini 3 with a clear mission: to end the parity debate. Unlike previous iterations (Gemini 1.0 or 1.5) that claimed to equal GPT-4 but often hallucinated or refused prompts, Gemini 3 demonstrated objectively superior performance in key areas:

-

Long-Context Reasoning: It could handle massive amounts of information without “forgetting” the beginning of the prompt.

-

Multimodal Fluency: Its ability to understand video and audio natively was faster and more accurate than OpenAI’s distinct voice/vision modes.

-

The Impact: This neutralized OpenAI’s “intelligence advantage.” Users no longer felt they were sacrificing brainpower by choosing Google; they were simply choosing a different flavor of genius.

The Viral “Nano Banana” Trend

Perhaps the most unexpected driver of the surge was “Nano Banana,” Google’s specialized image generation model hidden within Gemini.

-

What Happened: The model featured a unique, highly stylized aesthetic that became a meme format on TikTok and X (formerly Twitter). Unlike DALLE-3, which often struggled with specific text rendering or style consistency, Nano Banana was fast, fun, and incredibly precise with text.

-

The Funnel Effect: This viral moment acted as a massive top-of-funnel acquisition channel. Millions of young, creative users who had never used Gemini for “work” downloaded it to participate in the image trend. Once inside the ecosystem, they stayed for the chat features.

The “Invisible” Distribution Wall

While model quality matters to engineers, distribution wins markets for the general public. Google’s surge is largely attributed to what analysts call “Passive Distribution.”

The Android Moat

By making Gemini the default assistant on Android devices via a system-level update, Google removed the “friction of choice.”

-

The Old Way: Unlock phone -> Search for ChatGPT app -> Open app -> Type query.

-

The Gemini Way: Long-press power button (or swipe corner) -> Speak query.

-

Result: A user no longer needs to make a conscious decision to use AI; it is simply there.

Workspace Integration

For the enterprise and education sectors, Gemini is now “baked in” to the tools people spend 8 hours a day using: Google Docs, Gmail, and Slides.

-

The friction of “tab-switching”, copying a draft from ChatGPT, and pasting it into a Doc has been eliminated.

-

Strategic Insight: “The winner isn’t always the smartest AI, but the one that is closest to your cursor.” Google placed Gemini at the cursor.

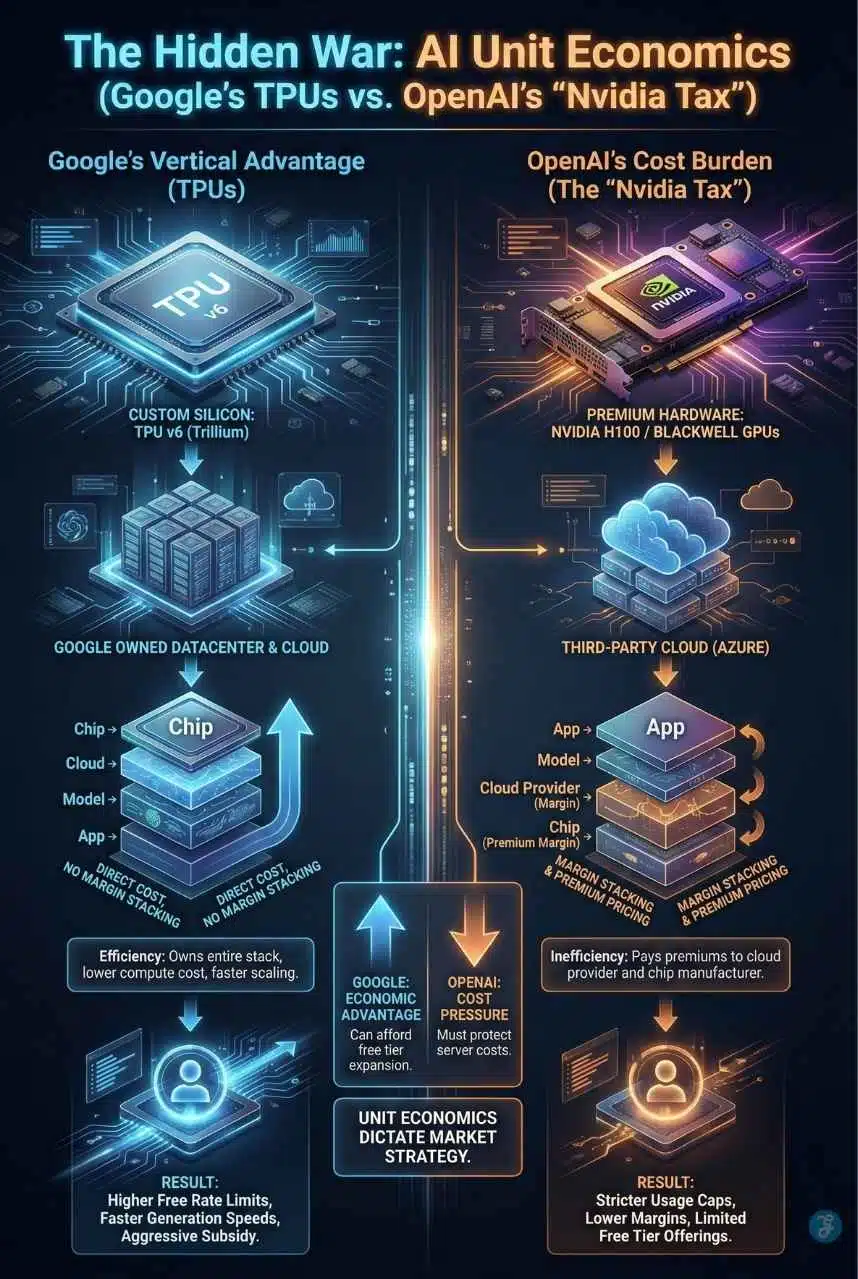

The Hidden War: Unit Economics (TPUs vs. The “Nvidia Tax”)

Beneath the user interface, a critical hardware battle is dictating the profitability and sustainability of this duopoly. This is where Google has a lethal long-term advantage.

Google’s Vertical Advantage (TPUs)

Google runs Gemini on its own custom-designed TPU (Tensor Processing Unit) chips (specifically the Trillium and v6 generations).

-

Google owns the entire stack: The Chip -> The Datacenter -> The Cloud Platform -> The Model -> The App.

-

This vertical integration allows them to avoid “margin stacking.” They pay the cost price for their compute.

OpenAI’s Cost Burden (The Nvidia Tax)

Conversely, OpenAI relies on Microsoft’s Azure infrastructure, which in turn relies heavily on Nvidia’s H100 and Blackwell GPUs.

-

The Tax: OpenAI pays a premium to Microsoft (who takes a margin) and indirectly to Nvidia (who commands massive margins).

-

The Consequence: This unit’s economic disadvantage forces OpenAI to be stingy. In late 2025, while OpenAI had to limit free users to protect server costs, Google successfully rolled out higher rate limits and faster generation speeds for free users. Google effectively “spent” its hardware advantage to buy market share.

The “Zero-Click” Interception: AI Overviews

A significant portion of ChatGPT’s traffic decline may not be users switching to the Gemini app, but users never leaving the Google Search page at all.

The “Answer First” Shift

With the aggressive rollout of AI Overviews (formerly SGE – Search Generative Experience), Google now answers informational queries directly in the search results.

-

Query: “How to remove red wine stains?” or “Capital of Estonia.”

-

Old Behavior: User clicks a link OR goes to ChatGPT to ask.

-

New Behavior: Google provides a comprehensive AI-generated answer at the top of the search page.

The Impact

Data from SEO firms indicates a 60%+ drop in organic click-through rates for informational queries. Google has effectively “insourced” the simple Q&A traffic that bloated ChatGPT’s numbers. This leaves OpenAI with only the more complex “creative” tasks, which are harder to serve and cost more compute to answer.

The Enterprise & Developer Landscape: The “Shadow War”

While ChatGPT fights for the consumer, two other battles are raging in the corporate and developer worlds.

The Enterprise Moat: Infinite Context

Gemini has secured a fortress in the enterprise sector through one specific feature: Context Window Size.

-

The Difference: ChatGPT’s context window allows it to analyze a large document. Gemini’s 2-Million+ token window allows it to analyze entire corporate archives, massive codebases, or hours of video footage in a single prompt.

-

The Shift: In Q4 2025, major legal, financial, and pharmaceutical firms reportedly shifted backend workflows to Gemini Pro because the ability to “upload the whole project” is more valuable than conversational nuance.

-

Maxim: “ChatGPT is for writing the email; Gemini is for analyzing the entire inbox.”

The “Shadow” War: The Rise of Claude

While headlines focus on Google vs. OpenAI, developer data reveals a hidden Triopoly.

-

The Coder’s Choice: Recent developer surveys from Jan 2026 show Anthropic’s Claude 3.7 capturing nearly 32% of the enterprise coding market.

-

The “Sandwich” Attack: OpenAI is being “sandwiched.”

-

Bottom: Google eats the low-end/casual market with free tools.

-

Top: Anthropic eats the high-end/developer market with superior reasoning.

-

Middle: ChatGPT is left squeezing the middle—a dangerous strategic position.

-

OpenAI’s “Code Red”: The 2026 Response

Reports from Silicon Valley indicate that OpenAI CEO Sam Altman issued a “Code Red” in December 2025. The company is pivoting from “expansion” (stores, devices) back to “core capability.”

The GPT-5.2 Sprint

Sources suggest OpenAI rushed the development of GPT-5.2 to counter Gemini 3. However, early benchmarks show Gemini 3 Flash still holding a slight edge in multimodal reasoning (81.2% vs 79.5%). The gap between models has narrowed to the point where “smartest” is a subjective metric.

The Next Battleground: “Agents” Over “Answers”

The decline in ChatGPT traffic signals a broader shift in user expectations: we are moving from the era of Chatbots (which give answers) to Agents (which perform actions).

-

Google’s Advantage: With the latest Android updates, Gemini can interact with other apps (e.g., “Find a flight in my email, add it to my calendar, and book an Uber”).

-

OpenAI’s “Walled Garden” Problem: Without an operating system (OS) of its own, ChatGPT risks becoming a “brain in a jar”—highly intelligent, but disconnected from the user’s digital hands.

Future Outlook: The Duopoly Era

As we move deeper into 2026, the “Monopoly Era” of ChatGPT is undeniably over. We are entering a fragmented Duopoly, or perhaps a Triopoly of specialized use cases:

-

Google Gemini: The “General Utility” AI. Dominant in mobile, email, and quick creative tasks.

-

ChatGPT: The “Specialist Destination.” Dominant in deep, complex writing and legacy workflows.

-

Claude: The “Architect’s Choice.” Dominant in coding and high-logic tasks.

The wild card remains Apple. With “Apple Intelligence” rolling out, their choice of preferred partner could tip the scales yet again. But for now, the data is clear: Google has successfully clawed its way back from the brink.

Final Thought: The “Sandwich” Era

The narrative of 2026 is not just Google Gemini vs ChatGPT Market Shift; it is the “Sandwiching” of the pioneer. OpenAI is fighting a two-front war: Google Gemini is attacking from below with massive distribution and free tiers, while Anthropic’s Claude is attacking from above with superior reasoning for power users.

For OpenAI, the path to survival isn’t just a new model; it’s proving they can be more than just a website in a world where AI is becoming an invisible utility. The question is no longer “Who has the best AI?” but rather “Who has the AI that is easiest to use?”, and right now, Google has the answer.