The first full trading week of 2026 has delivered a clear signal to global stock markets: global investors are leaning risk-on, and the move is broad enough that multiple major equity benchmarks across the U.S., Europe, and Japan have either set fresh all-time highs or pushed into record territory.

A Synchronized Start to 2026

In the United States, flagship indexes have climbed to new records early in the year, extending momentum from late 2025 and reflecting confidence that economic growth can hold up without inflation roaring back. In Europe, the UK’s FTSE 100 has pushed to new highs and moved beyond the milestone 10,000 level, while major continental benchmarks have also touched records. In Japan, the TOPIX has notched record closes, and the Nikkei 225 has opened the year with strong gains.

That said, “global” does not mean perfectly uniform. Some Asian markets have been mixed after the initial burst of enthusiasm, and even in record-setting regions, the leadership has varied by sector and by style. The most accurate way to read this moment is not as a single synchronized wave, but as a shared global mood expressing itself in different ways across continents.

Where the Records Are—and Where They Aren’t

This story is strongest where global capital is most concentrated: the U.S. and Europe. Japan’s record signals add important confirmation that the rally is not purely American.

Record Signals Across Continents (Early January 2026)

| Region | Benchmark(s) | What’s notable now |

| United States | S&P 500, Dow Jones Industrial Average | New all-time highs in early January trading |

| United Kingdom | FTSE 100 | Record highs; crossed above 10,000 |

| Europe (ex-UK) | DAX (Germany), IBEX (Spain), STOXX Europe 600 | DAX and IBEX hit records; STOXX Europe 600 extends its run |

| Japan | TOPIX, Nikkei 225 | TOPIX record close(s); Nikkei opens year with sharp gains |

| Broader Asia | Mixed | Some markets cooled after the initial risk-on burst |

The headline “record highs across continents” is directionally correct because key bellwethers are indeed printing new highs. But it’s also true that not every major market is at a record, and not every region is moving at the same speed. That nuance matters, because broad narratives can hide the real question: what is actually driving the rally—and how stable are those drivers?

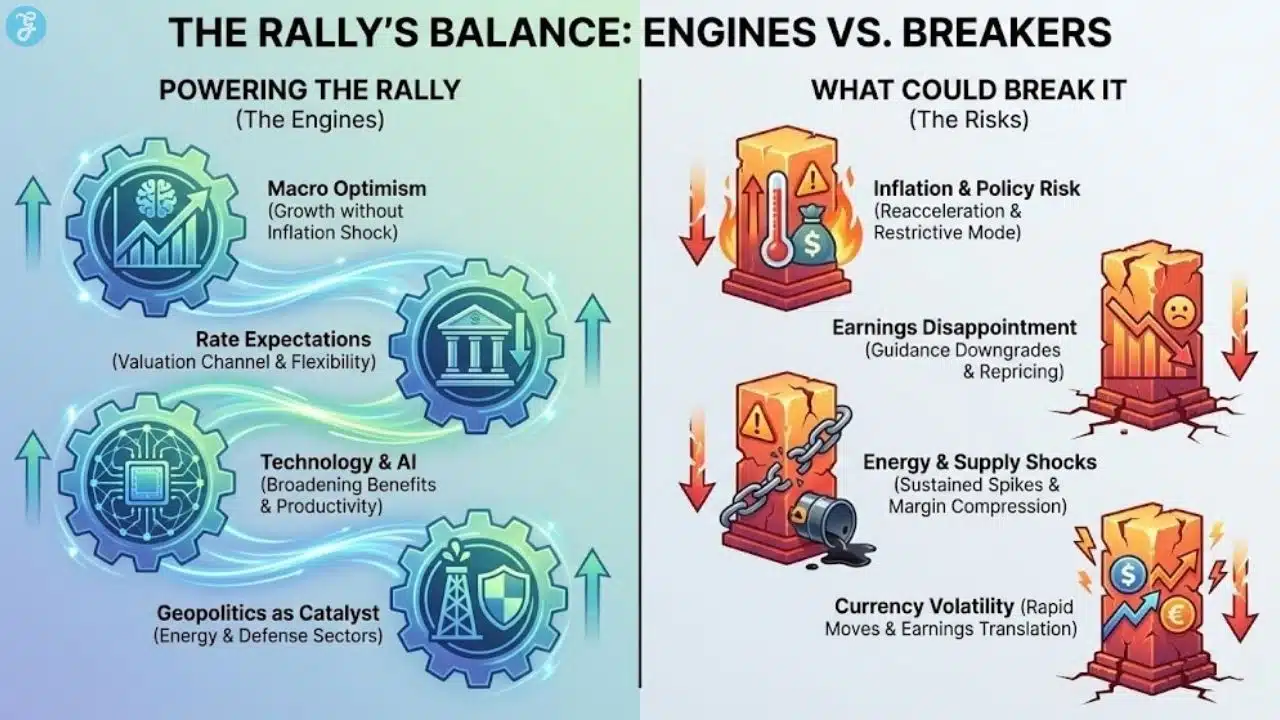

The Engines Behind the Global Stock Markets Surge

Here are the 4 engines behind the surge:

1. Macro Optimism: Growth Without a New Inflation Shock

Record highs often come from a simple belief: the economy can keep expanding without forcing central banks back into restrictive mode. Investors appear to be buying into a “good-enough growth” scenario—one where demand stays resilient, inflation trends remain manageable, and earnings can rise without cost pressures exploding.

This belief supports both higher profit expectations and a valuation environment that allows investors to pay more for future cash flows.

2. Rate Expectations and the Valuation Channel

Even if central banks do not immediately cut rates, markets move on expectations. If inflation appears contained and policymakers signal flexibility, equity valuations can expand as the perceived discount rate on future earnings declines.

This dynamic becomes especially powerful near record levels, where a significant share of upside comes from valuation tolerance rather than explosive earnings growth.

3. Technology and AI: Still Central, but Broadening

Technology—and especially artificial intelligence—remains central to the rally’s narrative. However, the story has evolved. Markets are no longer reacting simply to the promise of AI, but to signs that its benefits are spreading across supply chains, infrastructure providers, and productivity-linked industries.

This broadening matters because narrow rallies driven by a handful of stocks are fragile. A rally that pulls in adjacent beneficiaries and multiple sectors tends to be more durable, even if still vulnerable to macro shocks.

4. Geopolitics as a Sector Catalyst

Geopolitical tension has not derailed the rally so far. Instead, it has reshaped leadership. Energy and defense stocks have benefited from uncertainty, particularly in markets where those sectors carry significant weight.

This explains how some indexes can climb even when geopolitical headlines appear negative on the surface. The risk is not the headline itself, but whether it translates into sustained inflationary pressure or economic disruption.

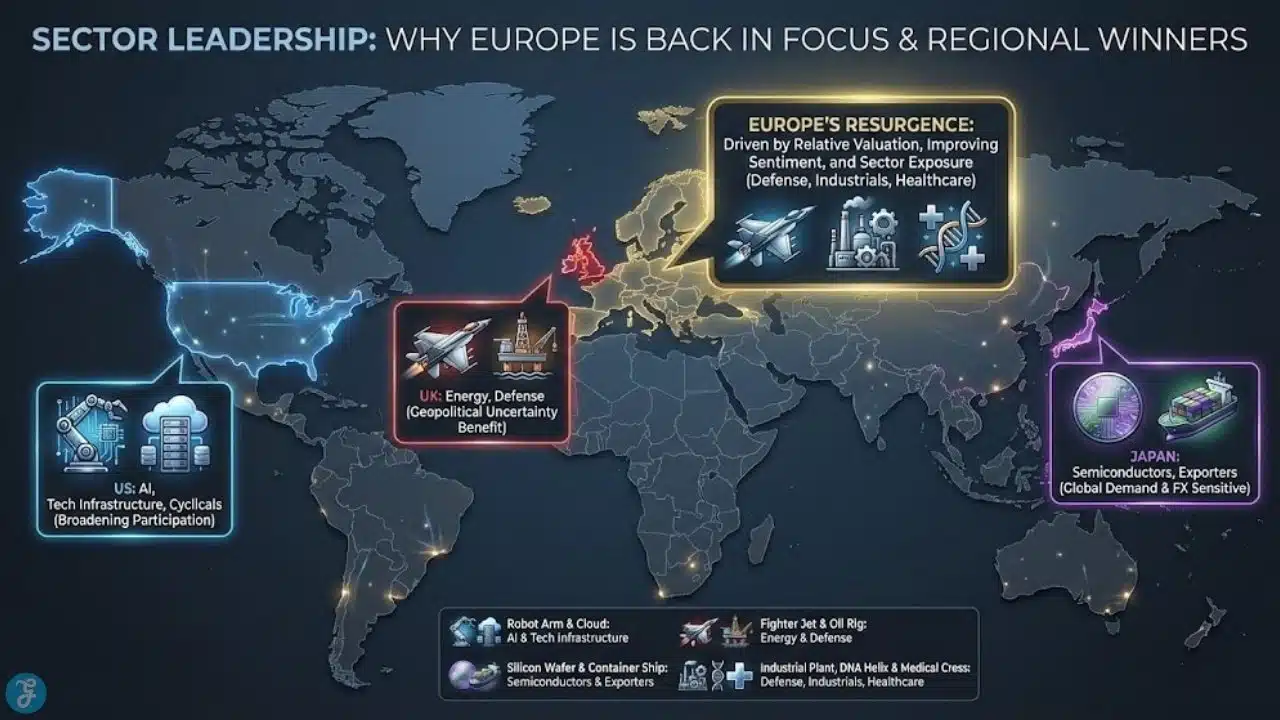

Winners and Losers by Sector

The rally looks synchronized in headlines, but sector leadership differs meaningfully by region, shaping how each market performs.

- United Kingdom: Energy and defense stocks play an outsized role in the FTSE 100, allowing the index to benefit from higher oil prices and security-related spending.

- Continental Europe: Defense, industrials, and selective healthcare names have supported gains, helped by relatively attractive valuations.

- United States: Technology and AI-linked stocks remain influential, but investors are increasingly focused on whether participation broadens beyond a narrow leadership group.

- Japan: Exporters and semiconductor-linked firms have driven gains, with currency dynamics often amplifying moves.

Sector Leadership Snapshot

| Region | Leading Sectors | Why It Matters |

| U.S. | AI, tech infrastructure, cyclicals | Breadth reduces concentration risk |

| UK | Energy, defense | Index structure benefits from geopolitical uncertainty |

| Europe | Defense, industrials, healthcare | Valuation and sector mix attract flows |

| Japan | Semiconductors, exporters | Sensitive to global demand and FX moves |

Why Europe Is Back in Focus

Europe’s resurgence is not driven by momentum alone. It reflects a combination of relative valuation, positioning, and sector exposure.

For years, global equity performance was dominated by U.S. mega-cap technology. Europe often looked cheaper but lacked a catalyst. Now, lower relative valuations, improving sentiment, and exposure to sectors aligned with current macro themes have made European equities more attractive.

Positioning also matters. If global investors remain underweight Europe, even modest reallocations can have an outsized impact on European benchmarks.

Global Flow Watch: Rotation or Repetition?

The defining question for 2026 is whether markets are entering a period of rotation or repeating old patterns.

Rotation would mean capital spreads into cheaper regions and broader sectors, including Europe and parts of Asia. Repetition would see the same crowded trades continue to dominate global performance.

Early signals suggest some appetite for rotation, but the U.S. remains the global liquidity center. As long as U.S. growth and earnings remain strong, concentration could persist longer than expected.

What Would Change the Bullish Narrative Quickly?

Three developments would force a rapid reassessment:

- A sustained rise in bond yields driven by inflation reacceleration

- A clear shift toward defensive earnings guidance from global bellwethers

- Energy prices are becoming a broad macro problem rather than a sector-specific tailwind

These factors matter more than short-term volatility or isolated geopolitical headlines.

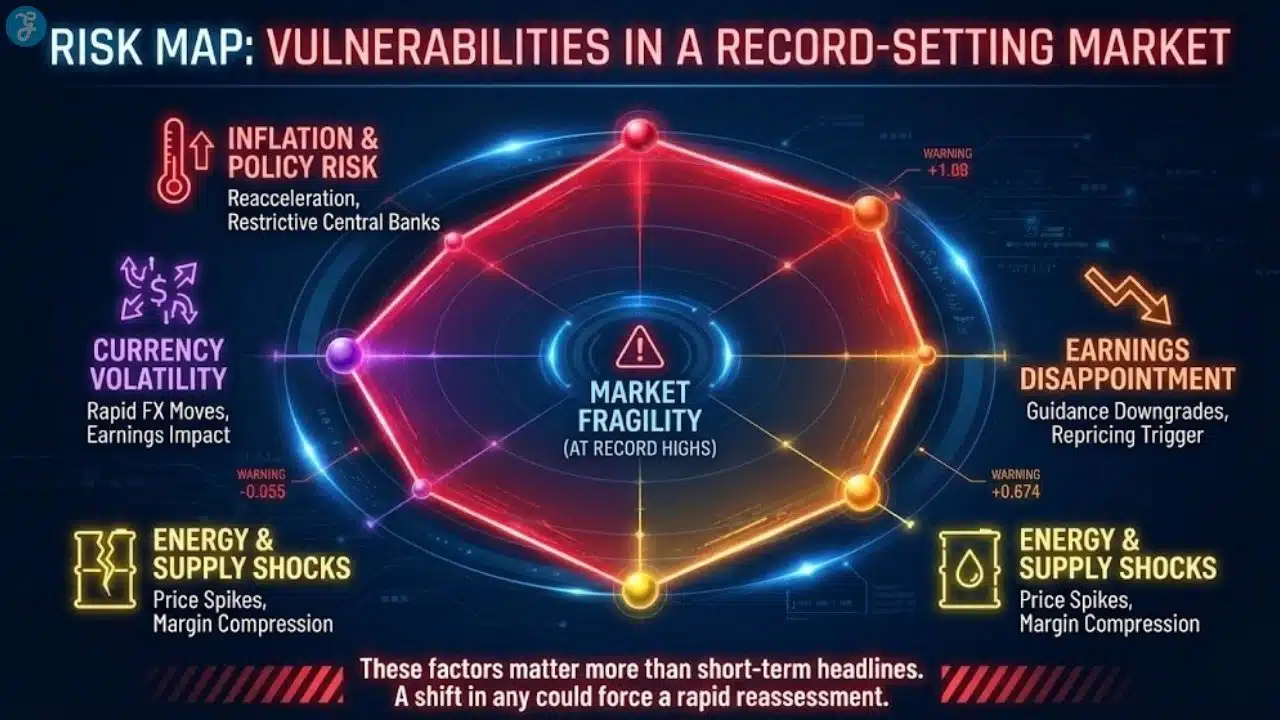

Risk Map: What Could Break the Record Run

Here

1. Inflation and Policy Risk

If inflation reaccelerates, central banks may be forced into a less flexible stance, pressuring valuations globally.

2. Earnings Disappointment

At record levels, markets are priced for confidence. Even small guidance downgrades can trigger repricing.

3. Energy and Supply Chain Shocks

Sustained energy price spikes can revive inflation fears and compress margins across industries.

4. Currency Volatility

Large FX moves can rapidly alter regional leadership and earnings translation for multinational companies.

Key Indicators to Watch in the Coming Weeks

| Indicator | Why It Matters |

| Inflation data | Drives rate expectations and equity multiples |

| Labor market reports | Signal growth strength or slowdown |

| Earnings season guidance | Tests whether optimism is justified |

| Credit spreads and volatility | Early warning signs of stress |

| Energy prices | Inflation and growth transmission channel |

Key Takeaways

- Global equity markets are starting 2026 near or at record highs across major regions

- The rally is driven by growth optimism, rate expectations, and a broadening AI narrative

- Europe’s resurgence reflects valuation appeal and sector composition

- Record highs increase sensitivity to inflation and earnings disappointments

- The next phase depends on fundamentals, not momentum alone

Records Are a Signal, Not a Shield

Record highs across continents signal confidence in global growth and corporate earnings. They do not guarantee safety. As markets move deeper into 2026, the durability of this rally will depend less on headlines and more on whether inflation remains contained, earnings deliver, and policymakers retain flexibility. Records can inspire optimism—but only fundamentals can sustain it.