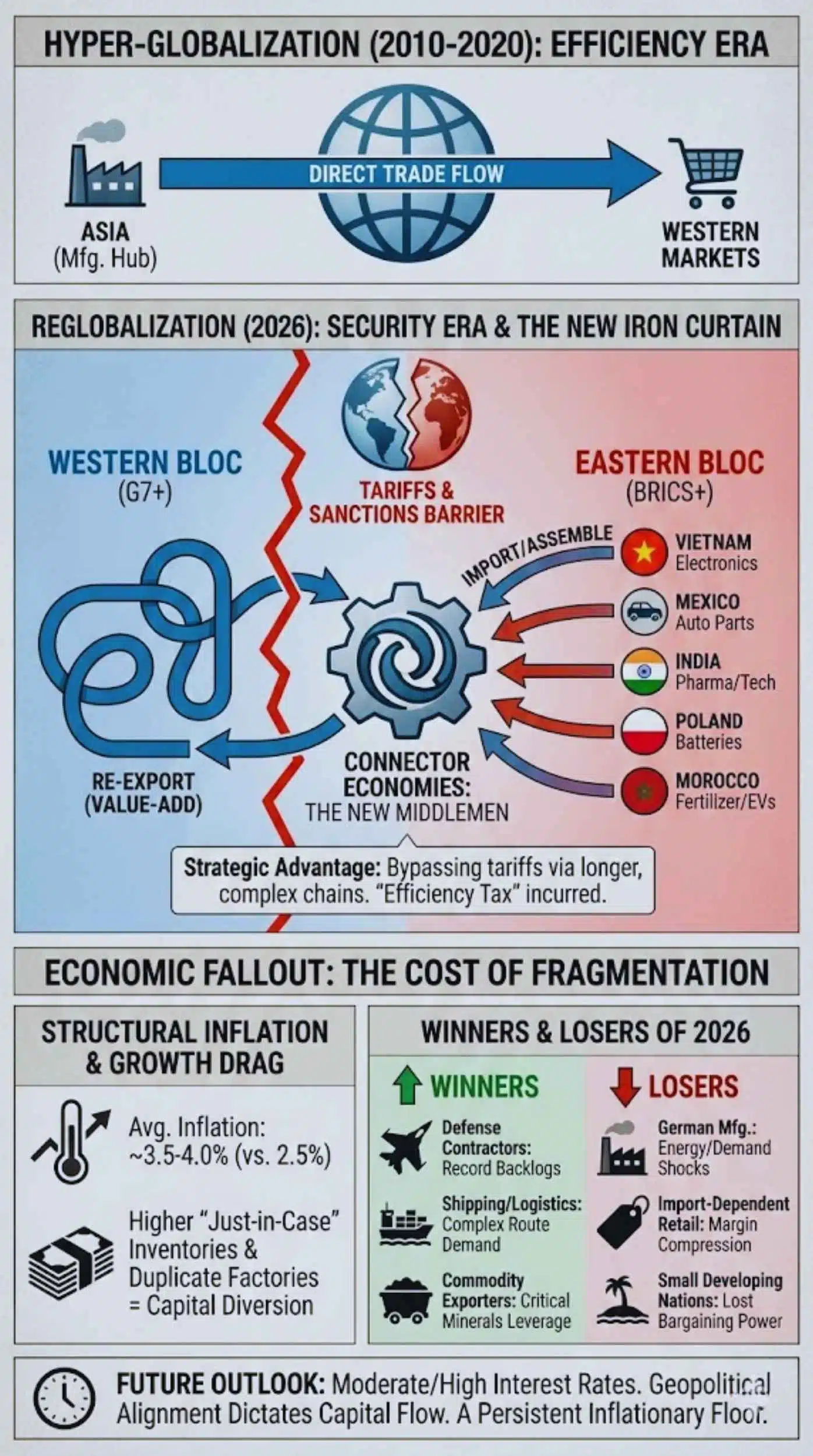

The global economy has moved past the initial shocks of decoupling into a permanent state of fragmentation. The “New Iron Curtain” is no longer theoretical; it is a complex web of tariffs, sanctions, and “friend-shoring” directives that has effectively split the world into Western-aligned and China-aligned spheres. This shift is fundamentally rewriting the rules of inflation, innovation, and investment for the next decade.

The Road to 2026: From Trade Wars to Systemic Split

To understand the current paralysis, we must trace the erosion of the hyper-globalized order. For three decades, the world operated on the principle of comparative advantage: make it where it’s cheapest, sell it where it’s richest. That consensus shattered under the weight of three converging crises: the lingering supply shocks of the pandemic, the geopolitical realignment following the Ukraine conflict, and the systematic technological rivalry between the U.S. and China.

By early 2026, these tensions have calcified. “Reglobalization” has replaced globalization. The G7 nations are aggressively pursuing “de-risking” strategies, effectively subsidizing domestic manufacturing to reduce reliance on adversaries. Simultaneously, the expanded BRICS+ alliance is internalizing trade to sanction-proof their economies. We are no longer in a trade war; we are in a trade cold war.

The Great Bifurcation: Manufacturing and Tech Divergence

The most visible scar of the New Iron Curtain runs through the technology and high-end manufacturing sectors. This is not just a separation of markets; it is a separation of standards, protocols, and hardware.

The Semiconductor Schism

The chip war has evolved into a complete schism. With the U.S., Japan, and the Netherlands tightening export controls on advanced lithography tools, China has been forced to pivot. While the West dominates the cutting-edge (sub-3nm logic and AI chips), China has aggressively expanded its market share in “legacy chips” (28nm and above)—the workhorses for automobiles, appliances, and industrial IoT.

The Semiconductor Divide (2026 Snapshot)

| Feature | Western Bloc (US, EU, JP, TW, KR) | Eastern Bloc (China & Allies) | Global Impact |

| Focus Area | AI, High-Performance Computing, Sub-5nm Logic | Legacy Nodes (28nm+), EVs, Industrial Tech | Market segmentation; potential oversupply of legacy chips. |

| Key Policy | CHIPS Act (US), European Chips Act | “Dual Circulation” Strategy, State Funds | Massive state subsidies driving inefficiency. |

| Dominance | ~90% of Advanced Equipment & Design | ~60% of Global Legacy Capacity (Proj.) | Supply chain bifurcation; increased costs for end-users. |

| Vulnerability | Reliance on Asian assembly & packaging | Lack of EUV Lithography access | Slower innovation diffusion globally. |

The Green Energy Paradox

Western nations face a critical dilemma: their aggressive climate goals rely on hardware (batteries, solar panels, magnets) that is overwhelmingly processed in China. While “friend-shoring” initiatives are funneling capital into Australia and Canada for mining, the processing capacity remains a Chinese stronghold. This has led to “Green Protectionism,” where tariffs on Chinese EVs protect Western automakers but paradoxically slow down the green transition and raise prices for consumers.

The Rise of ‘Connector Economies’: The New Middlemen

As direct trade routes between the superpowers decay, they are being replaced by longer, more complex chains. A new tier of nations—”Connector Economies”—has risen to profit from this friction. These countries import intermediate goods from China, add value (or simply assemble), and re-export to the West, effectively bypassing tariffs.

The Connector Economy Index (Growth in Exports to US/EU)

| Country | Primary Role | Export Growth (YoY) | Strategic Advantage |

| Mexico | Nearshoring Hub | +12.4% | USMCA proximity; massive auto/electronics assembly. |

| Vietnam | Electronics Assembly | +10.8% | Low labor costs; alternative to Chinese tech hubs. |

| India | Tech & Pharma Alternative | +9.2% | “China Plus One” beneficiary; growing iPhone production. |

| Poland | European Battery Hub | +8.5% | Key entry point for Asian battery makers into the EU. |

| Morocco | EV & Fertilizer Gateway | +7.6% | Critical trade pacts with both US and EU; distinct geographic value. |

Note: While these nations benefit, the added logistics and processing steps contribute to the “efficiency tax” paid by consumers.

Economic Fallout: The Cost of Fragmentation

The macroeconomic implications of this split are measurable and significant. The era of “lowflation” driven by cheap labor and cheap energy is over.

Structural Inflation and Growth Drag

The shift to redundant supply chains is inherently inflationary. Companies are now holding higher inventories (“just-in-case”) and building duplicate factories, capital that could have been used for innovation.

The Economic Scorecard (Hyper-Globalization vs. Reglobalization)

| Economic Metric | 2010-2020 Era (Efficiency) | 2026 Era (Security) | Change Driver |

| Avg. Global Inflation | ~2.5% | ~3.5 – 4.0% | Supply chain redundancy & friend-shoring costs. |

| Trade to GDP Ratio | 60% (Peak) | ~54% (Declining) | Localization policies & export restrictions. |

| FDI Flows | Broadly Global | Bloc-Specific | Geopolitical alignment dictates capital flow. |

| Interest Rates | Near Zero / Low | Moderate / High | persistent inflation requires tighter monetary policy. |

The Winners and Losers of 2026

The reshuffling creates distinct winners (those who provide security or bridging) and losers (those reliant on open, frictionless trade).

Strategic Winners vs. Vulnerable Losers

| Group | Who | Why? |

| Winners | Defense Contractors | Global re-armament drives record backlogs. |

| Shipping/Logistics | Complexity and longer routes increase demand for sophisticated logistics. | |

| Commodity Exporters | Nations with critical minerals (Chile, Australia) gain leverage. | |

| Losers | German Manufacturing | Loss of cheap Russian energy + cooling Chinese demand hits hard. |

| Import-Dependent Retail | Fast fashion and cheap consumer goods face margin compression. | |

| Small Developing Nations | Forced to “pick a side,” losing bargaining power and aid. |

Future Outlook: Navigating the Divide

As we look toward 2027, the “New Iron Curtain” will likely solidify further, driven by three emerging trends:

- The Code War: Expect the trade war to migrate deeper into software and data. Nations will increasingly ban foreign software platforms (social media, cloud services) citing data sovereignty, further splintering the internet (“Splinternet”).

- The Subsidy Race: The U.S. CHIPS Act and EU Green Deal were just the opening salvos. We will see a “subsidy arms race” as nations spend aggressively to domesticate critical industries, potentially straining fiscal deficits.

- The Shadow Trade: Just as oil found its way through sanctions, a “grey market” for chips and tech components will expand. Trade data will become less reliable as goods move through complex networks of shell companies in neutral jurisdictions to evade controls.

Final Thoughts

The global economy has not stopped growing, but it has stopped integrating. For businesses, the priority is no longer just price, but political durability. Supply chains must now be audited not just for efficiency, but for geopolitical allegiance.