In 2026, Artificial Intelligence has crossed the Rubicon from “generating text” to “executing actions.” The era of passive chatbots is over; we have entered the age of the Autonomous Economic Agent—digital entities capable of negotiating, purchasing, and managing workflows without human intervention. In this context, Generative AI in 2026 has evolved from a content tool into an economic actor, embedded directly into decision-making, transactions, and value creation. This shift isn’t just technological; it is rewriting the fundamental operating system of the global economy.

Key Takeaways

- From Chat to Action: Generative AI has evolved from Large Language Models (LLMs) to Large Action Models (LAMs), enabling software to interact directly with other software to complete complex goals.

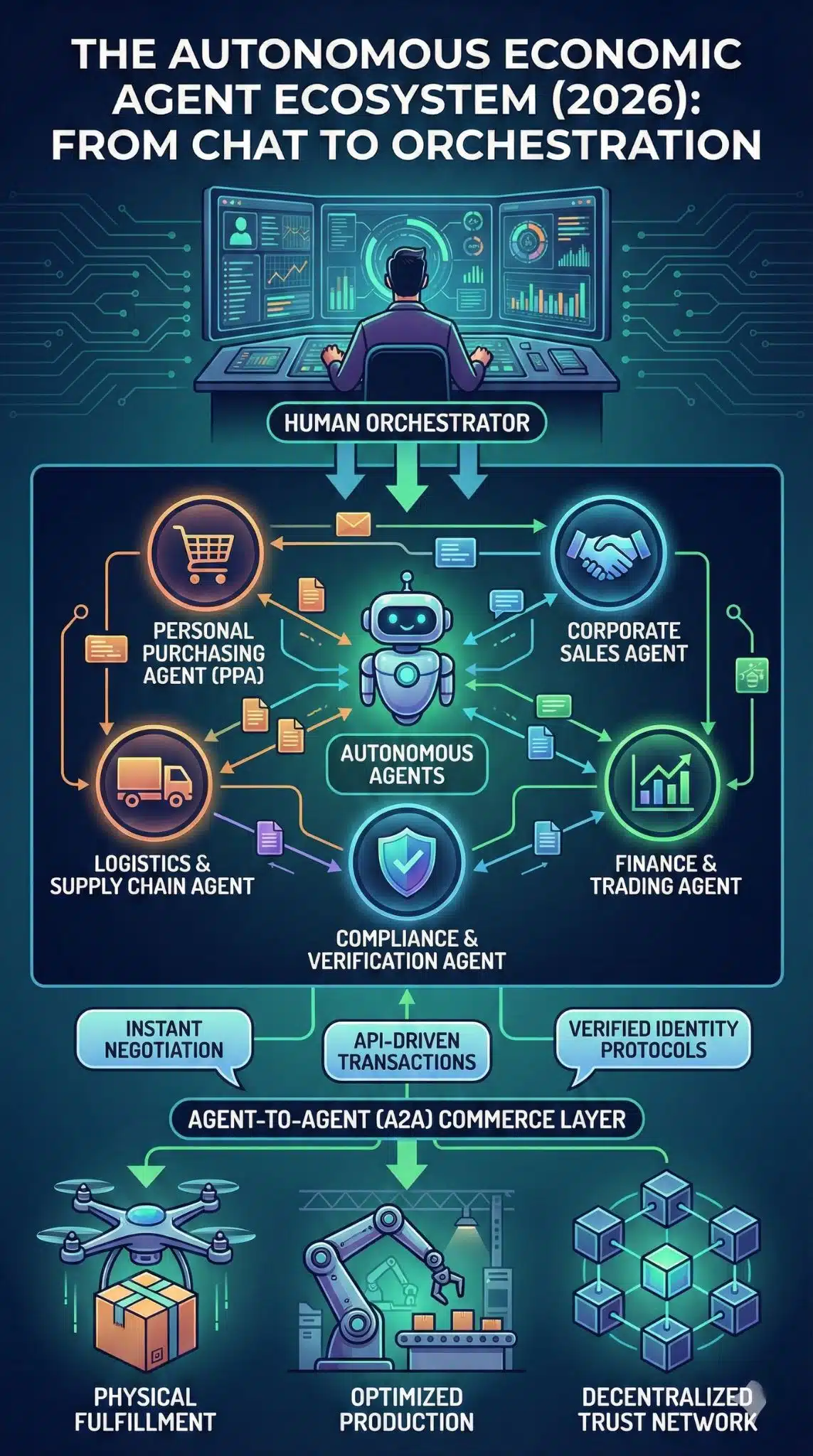

- The A2A Economy: A new layer of commerce, “Agent-to-Agent” (A2A), is emerging where consumer AI agents negotiate pricing and logistics with corporate sales agents, bypassing traditional web interfaces.

- Workforce Redefinition: The primary human skill set has shifted from “prompt engineering” to “agent orchestration”—managing teams of autonomous bots rather than performing individual tasks.

- Regulatory Friction: 2026 marks the first major enforcement year of the EU AI Act, with intense scrutiny on agent liability, specifically regarding who is responsible when an autonomous agent makes a financial error.

- Security Paradox: While agents drive efficiency, they have introduced “identity” as a critical vulnerability, necessitating blockchain-based verification to distinguish between authorized economic agents and rogue actors.

The Evolution of Autonomy: How We Got Here

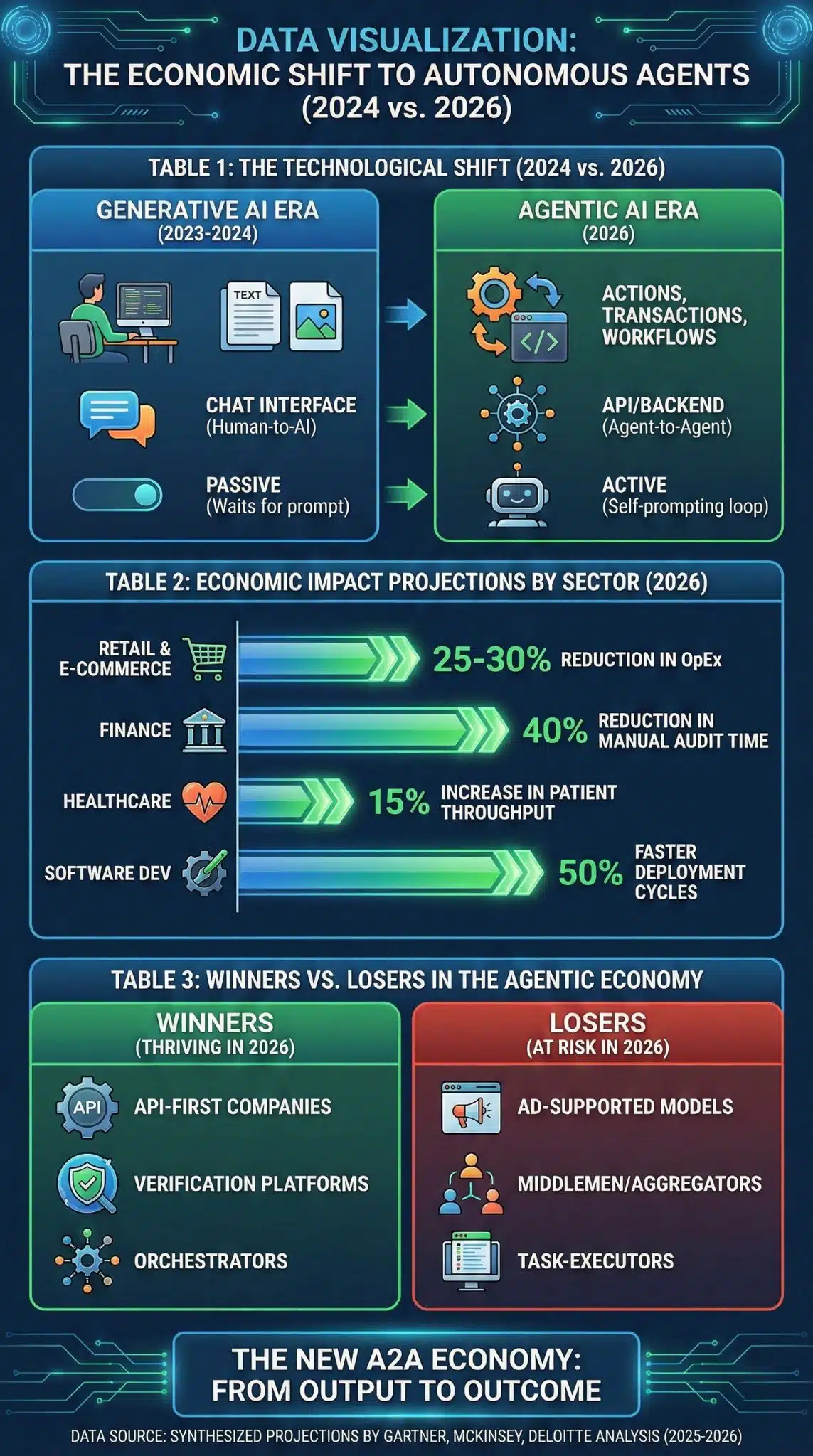

To understand the magnitude of the 2026 landscape, we must look at the trajectory of the last three years. In 2023-2024, the world was captivated by Chatbots. Systems like GPT-4 and Claude 3 were impressive conversationalists, but they were fundamentally passive. They could write a plan, but they couldn’t execute it. You still had to copy-paste the email, click the “buy” button, or compile the code.

By late 2025, the friction began to disappear. The integration of “tools” and API access allowed models to perform singular tasks. But 2026 represents the maturation of Multi-Agent Systems (MAS). Today, single agents are rare. Instead, we see “swarms” of specialized agents—one for research, one for coding, one for compliance—working in concert. This transition from Output (text/images) to Outcome (completed business goals) is the defining characteristic of the current moment.

Core Analysis: The Agentic Economy

1. The Rise of “Interface-less” Commerce (A2A)

The most disruptive trend of 2026 is the decline of the traditional graphical user interface (GUI). For two decades, the digital economy relied on humans clicking buttons on websites. Today, Agent-to-Agent (A2A) commerce is rendering many of these interfaces obsolete.

In this new paradigm, a consumer’s “Personal Purchasing Agent” (PPA) receives a broad instruction—“Book a trip to Tokyo for under $3,000 in March”—and communicates directly with “Sales Agents” from airlines and hotels via APIs. There is no scrolling, no ad targeting, and no shopping cart abandonment. This forces brands to optimize not for human eyeballs (SEO), but for machine logic (Agent Optimization).

2. The Workforce: From Creator to Orchestrator

The fear of “AI replacement” has evolved into the reality of “AI leverage.” The role of the junior analyst or coder has not disappeared but has been radically transformed. In 2026, the average knowledge worker functions as a Manager of Agents.

Corporations are restructuring into smaller, high-leverage teams. A marketing department that previously required 20 people for content creation, analytics, and distribution now runs with three “Orchestrators” supervising a fleet of specialized agents. This has created a “productivity paradox”: output per employee has skyrocketed, but the barrier to entry for junior roles has raised significantly, as entry-level tasks are exactly what agents excel at.

3. The Trust Architecture: Identity as the New Oil

With billions of agents executing micro-transactions, fraud has become the primary threat. “Rogue Agents”—autonomous scripts designed to exploit refund policies, crash server loads, or execute phishing attacks at scale—are rampant.

This has necessitated a new Trust Architecture. We are seeing the mass adoption of cryptographic identity standards for AI. Just as websites use SSL certificates, 2026 agents must present a “Verified Agent ID” (often tied to corporate blockchain registries) to transact. If an agent cannot cryptographically prove it represents a legitimate entity (e.g., Walmart or Delta Airlines), other agents will refuse to interact with it.

4. The Liability Gap

As agents gain autonomy, legal frameworks are straining to keep up. The pressing legal question of 2026 is: Who is liable?

- If an autonomous trading agent hallucinates a market signal and liquidates a portfolio, is the developer, the user, or the enterprise liable?

- Current frameworks are testing the concept of “Electronic Personhood” (limited liability for agents), but courts in the US and EU are currently split. The enforcement of the EU AI Act this year is setting the first concrete precedents, fining companies for “unsupervised agentic behavior” in high-risk sectors like healthcare and finance.

Data & Visualization

The Technological Shift (2024 vs. 2026)

| Feature | Generative AI Era (2023-2024) | Agentic AI Era (2026) |

| Primary Output | Text, Code, Images | Actions, Transactions, Workflows |

| Interaction | Chat Interface (Human-to-AI) | API/Backend (Agent-to-Agent) |

| Autonomy | Passive (Waits for prompt) | Active (Self-prompting loop) |

| Memory | Context Window (Session based) | Long-term Persistent Memory |

| Connectivity | Isolated (Sandboxed) | Integrated (Access to Bank/CRM/ERP) |

| Error Handling | Human must correct output | Agent self-corrects and retries |

Economic Impact Projections by Sector (2026)

| Sector | Primary Agent Application | Estimated Efficiency Gain |

| Retail & E-commerce | A2A Purchasing & Dynamic Supply Chain Negotiation | 25-30% reduction in OpEx |

| Finance | Autonomous Fraud Detection & High-Frequency Micro-trading | 40% reduction in manual audit time |

| Healthcare | Patient Triage & Insurance Pre-authorization Agents | 15% increase in patient throughput |

| Software Dev | “Self-Healing” Code & Automated QA Testing | 50% faster deployment cycles |

Winners vs. Losers in the Agentic Economy

| Winners (Thriving in 2026) | Losers (At Risk in 2026) |

| API-First Companies: Brands with robust APIs that allow external agents to “plug in” and buy. | Ad-Supported Models: Sites relying on human eyeballs and banner ads (agents don’t see ads). |

| Verification Platforms: Tech firms providing “Agent ID” and security layers. | Middlemen/Aggregators: Travel agents or comparison sites are bypassed by direct A2A connections. |

| Orchestrators: Employees with high strategic oversight and systems thinking skills. | Task-Executors: Roles defined strictly by repetitive digital output (e.g., basic copywriters, data entry). |

Expert Perspectives

The shift to autonomous agents has polarized the expert community in 2026.

- The Optimists: Dr. Aris Syntelis, a leading voice in Computational Economics, argues that agents are the ultimate deflationary force. “We are seeing the ‘friction cost’ of doing business collapse,” he noted in a recent symposium. “When an agent can negotiate a supply contract in 40 milliseconds for a cost of $0.002, the cost of goods sold (COGS) drops across the board.”

- The Realists: Conversely, labor economists point to the “hollowing out” of the junior workforce. A report from the Institute for Future Work highlights that while senior productivity is up, entry-level hiring in the tech and finance sectors has dropped by 18% year-over-year, as companies use agents to handle the “grunt work” that used to train fresh graduates.

- The Regulators: EU Commissioner Elena Dallenbach recently warned, “We cannot allow a ‘black box’ economy where algorithms trade with algorithms and humans are left with the bill. 2026 is the year we mandate explainability for every autonomous transaction.”

Future Outlook: What Happens Next?

As we look toward the latter half of 2026 and into 2027, three major milestones are visible on the horizon:

- The Physical Bridge: Agents are currently largely digital. The next phase (already in pilot) involves agents controlling Physical AI—drones, warehouse robots, and autonomous fleets. When a digital supply chain agent can physically command a forklift to move inventory, the loop will be closed.

- Sovereign Agent Clouds: We expect multinational corporations to move away from public LLMs (like those from OpenAI or Google) toward “Sovereign Agent Clouds”—proprietary, smaller models trained exclusively on internal data to prevent IP leakage.

- The “Agent Tax”: Governments will likely introduce transaction taxes specifically for non-human economic activity to offset the displacement of human labor income tax revenue.

Final Thoughts

2026 is not just another year of “better AI.” It is the year AI graduated from being a tool we use to being an entity we employ. For business leaders, the mandate is clear: Stop asking how AI can help you write emails, and start building the infrastructure for your agents to run your business.