Samsung’s Galaxy S26 Ultra AI-First Smartphone push matters in 2026 because upgrade cycles are slowing while phone prices rise, and AI is becoming the new interface for search, photos, and productivity. The S26 Ultra is a live test of whether “AI-first” becomes a daily habit or just another spec-sheet slogan.

Key Takeaways

- Samsung is signaling that AI is now the product strategy, not an add-on, with a stated goal to scale Galaxy AI from roughly 400 million to 800 million AI-enabled mobile devices in 2026.

- The market backdrop is tight: unit growth is soft, but average selling prices are expected to rise, pushing brands to justify premium pricing with software value, services, and AI differentiation.

- “AI-first” is really about control of the assistant layer, what runs on-device versus in the cloud, and whether consumers trust always-on intelligence with personal data.

- Rumored S26 Ultra changes like faster charging and iterative camera upgrades matter mainly because they reduce friction for heavier AI usage, not because they redefine hardware leadership.

- 2026 is also a governance year: AI rules and enforcement timelines make transparency, privacy controls, and risk management core product features, not legal fine print.

The Road To AI-First Phones: How We Got Here?

The smartphone industry did not wake up one morning and decide AI was the future. It was pushed there by economics, maturity, and a subtle shift in how people perceive “new.” Over the past few years, hardware gains became harder to feel. Displays improved, cameras became excellent, and chips got faster, but the everyday experience plateaued. When the difference between “last year’s flagship” and “this year’s flagship” feels modest, the emotional reason to upgrade weakens. That leaves brands with two levers: financing and meaning. Financing helps people buy. Meaning helps people want.

AI is the meaning lever because it promises a different kind of improvement. Not “your phone is 12% faster,” but “your phone does more for you.” That framing matters because it is the closest thing the category has had to a new interaction model since touchscreens made apps mainstream. Samsung is leaning into that shift publicly, describing AI as something that should be integrated across devices, functions, and services, not limited to a few showcase features.

The market context also explains why Samsung is making loud, measurable claims. A target like “800 million AI-enabled mobile devices in 2026” is not just a tech ambition. It is a distribution strategy. If AI becomes expected across price tiers, Samsung wants to be the company that normalizes it at scale, using the Ultra as the flagship reference and the broader lineup as the volume engine.

Consumer behavior data supports why brands think this could work. Surveys show generative AI use has moved into mainstream experimentation and regular use, and a meaningful share of consumers say embedded, on-device AI could nudge them to upgrade sooner. That does not guarantee people will actually keep using phone AI features every day, but it signals a window where the public is open to a new default workflow.

Here are the market signals that make Samsung’s timing logical:

- Forecasts point to a soft unit environment in 2026, paired with higher average selling prices.

- Supply dynamics, especially memory constraints and AI-driven demand for advanced memory, can raise costs and pressure margins.

- Competitive positioning is tight at the top, where Samsung and Apple trade leadership depending on quarter, region, and product timing.

| Signal In The 2025–2026 Smartphone Market | What It Suggests | Why Samsung Needs An AI Flagship |

| Softer unit growth outlook for 2026 | Replacement cycles are long and upgrades are selective | AI must create a stronger “reason to switch” story |

| Higher expected average selling prices | Consumers pay more per phone, but expect more value | AI becomes the premium justification, not just camera and chip |

| Memory and component constraints | Costs rise and pricing pressure grows | Software-led differentiation protects margins |

| Close competition at the top | Share shifts can hinge on narrative and ecosystem stickiness | “AI-first” is a brand identity play, not a feature checklist |

This is the real backdrop. The Galaxy S26 Ultra is arriving in a market that is not desperate for a new phone, but is looking for a new reason.

What “AI-First” Means In Practice For The Galaxy S26 Ultra?

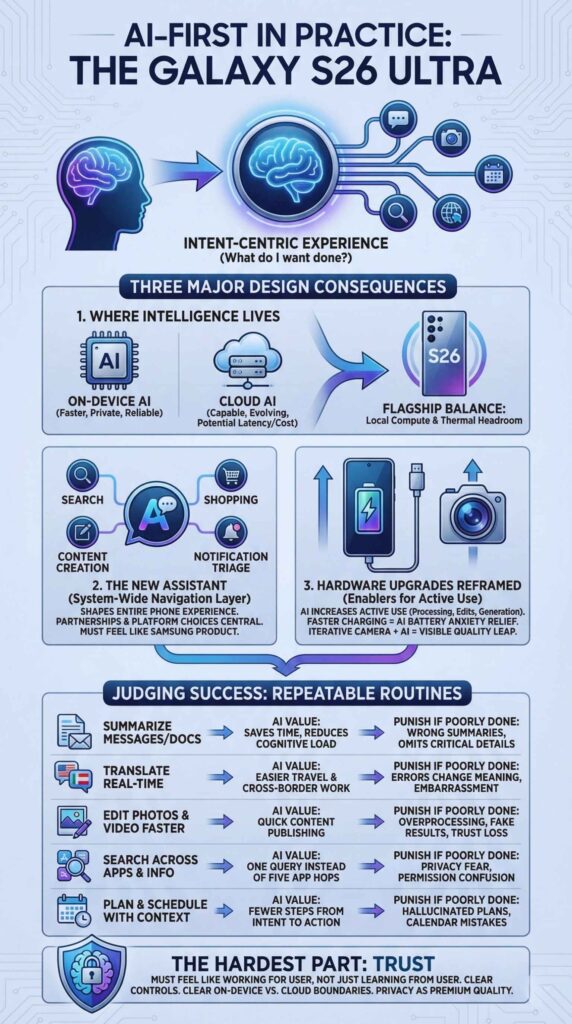

“AI-first” sounds like marketing until you define what it changes in daily behavior. In practical terms, an AI-first smartphone tries to make intent, not apps, the center of the experience. Instead of thinking “which app do I open,” the user increasingly thinks “what do I want done,” and the device routes the task through a mix of on-device processing, cloud models, and app actions.

That shift has three major design consequences.

First, it forces a decision about where intelligence lives. On-device AI is faster, more private, and more reliable when connectivity is poor. Cloud AI is often more capable and can improve continuously, but it introduces latency, privacy questions, and the risk that core features become paywalled. A flagship like the S26 Ultra matters here because it can afford more local compute and better thermal headroom, which makes on-device AI more viable.

Second, it changes what the “assistant” is. In the old world, assistants were optional voice tools. In the AI-first world, the assistant layer becomes a navigation system for the entire phone. It shapes search, shopping, content creation, and even how notifications get triaged. That makes partnerships and platform choices central. If Samsung’s AI experience is heavily powered by a partner model, Samsung must still shape the interface, privacy posture, and cross-device integration so it feels like a Samsung product, not a generic layer.

Third, it reframes hardware upgrades. Rumored additions like faster wired charging and incremental camera refinements are not irrelevant, but they are supportive. AI increases active use. More processing, more photo edits, more summarization, more generation, more always-on features. Better charging and efficiency turn AI from a battery anxiety trigger into a seamless default.

A useful way to judge “AI-first” is to map it to repeatable routines, not one-time demos:

| Routine People Actually Repeat | AI Value If Done Well | What Users Will Punish If Done Poorly |

| Summarize long messages, emails, and documents | Saves time and reduces cognitive load | Wrong summaries that omit critical details |

| Translate in real time | Makes travel and cross-border work easier | Errors that change meaning and cause embarrassment |

| Edit photos and video faster | Lets people publish content quickly | Overprocessing, fake-looking results, trust loss |

| Search across apps and personal info | One query instead of five app hops | Privacy fear, permission confusion, “creepy” behavior |

| Plan and schedule with context | Fewer steps from intent to action | Hallucinated plans, calendar mistakes, broken automations |

The Galaxy S26 Ultra’s success, as an AI-first device, depends on whether Samsung can deliver consistent outcomes in these routines. People will not upgrade for “AI” in the abstract. They upgrade because the phone saves them time, reduces friction, and feels reliably helpful.

This is also why rumors about performance details matter mainly as enablers. If the S26 Ultra really moves to faster charging, the benefit is not bragging rights. The benefit is making AI-heavy daily use feel safe. If camera hardware changes are iterative, AI becomes the lever that can still create a visible quality leap through better computational photography, smarter edits, and more flexible content creation.

The hardest part is not capability. It is trust. AI-first phones have to feel like they are working for the user, not learning from the user in ways the user does not understand. That means clearer controls, clearer on-device versus cloud boundaries, and a product philosophy that treats privacy as part of premium quality.

The Business Model Shift: Premium Pricing, Services, And Platform Power

Samsung’s AI-first framing is also a business model move. When the market is mature, the flagship has to do more than sell units. It has to justify price, protect margins, and pull customers into an ecosystem that makes switching harder. AI can do all three, but it also creates new risks that Samsung must manage carefully.

Start with pricing pressure. Component constraints and memory dynamics can raise costs. At the same time, consumers are more price sensitive than headline flagship demand suggests. The industry’s response has been “premiumization” paired with financing and trade-ins, keeping monthly payments attractive while pushing up headline price and average selling price. Forecasts that show higher average selling prices in 2026 reinforce why Samsung wants a story big enough to carry premium positioning.

Now consider monetization. AI features create an obvious temptation subscriptions. Cloud inference costs money. Model improvement cycles are expensive. If brands can charge for premium AI capabilities, they can create recurring revenue. But this is where the “AI-first” bet can backfire. If users start to feel they are being charged extra for features that used to be part of the phone, goodwill collapses. The most sustainable approach is usually a tiered model: core AI features remain included, while advanced cloud-heavy features become optional.

Then there is platform power. In an AI-first world, the assistant layer becomes the gatekeeper to search and discovery. Whoever controls that layer influences where users go, what they buy, and which services become default. This is why Samsung’s partnership choices matter so much. If Samsung relies heavily on a partner AI model, it can accelerate capability and compete with rivals quickly, but it also risks becoming dependent on decisions it does not control, including monetization and product direction.

Samsung’s counterbalance is its broader ecosystem. Samsung can argue that the phone is not just a phone, it is the personal hub for TVs, appliances, wearables, and home experiences. If AI becomes the glue across that ecosystem, Samsung can defend differentiation even in a world where core AI models become commoditized.

This competitive dynamic also shapes what the Galaxy S26 Ultra must prove against Apple and Chinese rivals:

- Apple’s advantage is vertical integration and a reputation for privacy-first messaging, which can matter more as AI becomes more personal.

- Chinese OEMs often push aggressive hardware value, including charging speeds and rapid feature iteration.

- Samsung’s advantage is global scale, premium Android leadership, and an ecosystem broad enough to make “AI companion” messaging believable.

Here is how the AI-first shift changes who gains leverage.

| Stakeholder | What They Want From AI-First Phones | How The S26 Ultra Can Help Or Hurt Them |

| Consumers | Convenience without losing control | Helpful defaults win, opaque data use loses |

| Samsung | Premium differentiation and ecosystem stickiness | Must avoid feeling like “hardware for someone else’s AI” |

| AI platform partners | Distribution and daily usage | Scale is a win, but failures become headline risks |

| App developers | Continued access to users | Assistant-first flows can reduce direct app discovery |

| Regulators | Accountability and transparency | AI-first phones raise the bar for disclosure and controls |

The key point is that the Galaxy S26 Ultra is a product and a negotiation. It is Samsung telling the market that the next smartphone cycle will be led by intelligence, not just hardware. But once you make that claim, you inherit a new burden: every AI failure feels like a platform failure, not a feature bug.

Trust, Safety, And The Coming Rules Of The Road In 2026

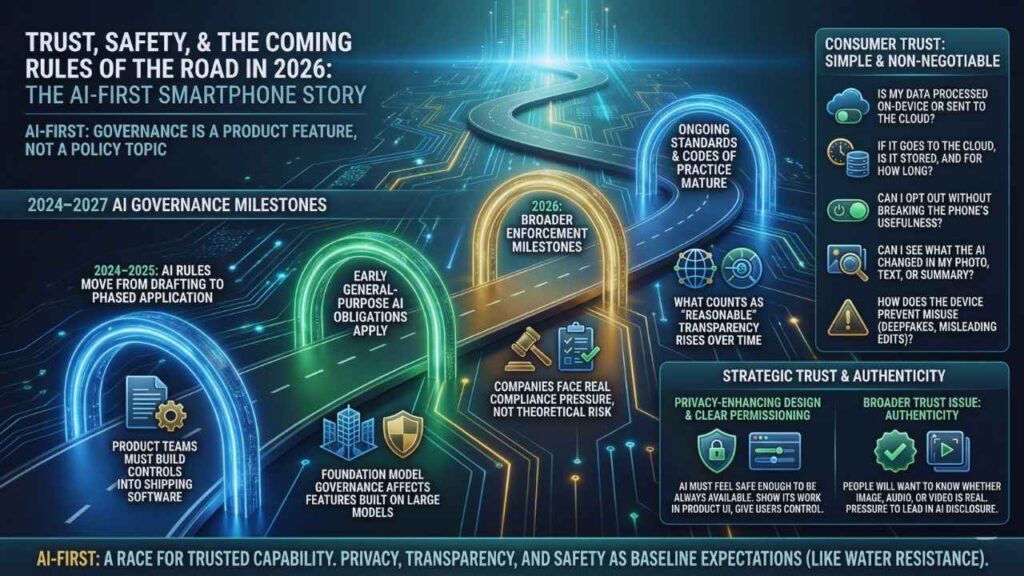

The biggest hidden variable in the AI-first smartphone story is regulation and trust. The more personal AI becomes, the more sensitive the data becomes. Phones are not like laptops. They travel everywhere. They hold messages, photos, location patterns, and personal routines. If AI becomes the default interface for this data, governance stops being a policy topic and becomes a product feature.

This is where the EU AI Act timeline matters in a very practical way. Even if many smartphone AI features do not fall neatly into “high-risk” categories, the direction is clear: transparency expectations rise, documentation and accountability increase for general-purpose AI, and enforcement timelines focus minds in 2026. Companies that treat compliance like an afterthought may still ship products, but they risk reputational damage, regional feature limits, or forced changes that break user experience.

For consumers, the trust questions are simple and non-negotiable:

- Is my data processed on-device or sent to the cloud?

- If it goes to the cloud, is it stored, and for how long?

- Can I opt out without breaking the phone’s usefulness?

- Can I see what the AI changed in my photo, text, or summary?

- How does the device prevent misuse, especially around deepfakes and misleading edits?

For Samsung, the trust questions are also strategic. If Samsung wants AI to be the reason to upgrade, Samsung has to make AI feel safe enough to be always available. That pushes Samsung toward privacy-enhancing design, clearer permissioning, and more on-device processing wherever possible. It also pushes Samsung to show its work. Not in technical jargon, but in product UI that communicates boundaries and gives users control.

There is also a broader trust issue beyond privacy: authenticity. AI-first phones make it easier to generate and edit content. That is a feature and a societal risk. People will increasingly want to know whether an image is real, whether an audio clip is manipulated, and whether a video has been altered. Phones that lead in AI creation will be pressured to lead in AI disclosure.

A timeline view clarifies why 2026 feels like a turning point.

| 2024–2027 AI Governance Milestones | Why It Matters For AI-First Smartphones |

| AI rules move from drafting to phased application | Product teams must build controls into shipping software |

| General-purpose AI obligations begin applying earlier in the timeline | Foundation model governance affects features built on large models |

| Broader enforcement milestones in 2026 | Companies face real compliance pressure, not theoretical risk |

| Ongoing standards and codes of practice mature | What counts as “reasonable” transparency rises over time |

The deeper implication is that “AI-first” is not just a race for capability. It is a race for trusted capability. The most durable winners will be the companies that treat privacy, transparency, and safety as part of quality, the same way water resistance and durability became baseline expectations over time.

What Happens Next: Scenarios For The S26 Ultra And The Smartphone Industry?

The Galaxy S26 Ultra’s AI-first narrative will be decided by what happens after launch, not during launch. Early hands-on impressions will focus on speed, camera, battery, and the novelty of new AI features. But the real question is whether those AI features become habits, and whether Samsung can scale them across its lineup without degrading quality or trust.

There are several near-term milestones that will shape the story in 2026:

- Launch timing and rollout rhythm, including when AI features arrive, how often they improve, and whether improvements feel meaningful.

- Pricing and bundling decisions, especially whether Samsung keeps core AI included or begins gating key value behind subscriptions.

- Expansion across tiers, because Samsung’s scale ambition implies that AI cannot remain a flagship-only experience.

- Regulatory posture, including whether features change by region and whether Samsung adds more transparency tools over time.

- Competitive responses, especially how Apple and top Android rivals position privacy, on-device performance, and assistant quality.

The future is best understood through scenarios, not certainties.

Scenario One: AI Becomes The New Default Interface

In this future, the assistant layer reliably handles planning, summarization, translation, and cross-app actions. Users stop thinking in apps and start thinking in outcomes. The Ultra becomes the reference device that sets expectations for the rest of Samsung’s lineup, and “AI-first” turns into a durable reason to upgrade.

Scenario Two: AI Fatigue Sets In

Here, AI features remain impressive but inconsistent. Users try them, get burned by errors, and retreat to manual workflows. AI becomes a background checklist feature, like AR once was. Samsung can still sell phones, but AI does not create a new upgrade cycle. It becomes a cost center rather than a growth engine.

Scenario Three: Governance And Trust Become The Differentiator

In this world, capability converges across brands, but trust does not. The winners are the companies that offer clearer controls, safer defaults, and better authenticity safeguards. AI-first phones still matter, but the differentiator is “trusted AI-first,” not “most features.”

Predictions should be labeled clearly, and these are best framed as conditional:

- Analysts suggest that premium phones will lean harder on AI value narratives as hardware improvements become less emotionally compelling and average selling prices rise.

- Market indicators point to more experimentation with AI feature tiers and service bundles, but brands that over-monetize too quickly risk backlash and reduced loyalty.

- It is plausible that Samsung uses the S26 Ultra to define the “best possible” Galaxy AI experience, then carefully ports the highest-retention features downward, prioritizing reliability over feature count.

The most important watchpoint is simple what do people keep using after 30 days. If AI-first features become daily routines, the S26 Ultra helps rewrite the smartphone playbook. If they do not, the industry moves back to incremental hardware cycles with AI as a supporting cast.

The Galaxy S26 Ultra AI-First Smartphone story matters because it signals where smartphone competition is heading: toward the assistant layer, trust-led product design, and ecosystems that make intelligence feel seamless across devices. If Samsung succeeds, AI becomes the next upgrade driver in a market that desperately needs a new reason. If Samsung fails, AI becomes another expensive feature wave that consumers enjoy briefly and then ignore.