Do you feel lost when NFT art jumps in price or fades fast? NFTs let artists sell digital art as digital assets on blockchain networks. This post shows seven simple predictions from wallets to the metaverse so you can spot the next big shift in the NFT market.

Read on.

Key Takeaways

- NFTs grow beyond art: users buy land on Sandbox and Decentraland, trade NBA Top Shot clips, and Yuga Labs saw Bored Ape Yacht Club sales hit $4 billion in 2024 while Pudgy Penguins reached $1.1 billion on DappRadar.

- Real goods link to tokens: cars, houses, and fine art prints get digital twins on Ethereum via smart contracts and oracles; the Seattle NFT Museum opened on January 14, 2022, and 21 museums plan shows with blockchain-backed art.

- Green chains rise: Cardano and Bitgreen moved to proof-of-stake, cutting energy use by up to 99 percent, Solarcoin rewards solar power, and carbon-neutral NFT marketplaces tie tokens to carbon credits.

- Metaverse perks grow: Decentraland and The Sandbox sell land as NFTs, NodeMonkes issued 400 badges for chats with Web3 stars, and brands use tokens as VIP passes, skins, and power boosts.

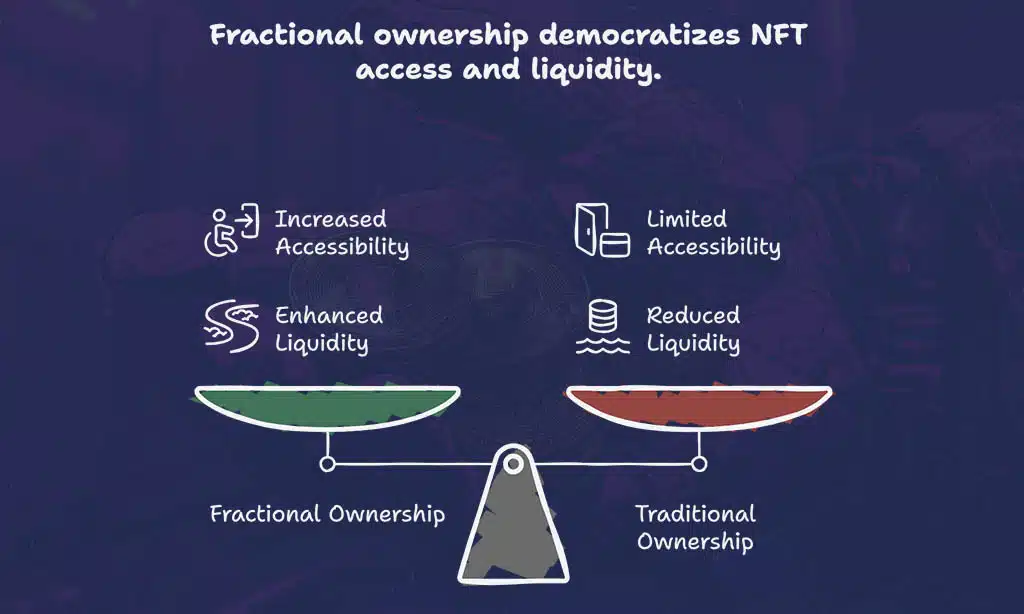

- Fractional NFTs and new funds: CryptoPunks floor sits at 22 ETH but shards start at 0.1 ETH, 5,469 wallets hold BAYC tokens, Messi and Ronaldo cards sold for over $100,000, and DAOs let fans vote on art picks.

NFTs Will Expand Beyond Digital Art

Collectors gobble up virtual land like hotcakes on platforms such as Sandbox and Decentraland. Musicians issue non-fungible tokens for royalty streams that pay fans with each play.

Game studios turn swords, shields, and skins into digital collectibles on Ethereum or Solana. Flow chain hosts NBA Top Shot highlights that thrill sports fans. Smart contracts lock trades in a secure, transparent blockchain record.

Brands such as Yuga Labs see Bored Ape Yacht Club sales soar over $4 billion in 2024. Pudgy Penguins hit $1.1 billion on DappRadar, proof of market expansion. Traders log in with MetaMask or PayPal and stake bids in NFT marketplaces like OpenSea or Binance NFT.

Fractional ownership splits high prices into bite-sized shares for more users. Blockchain technology drives this boom in trading volumes and digital ownership.

Integration of NFTs with Real-World Assets

People now attach non-fungible tokens to vehicles, real estate, and fine prints. A smart contract on Ethereum mints a digital twin for each underlying asset. External data from oracles proves title and history to that token.

The buyer checks the proof in a crypto wallet, even after they leave the auction house. This mix glues digital collectibles with real goods such as shoes, watches, and cars.

Analysts forecast these tokens will grow like traditional art investments. Trading volumes for property tokens may rival nft arts and crypto punks in the nft marketplace. Museums join the trend, with 21 sites set to show blockchain-backed art, and the Seattle NFT Museum opened on January 14, 2022, to wide praise.

Fractional ownership splits pricey prints into shares, so more fans claim a slice of that canvas. This shift uses blockchain technology to boost financial inclusion for art lovers.

Growth of Green and Sustainable Blockchains

Greener blockchains cut energy use, slash carbon footprints, and reduce fees. Solarcoin rewards solar power with sun-powered coins. Bitgreen and Cardano shift to proof of stake, cutting power use by up to 99 percent.

Abeer Raza champions these platforms at meetups and online summits.

Carbon-neutral nft marketplace pilots track offsets in smart contracts, they tie non-fungible tokens to carbon credits. Decentralized finance teams build tools to measure lifecycle emissions for digital collectibles.

More digital assets flow through these networks, boosting trading volumes in blockchain technology markets and shaping a cleaner digital economy.

Enhanced Utility of NFTs in the Metaverse

3D world platforms like Decentraland or The Sandbox host parcels that users buy as digital land assets via non-fungible tokens. Players fill these parcels with art, shops, or social lounges where passes grant VIP access to events.

A project named NodeMonkes sold 400 honorary badges that link to exclusive chats with Web3 stars. These collectibles live on an open ledger and on bitcoin blockchain networks, and they drive a lively virtual economy.

Brands add value by issuing tokens that act like membership cards, perks, or power boosts in game worlds. Avatars don rare skins that boost in-game stats or open secret levels. Bots track trading volumes on top platforms, and tweets hype flash sales to spark risk and reward thrills.

Fans trade pieces like digital art on nft marketplace platforms, and smart contracts lock in digital ownership for every asset.

New Economic Models for Artists and Creators

Artists tap fresh money paths with digital art assets. They mint their work as non-fungible tokens on a Layer One Network. This move lets them tap a global nft marketplace full of collectors.

A sports collectibles platform saw Messi and Ronaldo cards sell for over $100,000 each. Fans swap art with altcoins or btc, they skip bank fees. Royalty rules coded in smart deals give creators ongoing cash.

Museums plan nft exhibitions next to modern blockbusters.

Creators split a single work into tiny shares on a public ledger. This fractional ownership method links fans to art like stock. Collectors pool money in a DAO or token fund. They vote on spotlighted pieces, price changes, and new ideas.

A singer sold 500 tokens for a video drop, they sold out in an hour. DeFi tools track trading volumes and vaults in real time. Labels now use this path to fund tours, they sell perks with nft collections.

Fans flash proof on twitter as their digital ownership grows.

Emergence of Virtual NFT Galleries and Museums

Virtual hubs host digital art. These hubs run on blockchain technology and let fans own digital collectibles. You pay with cryptos on a cryptocurrency exchange. The Seattle NFT Museum opened Jan 14, 2022, and fans praised the show.

Visitors click a token in the nft marketplace and watch it appear. Rare digital assets gained more trading volumes.

21 museums plan to use blockchain-backed art this year. They will tackle digital ownership with non-fungible tokens (nfts). Big names like Justin Bieber, Eminem, Jimmy Fallon follow Bored Ape Yacht Club and stir up hype.

Virtual galleries boost customer engagement in the blockchain economy. They link digital twins, nba top shot, and fractional ownership to market growth.

Increased Adoption of Fractionalized NFTs

Fractional ownership opens doors. It splits high-value digital collectibles into slices of pizza, so more can pay in. That model uses a DAO, and 5,469 addresses hold BAYC tokens. Those tokens saw over $4B in sales by 2024.

Smart contracts on Ethereum lock in digital ownership. Rarible and OpenSea list these shares, so wallets of all sizes take part.

CryptoPunks floor price sits at 22 ETH, out of reach for many. Slicing tokens into smaller shares cuts entry down to 0.1 or 0.5 ETH. This shift revs up trading volumes in the nft market, it boosts liquidity in the nft marketplace.

ERC-20 tokens track each slice, ensuring clear proof of ownership. Fans get skin in the game, they jump from spectator to owner.

NFTs as Digital Records for Ownership and Authentication

NFTs stand for non-fungible tokens and act as open ledgers that track digital ownership for digital art, video clips and virtual land. They use blockchain technology to store records.

Each token links to a smart contract on Ethereum or a private chain like Hyperledger Fabric. You can trade these digital collectibles on any nft marketplace with full proof. We saw trading volumes top $3.89 billion for CryptoPunks this year.

Artists sell digital assets with clear provenance. This method cuts out middlemen and builds direct ties between creators and buyers.

Collectors use scanned video highlights from NBA Top Shot because they value real proofs. A token ties to a highlight clip via a distributed file system, it carries a timestamp, owner ID, URL.

Verifiers read a token’s metadata to check who minted it and on what date. Fractional ownership of high value art also links back to the master token, so each shareholder knows their stake.

This record helps with taxes or royalty rules, no guesswork left. Firms can add extra audit logs in a tool like a ledger explorer, they can view each transfer at any moment.

Greater Mainstream Adoption of Crypto Art Platforms

Celebrities and brands push crypto art into daily news. OpenSea boasts record trading volumes. Magic Eden and LooksRare draw new fans. Sorare counts 4.3 million users. These digital assets include digital collectibles, non-fungible tokens and digital art.

Technological innovations like blockchain technology and smart contracts power these platforms. They let users mint art on a public blockchain network. NBA Top Shot events and avatar art series auctions drive big bids, with over $4 billion in sales by 2024.

Artists offer fractional ownership on top nft marketplaces. Fans learn digital ownership through vibrant trading volumes in the nft market.

Transformation of NFT Marketplaces with AI and Automation

Smart bots on OpenSea sift through trading volumes, like a digital curator, to recommend digital collectibles that match your taste. Magic Eden runs AI-driven tools on Polygon to cut minting fees and speed transactions on Layer 2 chains.

LooksRare pairs revenue sharing with automated bidding scripts, giving collectors more power over non-fungible tokens. Interoperable blockchain technology, like Cosmos, links with Arbitrum to let artists list digital art across chains.

AI scripts handle offers in real time, cutting gas costs and easing user onboarding. Smart contracts automate payouts, boosting fractional ownership and fair play. These tech shifts scale the nft marketplace, lifting trading volumes and simplifying digital ownership.

New tools, like smart price feed networks, tie price data to auctions, giving artists and buyers peace of mind.

Adoption of NFTs in Gaming and Entertainment Industries

Gamers buy sports digital collectibles on platforms such as Sorare powered by blockchain technology. The game mints non-fungible tokens for each major league sports card. It partners with over 300 soccer clubs.

The floor price sits at 0.003 ETH. This model gives players true digital ownership. Trading volumes rise as fans chase rare cards.

Game makers tap play-to-earn models with rich digital assets. One collection, Pudgy Penguins, logged $1.1 billion in sales. Studios test in-game markets on a 3D engine and another popular 3D engine.

They wire in smart contracts to handle trade activity. Collectors list items on OpenSea or Rarible. Fractional ownership could bring high-end art to more fans.

Takeaways

Fans of crypto art will see NFTs pop up in many spots, from virtual homes in Decentraland to limited drops on Ethereum. Smart contract upgrades on Layer 2 chains, like Polygon, will cut fees and speed trades.

Some creators will use MetaMask and IPFS to host art with low energy demand. Market hubs like OpenSea will add AI tools to link collectors with fresh drops. Every turn in this ride feels like a surprise, and you get to pick the soundtrack.

FAQs

1. What are non-fungible tokens?

They are crypto goods that use blockchain technology to record who owns what. Each token stands alone, it cannot be swapped.

2. How will trading volumes change?

Trading volumes for virtual trading cards could grow like a snowball rolling down a hill. More buyers, more sellers, more deals on every block.

3. How will fractional ownership affect digital art?

Fractional ownership lets you buy small pieces of art, like slices of pizza. It will let more fans own digital art, it will widen the scene.

4. How does crypto art differ from other digital assets?

Crypto art lives as digital collectibles, special digital assets stored on blockchain technology. It uses non-fungible tokens to mark each work, so you know who owns it, for good.