Purchasing a fixer-upper property can be a profitable venture with possible significant financial returns. Turning a run-down house into a lucrative investment, however, calls for both strategic execution and a solid financial plan. Every choice you make will affect your bottom line, from selecting appropriate financing sources to expertly controlling renovation expenses. This article will go over doable financial advice to help you optimize earnings and reduce risks.

Securing Financing for Your Fixer-Upper

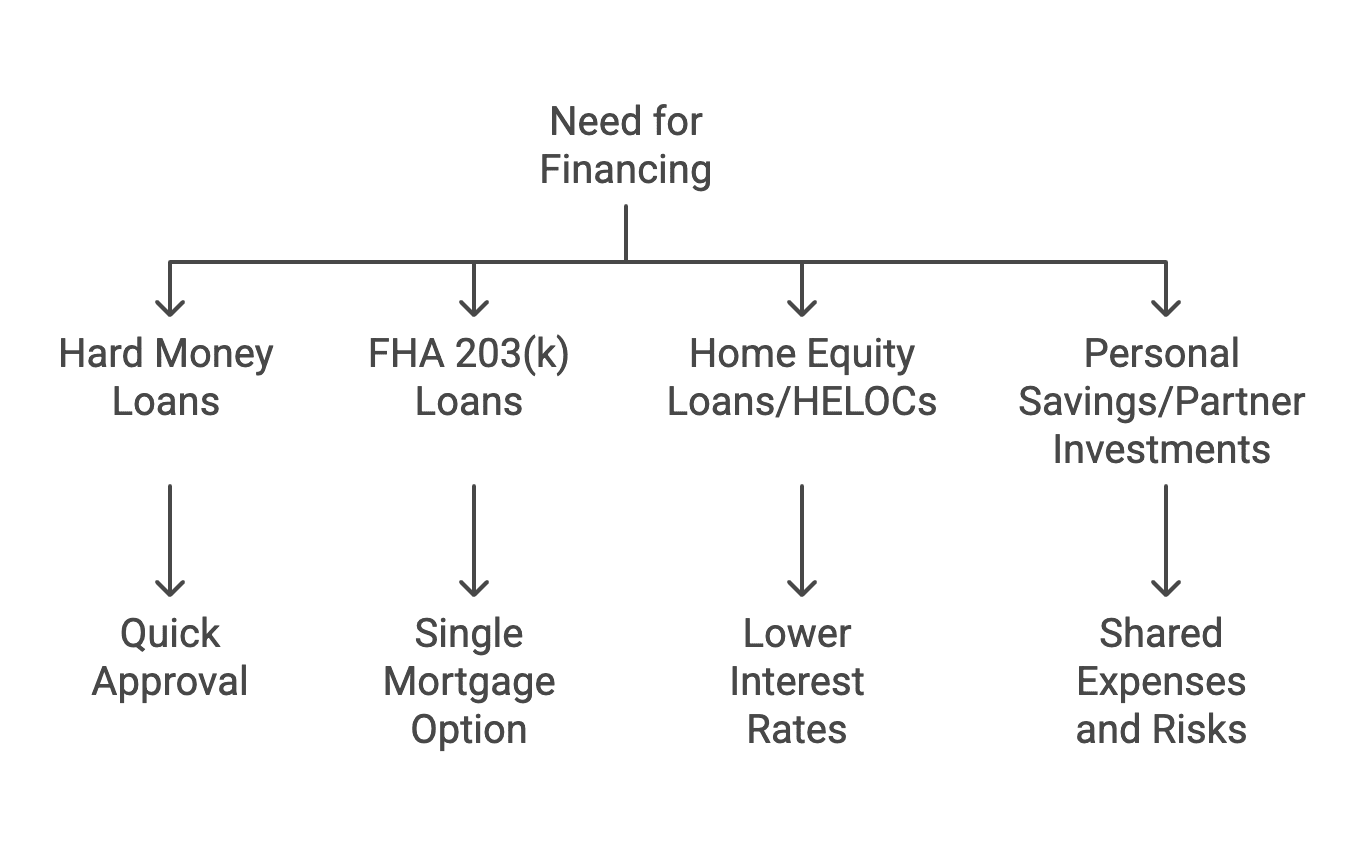

Acquiring the required finances is one the most important phases in every fixer-upper project. Fixer-uppers can call for a dual layer of financing, one for the purchase price and another for renovation expenses, which is not like traditional home purchases.

1. Hard Money Loan Solutions: A Fast and Flexible Option

Hard money loan solutions are a great fit for those seeking immediate and flexible financing. Usually tied to the property itself, hard money loans are financing options. They are perfect for fixer-uppers as they give quick approval, enabling you to grab time-sensitive opportunities.

Although hard money loans can have higher interest rates, their advantages—speed, ease of approval, and flexibility—make them a common alternative for real estate investors who are working with a limited budget and tight timelines.

2. FHA 203(k) Loans

Another financing option specifically meant for fixer-upper renovations is federal housing administration (FHA) 203(k) loans. These loans let you create a single mortgage from the purchase price and renovation expenses. Those with minimal upfront capital or first-time homebuyers will find this option ideal.

3. Home Equity Loans and Lines of Credit (HELOCs)

To fund a fixer-upper, you can use the equity in your current property as collateral. A HELOC lets you draw money as needed, while a home equity loan provides a lump sum of cash. The interest rates on these alternatives are typically lower than those on other loan types.

4. Personal Savings and Partner Investments

Using cash to finance a project relieves the loan repayment and interest load for those with enough savings. On the other hand, working with another investor will boost your whole purchasing power while helping to distribute expenses and risks.

Budgeting Wisely for Renovations

You should make a detailed renovation budget after you have your funding in place. Ignoring this important phase might cause cost overruns and reduced investment returns.

1. Conduct a Thorough Property Inspection

Hire a professional inspector to find structural problems, outdated systems, or other possible areas of concern before you commit on a property. Knowing the extent of repairs will enable you to more precisely estimate costs and prevent future unexpected expenses.

2. Prioritize High-Impact Improvements

The return on investment (ROI) of any renovation is not the same. Focus on renovations that will significantly increase the value of the house, such as:

- Kitchen remodels

- Bathroom upgrades

- Energy-efficient windows and insulation

- Curb appeal enhancements (landscaping, exterior paint)

By prioritizing these improvements, you can maximize your profits without overspending on less impactful upgrades.

3. Get Multiple Contractor Quotes

Get at least three estimates before you hire any contractors. This lets you evaluate work quality, budgets, and pricing and schedules. Be skeptical of bids that appear too inexpensive, as they may suggest poor materials or craftsmanship.

4. Include a Contingency Fund

Unexpected problems can arise even in well thought out renovations. Set aside at least 10 to 15 percent of your income as a backup to pay for unanticipated costs.

Setting the Right Price

Proper pricing of your fixer-upper is essential to draw in buyers and guarantee a good profit margin once it is ready for the market.

1. Conduct a Comparative Market Analysis (CMA)

Determine your home’s fair market worth after renovations by researching recently sold properties in the neighborhood. Pricing will be determined in part by location, square footage, bedroom and bathroom count, etc.

2. Factor in Your Costs and Desired Profit Margin

Take into account all you have spent on the property—including the purchase price, renovation expenses, and carrying costs—that is, property taxes, loan interest—when deciding on the price. To determine your asking price, add your desired profit margin to this total.

3. Consult a Real Estate Professional

A local real estate agent can help you present your house for maximum appeal and offer insightful analysis of current market trends.

Wrapping Up

It is a difficult but gratifying task to transform a run-down property into a lucrative investment. Maximizing your return on investment and reaching your investment targets depends on securing the right financing, smart budgeting, and efficient cost control. Whether you’re using personal savings, FHA 203(k) loans, or hard money loan solutions, success depends on a strong financial strategy.

Patience, discipline, and thoughtful decision-making are necessary on the road to prosperity. Your fixer-upper will become a profitable investment with the right approach that prepares you for future real estate projects.