Money moves fast, and when billions flow across borders, there’s no room for confusion. That’s why financial institutions have turned to something small but powerful: a Legal Entity Identifier (LEI). It’s not just a trend; it’s a global standard that’s become hard to ignore. This article uncovers the main reasons financial organizations insist on it and what it means for companies worldwide.

Helps Identify Who’s Who in the Global Market

To apply for an LEI in just minutes offers more than convenience; it unlocks verified identification for global transactions. Financial firms handle thousands of transactions every day, often with unfamiliar names. LEIs provide a unique code that clears the fog and says, “This is exactly who you’re dealing with.”

It’s like giving each company a digital passport for the financial world. This helps avoid mix-ups between similarly named entities and ensures that the right organization is recognized and processed. Clarity like this reduces delays and keeps trade flowing smoothly without second-guessing a firm’s identity.

Simplifies Regulatory Reporting

Maintaining regulations is tough, but an LEI makes things easier by providing structured data. Governments and regulators worldwide ask companies to report transactions clearly. LEIs bring a consistent format that regulators understand instantly.

This makes reviews faster, and compliance checks less painful for everyone involved. Without one, companies may be stuck translating scattered data into a format that fits regional standards. An LEI brings everything into focus, saving time and cutting down on manual work.

Strengthens Trust Across Financial Relationships

Trust isn’t given; it’s earned. And LEIs help build it with accuracy and accountability. When banks, investors, or trading partners see an active LEI, it signals transparency. It confirms that the company operates under proper legal structures and isn’t hiding in a gray area.

This simple code can go a long way in strengthening working relationships, especially when speed and trust are essential. It allows new partnerships to form more confidently and encourages smoother financial cooperation.

Supports Cross-Border Transactions

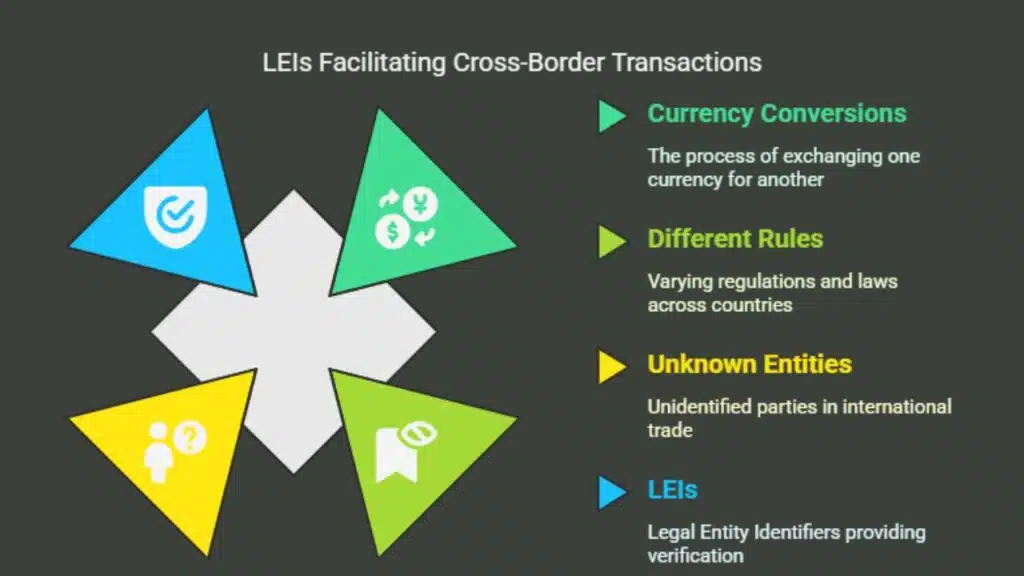

International trading often feels like stepping into unfamiliar territory, but LEIs help make things more predictable. Global transactions involve many moving parts: currency conversions entities.

LEIs create a consistent system across countries, removing the guesswork about who the other party is. This becomes even more valuable in financial markets where the slightest mistake can have major consequences. With a verified identifier, institutions can move forward with confidence, regardless of where the counterparty operates.

What are the benefits of early LEI registration?

Starting the LEI process through a reliable platform can save time and avoid future complications. Early registration ensures companies are prepared for reporting requirements as they scale operations. When a platform offers clarity, responsive service, and real-time status updates, the entire process becomes easier to manage from the outset.

Platforms that support quick applications, multi-year renewals, and secure verification provide long-term value. They help reduce administrative workload and ensure the LEI stays active through key stages of a company’s growth.

To apply for an LEI in just minutes is a step toward staying prepared in an increasingly complex financial world. LEIs are more than a technical requirement; they mark clarity, trust, and global alignment. With regulatory frameworks tightening and international relationships expanding, having a verified identifier is no longer optional for many. It’s a practical move that improves transaction quality, simplifies compliance, and builds stronger ties across industries.