Many high-income families fear that rising tax rates will erode their savings. They worry about steep capital gains tax bills and complex super rules. They want to lock down their assets and pass them on.

Australia has the second-highest personal tax rate, according to the OECD. This post shares 12 Tax Strategies For Wealth Preservation In Australia. You will learn to use discretionary trusts, SMSFs, salary sacrifice, negative gearing, and franked credits.

You will see how to cut capital gains tax, boost super contributions, set up family trusts, and use insurance. Each strategy aims to save tax, shield assets, and secure your legacy.

Keep reading.

Key Takeaways

- Australia has the OECD’s second-highest top tax rate. A family trust can hold $1 million in dividend shares. The trustee can split $40,000 in dividends into $20,000 for each child and save $18,800 in tax each year.

- You can salary-sacrifice $27,500 into super at 15%. You can use the three-year bring-forward rule to deposit $330,000 under the $110,000 non-concessional cap. You can aim for a $1.7 million balance to enter the tax-free pension phase.

- Negative gearing lets you claim loan interest and a $13,000 average depreciation on a rental property. You can drop your $220,000 income to $199,000 and save $9,870 in tax. You can use tax software or a depreciation schedule tool to plan.

- You get a 50% CGT discount if you hold shares or property over 12 months. You can move assets to a family trust or SMSF and allocate gains to low-income relatives. This strategy shifts profits into lower tax brackets and cuts capital gains tax.

- Franked dividends carry a 30% credit. A $500,000 SMSF portfolio might earn $20,000 in cash and $8,500 in credits. Paying 25% on $28,500 wins a $1,375 refund and lowers the fund’s tax burden.

Leverage Trust Structures for Tax Efficiency

Doctors and surgeons set up family trusts or discretionary trusts to shield assets and boost tax efficiency. These structures hold shares, property, or business stakes. The trustee moves income to family members in lower marginal tax rates, cutting tax on growth.

This plan guards assets from legal claims and adds asset protection.

A trust holds a $1 million block of high-dividend shares that pays $40,000 a year. The trustee splits $20,000 to each child, and each sits in a lower bracket. This shift slashes about $18,800 off the yearly tax bill.

Over five years, the trust snips $188,399 in total tax, freeing more cash for the family.

Maximize Superannuation Contributions

People boost super contributions with salary sacrifice to slim down their taxable income. You can stash up to $27,500 yearly into super and claim it as a tax-deductible deposit. That trick feels like feeding a piggy bank, one that fights the taxman.

Super funds tax deposits at just 15%, instead of your higher marginal rate. If your income tops $250,000, the ATO applies Division 293 tax and adds another 15% on concessional contributions.

Savvy savers use the three-year bring-forward rule to pile in $330,000 under the $110,000 non-concessional cap. Mind the $1.7 million super balance to tap the tax-free pension phase and lock in tax benefits.

Self-managed super funds let investors pick shares or property investment for stronger tax efficiency and asset protection. This tactic cuts future tax liabilities and boosts retirement planning.

Utilize Negative Gearing for Investment Properties

While super contributions boost retirement savings, negative gearing on an investment property can cut your taxable income. You claim loan interest, depreciation and letting agent charges as tax deductions.

Average depreciation on a new house runs about $13,000 a year.

That drop could lower a $220,000 income to $199,000. Saving $9,870 in tax can turn a cash shortfall into a $1,870 gain for an investor. Tax return software or a depreciation schedule tool can simplify your tax planning and boost cash flow.

Minimize Capital Gains Tax Through Strategic Asset Transfers

Small shifts in ownership can shave off big capital gains tax bills. CGT applies to profits from selling shares, property, or a business. You get a 50 percent discount if you hold assets for more than 12 months.

You can move shares or a rental house into a family trust or an SMSF. The trust can allocate gains to low-income family members, reducing your total tax. This trick works under ATO rules if you fill out the right forms.

Staggering asset sales across two tax years can tweak your taxable income. You can lock in a capital loss in year one, then sell more when your tax bracket drops. This lets you offset gains, cutting both company tax and personal income tax bills.

It takes only a few trust deeds, share transfer forms, and a chat with an accountant. You keep more of your profits and safeguard wealth at the same time.

Employ Franking Credits for Dividend Income

Companies pay 30 percent tax on profits and pass that tax as a franking credit on dividends. A shareholder who gets $70 in cash also holds a $30 credit. The investor adds $100 to his taxable income but cuts his bill by $30.

If his levy runs to $25, he claims a $5 refund.

An SMSF can hold those shares to boost tax efficiency in retirement. A high-net-worth investor with a $500,000 portfolio might see $20,000 in franked dividends plus $8,500 in credits.

The levy on $28,500 at 25 percent is $7,125. The fund wins a $1,375 cash refund. This tactic cuts the tax burden and lifts dividend income.

Use Testamentary Trusts for Wealth Distribution

After franking credits boost dividend yields, some beneficiaries use a testamentary trust. This legal vehicle sits in a trust deed in your estate plan and holds holdings at death. It steers payouts to children or spouse.

It also covers super death benefit planning, so funds flow fast. This tool enhances wealth transfer for families.

A trustee gets power to manage and pay funds. It avoids NSW intestacy laws that split estates evenly. Planners add it for high-net-worth families. This trust cuts capital gains tax on long held investments.

Holdings owned over twelve months get a half cost base discount, slashing cgt bills. It also guards against creditors, divorce claims and double taxation. Taxpayers see it as a key part of estate planning and wealth preservation.

Implement Salary Sacrifice Strategies

High earners trim tax using salary sacrifice. Super contributions feed a super fund at a 15% rate. Division 293 tax kicks in for those with taxable income above $250,000. Concessional contributions cap your sacrifice at $27,500 per year.

Payroll software or an ERP channels those contributions fast into your SMSF or retail super fund. ATO rules shape every step of tax planning. This move cuts tax liabilities and boosts wealth preservation.

Consider Debt Recycling for Tax Optimization

Salary sacrifice cuts taxable income; debt recycling builds investment strength. Debt recycling converts home loan debt into deductible investment loan debt. You pay down your mortgage while you borrow to buy shares or rental property.

The interest on that loan becomes tax deductible under the tax system. An investor might channel $50,000 a year through this loan recycling method. That interest then offsets taxable income, offering clear tax advantages for high-net-worth individuals.

This tactic pairs well with negative gearing on investment properties. You claim rental loan interest, then reduce your taxable income. You funnel freed cash into new growth assets.

You book capital gains tax on any profit later. You also boost super balance, but mind your concessional contribution cap. SMSF trustees or ATO planners can guide risk management, tax planning steps.

Structure Investments with Tax-Effective Entities

Family trusts shift income to beneficiaries in lower tax brackets. They curb capital gains tax and yield strong tax planning. A trust distributes income and saved $18,800 a year in one portfolio.

Corporate entities pay just 25% on profit, not the 45% top rate. Hybrid setups mix trusts, companies, and superannuation funds. They suit complex holdings and cut tax liabilities.

Wealthy individuals tap discretionary trusts and companies. They place property or stock gains into the right shell. This approach drives tax efficiency and cuts Medicare levy hits.

Superannuation funds hold shares and use franking credits to lower taxable income. Small tweaks in entity choice trim risks, fees, and estate planning headaches.

Explore Tax-Effective Charitable Giving Options

Gift trusts and giving funds help you lower taxable income. You link those tools to the ATO portal. Donations to a registered political party or independent candidate qualify for deductions.

A $10,000 gift can trim about $3,000 off your tax bill. That tax planning move also helps with estate planning.

Using a deductible gift recipient setup cuts tax. You give cash to an approved fund, then claim a deduction on your tax return. This shift sends money from your taxable income to causes you support, while it lowers your tax bill.

High-income earners see real tax deductions, and you kill two birds with one stone.

Protect Wealth with Insurance Strategies

Shield your home and personal items with a high-value home and contents insurance policy. Business owners pick a business policy to protect stores and stock. Income protection insurance covers a slice of your salary if you face illness or disability.

Life insurance clears estate taxes and debts to enable smooth transfer to heirs. Mixing these covers ties into estate planning, tax planning, and risk management.

Think of insurance as a safety net under a tightrope walk in property investment. It fills gaps in a negative gearing plan if values tumble. A family trust can own a policy, to boost tax efficiency and shield funds in a self-managed super fund.

Planners often add business insurance for key staff to curb revenue loss. Clients sleep better, knowing they have cover for asset protection and retirement planning.

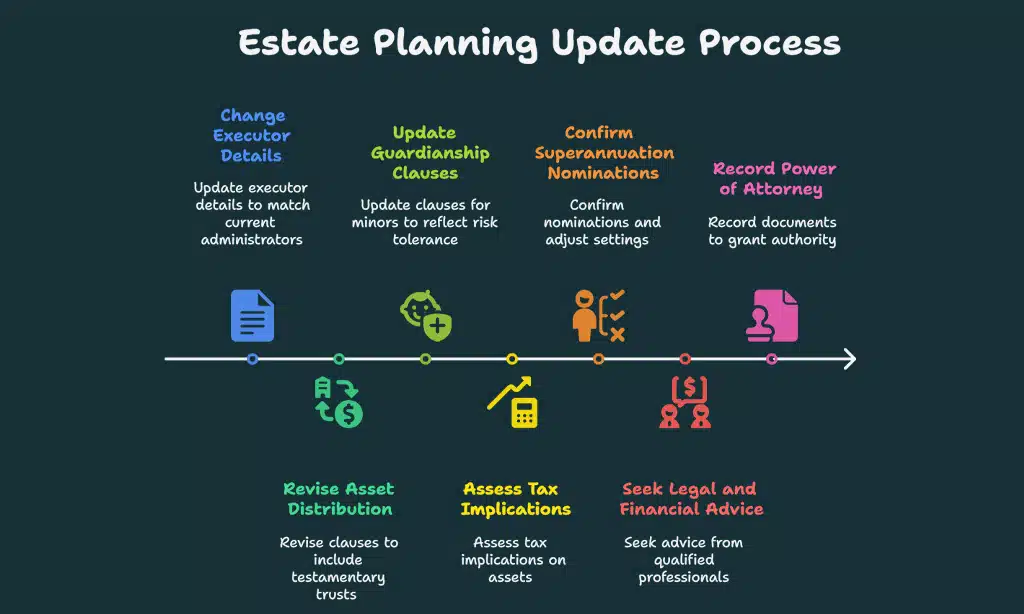

Regularly Update Your Will and Estate Plan

A solid will shields your assets and heirs. It stops intestacy laws in NSW from dictating your legacy.

- Change executor details to match current family trusts or self-managed super funds administrators, avoiding confusion and delays in estate settlement.

- Revise asset distribution clauses to include testamentary trusts, which can sidestep intestacy rules in NSW and reduce capital gains tax.

- Update guardianship clauses for minors to reflect your risk tolerance and set clear directives for their future care and funds.

- Assess tax implications on your assets, checking new Medicare levy rates and capital gains tax changes for high-net-worth individuals.

- Confirm superannuation nominations, adjusting pension phase settings or concessional contributions so your SMSF meets retirement planning and tax efficiency goals.

- Seek legal and financial advice from a qualified solicitor or financial advisor to maintain tax compliance and limit estate planning liabilities.

- Record power of attorney documents to give someone authority over property investment or tax planning moves if you become incapacitated.

Up next, we explore how to seek professional financial and legal advice.

Seek Professional Financial and Legal Advice

Expert advice saves time. A financial advisor, like Poole Advisory, reviews your retirement planning, salary sacrifice, and income protection insurance needs, and they offer free introductory meetings.

Hudson Financial Planning crafts tax planning and wealth strategies for high-net-worth individuals. They examine investments, negative gearing on property, and concessional contributions to boost tax efficiency.

An estate planning attorney tweaks wills, testaments, and trusts to guard your capital gains tax obligations and estate tax liabilities. They work with family trusts or self-managed super funds, monitor changes in tax laws, and avoid tax avoidance pitfalls.

Good counsel links asset protection with risk management, and it steers you clear of double taxation.

Understand Changes in Australian Tax Laws

Governments tweak super caps often. The ATO set the concessional contributions cap at $25 k per year. High-income earners face a 30 % Medicare levy bite there. They lifted non-concessional caps from $100 k in 2018 / 19 to $110 k in 2019 / 20.

They then set a $330 k cap by 2021 / 22 under bring-forward rules. SMSFs feel the shift, and fund holders must adjust. On June 30, 2020 lawmakers eased tax bills for retirees in pension phase.

That change boosted tax efficiency in retirement planning. Tax planning on property investment and negative gearing still matters. Keep your eye on the ball or risk missing the wealth preservation train.

Trust rules saw fresh tweaks too. The Treasury boosted limits for family trusts. It barred sweet distributions to minors under 18. CGT laws also moved the goalposts, slicing the discount for small business assets to 33 %.

That tweak jacks up capital gains tax on asset transfers in property investment holdings. You can plug that hole with a discretionary trust or a self-managed super fund, and gain asset protection in estate planning.

Pick tools that match your financial goals and cut tax liabilities fast. Chat with a financial advisor to steer clear of tax traps.

Plan for Intergenerational Wealth Transfers Strategically

Testamentary trusts give families asset protection and tax efficiency at death. A 2022 Melbourne estate plan used a trust and nomination to shift five million dollars to children. This move cut capital gains tax and boosted estate planning for high net worth individuals.

A nomination on your superannuation death benefit under a private fund adds another layer of risk management.

Financial advisors draft a document that covers alternative investments, salary sacrifice, and non concessional contributions for SMSFs. It aligns with strategic intergenerational wealth transfer planning.

This plan fits your family’s wealth preservation vision. That strategy guides assets to the next generation without steep tax concessions, and keeps property investment and franking credits in play.

Consolidate Accounts to Avoid Excess Fees and Taxes

Scattered savings and investment accounts drain your wealth like termites in a fence. The Australian Taxation Office tracks fees per account, and that adds up. A data aggregator tool can pool balances on one dashboard; you spot spare accounts and shut them down.

That move cuts hidden platform fees and reduces taxable income.

Armed with fewer accounts, you dodge extra annual fees. Your self-managed fund or robo-advisor account count drops. A financial advisor can spot overlaps and advise which funds to merge.

You protect your nest egg and cut tax liabilities at the same time.

Monitor and Adjust Strategies Based on Financial Goals

Consolidating accounts cuts fees and taxes, so you must watch your plan. You must check your goals each quarter. You track results and you adjust your moves.

- Set measurable goals that match your income and tax planning aims.

- Use financial planning software like a tax calculator or cash flow model to track asset protection needs.

- Review SMSF statements and concessional contributions to keep your super phase on track.

- Audit your property investment portfolio for negative gearing impacts and estimate future capital gains tax.

- Schedule regular meetings with your financial advisor to tweak your strategy and lower Medicare levy hits.

- Compare estate planning tools, such as testamentary trusts or family trusts, and shift assets to guard wealth.

- Hold quarterly check-ins on risk management metrics and income tax liabilities to stay agile.

Takeaways

Estate planning can guard your wealth. A solid will, backed by a family trust, can halve your CGT. You grow your nest egg with self-managed funds and clever super contributions. Franked dividends and property tax strategies shrink your tax dues.

Salary sacrifice and debt recycling pump up your cash flow. You protect heirs by locking assets in an inheritance trust. You manage risk with income protection insurance. Tax rules can flip overnight; stay nimble by reviewing your plan yearly.

Chat with a planner to align your moves with fresh advice.

FAQs

1. How does negative gearing help with tax planning in property investment?

Negative gearing means you borrow money for a property and the rental costs exceed the rent you earn. You use the loss to cut your taxable income. This lowers your tax liabilities and boosts your wealth preservation plan.

2. What role do family trusts and discretionary trusts play in estate planning and asset protection?

A family trust holds assets under a discretionary trust deed. It acts like a safety net, so you can direct income to different people. This aids succession planning and shields assets from risk.

3. How can self-managed super funds use concessional and non-concessional contributions for retirement planning?

You add money before tax by making concessional contributions in your SMSF. This lowers your income tax today. You can also use non-concessional contributions in good years. Then you move to pension phase at a low tax rate.

4. How do capital gains tax concessions help preserve wealth?

When you sell an asset, capital gains tax (CGT) applies to your profit. Small business CGT concessions or the 50 percent discount can slash the tax you pay. Less tax means more money stays in your pocket.

5. What tax deductions, tax offsets, franking credits, and salary sacrifice moves lower taxable income and the Medicare levy?

You claim tax deductions on expenses like income protection insurance. You grab franking credits from shares. You use salary sacrifice to fund super. These steps cut your taxable income and trim your Medicare levy bill.

6. Why should high-income earners get financial advice on succession planning and tax efficiency?

If you earn a lot, your tax planning can get complex. A financial advisor helps spot double taxation, tax credits, and alternative investments. They guide you on estate planning, family trusts, and SMSFs so you protect wealth for the next generation.