Donald Trump’s unpredictable behaviour, reflected in his leadership style marked by abrupt policy shifts, aggressive rhetoric and unconventional decisions, has catalyzed profound uncertainty in global markets, strained historic alliances, challenged US democratic norms and restructured foreign policy norms at a moment of heightened geopolitical tension.

Setting the Scene: How We Arrived at a Moment of Uncertainty

Donald Trump’s political trajectory has long hinged on unconventional decision‑making, from the first “America First” presidency (2017–2021) through to his second term beginning in 2025. What distinguishes the current phase, however, is the scale and tempo of unpredictable actions.

- His rhetoric and policy moves increasingly diverge from traditional US diplomatic norms, replacing predictable alliances with transactional demands.

- Domestic governance sees abrupt announcements on elections and policy without established institutional scaffolding.

- Public and elite perceptions, within and outside the US, increasingly view unpredictability as a defining feature of the Trump era.This analysis decodes these patterns, connects them to broader historical contexts, and projects their near‑ and long‑term implications.

1) A Doctrine of Unpredictability: Strategic or Structural?

Trump’s refusal to adhere to predictable foreign policy frameworks is not merely chaotic. Some scholars argue it reflects a deliberate doctrine that treats uncertainty itself as leverage in global affairs.

-

What This Strategy Entails

- Cultivating strategic ambiguity to keep allies and adversaries uncertain about US intentions

- Using rhetoric such as “we may do anything at any time” to extract concessions

- Shifting abruptly between negotiation and coercion

Yet academic analysis underscores a deeper tension. Unpredictability in international relations is typically viewed as a liability because alliances, markets, and deterrence depend on expectations of continuity.

Predictability in Foreign Policy: A Comparative View

| Characteristic | Traditional Diplomacy | Trump-Era Diplomacy |

| Alliance Stability | Reinforced through treaties | Challenged through threats (e.g., tariffs on Europe) |

| Trade Policy | Predictable tariffs and negotiations | Abrupt tariff demands tied to unrelated issues |

| Multilateral Engagement | Central to US strategy | Deprioritized in favor of bilateral pressure |

| Threat Signaling | Calibrated and measured | Public, high-stakes, and volatile |

The problem is that unpredictability, even when intentional, raises transaction costs in diplomacy and steadily erodes trust.

“The United States’ unpredictability with President Donald Trump’s reelection to the White House was inevitable, and the world was more or less coming to terms with it. But nobody would have expected that Trump 2.0 would disrupt the global world order and demolish international rules-based laws. The global pattern that seems to be emerging today is one where might is power, even as the world gallops towards a unipolar order. From claiming sovereign territories to ransacking supply chains with tariff measures, the United States is fast emerging as a global hegemon,” says Nayanima Basu, independent journalist and author, and adjunct fellow at Gateway House.

“The United States has always behaved and acted as a global hegemon, but there was a certain kind of benevolence through institutional mechanisms like USAID. Under Trump 2.0, the US has shed all that benevolence, as if the mask has fallen off the hegemon. The US is now trying to create a unipolar world around which it wants the world to set up a new architecture.

“For India, the challenge is to manage Trump with deft diplomacy and push back against major policies that threaten its national interests. This is the time for India to speak up against what’s happening in the world due to Trump’s policies, but for that New Delhi has to strengthen its position within the subcontinent,” adds Basu.

2) Economic Ripples: Markets Grapple With Political Volatility

Political uncertainty has increasingly seeped into financial markets and investor expectations. A recent analysis by Fortune notes that some institutional investors are diversifying away from US dollar assets amid concerns over policy unpredictability.

Key Economic Indicators Affected

| Indicator | Relation to Trump’s Unpredictability |

| US Dollar Status | Perceived instability driving some diversification away from the USD |

| Stock Market Volatility | Markets remain resilient, though analysts warn of corrections |

| Inflation Expectations | Political pressure on the Federal Reserve could influence rate decisions |

| Foreign Investment | Some capital shifting toward non-US assets |

Investor sentiment increasingly treats political unpredictability as a structural risk factor — one capable of reshaping asset valuations and long-term capital flows.

3) Fraying Alliances and Geopolitical Realignments

Perhaps nowhere is Trump’s unpredictability more consequential than in US–Europe and broader ally relations.

- Threatening 25% tariffs on European nations over Greenland negotiations sparked sharp condemnation from EU leaders.

- European policymakers are increasingly seeing the US as an unreliable partner, prompting strategic recalibration.

- Traditional frameworks such as NATO risk losing cohesion as allies hedge against unpredictability.

This isn’t minor diplomatic friction, it signals a potential shift in global power architectures.

4) Domestic Governance and Democratic Norms Under Pressure

Domestically, Trump’s statements questioning the necessity of elections and praising the idea, however facetious, of bypassing them represent a normative shock to democratic traditions.

Institutional Uncertainty Factors

- Republican dominance in Congress has diluted legislative checks on executive actions.

- Supreme Court decisions have increasingly bolstered executive authority in contentious areas.

- Public opinion polls show polarization on military intervention, reflecting deep distrust in policy unpredictability.

These developments carry democratic risks when executive behaviour sidesteps long‑standing institutional constraints and norms.

5) Leadership Psychology: Beyond Policy to Persona

Understanding Trump’s unpredictability requires not just political analysis, but insight into leadership psychology. Analysts note that his decision‑making often prioritizes emotional immediacy over deliberative reflection, which can amplify volatility.

Some psychologists even describe traits such as paranoia and insecurity driving power dynamics, though these remain interpretations rather than medical findings.

| Aspect | Implication for Leadership |

| Emotional decision‑making | Fast, visceral decisions with outsized public impact |

| Narcissistic tendencies | Policies that reinforce personal narratives |

| Public rhetoric style | Unfiltered, combative, and unpredictable messaging |

Whether innate personality traits or political strategy, this combination deepens unpredictability’s imprint on decision outcomes.

6) Global Order at a Crossroads

Long before Trump’s second term, scholars argued that American foreign policy was entering a phase of contested leadership in the global system. Trump’s unpredictable conduct accelerates this phenomenon. With US commitment to multilateral institutions weakening, other powers, notably China and regional blocs, are positioning to fill perceived strategic vacuums.

This dynamic has three major implications:

- Multipolar expansion: Alternatives to US leadership may consolidate.

- Trade realignment: Allies hedge by seeking new connections (e.g., Canada pivoting toward China).

- Norm erosion: Global norms around conflict resolution, trade cooperation, and alliance solidarity face greater strain.

Expert Perspectives: Diverging Views on Predictability

| Perspective | Summary |

| Market Analyst View | Unpredictability is real and affecting investor behaviour. |

| Strategist Counter‑View | Some argue Trump is predictable in his unpredictability (a pattern). |

| Academic IR Perspective | Unpredictability may form part of a deliberate doctrine, but risks undermining long‑term stability. |

| Public Opinion Polls | Majorities view foreign interventions as excessive. |

This diversity of interpretation highlights that unpredictability is not universally condemned nor uniformly experienced, but its impact is measurable.

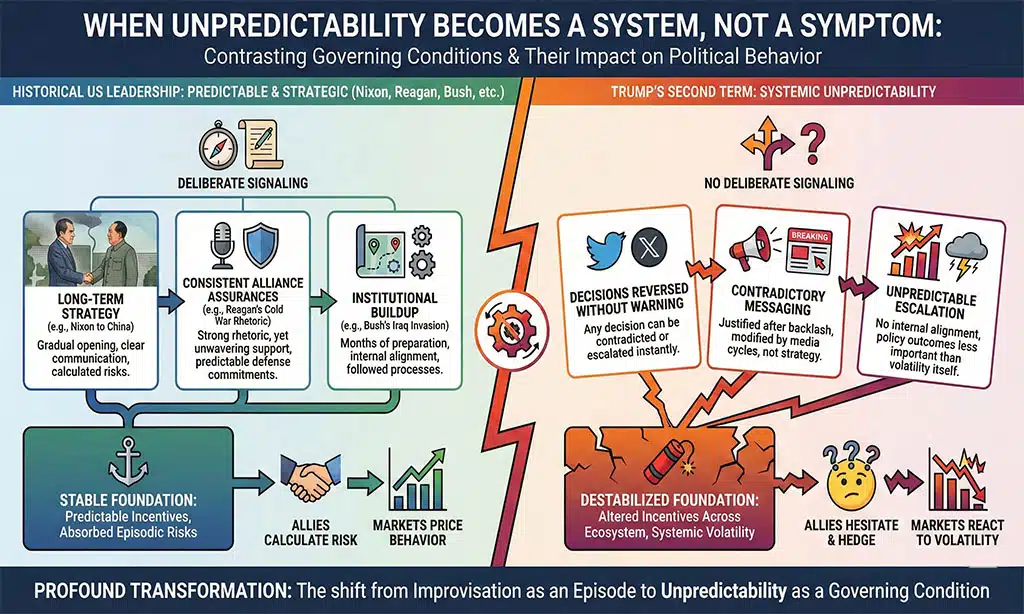

When Unpredictability Becomes a System, Not a Symptom

By Trump’s second term, unpredictability is no longer episodic. It is systemic. What once appeared as improvisation now functions as a governing condition that shapes how institutions respond, how allies calculate risk, and how markets price political behaviour. This distinction matters. Episodic erraticism can be absorbed; systemic unpredictability alters incentives across the entire political and economic ecosystem.

The central shift is this: actors no longer react to Trump’s decisions alone, but to the expectation that any decision can be reversed, contradicted, or escalated without warning. In such an environment, policy outcomes matter less than volatility itself. This is a profound transformation in how power is exercised.

Historically, US leadership relied on predictability even when policies were controversial. Nixon opened China but did so through deliberate signaling. Reagan escalated Cold War rhetoric yet maintained consistent alliance assurances. Even George W. Bush’s Iraq invasion followed months of institutional buildup. Trump’s approach diverges sharply. Decisions are often announced before internal alignment, justified after backlash, and modified in response to media cycles rather than strategic reassessment.

This inversion destabilizes not only outcomes but processes.

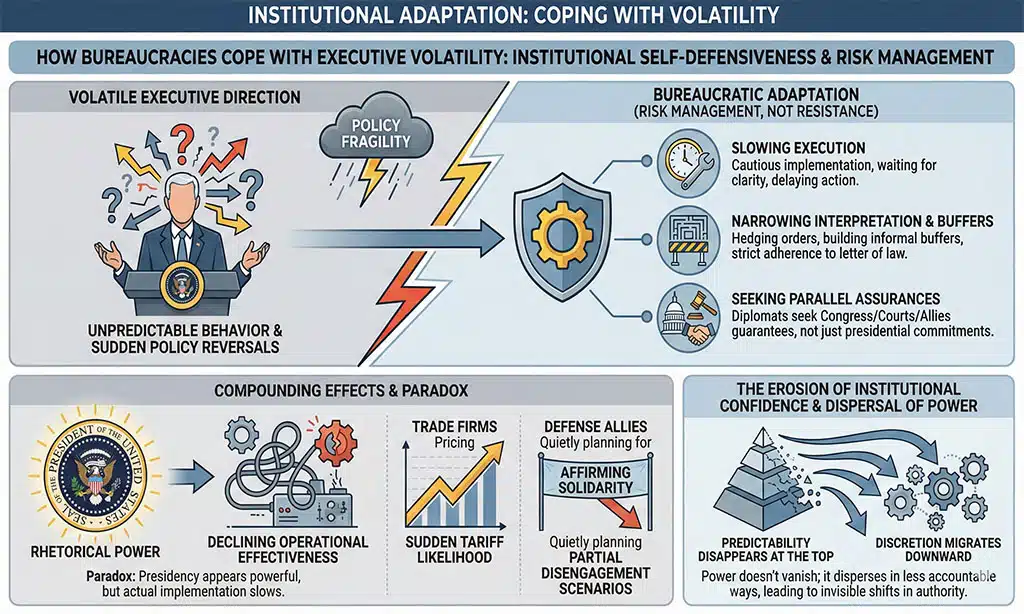

Institutional Adaptation: How Bureaucracies Cope With Volatility

One underexplored consequence of Donald Trump’s unpredictable behaviour is institutional self-defensiveness. When executive direction becomes volatile, bureaucracies adapt by slowing execution, narrowing interpretation, or building informal buffers. This is not resistance in the ideological sense, but risk management.

Federal agencies, foreign ministries, and even military planners increasingly operate under an assumption of policy fragility. Orders are implemented cautiously, hedged with contingencies, or delayed until clarity emerges. Over time, this creates a paradox: the presidency appears powerful rhetorically, but operational effectiveness declines.

In foreign policy, diplomats increasingly seek parallel assurances from Congress, courts, or allies rather than relying solely on presidential commitments. In trade, firms price in the likelihood of sudden tariffs regardless of official negotiations. In defense, allies quietly plan for partial disengagement scenarios even while publicly affirming solidarity.

This erosion of institutional confidence has compounding effects. When predictability disappears at the top, discretion migrates downward, often invisibly. Power does not vanish; it disperses in less accountable ways.

Markets, Risk, and the Normalization of Political Volatility

Financial markets are often cited as resilient to political noise, but resilience should not be mistaken for indifference. Under conditions of sustained unpredictability, markets adapt not by ignoring politics but by reclassifying it as structural risk.

In Trump’s second term, political volatility is increasingly embedded in pricing models. Currency traders, bond investors, and multinational firms factor in sudden policy shifts as baseline assumptions. This does not always trigger immediate crashes, but it raises long-term costs. Capital becomes more cautious, investments shorter-term, and supply chains more diversified away from single political centers.

This recalibration has subtle consequences. The United States retains enormous economic gravity, but its political risk premium quietly increases. Over time, even small increases in perceived instability can redirect marginal investments elsewhere. The effect is gradual, not dramatic, but cumulative.

Crucially, markets respond not to ideology but to uncertainty. It is not Trump’s conservatism or nationalism that unsettles investors most, but the absence of durable signaling. When policy is negotiable until it is not, and permanent only until tomorrow, planning horizons shrink.

Alliance Psychology: From Trust to Transaction

Alliances are not contracts alone; they are psychological arrangements built on expectations of reliability. Donald Trump’s unpredictable behaviour alters the emotional architecture of alliances, replacing trust with transaction.

Allies increasingly interpret US commitments as conditional and personalized. Security assurances, trade access, and diplomatic support are perceived as contingent on immediate alignment with Trump’s priorities rather than shared long-term interests. This shifts alliance behaviour in three ways.

First, allies hedge. They diversify partnerships, invest in strategic autonomy, and reduce exposure to unilateral pressure. Second, they compartmentalize. Cooperation continues in some areas while quietly preparing for rupture in others. Third, they recalibrate rhetoric. Public deference increases even as private confidence declines.

This duality creates fragile stability. Relationships appear intact, but their foundations are thinner. In moments of crisis, such alliances may hold, but with greater hesitation and higher coordination costs.

Domestic Politics and the Rewriting of Norms

Within the United States, unpredictability reshapes political norms more than policies. When leadership oscillates between positions, institutional guardrails become more important but also more contested.

Statements questioning electoral necessity, judicial legitimacy, or bureaucratic authority may not translate into immediate action, but they shift the boundaries of acceptable discourse. Over time, repetition normalizes the unthinkable. What once would have triggered bipartisan alarm becomes another headline in an endless cycle.

This normalization effect is particularly potent because it operates without formal change. Laws remain intact; norms erode quietly. Democratic systems rely not only on rules but on shared assumptions about restraint. When unpredictability undermines those assumptions, systems become more brittle even if they appear unchanged.

Polarization intensifies this effect. Supporters interpret unpredictability as strength and authenticity; critics see danger and decay. The middle ground, where institutional consensus once resided, narrows.

Is Unpredictability a Strategy or a Constraint?

A central debate among analysts is whether Donald Trump’s unpredictable behaviour reflects a deliberate strategy or an emergent constraint shaped by personality, political incentives, and the governing environment. Most assessments suggest it contains elements of both. At times, unpredictability can function as leverage.

Sudden threats may force negotiations, unsettle adversaries, or disrupt entrenched arrangements. However, strategy requires calibration. When unpredictability becomes persistent rather than episodic, its signaling value diminishes. Adversaries adapt, allies discount commitments, and markets hedge against volatility. What begins as leverage increasingly risks becoming background noise.

Moreover, sustained unpredictability limits internal capacity. Decision-makers around the president become risk-averse, hesitant to propose long-term plans that may be overturned. Policy coherence suffers not because of opposition, but because of anticipatory instability.

In this sense, unpredictability becomes self-limiting. It expands short-term maneuverability at the expense of long-term control.

The Deeper Structural Question

Beyond Trump himself lies a deeper question: has the American presidency structurally changed in ways that reward unpredictability? The convergence of hyper-polarization, media acceleration, weakened institutional trust, and personalization of power suggests that Trump is not an anomaly but an extreme expression of broader trends.

If so, the challenge is not merely managing one leader’s behaviour, but reassessing how modern democracies absorb volatility without collapsing into dysfunction. Trump’s presidency exposes fault lines that predate him and may outlast him.

This is why his unpredictable behaviour matters beyond immediate headlines. It tests whether the US system can maintain coherence under conditions of sustained uncertainty, and whether global leadership can function when reliability is no longer assumed.

Future Outlook: What Comes Next?

Short‑Term Watchlist

- Davos and IMF economic forecasts may adjust based on tariff escalation risks.

- Midterm election dynamics will test the grip on democratic norms.

- Bond markets and USD volatility could reflect growing political risk premiums.

Long‑Term Scenarios

Scenario 1 — Reinforced Realignment: Global economic and political alliances diversify away from historical US dependence.

Scenario 2 — Institutional Pushback: Domestic checks (courts, Congress) regain strength, curbing unpredictable governance.

Scenario 3 — Policy Coherence Emerges: Ironically, persistent unpredictability fosters its own predictable pattern, enabling strategic adaptation (as some strategists argue).