Many people who use Japan’s healthcare system face scattered health data. They log in to portals, but get no clear view of their records. They want a simple way to scan all medical info at once.

In 2023, Fujitsu launched a cloud platform that uses HL7 FHIR to link electronic medical records and personal devices. We will show you five digital health platforms that drive digital transformation, from artificial intelligence telemedicine to remote patient monitoring tools.

This post will help you find the best fit for your care. Stay tuned.

Key Takeaways

- In 2023, Fujitsu launched a cloud platform that uses HL7 FHIR to link clinic, lab, and hospital records with personal devices.

- The Japanese government invested 6.1 billion yen in digital prescriptions and 3.6 billion yen in long-term-care and disability data digitization.

- Telemedicine use rose from 5% in 2018 to widespread AI-powered video visits after rules eased in 2020; a 10 billion yen fund will support AI hospitals over five years.

- Japan aims to roll out its nationwide EHR system by summer 2022, backed by 8.13 billion yen for staff and 300 billion yen to merge scattered records.

- Mobile health apps like CureApps won insurance coverage for smoking cessation and may generate 15 billion yen by 2025 with AI-driven treatments.

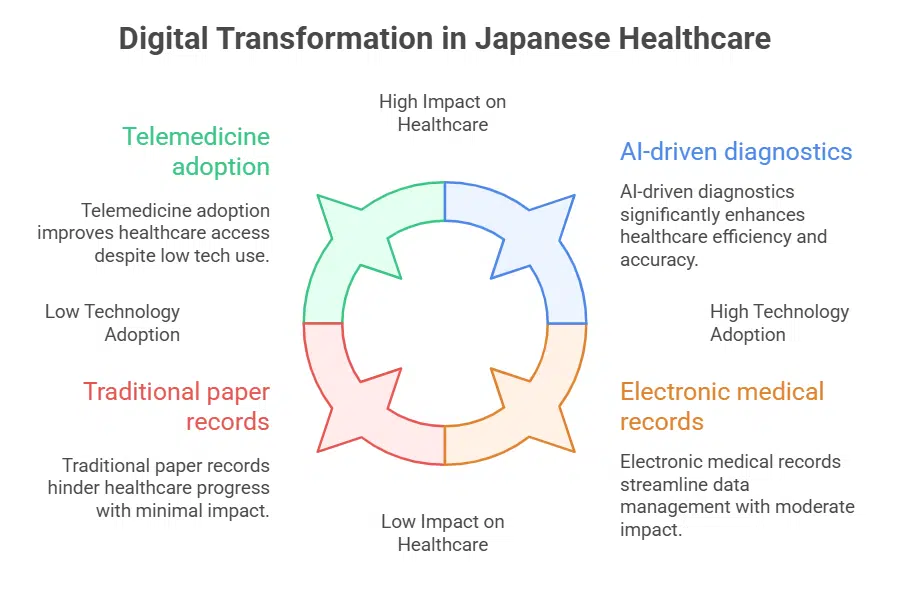

Overview of Japan’s Digital Transformation in Healthcare

A digital shift swept through Japanese healthcare after COVID-19. It spurred new telemedicine, cloud care, and artificial intelligence in healthcare. Government poured 6.1 billion yen into digital prescriptions and 3.6 billion yen into long-term care and disability data digitization.

Big firms rolled out HL7 FHIR platforms for seamless data flow. Clinics started using electronic medical records. Pharmacies switched to scanned electronic prescriptions. Patients even share fitness tracker data with doctors.

Japan faces an aging society that needs solutions, not paperwork. Hospitals link electronic health record systems with AI tools for swift diagnoses. They use fast healthcare interoperability resources to share info across labs and drug stores.

Researchers mine huge data troves for clinical trials and drug development. Folks tap personal health record apps on smartphones to track vital signs. The healthcare industry jumped to 43.4 trillion yen in value, and it can near 100 trillion yen by 2040.

These steps promise to ease strain, cut errors, and boost preventive healthcare.

Platform 1: Fujitsu’s Cloud-Based Healthcare Solution

Fujitsu’s cloud service gathers patient records from clinics, labs, and hospitals, then secures them for research institutions and pharmaceutical companies. The platform converts electronic medical records into HL7 FHIR format to speed up data sharing.

It analyzes details like age, health history, and treatment response to spot disease patterns and test drug targets. Researchers and pharmaceutical companies use these insights to craft personalized healthcare strategies.

Patients hold the key to their data and grant consent before any upload or anonymization step. They swipe through test results and visit logs on mobile devices, making it easier to track checkups and medication schedules.

This privacy-first design links smart apps and personal health records in one spot, so users manage their care without confusion.

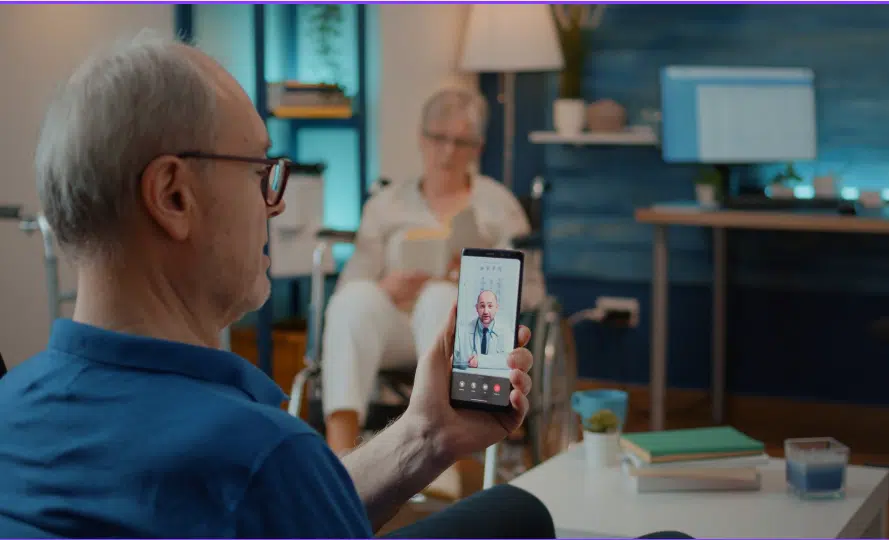

Platform 2: AI-Powered Telemedicine Services

Telemedicine gained steam after the government eased rules in 2020. Just 5% of the public used remote medical care in 2018, but usage soared with new AI algorithms in 2021. The Medical Practitioner Act now lets doctors run two facilities at once, and they host video chats for medication counseling.

Patients log in via apps that follow HL7 FHIR, sharing electronic health record details with pharmacists and nurses. Japan Medical Association still fights to block permanent telemedicine, citing patient privacy risks.

Government plans a 10 billion yen fund for AI hospitals over the next five years, pushing digital transformation in health technology.

Platform 3: Nationwide Electronic Health Record (EHR) System

Japan builds a nationwide electronic health record for each patient. Clinics and hospitals update electronic medical records at once. It uses data-sharing rules by Health Level Seven, Inc.

The system plans e-prescription support by summer 2022. Staff scan social ID cards, but only 26.3% of people held them by March 2021. Facial readers saw slow uptake, with just 34.3% of sites applying by February 2021.

Online insurance checks slipped from March to October due to delays. The Digital Government Office launched in September 2021 to speed the push.

Officials poured 8.13 billion yen into staff and gear. They added 300 billion yen to merge scattered records. HL7 FHIR and electronic medical records link clinics, labs, and pharmacies.

That link fuels digital healthcare across Japan. Patients track their own care through a personal health record. Doctors read records in seconds instead of sifting paper files. A doctor quipped, “I swapped file cabinets for a tablet, and my back thanks me.

Platform 4: Data-Driven Remote Patient Monitoring Tools

Hospitals tapped oxygen sensors and smart garments in Kyoto to track vital signs during the coronavirus pandemic. Local clinics linked these tools with electronic medical records and personal health record platforms via IoT technologies.

Clinic staff watched early signs of trouble on a digital dashboard. Medical Big Data Act of 2018 let researchers and pharmaceutical companies access anonymized health data for clinical research.

AI hospitals use this flow to cut medical spending and fill rural workforce gaps.

Officials poured over 100 billion yen into cybersecurity and data management in FY2021 to drive digital transformation. Data hubs in Kobe City now share health info under a citywide collaboration system.

Security layers in MEDRiNG use AES encryption to protect patient history. HL7 FHIR works behind the scenes to sync records from wearables to EMRs.

Platform 5: Mobile Health Apps for Personalized Care

Many people now use mobile health apps that shape custom care. CureApps developed the first therapeutic mobile app for smoking cessation and got health insurance coverage in Japan.

This app links to personal health record systems and electronic medical records via HL7 FHIR. It syncs with fitness trackers and wearable devices. Users see step counts, heart rates, and mental health tips.

It supports preventive medical care and clinical practice.

Pharmaceutical companies partner with digital agencies to build new tools. Apps use facial recognition to track stress or stroke risk. They let patients log in and share data with medical informatics teams.

Fuji Keizai research predicts AI-driven treatments in these apps will earn 15 billion yen by 2025. These tools reflect digital transformation in Japan healthcare and boost patient care.

Takeaway: The Future Impact of Digital Platforms on Japanese Healthcare

Future care leans on these five platforms. These tools use secure cloud models and HL7 FHIR so systems talk. EHR and personal health records sync across clinics. Remote monitoring sends health updates in real time.

Apps guide people toward personalized medicine. Japanese healthcare will grow smarter and kinder.

FAQs on Digital Health Platforms Transforming Japanese Healthcare

1. What is digital transformation in Japanese health care systems?

It uses digital tools and medical technology to power better care, linking electronic medical records, personal health record systems, and HL7 FHIR data. It acts like a bridge between clinics, nurses, and patients.

2. How do the platforms handle electronic medical records?

They store your medical history in EMRs and PHRs on secure clouds. Doctors and nurses log in, view medical images, and update notes in real time. It feels like a smooth sail.

3. How do they keep patient data safe?

They use secure cookies, strict login steps, and a strong decryption key. That locks private info up tight, so patients can rest easy.

4. How do these services boost personalized health care?

They combine your medical history, medical images, and market research from pharmaceutical companies. They design care plans that fit your life. They flag risks early for preventative medicine.

5. How did they get through the pandemic?

They picked up the slack for healthcare delivery with remote medical service. They offered video visits, chat care, and online pharmacy access. That kept universal healthcare running without long clinic lines.

6. How do they drive healthtech growth and market access in ASEAN countries?

They fuel the healthtech scene with help from digital agencies. They aid workforce development in nursing and link healthcare insurance systems. They push medical technology into new clinics and labs.