Many people struggle with debt and poor budgeting every day. They feel stressed about money and wonder how to gain control. This common problem keeps them from enjoying financial freedom.

Dave Ramsey has helped millions through his practical advice. One key fact shows that his methods have guided over 10 million people to pay off debt. This blog post lists essential Dave Ramsey books and explains their main ideas.

It gives you tools to build better habits in saving, investing, and managing money. Keep reading to start your journey.

The Total Money Makeover

Dave Ramsey shares key concepts like the debt snowball method, which helps you pay off debts fast. Readers love this book for its step-by-step plan to transform your finances, so grab a copy and start your journey today.

Key concepts and strategies

The Total Money Makeover introduces key concepts in personal finance that focus on debt management and wealth building. Readers learn the seven baby steps system. This starts with building a small emergency fund of $1,000.

Next, you pay off all debts using the debt snowball method. This approach lists debts from smallest to largest and tackles them one by one. It builds momentum and keeps you motivated.

Budgeting plays a central role in these strategies. Create a zero-based budget each month. Assign every dollar a job before the month begins. This ensures you control your money. Saving strategies include setting up a full emergency fund after debts.

Why it’s a must-read for financial transformation

Dave Ramsey’s “The Total Money Makeover” stands out in personal finance. This book delivers clear steps for debt management and wealth building. Readers gain tools to create a solid savings plan.

It breaks down budgeting in simple ways that work for anyone. Many people transform their money habits after reading it. They cut debt and build emergency funds fast.

You need this book for real financial education. It shares stories of folks who followed the advice and reached financial peace. The strategies focus on investment basics and long-term money management.

Grab a copy to start your own path to financial independence. Act now and see changes in your economic wellness.

Financial Peace Revisited

Dave Ramsey shares his proven baby steps in this book to help you tackle debt and build wealth. Readers gain tips on creating lasting financial peace through smart habits and choices.

Learn more about these strategies today.

Overview of the baby steps system

Dave Ramsey’s baby steps system guides you through personal finance with seven clear steps. Start by building a $1,000 emergency fund for quick safety. Next, pay off all debt except your mortgage using the debt snowball method in debt management.

Then, save three to six months of expenses for a stronger buffer. Invest 15% of your household income into retirement accounts as part of investment strategies.

Continue with saving for your kids’ college education. Pay off your home early to boost wealth building. Finally, focus on giving and enjoying true financial peace through smart money management and a solid savings plan.

Learn more about these steps in Financial Peace Revisited to master financial education.

Insights on achieving long-term financial stability

Financial Peace Revisited shares key insights on building long-term financial stability through smart money management. Readers learn to create a solid emergency fund that covers three to six months of expenses.

This step protects against unexpected costs and reduces stress. The book stresses paying off debt using the debt snowball method, where you tackle smallest debts first for quick wins.

You gain tools for budgeting that align with your income and goals.

Invest in mutual funds after clearing debt to grow wealth over time. Dave Ramsey explains how consistent saving leads to financial independence. Follow these strategies to avoid common pitfalls in personal finance.

Readers build habits that support debt reduction and wealth building for years. Start applying these ideas today to transform your financial planning.

Dave Ramsey’s Complete Guide to Money

This book offers a full rundown on money basics, with practical tips for everyday use. Grab a copy to build your skills in budgeting, saving, and smart investing, and check out more details online.

Comprehensive financial education

Dave Ramsey’s Complete Guide to Money delivers comprehensive financial education in plain language. Readers gain core knowledge on personal finance basics. The book breaks down key ideas like budgeting and debt management.

It helps you grasp money management without confusion. You learn practical steps for everyday use.

Explore tools that boost your financial literacy right away. Ramsey covers saving strategies and investment principles clearly. He includes tips for wealth building and financial planning.

Grab this guide to master economic wellness. Add it to your reading list now for real results.

Tools for budgeting, saving, and investing

Dave Ramsey’s Complete Guide to Money offers practical tools that help you take control of your finances. Readers find these resources easy to use for everyday money decisions.

- Budgeting tools in the guide teach you to create a zero-based budget, where every dollar gets a job before the month starts, promoting better financial planning and debt reduction.

- Saving strategies focus on building an emergency fund first, starting with $1,000, then expanding to three to six months of expenses for true financial peace.

- Investing principles explain simple options like mutual funds, urging you to avoid debt and invest 15% of your income only after clearing debts and saving basics.

- Money management worksheets provide step-by-step forms to track income and expenses, making personal finance less overwhelming and more actionable.

- Wealth building tips include the envelope system for cash spending, which curbs impulse buys and supports long-term savings plans.

- Financial education sections break down insurance needs, helping you protect your assets without overspending on unnecessary coverage.

- Debt management advice outlines the debt snowball method, where you pay off smallest debts first to build momentum toward financial independence.

- Investment strategies recommend diversifying in growth stock mutual funds with a track record, aligning with your risk tolerance for steady wealth building.

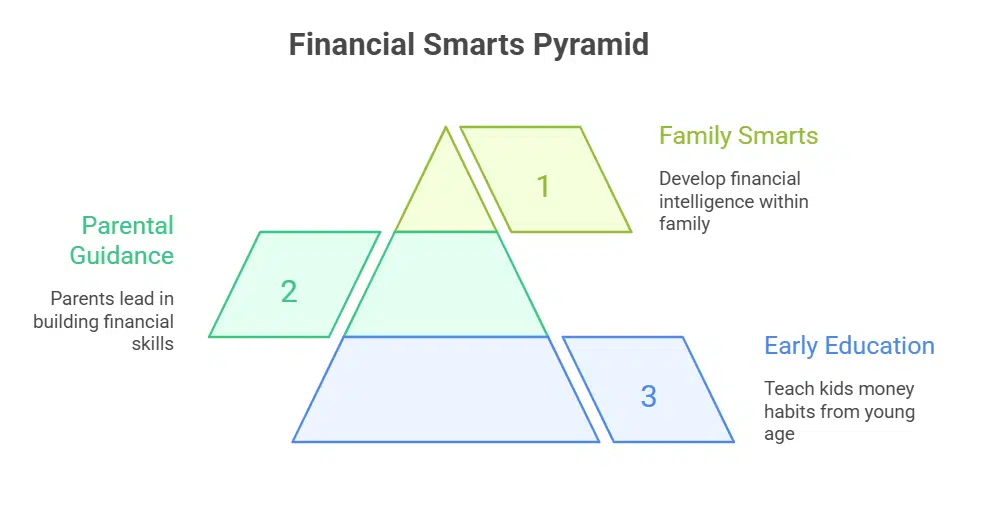

Smart Money Smart Kids

Dave Ramsey teams up with his daughter, Rachel Cruze, to create this guide that shows parents how to teach kids strong money habits from a young age. Grab a copy, and start building financial smarts in your family right away.

Teaching kids about money management

Parents often struggle with teaching kids smart money habits. Smart Money Smart Kids changes that. Dave Ramsey and his daughter, Rachel Cruze, wrote this book together. They share practical tips for money management.

Kids learn about budgeting from a young age. The book covers saving strategies and debt reduction. It builds financial literacy step by step.

Families use this guide to foster wealth building. Rachel Cruze adds real stories from her life. Parents teach kids to avoid common money mistakes. The book includes tools for financial planning.

Readers gain insights into investment principles. Start early, and kids achieve financial independence. Pick up this book to master personal finance with your family. Learn more about these essential strategies today.

Co-authored by Rachel Cruze

Dave Ramsey teams up with his daughter, Rachel Cruze, to write Smart Money Smart Kids. This book focuses on money management for families. It offers practical tips for parents to teach kids about budgeting and saving from a young age.

Rachel Cruze brings her own experiences to the pages, making financial education fun and relatable. Readers learn wealth building strategies that start early. Pick up this guide to boost your family’s financial literacy and debt management skills.

Baby Steps Millionaires

This book shows you how to build wealth with Dave Ramsey’s baby steps method. It shares real-life success stories from people who became millionaires, and you can learn more about their journeys to inspire your own path.

How to build wealth using the baby steps

Dave Ramsey’s baby steps offer a clear path to wealth building. Readers can use these steps to gain financial independence through smart money management.

- Start with Baby Step 1 by saving $1,000 for an emergency fund quickly. This step creates a safety net for unexpected costs in personal finance, and it stops you from using credit cards during surprises. Build this fund by cutting extra spending and focusing on budgeting basics.

- Move to Baby Step 2 and pay off all debt except your mortgage with the debt snowball method. List debts from smallest to largest, then attack them one by one while making minimum payments on others. This approach boosts motivation through quick wins and supports debt reduction for long-term financial planning.

- Advance to Baby Step 3 and save three to six months of expenses in a fully funded emergency fund. Put this money in a simple savings account for easy access. It protects your wealth building from job loss or big repairs, and it strengthens your financial literacy by teaching disciplined saving strategies.

- Enter Baby Step 4 by investing 15% of your household income into retirement accounts like Roth IRAs or 401(k)s. Choose mutual funds with strong track records for growth. This step focuses on investment principles that compound over time, and it helps you achieve financial peace through steady wealth accumulation.

- Tackle Baby Step 5 and save for your kids’ college education if you have children. Use tools like 529 plans or ESAs to grow the money tax-free. This prepares for future costs without debt, and it ties into money management by planning ahead for family financial education.

- Proceed to Baby Step 6 and pay off your home mortgage early with extra payments. Apply the debt snowball intensity here to eliminate this large debt. Owning your home free and clear accelerates wealth building, and it frees up cash for more investment strategies.

- Reach Baby Step 7 to build wealth freely and give generously once debt-free. Invest beyond the 15% in retirement, start businesses, or donate to causes. This final step emphasizes economic wellness through generous living, and real stories show everyday people becoming millionaires this way.

Real-life success stories

Readers discover inspiring tales in Baby Steps Millionaires. The book shares stories of everyday people who built wealth through smart money management. One example features a couple who paid off $50,000 in debt, then invested wisely to hit millionaire status in under 10 years.

They followed the baby steps system strictly. This approach helped them focus on budgeting and debt reduction first.

These success stories highlight practical financial planning. Another account describes a single parent who started with nothing, used savings plans to grow an emergency fund, and later dove into investment strategies.

She reached financial independence by age 45. The book includes data from Ramsey’s study of over 10,000 millionaires. It shows most built wealth slowly, with discipline in personal finance and wealth building.

You can apply these lessons to your own journey. Learn more about these paths to economic wellness.

Is Dave Ramsey a Millionaire? Exploring the Success Behind the Strategies

Dave Ramsey built his fortune after facing bankruptcy in his twenties. He turned things around with smart personal finance strategies. Today, his net worth tops $200 million. Ramsey Solutions, his company, brings in over $300 million each year.

This success comes from books, radio shows, and live events on budgeting and debt management.

People follow his baby steps for wealth building. Ramsey proves his methods work through his own story. He stresses financial education and money management. Readers can apply these investment strategies for their own financial peace.

Check out his books to start your savings plan today.

Takeaways

These Dave Ramsey books offer practical tools for financial success. Pick up a copy today to start your journey toward debt-free living. Learn more about budgeting and wealth building with these proven strategies.

Add one to your cart now and transform your money habits.

FAQs

1. What makes Dave Ramsey books essential for mastering personal finance?

Dave Ramsey books offer clear steps to build wealth, cut debt, and gain financial freedom. They use simple plans that anyone can follow. Learn more about his top titles to start your journey today.

2. Which Dave Ramsey book helps with debt reduction?

The Total Money Makeover provides a proven plan to pay off debt fast and build an emergency fund. It includes real stories from people who succeeded. Add to cart now for quick tips on budgeting.

3. How does Financial Peace University book improve money habits?

This book teaches you to live without financial stress by following seven baby steps. Add it to your reading list for lasting change.

4. Are there Dave Ramsey books for beginners in personal finance?

Yes, books like Baby Steps Millionaires show how ordinary people become wealthy. They focus on smart saving and investing basics. Click learn more to compare options and pick the best one for you.