In the fast-growing world of cryptocurrencies, crypto market makers play a vital role in ensuring the liquidity and stability of digital asset markets. But what exactly is a crypto market maker, and how does their role differ from traditional market makers?

Crypto Market Maker Definition

A crypto market maker is an individual or entity (often a trading firm) that provides liquidity in the cryptocurrency market by consistently offering to buy and sell digital assets at specific prices. Their primary objective is to facilitate smooth and efficient trading by ensuring that buyers and sellers can always find counterparties for their trades, even in less liquid markets.

Much like traditional market makers in stock or forex markets, crypto market makers profit from the difference between the buy price (bid) and the sell price (ask), known as the spread. They also play an essential role in maintaining price stability by reducing volatility, particularly in smaller or newer crypto markets.

The Role of Crypto Market Makers in Crypto Markets

The role of crypto market makers is crucial for the overall functioning of cryptocurrency exchanges. Their presence helps mitigate some of the issues associated with liquidity, volatility, and price discrepancies that can occur in digital asset markets.

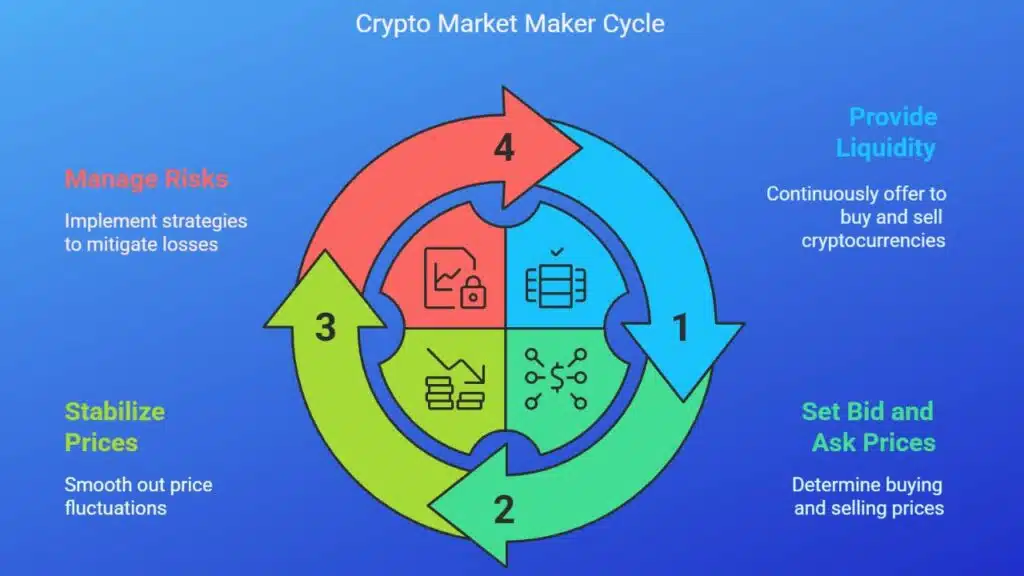

- Providing Liquidity: One of the primary functions of a crypto market maker is to ensure liquidity in the market. They do this by continuously offering to buy and sell cryptocurrencies at various price levels. This ensures that traders can execute their buy or sell orders quickly, even in markets with lower trading volumes.

- Bid and Ask Prices: Just like traditional market makers, crypto market makers set both the bid price (what they are willing to buy at) and the ask price (what they are willing to sell at). The difference between these prices—the spread—represents their profit.

- Price Stability: In crypto markets, especially those with lower liquidity, prices can fluctuate rapidly. By consistently offering to buy and sell at different price points, crypto market makers help to smooth out these price swings, making the market less volatile and more attractive to traders.

- Profit from the Spread: The crypto market maker profits from the difference between the bid and ask prices. In more liquid markets with higher trading volume, the spread may be smaller, but the volume of transactions can make up for the lower margins. In less liquid markets, the spread can be wider, but the market maker may take on more risk.

- Risk Management: As crypto market makers hold positions in various digital assets, they are exposed to market risks. They use sophisticated risk management strategies to mitigate potential losses, including hedging techniques, algorithmic trading, and diversification of their holdings.

Conclusion

A crypto market maker is a vital player in the cryptocurrency ecosystem, ensuring that there is always liquidity, helping to stabilize prices, and enabling seamless trading. Their role is especially crucial in markets characterized by high volatility and low liquidity. By offering continuous buy and sell prices, they make digital asset trading more efficient, transparent, and accessible for traders.