The trading day began with volatility for major crypto-related stocks, with MicroStrategy (MSTR) and Coinbase (COIN) initially tumbling after the opening bell before staging a modest rebound. By the end of the session, MicroStrategy shares were up 1.95% and Coinbase edged 0.5% higher. However, these minor gains barely mask the steep decline of the past month. Over the last four weeks, MSTR stock has dropped by nearly 20%, while COIN has fallen close to 27%.

In contrast, the leading digital currencies have fared better. Bitcoin, the largest cryptocurrency by market capitalization, is down only 3.7% in the same timeframe. Ethereum, the second-largest, has actually surged 13.4%. This divergence highlights a key issue: while cryptocurrencies themselves have shown resilience, companies with business models tied to them have been hit harder, reflecting deeper investor concerns.

MicroStrategy’s Unique Exposure and Investor Concerns

MicroStrategy’s stock is under particular pressure, hitting its lowest levels since April. The company is widely known for its aggressive Bitcoin strategy, holding more than 200,000 BTC on its balance sheet. While this approach has given it huge exposure to crypto rallies, it also makes it highly vulnerable to downturns. Analysts point out that MicroStrategy’s shares tend to trade with a high “beta,” meaning their moves are amplified compared to Bitcoin’s own swings.

Beyond simple correlation, there are structural concerns. Market watchers note that MicroStrategy’s share price has been losing its premium relative to its Bitcoin holdings, signaling a weakening investor appetite for using the stock as a proxy for direct Bitcoin exposure. Recent commentary from financial analysts also points to worries about dilution from equity offerings and the sustainability of MicroStrategy’s long-term leverage strategy.

Coinbase Faces Growing Competition and Regulatory Pressure

Coinbase’s challenges look different, but no less serious. As the largest U.S.-based cryptocurrency exchange, it faces constant regulatory scrutiny from the Securities and Exchange Commission and other agencies. At the same time, competition in the exchange sector is intensifying, with new entrants and decentralized exchanges steadily cutting into its dominance.

The company has also been highly sensitive to shifts in trading volume. When market activity slows, Coinbase’s revenues drop rapidly. That is what investors appear to be factoring in now, as trading volumes across major exchanges have softened in recent weeks despite Ethereum’s rally.

Broader Market Trends: Inflation, Interest Rates, and Volatility

The poor performance of crypto equities is not occurring in isolation. Broader macroeconomic concerns are weighing heavily on investor sentiment. Inflation data, uncertainty over Federal Reserve policy, and questions about tariffs and global trade are all playing a role.

While traditional indexes like the Dow Jones Industrial Average and the S&P 500 have both climbed about 1% this month, crypto-linked stocks have diverged sharply, underscoring their heightened volatility. Industry experts explain that crypto equities amplify crypto asset moves, creating larger swings both upward and downward. For digital asset treasury companies such as MicroStrategy, that effect is even more pronounced because their business is directly tied to the value of underlying crypto assets.

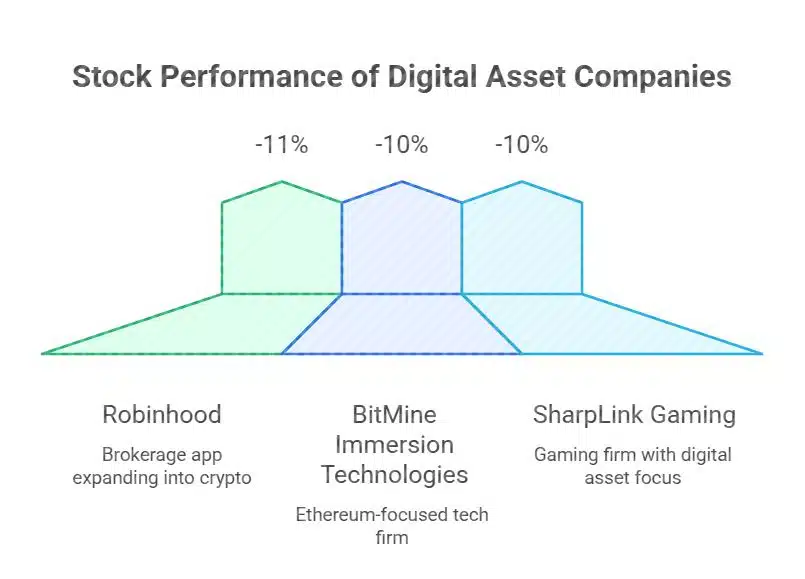

Robinhood and Other Equities Join the Slide

It is not only Coinbase and MicroStrategy that have been under pressure. Robinhood (HOOD), which has expanded from a brokerage app into a broader trading platform that includes crypto, fell below $100 briefly before rebounding to $104.53. Even so, the stock is down more than 11% from its recent record high of $117.70.

Ethereum-focused firms like BitMine Immersion Technologies and SharpLink Gaming managed to post small gains on Wednesday, but both remain down more than 10% over the last five trading sessions, showing that niche digital asset businesses are facing the same headwinds.

Crypto IPOs Deliver Disappointment After Initial Surge

Recent crypto IPOs have also stumbled after a brief period of optimism. Bullish (BLSH), the latest to list, initially surged to over three times its IPO price of $37 but has since fallen nearly 50% within days, leaving late buyers nursing heavy losses. Circle (CRCL) and eToro (ETOR), two other high-profile entrants, are also down 7.5% and 4.8% respectively in the past week.

This pattern reflects both the excitement and the risk of investing in newly listed crypto firms. Analysts note that while investor appetite is strong for innovative digital asset businesses, enthusiasm often fades quickly if share performance does not align with lofty expectations.

Long-Term Outlook: Investor Confidence Still Present

Despite the recent turbulence, many in the industry remain confident about the long-term prospects of crypto equities. Experts argue that companies such as Coinbase and MicroStrategy have proven resilient through past market downturns, including the severe “crypto winter” of 2022–23. Their ability to survive and adapt is seen as a valuable asset in a market prone to extreme boom-and-bust cycles.

Additionally, analysts highlight pent-up investor demand for crypto stocks. Since Coinbase’s 2021 IPO, opportunities to invest in publicly traded crypto firms have been limited. That scarcity has created enthusiasm around new entrants, even if early performance has disappointed.

For now, the sharp divergence between the performance of digital currencies and crypto-linked equities underlines the uncertainty investors face. While Bitcoin and Ethereum continue to anchor the broader ecosystem, companies built around them remain far more volatile and subject to the swings of both markets and policymakers.