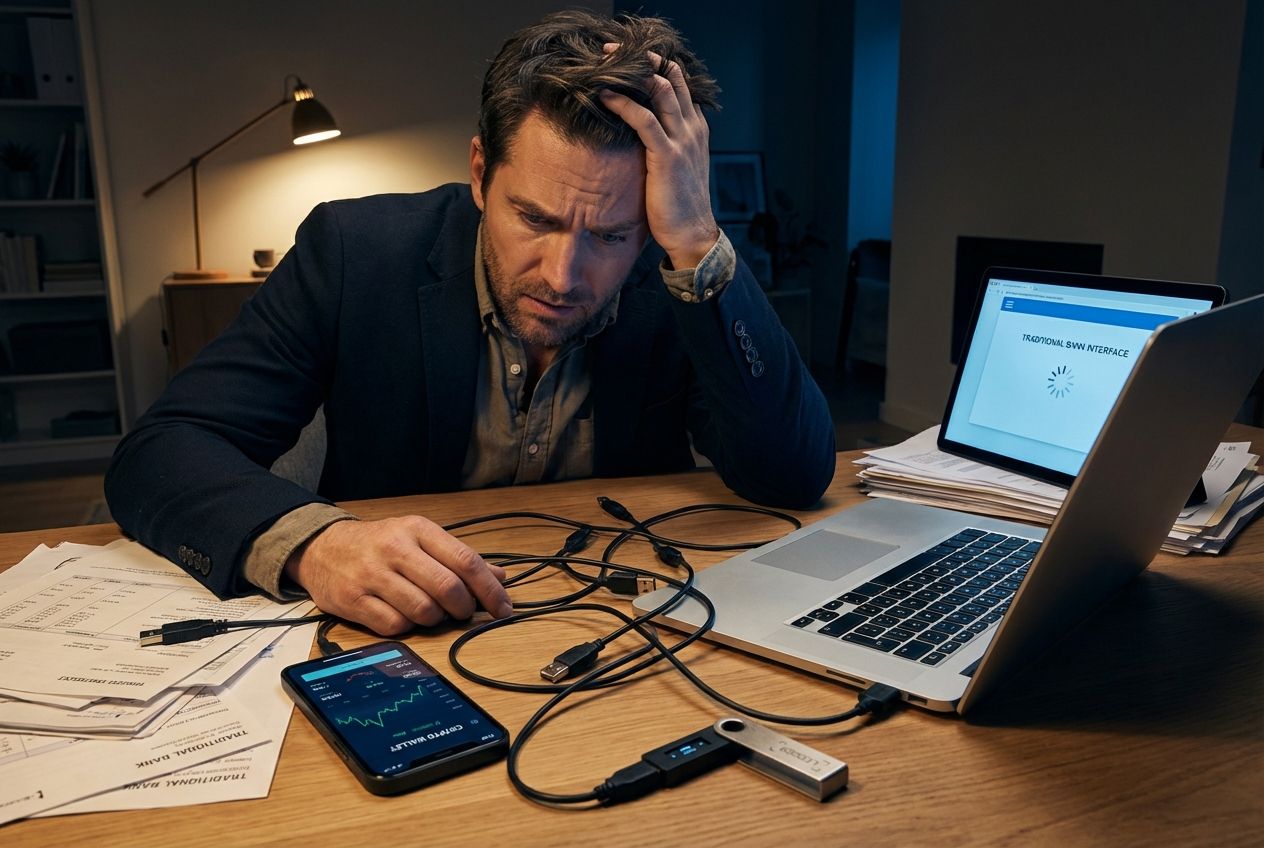

You know the feeling, trying to track your money is like debugging spaghetti code. You have a traditional bank account for bills, a separate wallet for your crypto, and three different apps just to move cash between them. It’s inefficient, and frankly, the latency between these systems is a bug, not a feature.

I’ve spent years building front-end architectures where data needs to flow seamlessly, and I view finance the same way. If the backend isn’t connected, the user experience breaks. Here is the good news: the patch is finally here. Crypto-enabled banking is merging the stability of legacy finance with the speed of the blockchain. We aren’t just talking about “buying Bitcoin” anymore; we are seeing major institutions integrating these assets directly into their core tech stacks.

I’ll walk you through which banks are actually shipping these features, the specific tools they use, and how to upgrade your own financial setup. Let’s debug your portfolio strategy.

What is Crypto-Enabled Banking?

Crypto-enabled banking is the integration of digital currency protocols with traditional fiat banking infrastructure. Instead of keeping your dollars and your digital assets in isolated silos, this model allows them to interact on a single platform.

Think of it as a full-stack financial solution. You can hold, send, and manage both USD and USDC (a digital dollar) from one dashboard. This convergence is driven by APIs that connect legacy banking networks like SWIFT with blockchain networks like Ethereum or Solana.

While consumer apps like PayPal and Cash App have brought this to the mainstream, the real heavy lifting is happening on the institutional side.

Anchorage Digital, for example, became the first federally chartered crypto bank in the U.S., allowing it to hold digital assets with the same legal standing as a traditional bank holds gold or cash. This isn’t just a wrapper; it’s a fundamental upgrade to the banking backend.

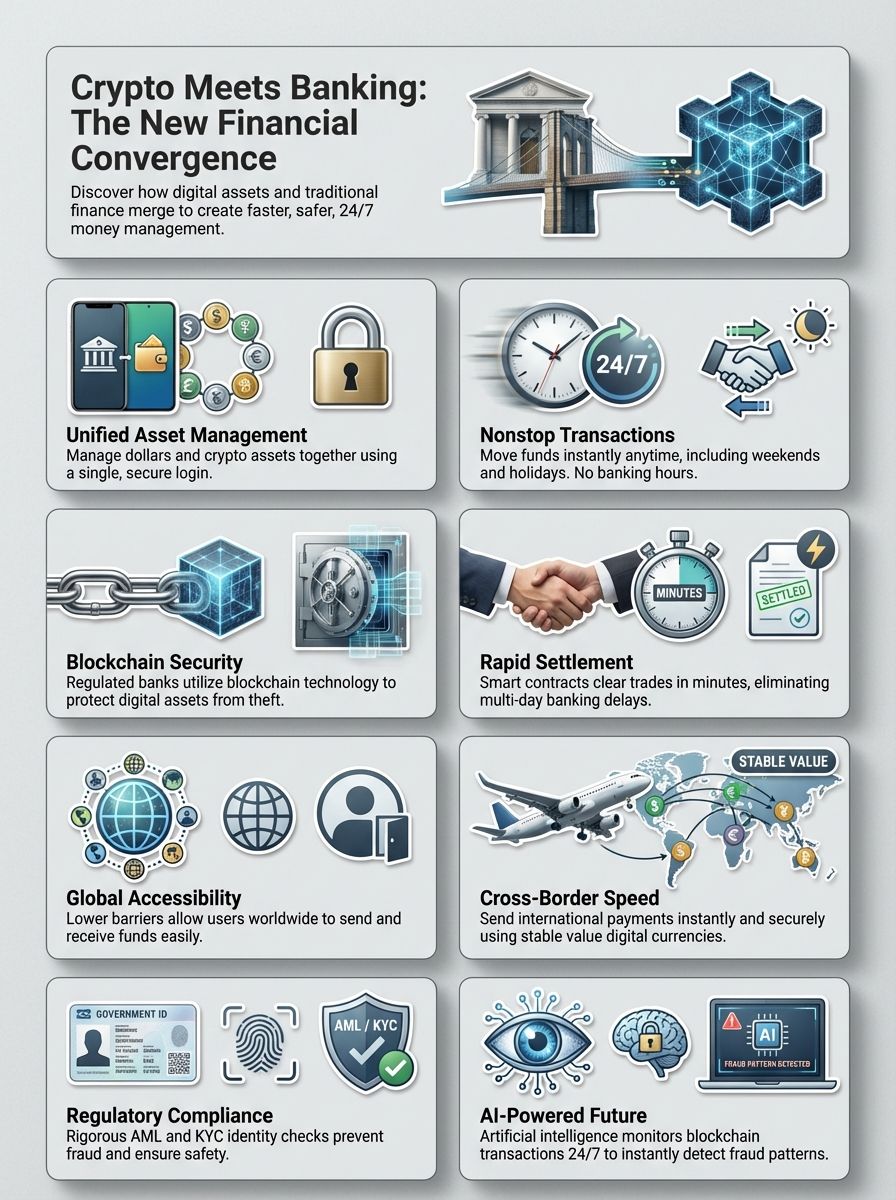

Key Features of Crypto and Traditional Banking Convergence

The best features of this convergence fix specific pain points we’ve all accepted for too long—like waiting three days for a wire transfer.

Integrated Fiat and Crypto Asset Management

Modern platforms are solving the “context switching” problem. Instead of logging into Chase for your checking account and Coinbase for your crypto, new hybrid models put everything in one view.

- Unified Balances: You can view your total net worth, cash, stocks, and crypto in a single verified dashboard.

- Instant Conversion: Platforms like PayPal allow you to convert crypto to fiat instantly at the point of sale, effectively letting you buy coffee with Bitcoin without the merchant ever knowing.

- Automated Tax Tracking: Integrated systems often track the cost basis of every trade automatically, simplifying the nightmare of year-end tax reporting.

This integration saves you from managing multiple login keys and reduces the security risk of transferring funds between disjointed apps.

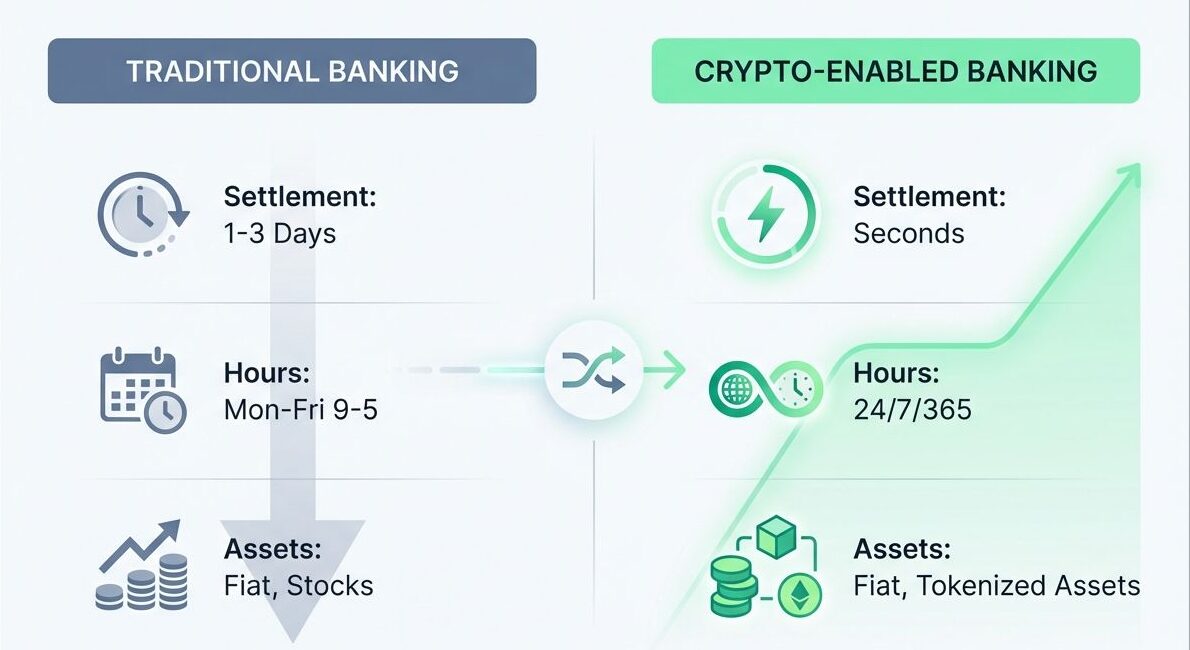

24/7 Transaction Capabilities

Traditional banking runs on “banker’s hours”, roughly 9 to 5, excluding weekends and holidays. Blockchains run 24/7/365. Convergence means banking services are finally catching up to the “always-on” nature of the internet.

JPMorgan’s Onyx network is the prime example here. It processes between $1 billion and $2 billion daily, allowing institutions to settle payments instantly at 3 AM on a Sunday. For a global company, this means capital isn’t trapped in transit over a long weekend; it can be deployed immediately.

“In a programmable money system, “business days” are a deprecated concept. Your money should work on the same schedule you do.”

Secure Custody and On-Chain Settlement

Security in crypto used to mean writing a private key on a piece of paper. That doesn’t scale for serious wealth. The convergence has introduced “Qualified Custodians”, regulated entities that use enterprise-grade security.

Banks now use Multi-Party Computation (MPC) wallets. Unlike a standard hardware wallet, MPC splits the private key into multiple shards distributed across different servers. A transaction is only approved if multiple parties sign off, making a single point of failure nearly impossible.

Anchorage Digital uses this technology to secure assets for giants like BlackRock. It allows them to participate in on-chain governance (voting on protocol updates) without ever exposing the underlying private keys to the open internet.

Enhanced Liquidity Management

Liquidity is simply how fast you can turn an asset into spendable cash. In the past, selling a real estate asset or a bond took days or weeks. Tokenization is changing that.

BlackRock’s BUIDL fund creates a digital token representing U.S. Treasury bills. Investors can trade these tokens 24/7, effectively making a slow asset (treasury bills) as liquid as cash. This allows corporate treasurers to earn yield on their idle cash overnight without locking it up for days.

Benefits of the Convergence

This shift isn’t just about cool tech; it creates tangible improvements in efficiency and access.

| Feature | Traditional Banking | Crypto-Enabled Banking |

|---|---|---|

| Settlement Time | 1-3 Days (ACH/Wire) | Seconds to Minutes |

| Operating Hours | Mon-Fri, 9-5 | 24/7/365 |

| Asset Types | Fiat, Stocks, Bonds | Fiat, Tokenized Assets, Stablecoins |

| Transparency | Opaque (Internal ledgers) | Transparent (Public/Private Blockchain) |

Faster and More Efficient Transactions

Legacy systems like SWIFT involve multiple intermediary banks, each taking a fee and adding time. Blockchain transactions are peer-to-peer. Using a stablecoin like USDC on the Solana network, you can send $1 million for a fraction of a cent, and it settles in under a second.

Payment processors like Stripe have reintegrated crypto payments for this exact reason. It allows a developer in New York to pay a contractor in Singapore instantly, bypassing the friction of international wire transfers.

Improved Accessibility for Users

Crypto-enabled banking lowers the barrier to entry. You no longer need to understand complex wallet addresses or gas fees to get exposure to digital assets.

With the approval of Spot Bitcoin ETFs in 2024, anyone with a standard brokerage account (like Fidelity or Vanguard) can invest in crypto price action without handling the underlying coins. This “wrapper” approach bridges the gap for users who want the financial upside without the technical headache.

Better Regulatory Compliance and Security

Early crypto was the Wild West, but the convergence has brought strict compliance standards. Leading institutions now enforce KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols that mirror top-tier banks.

Chainalysis is a tool widely used by these banks to monitor blockchain activity. It flags suspicious wallets linked to hacks or sanctions, ensuring that clean capital stays separate from illicit funds. This level of automated, real-time auditing is actually superior to traditional manual compliance checks.

Leading Institutions in Crypto-Enabled Banking

The landscape has shifted dramatically. While some early movers have pivoted, new heavyweights have entered the ring.

PayPal: Consumer-Focused Integration

While SoFi was an early adopter, it actually exited the crypto space in late 2023, migrating its users to Blockchain.com due to regulatory pressure. The new standard-bearer for consumer convergence is PayPal.

PayPal didn’t just add a “buy” button; they launched their own stablecoin, Crypto-enabled Banking. It is fully backed by U.S. dollar deposits and Treasuries. You can use it to pay for goods, transfer to external wallets, or convert to dollars seamlessly. It bridges the gap between a familiar payment app and the open crypto economy.

Anchorage Digital: Institutional-Grade Services

Anchorage Digital remains the gold standard for institutional custody. As the only federally chartered crypto bank in the U.S., they operate with the same regulatory oversight as a national bank.

Their most significant recent move is partnering with BlackRock to custody the assets for the BUIDL tokenized fund. This partnership validates their security model, proving that blockchain rails are ready for the world’s largest asset managers.

Sygnum Bank: Regulated Digital Asset Banking

Based in Switzerland and Singapore, Sygnum Bank continues to lead the global market. They hold a full Swiss banking license, allowing them to offer a complete suite of services: commercial banking, asset management, and tokenization.

Their 2025 Future Finance Report highlights a massive shift in sentiment: 57% of institutional investors they surveyed plan to increase their crypto allocations. Sygnum facilitates this by letting clients use their crypto assets as collateral for fiat loans, a feature that unlocks liquidity without triggering a taxable sale.

The Role of Stablecoins in Crypto Banking

Stablecoins are the API of this new financial system—they provide the stability of fiat with the programmability of code.

Seamless Cross-Border Payments

For businesses, stablecoins like USDC (by Circle) and PYUSD (by PayPal) are solving the remittance problem. Instead of pre-funding foreign bank accounts, companies can stream payments in real-time.

Visa has expanded its stablecoin settlement capabilities, allowing merchant acquirers to settle transactions in USDC on the Solana blockchain. This removes the need for currency conversion delays and reduces forex fees significantly.

Tokenized Money Markets

This is where the engineering gets interesting. Tokenization turns a static asset into a dynamic one. Franklin Templeton’s OnChain U.S. Government Money Fund (FOBXX) was the first U.S.-registered fund to use a public blockchain to process transactions and record share ownership.

By keeping the ledger on-chain, investors can see transparent, real-time proof of assets. It reduces administrative costs and allows for 24/7 subscriptions and redemptions, something impossible with traditional money market funds.

Challenges and Risks in Bridging Crypto and Traditional Banking

Integrating two different architectures always creates edge cases. Here are the bugs we are still trying to patch.

Regulatory Hurdles

The regulatory environment in the U.S. remains fragmented. The SEC’s SAB 121 (Staff Accounting Bulletin 121) has been a major blocker. It requires banks to hold customer crypto assets on their own balance sheets as liabilities, making it prohibitively expensive for them to offer custody services.

While the House passed the FIT21 Act to provide more clarity, the conflict between banking regulators and crypto innovation is ongoing. Banks are hesitant to fully commit until these rules are refactored into clear laws.

Compliance with AML and KYC Standards

The pseudonymity of blockchain makes compliance tricky. Banks must ensure they aren’t facilitating money laundering. This requires sophisticated “Oracle” services that link real-world identities to wallet addresses.

If a bank interacts with a “tainted” wallet, one that has interacted with a sanctioned entity like Tornado Cash, they risk massive fines. Tools like TRM Labs help automate this screening, but it remains a high-stakes game of cat and mouse.

Future Trends in Crypto-Enabled Banking

The roadmap for the next few years is clear: abstraction and automation.

Widespread Adoption by Traditional Banks

We are moving past the “pilot” phase. BNY Mellon, the oldest bank in America, has launched a digital asset custody platform. They recognize that if they don’t offer these services, their clients will leave for crypto-native competitors.

Expect to see more regional banks integrating “buy/sell” features directly into their mobile apps, powered by white-label APIs from companies like Ripple or Coinbase Prime.

Advanced Blockchain and AI Integrations

The convergence of AI and crypto is the next frontier. Imagine an AI agent that manages your finances.

- Automated Yield Farming: An AI could scan different lending protocols (like Aave or Compound) and automatically move your stablecoins to the highest-yielding verified pool.

- Smart Contract Audits: AI tools are being deployed to audit smart contract code in real-time, preventing hacks before they happen.

This combination will make “self-driving money” a reality, optimizing your wealth 24/7 without you lifting a finger.

Wrapping Up

The wall between “crypto” and “real money” is crumbling. We are seeing a new architecture emerge where the stability of banks meets the efficiency of blockchain code. Whether it’s PayPal’s stablecoin making payments instant or BlackRock tokenizing treasury bills, the upgrade is already live.

You don’t need to be a day trader to benefit from this. Simply using a high-yield stablecoin account or holding a portion of your portfolio in a spot ETF gives you access to this efficiency. The system is being rewritten.

Are you going to stick with the legacy version, or is it time to update your financial stack?