Many people feel stuck with slow gains in stocks, exchange-traded funds, or bonds. Crypto assets run on a peer-to-peer blockchain that no central bank controls. This guide will cover seven crypto assets, from Bitcoin to Solana, and show how a crypto wallet can help you replace stocks and bonds.

Keep reading.

Key Takeaways

- Bitcoin has a 21 million coin cap and a stock-to-flow ratio of 57. It reached a $1 trillion market cap in March 2021 and shows just 0.42 correlation to the S&P 500. You lock coins with private keys in a peer-to-peer blockchain.

- Vitalik Buterin launched Ethereum in 2015. It runs smart contracts on the EVM, hosts ERC-20 tokens, and powers thousands of dapps. The SEC approved Ethereum ETFs in July 2024, boosting institutional interest.

- Binance Coin cuts fees on Binance Smart Chain and drives DeFi apps. Solana handles tens of thousands of trades per second at a few cents each. Charles Hoskinson shaped Cardano with the energy-saving Ouroboros proof-of-stake and Plutus smart contracts. Gavin Wood built Polkadot to link blockchains via a relay chain. Ava Labs launched Avalanche in 2020, offering subnets that run at 4,500 tps and sub-second finality.

- Crypto trades 24/7 in digital wallets secured by public/private keys. You can buy tokenized real estate or private equity fractions. The SEC greenlit Bitcoin and Ethereum ETFs in 2021, and 62 percent of institutions now use registered crypto vehicles.

- Crypto assets can swing 20 percent in days. Hacks or lost keys can lock away funds. Smaller coins may lack liquidity, and US rules on token launches and decentralized exchanges remain thin.

Bitcoin (BTC) as a Store of Value

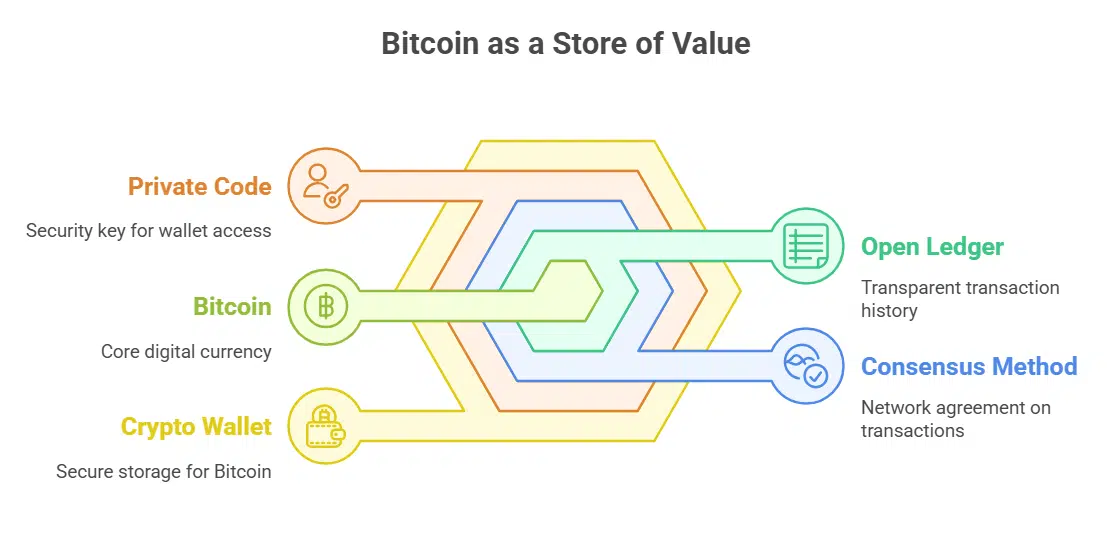

Bitcoin works like digital gold, thanks to its open ledger and consensus method. You lock it behind a private code in a crypto wallet, then watch it guard your wealth.

How does Bitcoin serve as digital gold for preserving wealth?

Investors treat Bitcoin like modern gold. A cap at 21 million coins makes it rare. Its stock to flow ratio sits at 57, a number that rivals gold’s. Miners secure trades on a distributed ledger with proof of work.

People lock coins behind private keys in digital wallets. That design turns Bitcoin into a store of value and protects wealth against rising money supply.

Bitcoin hit a market cap of 1 trillion dollars by March 2021. It trades on cryptocurrency exchanges, often 24/7. Its low link of 0.42 to the S&P 500 means less drag from stocks. Some use Bitcoin to balance asset class risk with stocks, bonds or real estate.

The peer to peer blockchain system records each move, so no single gatekeeper can seize your savings.

Ethereum (ETH) as a Smart Contract Platform

Ethereum runs smart contracts and powers dapps on its EVM with Remix and MetaMask, so keep reading to learn more.

How is Ethereum transforming decentralized apps and smart contracts?

Vitalik Buterin launched Ethereum in 2015 as a public ledger platform. That protocol supports ERC-20 tokens and hosts thousands of decentralized applications. It uses automated smart contracts to record agreements on a distributed ledger.

SEC approval of Ethereum exchange-traded funds in July 2024 spiked institutional interest and lifted market cap.

Developers write code in Solidity for secure simple contracts. They run these programs on the Ethereum Virtual Machine inside digital wallets. Those tools fuel decentralized finance, tokenized securities, and new asset allocation models.

Network upgrades boost speed, lower fees and widen access for everyday investors.

Binance Coin (BNB) and the Binance Ecosystem

BNB drives transactions on the BSC network, firing smart contracts and powering DeFi apps. It feels like a credit card for crypto geeks, letting you stake in liquidity vaults, swap on peer-to-peer exchanges, or fetch live charts via the Binance API.

What makes Binance Coin a versatile asset within Binance?

Traders pay fees with Binance Coin on the top crypto exchange. Users cut trading costs with discounts. That perk drives more volume and pushes up BNB value. Investors place coins in digital wallets on Binance Smart Chain.

Stakers earn yield on DeFi apps. Developers use smart contracts to create tokenized assets with ease.

Institutions list BNB in exchange-traded products on Binance. They treat it like an equity or a fund. Gas fees, staking rewards, swap costs and token sales all rely on BNB. This range of uses makes it a versatile digital asset.

Growth on Binance Exchange feeds BNB value in a constant loop.

Solana (SOL) for Scalable DeFi

Solana zips trades like a cheetah chasing lunch, it handles thousands of DeFi moves in a blink with tiny fees. You can link any crypto wallet to its JSON RPC API, swap tokens on a decentralized exchange, or call a software library on the fly.

Why is Solana known for high-speed and scalable decentralized finance?

Developers value this blockchain for rapid transaction speeds. It handles tens of thousands of operations each second. Fees stay low per swap, making DeFi trading smooth. It holds a top ten market capitalization among digital currencies.

The distributed ledger and public-private key encryption secure decentralized finance, tokenized assets, and smart contracts on the platform.

Institutional investors and family offices now run digital wallets on the platform to test tokenized securities. Many use it to trade futures contracts, launch exchange-traded products, and mint non-fungible tokens.

Low fees at just a few cents attract traders away from crowded chains.

Cardano (ADA) as a Sustainable Blockchain

Cardano runs on proof of stake, uses a distributed ledger and features Plutus for smart contracts, so it cuts energy use—read on to learn more.

How does Cardano support smart contracts with sustainability?

The network uses a proof-of-stake consensus called Ouroboros. It demands far less electricity than proof-of-work, making it eco-friendly. Stakeholders run nodes with low computing power, cutting overall power draw.

Developers use Plutus to write smart contracts on the distributed ledger. The peer-to-peer network links every transaction, boosting transparency in blockchain technology. Charles Hoskinson shaped this design, aiming for scalable and sustainable decentralized finance.

Polkadot (DOT) and Blockchain Interoperability

Polkadot ties blockchains to a shared ledger, letting custom chains move tokens, smart contracts, and NFTs at high speed. Read on to learn how Substrate frameworks help developers build these bridges.

How does Polkadot connect blockchains for innovation?

Dr. Gavin Wood, an Ethereum co-founder, built Polkadot to link blockchains for fresh ideas. It uses a central relay chain to tie together parallel blockchains and bridges. Developers can shift digital assets and smart contracts across chains in seconds.

Parallel chains serve various use cases from DeFi to NFTs. This design lets projects tap into blockchain technology without rebuilding a network from scratch. Cross-chain compatibility drives innovation in decentralized finance and tokenized assets.

Avalanche (AVAX) for Custom Blockchains

Custom subnets on Avalanche let teams launch private clusters with their own validator nodes, fee rules, and instant confirmations. Developers use the C-Chain, via the Avalanche CLI or Wallet, to power Ethereum-style DeFi and low-latency on-chain scripts.

What benefits does Avalanche offer for low-latency blockchain networks?

Ava Labs launched Avalanche in 2020. It uses a consensus model that cuts wait times to under one second. This blockchain technology can handle 4,500 transactions per second. Developers launch subnetworks on the distributed ledger.

These nets host smart contracts, digital assets, and tokenized assets.

Institutional investors now eye Avalanche for decentralized finance (DeFi) uses. They add subnets for fast settlement and clearings. They link each net to digital wallets, exchanges, and asset allocation tools.

They rely on private keys and cold storage for security.

What Are the Benefits of Crypto Assets Compared to Traditional Investments?

Crypto assets boost diversity. They tie weakly to equities and the U S stock market index. That index shows only a 0.42 correlation. Tokenized securities open doors to fractional real estate or private equity.

The SEC greenlit Bitcoin and Ethereum exchange traded funds in 2021. This approval raises credibility and access. Sixty-two percent of institutional investors now use registered vehicles.

Public private key encryption locks digital wallets and secures cold storage. Blockchain technology powers decentralized finance apps. Scarcity in digital currency, like Bitcoin’s 21 million cap, mimics gold.

That cap shields against inflation in the U S dollar. Smart contracts run on the Ethereum blockchain. Non-fungible tokens capture unique asset valuations. Virtual currencies offer fast settlement and 24 7 trading.

What Challenges Exist When Adding Crypto Assets to Investment Portfolios?

Investors face wild price volatility in digital assets. One asset may lose 20% of its market capitalization in days. No central banks or legal tender status protect these holdings.

Federal securities laws often omit clear rules on blockchain technology. Many assets launch via initial coin offering or on the Ethereum blockchain without SEC compliance. Hackers target ledgers.

A lost private key can lock away assets in wallets.

Smaller assets suffer from low liquidity, which ties up capital in asset allocation. Institutional investors watch for market manipulation on decentralized exchanges and contracts for difference.

Cold storage limits quick access, adding steps and risk. Regulators may review exchange-traded funds or exchange-traded products that track spot bitcoin etfs. Rules remain thin. That gap exposes portfolios to fraud and extreme price volatility.

Takeaways

These seven crypto coins stand ready to shake up mutual funds and ETFs. Bitcoin locks value tight in cold storage vaults, like gold bars buried deep underground. Ethereum spins up smart contracts, while Polkadot links chains with its parachains.

Avalanche and Solana race trades through a seamless distributed ledger. Cardano runs green, at low energy cost. Tokenized securities and digital wallets open doors to fresh asset classes.

FAQs on Crypto Assets That Challenge Traditional Investing

1. What is a spot cryptocurrency fund?

A spot cryptocurrency fund is an exchange traded fund, ETF, that tracks one crypto coin and trades like a stock.

2. How do smart contracts on a public decentralized ledger help investors?

Smart contracts run on a distributed ledger, they cut out middle men in banking, they automate trades in decentralized finance, defi, and they make deals clear.

3. What are non-fungible tokens?

Non-fungible tokens, nfts, are tokenized assets that turn one digital item into a digital collectible. They live on a decentralized blockchain and show who owns what.

4. How do I keep my digital assets safe?

You use a digital wallet, you hold private keys in cold storage, you rely on public-private key encryption. Think of your keys as a secret code to a vault.

5. What risks come from price volatility in crypto?

Crypto coins can spike or crash fast, that is price volatility, it can feel like a roller coaster. Market manipulation can play a part. A coin might lose its peg to a U.S. dollar or legal tender.

6. Can tokenized securities replace mutual funds?

Tokenized securities or security token offerings can split assets into small shares. You mix them in your asset allocation like mutual funds. Some institutional investors and Ark Invest eye exchange-traded products, etps, as a fresh choice.