In a landmark settlement with U.S. authorities, Credit Suisse Services AG, a unit of the Swiss financial powerhouse Credit Suisse, has admitted to criminal wrongdoing for its role in helping ultra-wealthy American clients evade U.S. taxes by hiding billions of dollars in offshore accounts. The U.S. Department of Justice (DOJ) announced that the bank will pay $511 million in penalties, after pleading guilty to conspiracy charges tied to long-term tax evasion schemes.

Repeat Offense: A Breach of Credit Suisse’s 2014 Plea Agreement

This latest plea deal comes nearly a decade after Credit Suisse made headlines in May 2014 for pleading guilty to similar charges—assisting Americans in hiding assets offshore to evade taxes. At that time, the bank paid a record-breaking $2.6 billion fine in a landmark case that was meant to signal a crackdown on offshore tax havens.

However, according to the DOJ, Credit Suisse continued the same behavior despite that prior agreement. In fact, prosecutors say the bank actively violated the terms of its 2014 plea deal by secretly helping Americans to shield more than $4 billion in at least 475 undeclared offshore accounts between 2010 and 2021.

“In doing so, Credit Suisse AG committed new crimes and breached its May 2014 plea agreement with the United States,” the DOJ confirmed in its official statement.

Singapore Operations Under Scrutiny

A key focus of the new criminal case was the role played by Credit Suisse AG Singapore, which held over $2 billion in undeclared assets for American taxpayers between 2014 and June 2023. These clients were not properly reported to U.S. tax authorities, and many accounts were falsely labeled to mask their true American ownership.

The Singapore-based subsidiary has now entered into a non-prosecution agreement (NPA) with U.S. prosecutors. This agreement is conditional upon full cooperation in any ongoing investigations and future disclosures.

Falsified Documents and Fake Paperwork

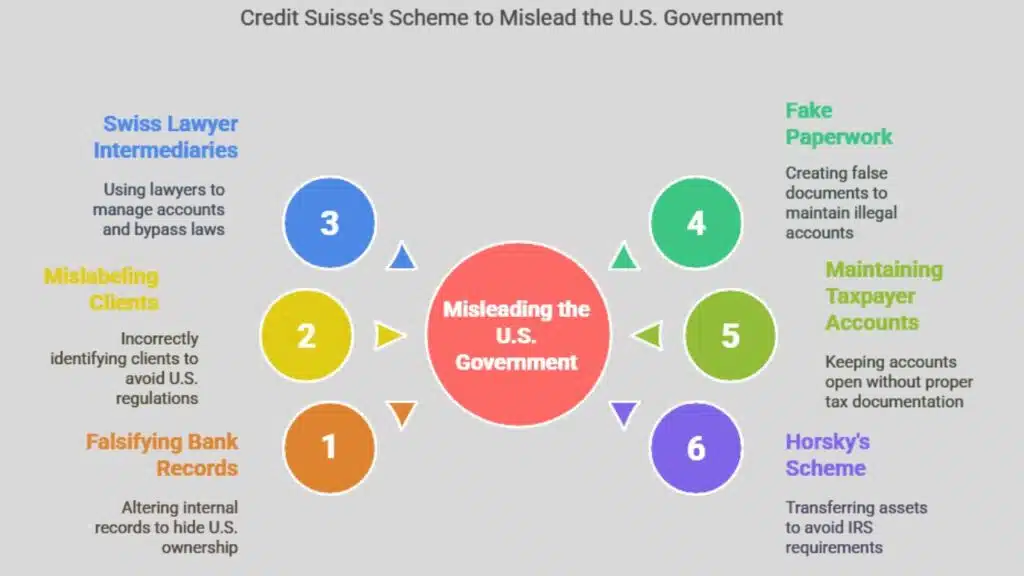

Court documents filed on Monday in the U.S. District Court in Alexandria, Virginia, outline a sophisticated and deliberate effort to mislead the U.S. government. The charging document accuses Credit Suisse of:

- Falsifying internal bank records to hide U.S. ownership of offshore accounts.

- Labeling American clients as “non-U.S. persons” on documentation.

- Allowing Swiss lawyers to act as intermediaries for over 100 client accounts.

- Processing fake paperwork to keep accounts open even when they were in violation of U.S. laws.

- Continuing to maintain over $1 billion in U.S. taxpayer accounts that lacked proper tax documentation.

One striking example involved Dan Horsky, a former University of Rochester business professor, who kept control of nearly $200 million in foreign assets by transferring ownership to a relative who wasn’t a U.S. citizen. This maneuver allowed him to skirt IRS requirements. Horsky pleaded guilty in 2016, was sentenced to seven months in prison, and paid a $100 million civil penalty.

Whistleblowers Took Personal Risks to Expose Misconduct

The DOJ credited the successful prosecution to several whistleblowers—former employees of Credit Suisse—who came forward with detailed and actionable intelligence despite potential retaliation and legal consequences under Swiss law.

Florida-based attorney Jeffrey Neiman, who represented these whistleblowers, explained that his clients took extraordinary risks to aid the investigation. Over more than a decade, they provided:

- Names and personal details (including Social Security numbers and passport information) of American clients.

- Internal documents, such as emails and account statements.

- Intelligence on banker movements and account transfers, which allowed U.S. agents to act quickly.

“Today, they feel vindicated — for telling the truth, for risking everything, and for standing up to one of the world’s most powerful financial institutions,” said Neiman.

Senate Investigation Played a Key Role

A 2023 Senate Finance Committee report, led by Senator Ron Wyden (D-Oregon), was instrumental in pushing this case forward. The report accused Credit Suisse of continuing to assist rich Americans in hiding assets even after the 2014 plea deal.

It specifically identified a previously unknown criminal conspiracy involving nearly $100 million hidden in secret offshore accounts held by one American family. In total, the committee found that Credit Suisse had failed to disclose over $700 million held in undisclosed accounts in violation of its plea agreement.

“This settlement fully vindicates the findings of my investigation,” said Sen. Wyden. “The ultra-wealthy and shady Swiss bankers shouldn’t get a free pass to cook up offshore tax evasion schemes when regular Americans are paying their fair share.”

Wyden has also called for criminal prosecution of individual bankers and advisors who were involved.

UBS Response After Acquiring Credit Suisse

In 2023, Credit Suisse was acquired by rival Swiss bank UBS in a dramatic bailout and merger move after mounting scandals and financial instability.

UBS issued a statement clarifying that it was not involved in the misconduct, emphasizing its zero-tolerance policy toward tax evasion and financial crimes. The bank added that it had prepared for possible liabilities related to Credit Suisse’s “legacy issues” during the acquisition.

“UBS is pleased to have resolved another of Credit Suisse’s legacy issues in a fair and balanced way,” the company said.

As a result of the settlement, UBS Group AG expects to:

- Record a financial charge in the second quarter of 2025.

- Recognize a credit from releasing a portion of the contingent liability set aside during the purchase.

What Happens Next?

- Credit Suisse Services AG will pay the $511 million settlement.

- UBS and Credit Suisse must continue full cooperation with ongoing and future investigations.

- No individuals involved in the conspiracy are protected under the current agreements, meaning personal prosecutions are still on the table.

The DOJ emphasized that this case is part of a broader effort to hold financial institutions and wealthy tax evaders accountable, stating:

“The agreements provide no protections for any individuals.”

Why This Matters

This case highlights the ongoing global challenge of financial secrecy, offshore tax shelters, and the special responsibility of financial institutions in maintaining tax compliance. While ordinary taxpayers follow the rules, a privileged class of clients used complex international structures and willing bankers to escape oversight.

It also underscores the value of whistleblowers, rigorous congressional oversight, and aggressive legal enforcement in deterring future misconduct.

The Information is Collected from CNBC Yahoo Finance.