Have you ever checked your credit card bill and felt your stomach drop? You are not alone. Many people feel worried or confused when they spot strange charges. Credit card fraud alert: it targets everyone, from college students to retirees.

Last year, Americans reported losing a staggering $12.5 billion to fraud, according to the Federal Trade Commission’s 2024 Data Book. That is a massive amount of stress and lost savings.

This guide will help you spot the new tricks scammers are using right now. You will learn how to guard your cash and catch fraud before it hurts your wallet. So, let’s walk through the exact steps you need to take to stay safe.

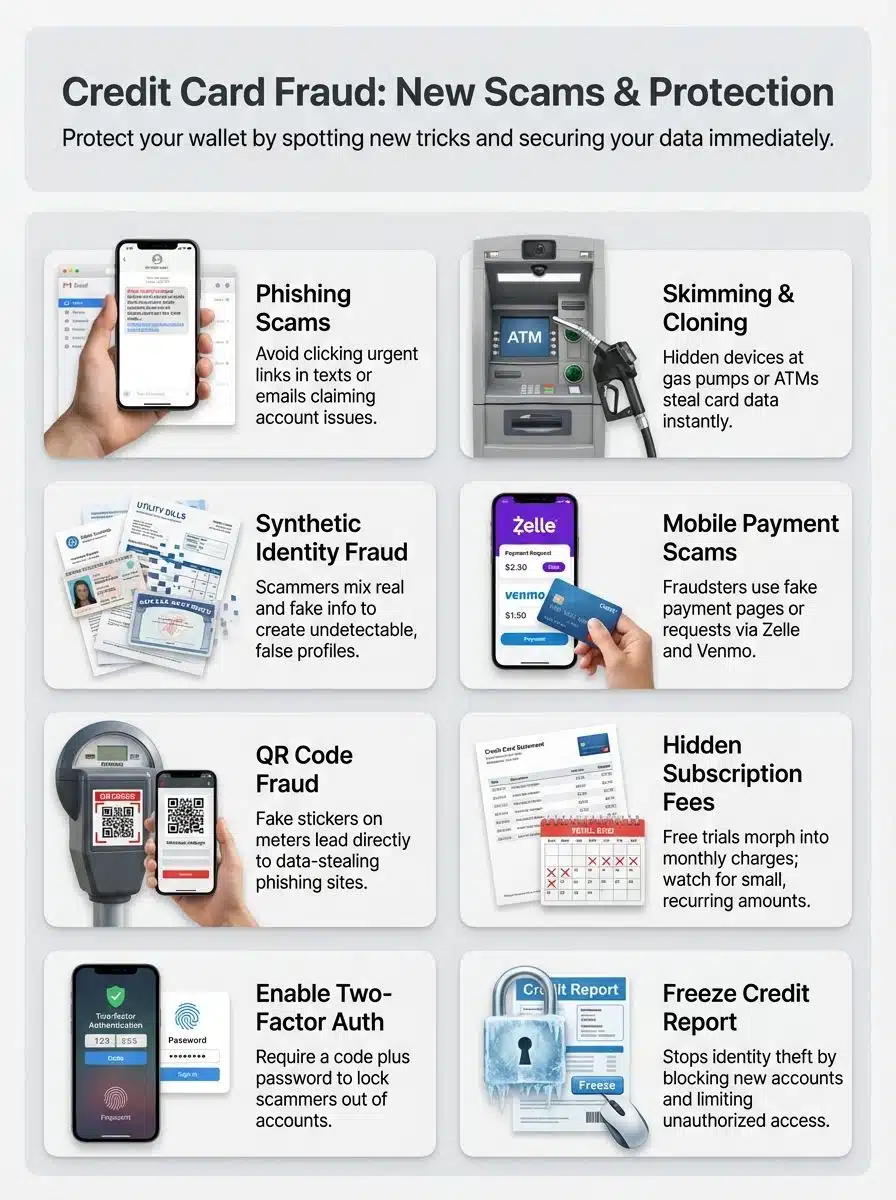

Common Types of Credit Card Fraud

Scammers seem to have a bag of tricks for stealing card information. Some tricks are old dogs with new collars, often catching folks off guard.

Phishing Scams

Phishing scams trick you into giving out your credit card or personal details. A fake email may ask you to “fix” a problem, or a text might warn that someone tried to use your account. These messages seem urgent and real.

Some look like they came from your bank, Amazon, or even Netflix, but they are not. Clicking the wrong link can lead thieves right to your information. In 2024, “imposter scams” were the most common fraud category reported to the FTC.

Some scammers even call pretending to be customer service. They might claim something is wrong with your account and need your password, PIN, or code. If you share it, they can drain your account in minutes.

Pro Tip: “If it sounds fishy on the phone or online, it probably is,” as my grandma loves to say! Always check before sharing any private details. One click shouldn’t empty your wallet!

Skimming and Cloning

A scammer with a small device can copy your card info in seconds. This trick is called skimming. They often place hidden gadgets at gas pumps, ATMs, or store checkouts.

If you swipe your card through one of these fake slots, the crook captures your data right away. But there is a newer, nastier version called a “Shimmer.” Unlike bulky skimmers that sit on top of the reader, shimmers are paper-thin devices inserted inside the chip reader slot. They are almost impossible to see.

Next comes cloning. The thief puts the stolen details on a blank card. Now, they shop using your money while you go about life none the wiser. Using “Tap to Pay” (NFC technology) is your best defense here because it uses encrypted data that shimmers cannot easily steal.

Account Takeover Fraud

Thieves slip into your life and pretend to be you. They use stolen passwords or personal info from data breaches, phishing, or malware. Soon, they control your credit card accounts.

These scammers often change account settings, addresses, or phone numbers so only they get alerts. One popular method is “SIM Swapping,” where they trick your mobile carrier into switching your phone number to their device, letting them intercept your security codes.

You might see surprise purchases or even lose access to statements because the crooks rerouted them. Hackers strike fast, so strong passwords plus two-factor authentication are your best locks against this intrusion.

Application Fraud

Fraudsters often trick banks by using fake names, stolen Social Security numbers, or made-up addresses. They fill out credit card applications with these lies. This scam is called application fraud.

Criminals may use real personal information mixed with some false details to get approved for a new card fast. They often buy these Social Security numbers on the dark web for as little as $1 to $5.

Children and seniors face a high risk because their credit files are not checked as much. With new cards in hand, scammers can quickly rack up charges and vanish before anyone notices anything wrong.

New Scams to Watch Out For This Year

This year, tricky crooks have cooked up new ways to snatch your money. You will want to stay sharp, so keep reading for the latest tricks.

Synthetic Identity Fraud

Scammers use fake identities by mixing real and made-up information. They might use a child’s Social Security number with a false name and date of birth to create a “Frankenstein identity.” Criminals open credit card accounts under these new, fake profiles.

Banks cannot spot the trick at first because the details look real on paper. After building up trust, scammers take out loans or max out credit cards and vanish without paying back anything. This is often called a “bust-out” scheme.

Children are easy targets since their credit history is blank. It is like planting a fake tree that grows unnoticed until it falls and causes damage to everyone nearby, including you, if your child’s data gets used!

Mobile Payment Scams

Mobile payment scams have become trickier in 2025. Fraudsters use fake texts, emails, or calls to trick people into sending money with apps like Zelle, Venmo, Cash App, and Apple Pay.

A common tactic is the “accidental transfer” scam. A stranger sends you money on Venmo, claims it was a mistake, and asks you to send it back. When you do, the original stolen credit card charge is reversed, and you are out the money you sent them.

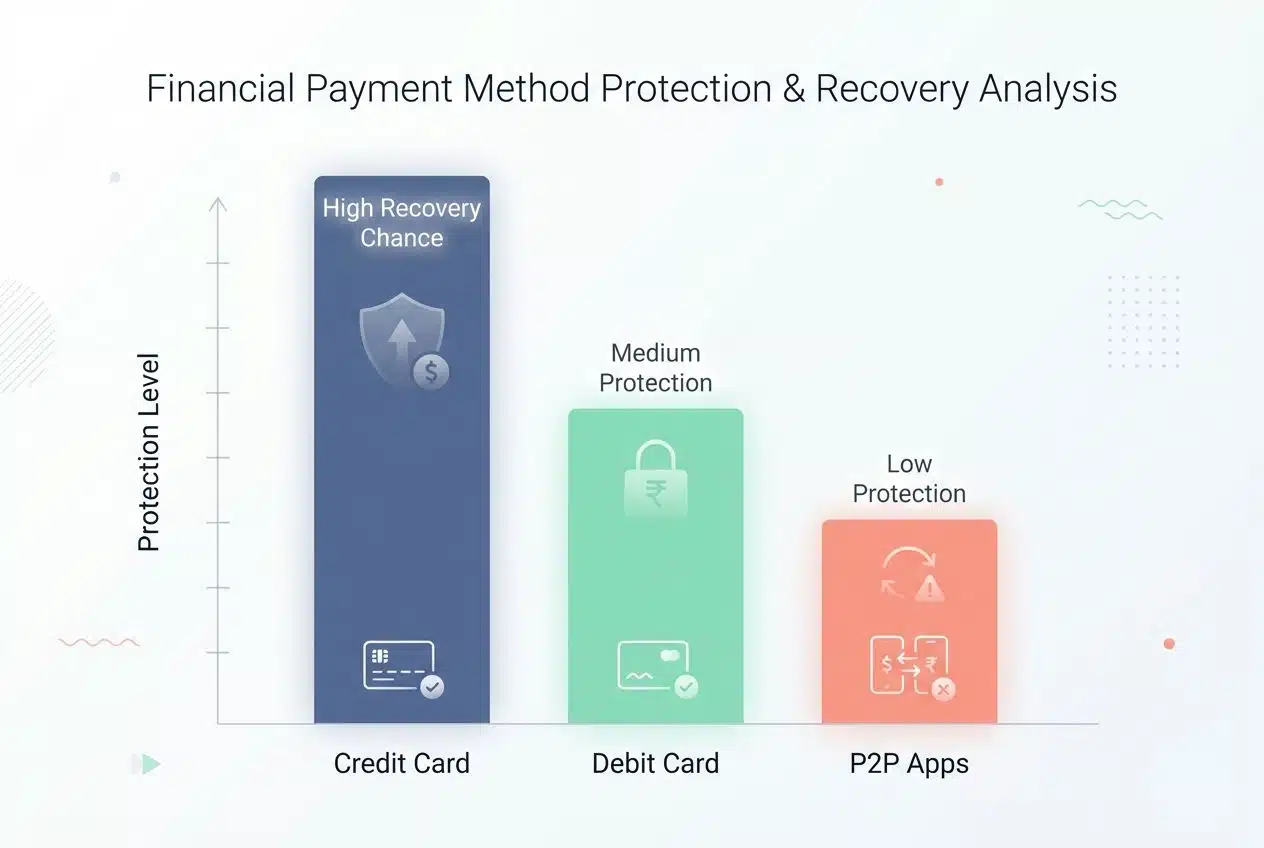

One wrong tap can lead to huge losses. Unlike credit cards, peer-to-peer (P2P) payments are often instant and irrevocable, meaning the bank usually cannot get your money back.

| Payment Method | Fraud Liability | Money Recovery |

|---|---|---|

| Credit Card | Limited to $50 by law (often $0) | High chance of refund |

| Debit Card | Varies by report time ($50-$500+) | Funds frozen during investigation |

| P2P Apps (Zelle/Venmo) | Often treated as “authorized” cash | Very difficult to recover |

QR Code Fraud

Scammers love QR codes. Experts call this “Quishing.” They stick fake QR stickers on parking meters, restaurant menus, and posters. You scan it because it looks safe and quick.

In 2024, reports of Quishing spiked significantly. These fake codes can send you to phishing sites that look exactly like a payment portal but exist only to steal your credit card or bank details.

Some sneaky crooks use malware through these codes too. Always check for stickers or anything odd around a QR code before scanning. If the sticker looks peeled or placed over another one, do not scan it.

Subscription and Unexpected Repeat Billing Scams

QR code scams keep people on their toes, but repeat billing scams can hit even closer to home. Some apps or websites trick users with free trials, then start charging each month without a clear warning.

These charges might show up in small amounts, easily overlooked by many. Fraudsters often hide these fees under names you do not recognize, hoping you are too busy to check.

In 2024, the FTC finalized new “Click to Cancel” rules to help fight this, but scammers ignore the rules. Staying alert by checking your statements helps spot these sneaky tactics before they empty your wallet further.

Credit Card Fraud Alert: Warning Signs

Strange things can pop up on your bank statement and leave you scratching your head. If something feels off with your cards, it might be the start of trouble.

Unfamiliar Transactions on Statements

Finding charges on your credit card statement that you do not recognize is a big red flag. Fraudsters love to sneak in small amounts at first, sometimes just $0.01 or $1.00.

They do this to “test” if the card is active before making bigger purchases later. Watch out for odd company names or places where you have never shopped. A sudden charge from an online game shop or a foreign store could mean trouble.

Spotting these signs early helps stop further financial fraud. If you see a $1 charge from a gas station you didn’t visit, lock your card immediately.

Unexpected Declines of Your Card

You pull out your card at the store, swipe it, and get a red-faced “declined.” Your heart sinks. Fraudsters might have triggered this by racking up charges or changing account settings behind your back.

Banks often flag odd activity for your financial safety. Scammers could use stolen data from phishing or skimming and spend big before you notice. Some criminals make small online test purchases using hacked accounts first; if these clear, they start making larger buys fast.

Regular alerts pop up for unusual activity to warn you early. Stay alert with every decline; quick action helps prevent bigger losses.

Notifications of Account Changes You Didn’t Make

After spotting unexpected declines on your card, check for alerts about changes to your account. Fraudsters often switch your contact email, phone number, or mailing address once they get in.

Banks might send you texts or emails confirming these updates. If you receive an email saying “Your password has been changed” and you didn’t do it, act instantly. That is a massive red flag for identity theft.

- Check your junk mail: Sometimes scammers flood your inbox with spam to hide the real security alert.

- Verify the sender: Make sure the alert is actually from your bank and not a phishing attempt.

- Login manually: Go directly to your bank’s app, do not click the link in the suspicious email.

How to Protect Yourself from Credit Card Fraud

Staying safe from credit card scams takes smart habits, sharp eyes, and a bit of street smarts. These tips could save you money and headaches.

Monitor Transactions Regularly

Check your credit card statement at least once a week. Scan for anything strange, like small charges you do not recognize or shops you did not visit. Fraudsters often test cards with tiny purchases before taking bigger steps.

Some banking apps send alerts for every transaction. Turn this feature on! It makes things easier and safer. A quick ping on your phone for a $500 charge you didn’t make lets you stop the fraud in seconds.

Enable Two-Factor Authentication

Enable two-factor authentication (2FA) for your credit card and online accounts. This simple step adds a strong wall between you and scammers. You will need to enter a code from your phone or email, not just your password.

Many big banks like Chase, Bank of America, and Wells Fargo offer this. However, SMS text codes can be intercepted. For the best security, use an authenticator app like Google Authenticator or a hardware key like a YubiKey.

Scammers may get your password through phishing or data breaches, but without that one-time code, they are locked out.

Avoid Sharing Credit Card Information Online

Strong security means more than two-factor authentication. It also means treating your credit card numbers like gold. Never post them in an email, text, or on a random website.

Fake websites and phishing emails are everywhere. Keep your personal information close to the vest; only enter card data on safe, secure sites with “https” in the address bar and a padlock icon.

Even one mistake can open the door to identity theft. Be especially careful with public Wi-Fi at coffee shops; use a VPN or your phone’s data plan when checking your bank balance.

Use Virtual Credit Card Numbers

Virtual credit card numbers keep your real account safer. These cards give you a one-time number for each online purchase. If scammers steal it, they cannot use your main card.

Services like Privacy.com or features like Capital One’s Eno allow you to generate these “burner” cards instantly. You can set them to close automatically after one use.

Some virtual cards let you set spending limits or lock them to a specific merchant. This feature stops repeat billing scams before they start draining your cash.

What to Do if You’re a Victim of Credit Card Fraud

Act fast to limit the damage. Getting help early can make all the difference, so take action as soon as you spot trouble.

Contact Your Card Issuer Immediately

Call your card issuer as soon as you notice fraud or strange charges. Most banks have 24-hour support, so grab the phone and tell them what happened right away. Use the number on the back of your card, not one you found in a suspicious email.

They will block or freeze your account to protect it. Bank staff may ask about recent purchases to check which charges are real and which are part of the scam.

Under federal law (the Fair Credit Billing Act), your liability for unauthorized credit card charges is capped at $50, and most issuers have a Zero Liability policy, meaning you pay nothing.

File a Fraud Report with the Authorities

Act fast and report credit card fraud to your local police or the Federal Trade Commission. The FTC has a dedicated website for this: IdentityTheft.gov.

This site is incredibly helpful because it helps you create a personal recovery plan and pre-fills letters you can send to creditors. Reporting helps protect others from falling into similar traps.

Important: “Sharing these facts makes it easier for law enforcement to track the crime. The authorities use this information to spot new scams like QR code fraud or sudden repeat billing tricks that have spiked recently.”

Freeze Your Credit Report

Freezing your credit report blocks anyone from opening new accounts in your name. This stops identity theft and keeps scammers from using stolen information to wreak havoc on your finances.

It is free and does not hurt your credit score. You must contact each of the three major credit bureaus individually:

- Equifax

- Experian

- TransUnion

Many victims of financial fraud take this step right after talking with their bank. No one gets access to your personal details for loans or new credit cards while the freeze is active, even if they have every bit of your stolen data.

Wrapping Up

Staying safe from credit card fraud is more important than ever, especially with new scams popping up left and right. Checking your statements often, using simple tools like two-factor authentication, and never sharing your card info online help keep trouble away.

These steps take just a few minutes but can save you hours of hassle. Catching odd charges quickly or spotting fishy messages stops scammers in their tracks before they do real harm.

For those who want to dig deeper, many banks offer free alert services online. Protecting your wallet is easier than you think; smart habits are all it takes!