Fraudsters move fast, but you can move faster. Imagine getting a text the second someone tries to open credit in your name. That’s what instant credit alert apps to stop fraud before it happens do—they give you the upper hand.

Here’s a fact: Placing a fraud alert with just one credit bureau (Equifax, Experian, or TransUnion) protects you across all three. This post covers five apps that monitor your account 24/7 and send real-time alerts for any suspicious activity.

No more sleepless nights over stolen identities. Keep reading to lock down your money before thieves strike.

Overview of Aura Credit Monitoring

Aura Credit Monitoring keeps your finances safe with real-time alerts for suspicious activity. The app scans your credit reports, bank accounts, and even the dark web to catch fraud early.

Features of the Aura App

Staying ahead of fraud starts with the right tools. The Aura app offers powerful features to keep your finances safe.

- Real-time fraud alerts – Aura sends instant notifications if suspicious activity is detected on your credit report, bank accounts, or personal info.

- Credit monitoring – It tracks changes across all three bureaus (Equifax, Experian, TransUnion) with a single fraud alert placement.

- Identity theft protection – The app scans the dark web for stolen data, like Social Security numbers or credit card details.

- Bank account monitoring – Get alerts for unauthorized transactions, helping stop scams like Zelle fraud or APP fraud early.

- Security tools – Set up custom credit card alerts and use multi-factor authentication for extra safety.

- Transaction monitoring – Advanced detection spots unusual spending patterns linked to cybercrime before damage is done.

- Credit lock feature – Freeze your credit file instantly to block new accounts opened in your name.

- Personalized security tips – Learn how to avoid phishing texts, third-person fraud, and other scams.

- 24/7 customer support – Get help fast if you suspect fraud or need to dispute charges.

- Family protection plans – Extend coverage to loved ones, guarding against identity theft risks for everyone.

Getting Real-time Fraud Alerts with Aura

Aura keeps your credit safe with instant fraud alerts. The app watches your accounts 24/7, so you know right away if something’s wrong. If a lender or creditor checks your report, Aura sends an alert fast.

This helps stop identity theft before it starts.

You only need to set up fraud alerts with one bureau—Equifax, Experian, or TransUnion—and Aura does the rest. Suspicious texts about payments? Is there any unusual activity in your account? The app catches it all.

Pair it with KCU account code words and mobile banking checks for extra security. Fraudsters hate quick detection, and Aura makes sure they don’t get far.

Understanding Experian CreditLock

Experian CreditLock lets you freeze your credit with a tap, blocking fraudsters in seconds. It also sends instant alerts if someone tries to open an account in your name.

Operations of Experian CreditLock

Experian® lets you lock your credit file fast through their CreditLock feature. This stops anyone from opening new accounts under your name without permission. Just tap once on their app, then lenders must verify who you are before approving loans or cards.

You only need one call—to Equifax, Experian, or TransUnion—to set up free initial fraud alerts. But CreditLock goes further, giving real-time control over access.

If something fishy pops up, like unauthorized loan attempts, you’ll know immediately. Pair this tool with bank transaction alerts, extra PINs, plus checking statements weekly. That combo keeps scammers out like bouncers at midnight.

Advantages of Experian CreditLock

Protecting your credit from fraud is easier with Experian CreditLock. This tool helps keep your data safe with real-time alerts.

- Locks your credit file fast – With one click, you can freeze your Experian® report, stopping fraudsters from opening new accounts in your name.

- Instant fraud alerts – Get notified right away if someone tries to use your credit info without permission.

- Easy to use – No need to call or mail forms. You can lock and unlock your credit anytime through the app.

- Extra security for lenders – Businesses must verify your identity before approving credit, making scams harder to pull off.

- Works with fraud alerts – Even if you place a fraud alert with Equifax® or TransUnion®, CreditLock adds another layer of protection.

- Stops third-person fraud – Prevents criminals from using stolen details to apply for loans or credit cards.

- Monitors suspicious activity – Keeps an eye on changes in your credit report, like new accounts or inquiries.

- No extra cost for some plans – Certain Experian services include CreditLock at no additional charge.

- Mobile-friendly security – Manage everything from your phone, so you’re always in control.

- Reduces APP fraud risk – Helps block scams where thieves trick you into sending them money.

Insights into LifeLock by Norton

LifeLock by Norton keeps your identity safe with strong credit monitoring. Get instant alerts if someone tries to mess with your accounts.

Identity Theft Protection with LifeLock

LifeLock helps protect you from identity theft by keeping watch over your personal info around-the-clock. If someone tries using your details without permission, you’ll get real-time alerts so you can act fast.

The service monitors credit reports, bank accounts, even shady transactions linked to your name. With features like transaction tracking and instant notifications, spotting potential scams becomes easier before damage happens.

Just set up custom codes or secure logins through their app—it adds layers against sneaky moves like third-party application tricks where crooks steal identities quietly.

Monitoring Credit and Receiving Fraud Alerts

Keeping an eye on your credit is like having a watchdog for your finances. Apps like LifeLock by Norton track changes in your credit report and send instant fraud alerts if something fishy pops up.

If a scammer tries to open a line of credit in your name, you’ll know right away.

Set up account alerts for unusual activity, like unexpected payments or Zelle transfers. Contact just one credit bureau—Equifax, Experian, or TransUnion—to place a fraud alert.

Lenders will then double-check identities before approving new accounts. Monitoring tools help stop cybercriminals from turning stolen info into financial chaos.

Exploring CreditWise by Capital One

CreditWise by Capital One gives you free tools to watch your credit like a hawk. Get instant alerts if something fishy pops up, so you can act fast before trouble starts.

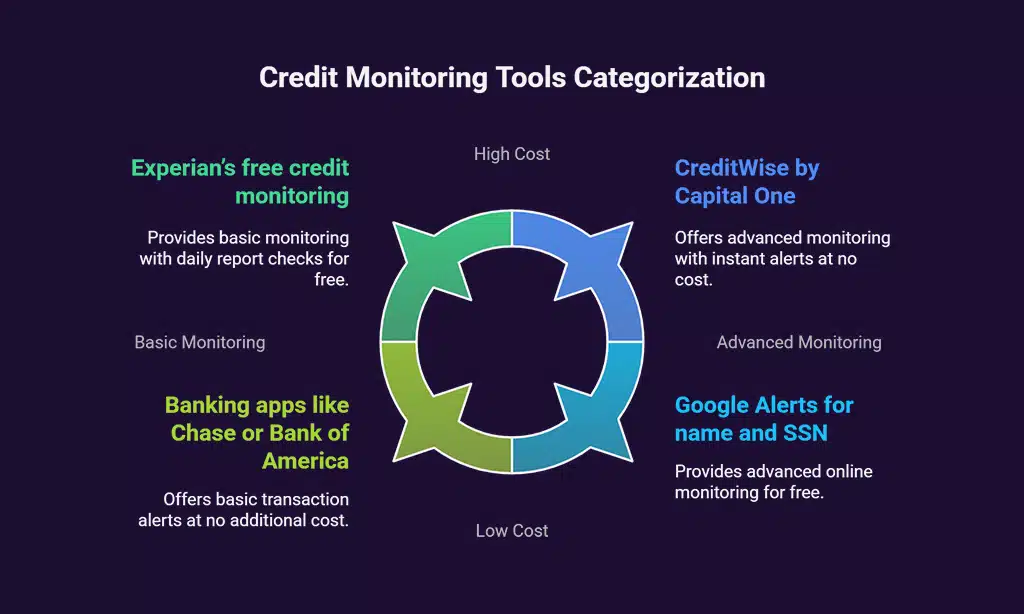

Tools for Free Credit Monitoring

Keeping an eye on your credit doesn’t have to cost a dime. Free tools help you spot fraud fast, so you can act before it’s too late.

- CreditWise by Capital One gives free access to your credit score and report. It sends instant alerts for suspicious activity, like new accounts opened in your name.

- Experian’s free credit monitoring checks your report daily for changes. You’ll get alerts if someone tries to use your info for loans or credit cards.

- Credit Karma tracks your TransUnion and Equifax reports for free. It flags unusual changes, such as hard inquiries or new accounts you didn’t authorize.

- NerdWallet’s free credit monitoring keeps tabs on your VantageScore. It notifies you of sudden drops in your score, which could mean fraud.

- Banking apps like Chase or Bank of America offer free transaction alerts. Turn on notifications for large purchases or withdrawals to catch fraud early.

- Zelle and payment app alerts warn you about suspicious transfers. Scammers often use these platforms, so real-time alerts are key.

- Setting up a fraud alert with Equifax, Experian, or TransUnion is free. Lenders must verify your identity before approving new credit, stopping scammers cold.

- FICO’s free score monitoring watches for sudden changes in your credit. A big drop could mean someone’s misusing your personal data.

- Google Alerts for your name and SSN can catch shady activity online. If your details pop up where they shouldn’t, you’ll know fast.

- Social Security Administration’s mySocialSecurity account tracks earnings linked to your SSN. Unfamiliar income reports? That’s a red flag for identity theft.

Receive Instant Alerts for Suspicious Activities

Spotting fraud early can save you time, money, and stress. Apps like CreditWise by Capital One send instant alerts if they detect unusual activity on your credit report or accounts.

You’ll get a heads-up if someone tries to open a new line of credit in your name or makes unexpected charges.

Setting up account alerts for your credit cards adds another layer of security. If a payment goes through using Zelle or another service, you’ll know right away. Fraudsters often move fast, but real-time notifications help you act faster—locking down accounts before damage is done.

Stay ahead by monitoring transactions daily through mobile banking tools that flag anything fishy the moment it happens.

Features of the myFICO Mobile App

The myFICO mobile app keeps your credit report under tight watch like a hawk eyeing its prey—spotting trouble before you do! Get instant pings if shady moves pop up on your accounts so you can shut things down fast!

Monitoring Your Credit Report

Keeping an eye on your credit report helps catch fraud early. Apps like myFICO track changes in real time, sending alerts for suspicious activity. If someone tries to open a line of credit in your name, you’ll know fast.

Fraudsters often use stolen info to apply for loans or cards without permission. Setting up transaction monitoring stops them cold. Contact Equifax, Experian, or TransUnion once to activate a fraud alert—it makes lenders verify your identity before approving anything sketchy.

Stay sharp with instant notifications and check accounts regularly through mobile banking.

Notifications for Detected Fraud

The myFICO mobile app sends instant alerts when it spots potential fraud. If someone tries to open a new account with your info, you’ll know right away. These real-time warnings help stop identity theft before it causes damage.

You can also set up custom alerts for credit score changes or unusual activity. The app even flags suspicious transactions, like unauthorized Zelle payments. Pair this with setting a code word for extra security, and scammers won’t stand a chance.

Stay one step ahead by checking alerts as soon as they pop up—your finances will thank you later!

Takeaways

Fraud doesn’t wait—so neither should you! These five instant credit alert apps help catch trouble before it starts; real-time warnings keep you safe from sneaky scams like identity theft & unauthorized charges! With options like Aura & LifeLock tracking every move & Capital One’s free tool spotting red flags fast—you won’t miss risky business again!

Simple setup takes minutes but saves headaches later; staying ahead means less stress over stolen cash! Want peace-of-mind? Grab one today & sleep easy knowing croats hit roadblocks first!