You know the feeling: you find a decent flight price, but by the time you add a checked bag and select a seat, the total has jumped by $80 or more. With airlines like American, United, and Delta now charging up to $40 for a first checked bag, those “optional” fees have become a significant line item in travel budgets. That’s where co-branded airline credit cards often enter the conversation—not just as payment tools, but as defensive strategies against rising costs.

From what I’ve seen in the 2026 landscape, the value proposition has shifted. It’s no longer just about earning miles for a free trip someday; it’s about immediate protection from fees today. However, with annual fees on popular cards like the United Explorer and Delta SkyMiles Gold Amex climbing to $150 after the first year, the math isn’t as automatic as it used to be.

So, let’s break down exactly how these cards work, run the real-world numbers on whether they’re worth the higher price tags, and look at a few specific strategies to squeeze the most value out of them. Co-Branded Airline Credit Cards are complex, but understanding them is the key to smarter travel.

What are Co-Branded Airline Credit Cards?

Co-branded airline credit cards are specialized financial products launched through a partnership between a major airline and a bank. Unlike a standard bank card that earns generic cash back, these cards are built to reward loyalty to a specific carrier.

The most common partnerships you’ll see in the U.S. include Delta Air Lines with American Express, United Airlines with Chase, and American Airlines with Citi or Barclays. The dynamic is simple: the bank manages the financial transaction, and the airline provides the rewards currency (miles) and the travel perks.

Why do these exist? For the airlines, it’s a massive revenue stream. For you, the traveler, they function as a “status shortcut.” Instead of flying 50,000 miles a year to earn perks like free bags or priority boarding, you can simply hold the card to unlock similar benefits. It’s a paid fast-track to a better airport experience.

How Do Co-Branded Airline Credit Cards Work?

At their core, these cards function like any other Visa, Mastercard, or American Express, but with a specific reward structure. Every time you swipe, you earn miles deposited directly into your frequent flyer account. Most entry-level cards earn 1 mile per dollar on everyday purchases, while mid-tier cards often boost this to 2x or 3x miles on purchases made directly with the airline.

But the real engine here isn’t the spending; it’s the linked benefits. When your credit card is linked to your frequent flyer number, the airline’s system automatically recognizes your status.

“Pro-Tip: You usually don’t need to pay with the card to get the perks. For example, if you hold the United Explorer Card, you get a free checked bag just for being a cardholder, provided your MileagePlus number is on the reservation—though you must pay with the card in United’s specific case. Always check the fine print, as Delta and American typically just require the card to be linked to your profile.”

These cards also open up “award availability.” For instance, United cardholders often see more open seats available for booking with miles (booking class XN) than non-cardholders. This subtle feature can be the difference between finding a flight for 15,000 miles versus 30,000.

Benefits of Co-Branded Airline Credit Cards

The perks listed below are the primary reasons travelers keep these cards in their wallets. Let’s look at the hard data on why they matter.

Free Checked Bags

This is the single biggest money-saver. In 2026, the standard fee for a first checked bag on major domestic carriers like United, Delta, and American is roughly $35 to $40 each way. If you fly round-trip with a partner and you both check a bag, that’s $160 in fees for one vacation.

Most mid-tier airline cards (with annual fees around $95-$150) waive the fee for the first bag for you and usually up to eight companions on the same reservation. If you take even two round-trip flights a year with luggage, the card effectively pays for itself. For families of four, a single trip can save $320 in baggage fees, making the annual fee irrelevant by comparison.

Priority Boarding

Priority boarding isn’t just about feeling important; it’s about overhead bin space. With flights operating at record-high capacity, bin space runs out quickly. Being in “Group 5” (standard economy) often means checking your carry-on at the gate.

Co-branded cards typically bump you into “Group 2” (United) or “Main Cabin 1” (Delta). This ensures you board early enough to find space for your bag near your seat. For frequent travelers, avoiding the wait at baggage claim is worth the price of admission alone.

Lounge Access and Travel Perks

While entry-level cards generally don’t offer lounge access, premium cards (with annual fees of $550-$695) like the Delta SkyMiles Reserve or United Club Infinite include membership to their respective lounge networks.

However, a sweet spot exists in the mid-tier market. The United Explorer Card provides two one-time passes to the United Club every year. With day passes costing $59 each, those two passes alone represent nearly $120 in value.

Additionally, some cards offer unique discounts. For example, Delta cardholders get the “TakeOff 15” benefit, which gives a 15% discount on the number of miles required for an award flight. If a flight costs 20,000 miles, a cardholder pays only 17,000.

Companion Certificates

Companion certificates are high-value perks often found on premium or specific mid-tier cards. The most famous example is the Alaska Airlines Famous Companion Fare, which lets you book a companion ticket for just $99 plus taxes and fees (usually totaling around $122) once a year.

Delta’s Platinum and Reserve cards also offer companion certificates for domestic travel upon renewal. The math here is compelling: if you use a certificate for a $600 cross-country flight, you’ve instantly recouped the card’s annual fee. The catch? You have to actually use it. If you travel solo or can’t find availability, this benefit has zero value.

Enhanced Earning Potential for Airline Purchases

If you spend heavily on flights, these cards accelerate your earnings. A standard traveler might earn 5 miles per dollar spent on the ticket fare. A cardholder paying with their co-branded card might earn an additional 2 to 3 miles per dollar.

While this sounds good, it’s important to compare it to general travel cards. A general card might earn 3 points per dollar on all travel, not just one airline. The airline card wins only if you are fiercely loyal to one brand.

Drawbacks of Co-Branded Airline Credit Cards

Before you apply, you need to be aware of the specific downsides that banks don’t highlight in their brochures.

Annual Fees Are Rising

The era of the $95 standard annual fee is fading. In recent updates, we’ve seen cards like the United Explorer and Delta Gold Amex move toward a $150 annual fee (often waived the first year). While they have added credits (like Uber or Rideshare credits) to justify the hike, these “coupon book” perks require you to remember to use them monthly or quarterly.

Limited Flexibility Across Airlines

This is the “golden handcuffs” problem. If you earn 100,000 Delta SkyMiles, you can only use them on Delta and its partners. If United has a cheaper flight or a better schedule, your points are useless there. General travel cards protect you from this by allowing you to transfer points to multiple different airlines.

Potential for Overspending

Many airline cards entice you with “status boosts” if you hit high spending thresholds—like spending $25,000 a year to waive a status revenue requirement. This gamification can lead to overspending on a card that earns poor rewards on everyday categories like groceries or gas, just to chase a status tier that might not be worth the cost.

Airline Cards vs. General Travel Cards

Should you commit to one airline or stay flexible? Here is a direct comparison to help you decide.

| Feature | Co-Branded Airline Card (e.g., United, Delta) | General Travel Card (e.g., Chase Sapphire, Amex Gold) |

|---|---|---|

| Reward Currency | Airline Miles (Locked to one carrier) | Bank Points (Transferable to 10+ airlines) |

| Key Perks | Free bags, Priority Boarding, Lounge Passes | Travel Insurance, Dining Credits, Flexible Redemption |

| Best For | Travelers who fly 2+ times/year on ONE airline and check bags. | Travelers who want the cheapest flight or best route regardless of airline. |

| Baggage Benefit | Yes (usually free first bag) | No (rarely covers baggage fees directly) |

When Each Option Makes Sense

Choose the Airline Card If: You live near a hub (like Atlanta for Delta or Houston for United) and fly that airline exclusively. The baggage savings and boarding priority provide immediate, tangible operational benefits that general cards cannot match.

Choose the General Card If: You are a “free agent” who shops for the cheapest ticket on Kayak or Google Flights. Earning flexible points protects you from airline devaluations. If Delta raises award prices tomorrow, you can simply transfer your points to Air Canada or British Airways instead.

Tips for Maximizing an Airline Credit Card

If you decide to get an airline card, don’t just use it for flights. Use these strategies to get more out of the account.

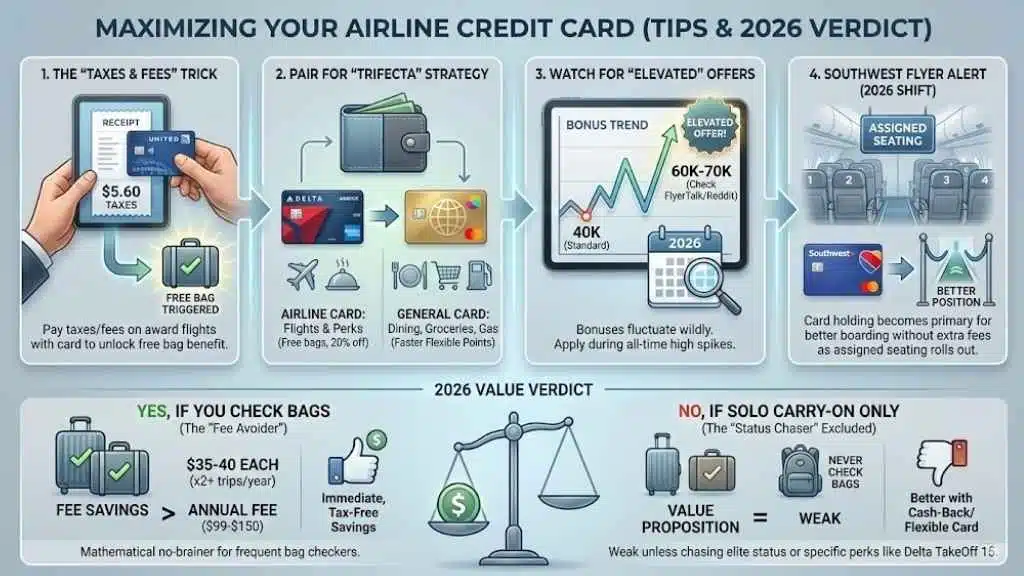

- The “Taxes and Fees” Trick: Even if you are booking a flight with miles, pay the small tax ($5.60 on domestic flights) with your co-branded card. On cards like the United Explorer, this is often required to trigger the free checked bag benefit for that itinerary.

- Pair It With a General Card: This is the “Trifecta” strategy. Use your airline card only for perks (free bags, 20% in-flight discounts on food) and for buying flights on that specific airline. Use a general rewards card for dining, groceries, and gas to earn flexible points that accumulate faster.

- Watch for “Elevated” Offers: Banks fluctuate their sign-up bonuses wildly. A standard offer might be 40,000 miles, but twice a year it might jump to 60,000 or 70,000. Check sites like FlyerTalk or Reddit’s r/churning to see if the current offer is at an all-time high before applying.

- Southwest Flyer Alert: With Southwest Airlines shifting to assigned seating in 2026, holding their co-branded card is expected to become a primary way to secure better boarding positions without paying extra for every single flight. Keep an eye on your card terms as this new policy rolls out.

Are Co-Branded Airline Cards Still Good Value in 2026?

In 2026, the verdict is yes—but with a condition. The value has shifted from “earning free flights” to “avoiding expensive fees.”

With baggage fees practically standardized at $35-$40, holding a card with a $99-$150 annual fee is a mathematical no-brainer for anyone who checks a bag on two or more round trips per year. The savings are tax-free and immediate.

However, for the solo traveler who never checks a bag and always carries on? The value proposition is weak. Unless you are chasing elite status or highly value a specific perk like the Delta “TakeOff 15” discount, you are likely better off with a cash-back card or a flexible travel rewards card that offers better protection and versatility.

Final Thoughts

Co-branded airline credit cards act as a shield against the modern fees of air travel. They offer a reliable way to secure free checked bags, board early to snag overhead bin space, and occasionally enjoy lounge access, all for an annual fee that is often cheaper than the cost of baggage for a single family vacation.

The smart move is to assess your loyalty. If you are married to one airline because of where you live, get the card. If you value flexibility above all else, stick to general travel rewards. By aligning the card with your actual travel habits, you turn that annual fee from a cost into an investment.

Before you apply, take five minutes to check the current baggage fees of your preferred airline and the “elevated” bonus offers available this month. A little timing can lead to hundreds of dollars in free travel right from the start.