The January 2026 decision to extend visa-free access to six additional European nations is a geopolitical calculation masquerading as tourism policy. By unilaterally dismantling the “Great Wall” of bureaucracy for a new bloc of Western economies, Beijing is betting that frictionless access can neutralize political de-risking, turning European travelers and business leaders into de facto ambassadors of engagement.

The “Unilateral” Pivot: Contextualizing the Shift

To understand the significance of the 2026 expansion, one must look at the trajectory of the last 36 months. Until late 2023, China’s visa policy was transactional and strictly reciprocal—a mirror of the diplomatic “you-give-I-give” standard. The breakdown of this model began with the “pilot” waiver for five major EU economies in December 2023.

By early 2025, what began as a temporary trial had calcified into a core pillar of China’s foreign policy. The “unilateral” approach—granting access without demanding immediate reciprocity from Europe—signals a profound shift in Beijing’s confidence. It acknowledges a post-pandemic reality where China needs to aggressively court global capital and footfall. The addition of this new six-nation cohort in 2026 (bringing the total European visa-free bloc to nearly 30 nations) marks the transition from “emergency recovery measure” to “permanent strategic openness.”

The “Inbound Deficit” & Economic Gravity

The most immediate driver is the persistent “service trade deficit.” While China’s domestic tourism economy hit record highs of 5.6 billion trips in 2024, the return of international capital and visitors has been slower.

Data from the Ministry of Culture and Tourism (2025 reports) highlights the gap. While inbound numbers surged to 132 million in 2025 (a 60% jump year-on-year), the composition of these travelers changed. The recovery was driven largely by visitors from Southeast Asia and visa-free nations like Malaysia and Singapore. The “high-yield” travelers—business executives and luxury tourists from Western Europe—lagged behind.

Key Statistics: The 2025 Recovery Baseline

- Total Inbound Visits (2025): ~132 Million (approx. 90% of 2019 levels).

- Visa-Free Entries: 20.1 Million (+112% increase YoY).

- Economic Contribution: $94.2 Billion in direct foreign expenditure.

- The Gap: Western European business travel remained at ~70% of pre-pandemic levels before this newest expansion.

This 2026 expansion is a precision instrument designed to close that specific gap. By targeting these six remaining European markets, Beijing is removing the friction costs (time, visa fees, consulate visits) that deter casual business trips and spontaneous tourism.

Countering “De-Risking” with “Re-Connecting”

The timing of this policy is inextricable from the broader EU-China trade narrative. As Brussels continues to debate “de-risking” and imposes tariffs on Chinese EVs, Beijing is using visa policy as an asymmetric counter-measure.

By offering visa-free travel, China is effectively bypassing European governments to appeal directly to the European private sector. A simplified entry process reduces the “transaction cost” of doing business in China. It allows a mid-sized European manufacturer to send engineers to Shenzhen for a 48-hour troubleshooting mission without a month of paperwork. This “operational intimacy” makes supply chains stickier and decoupling harder.

Expert Perspective: “The visa waiver is a non-tariff incentive. Beijing understands that if European SMEs can easily visit their suppliers, they are less likely to move operations to Vietnam or Mexico. It’s a strategy to keep the supply chain anchored in the Yangtze River Delta through sheer convenience.” — Dr. Elena Russo, Senior Analyst at the Global Trade Institute.

The “China Travel” Soft Power Offensive

A surprising beneficiary of the 2024-2025 visa trials was China’s soft power, driven not by state media, but by the viral “China Travel” trend on TikTok and Instagram. Unfiltered vlogs by Western tourists documenting safety, high-speed rail, and futuristic skylines garnered billions of views, challenging prevailing Western media narratives of a closed, hostile nation.

The 2026 expansion is a double-down on this “seeing is believing” strategy. Beijing is effectively crowdsourcing its public relations. By letting citizens of these six new nations enter freely, they are recruiting a new wave of digital witnesses to validate China’s modernization. This is “people-to-people” diplomacy weaponized for the algorithm age.

Comparative Data: The Evolution of Access (2023–2026)

The table below outlines the rapid escalation of China’s openness strategy.

| Phase | Timeline | Policy Action | Strategic Intent |

| The Pilot | Dec 2023 | 15-Day Visa-Free (France, Germany, Italy, etc.) | Test diplomatic goodwill; jumpstart tourism. |

| The Expansion | 2024-2025 | Added Nordic & Central EU nations; Transit extended. | Broaden the net; signal “Open for Business” during economic slowdown. |

| The Deepening | Jan 2026 | New 6-Nation Access + 30-Day Standard | normalization of travel; targeting holdout economies. |

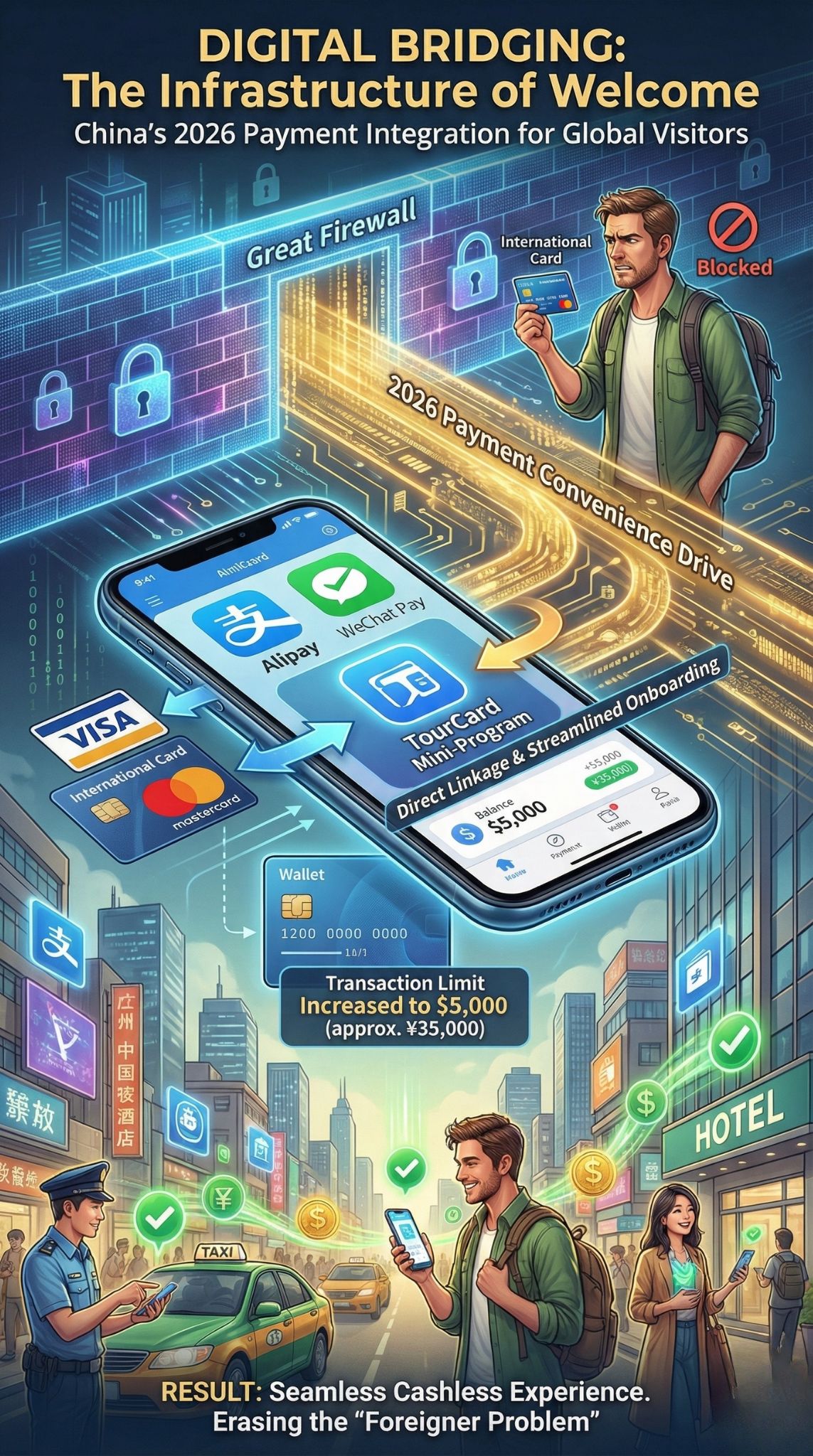

The Infrastructure of Welcome (Alipay & The “Great Firewall”)

Visa-free entry is useless if the visitor cannot pay for a taxi. Recognizing this, the 2026 policy rollout is paired with a massive “Payment Convenience” drive.

Throughout 2025, the People’s Bank of China mandated that all 3-star+ hotels and major taxi services accept international credit cards. Furthermore, the integration of foreign cards into Alipay and WeChat Pay has been streamlined. The “TourCard” mini-programs now allow for higher transaction limits ($5,000 per transaction).

This “infrastructure layer” is crucial. In 2026, the “Foreigner Problem”—where visitors felt digitally stranded in China’s cashless ecosystem—is being systematically erased. This signals that the government is prioritizing foreign currency inflow over strict financial data sealing.

The Reciprocity Standoff

Notably, this remains a one-way street. The EU has not granted visa-free access to Chinese citizens, citing migration security.

Why does China persist without reciprocity?

- Confidence: It signals that China is secure enough to open its borders unilaterally.

- Leverage: It creates a powerful lobby within Europe. As European businesses enjoy seamless access, they become vocal advocates for reciprocal easing to ensure their Chinese partners can visit Europe just as easily.

- Economic Reality: China needs the capital inflow more than it needs the symbolic victory of immediate reciprocity.

Future Outlook: The Road to 2027

As we look beyond this announcement, three trends will define the next 12 months:

- The “North American” Question: With Europe largely covered, will China extend this olive branch to the US, Canada, or Japan? Current tensions suggest this is unlikely in early 2026, but a limited “Business Track” visa waiver could be the “October Surprise” of late 2026.

- The 30-Day Standard: The shift from 15 days to 30 days for these new entrants suggests 30 days will become the universal baseline for all visa-free nations, enabling “digital nomad” style stays rather than just short trips.

- FDI Correlation: Analysts will watch the Q3 2026 FDI (Foreign Direct Investment) numbers closely. If the visa expansion succeeds, we should see a stabilization in the “utilized foreign capital” metric, which hovered around $116B in 2025.

Conclusion

China’s 2026 visa expansion is not merely an administrative update; it is a strategic counter-offensive against isolation. By lowering the drawbridge, Beijing is challenging the world to engage with it on its own terms, betting that the sheer gravity of its market and the convenience of access will outweigh geopolitical hesitation.