You have the capital. You have a legitimate business model. You have the technical skills to scale a global enterprise. Yet, when you try to open a simple Stripe account to process payments or an Interactive Brokers account to invest your wealth, you hit a brick wall. Your application is rejected instantly, or worse, your account is frozen weeks later without explanation. You are not a criminal; you are simply a victim of your passport. In the eyes of modern financial compliance algorithms, you are “Unbankable.”

This is the reality for millions of high-net-worth individuals from nations labeled as “high-risk” by global financial watchdogs. But there is a legal, established backdoor. By leveraging Caribbean citizenship banking solutions, entrepreneurs are rewriting their risk profiles, bypassing automated filters, and unlocking the global financial system. This guide is not just about travel freedom; it is a financial survival manual for 2026, detailing exactly how to use a second passport to secure the banking access you deserve.

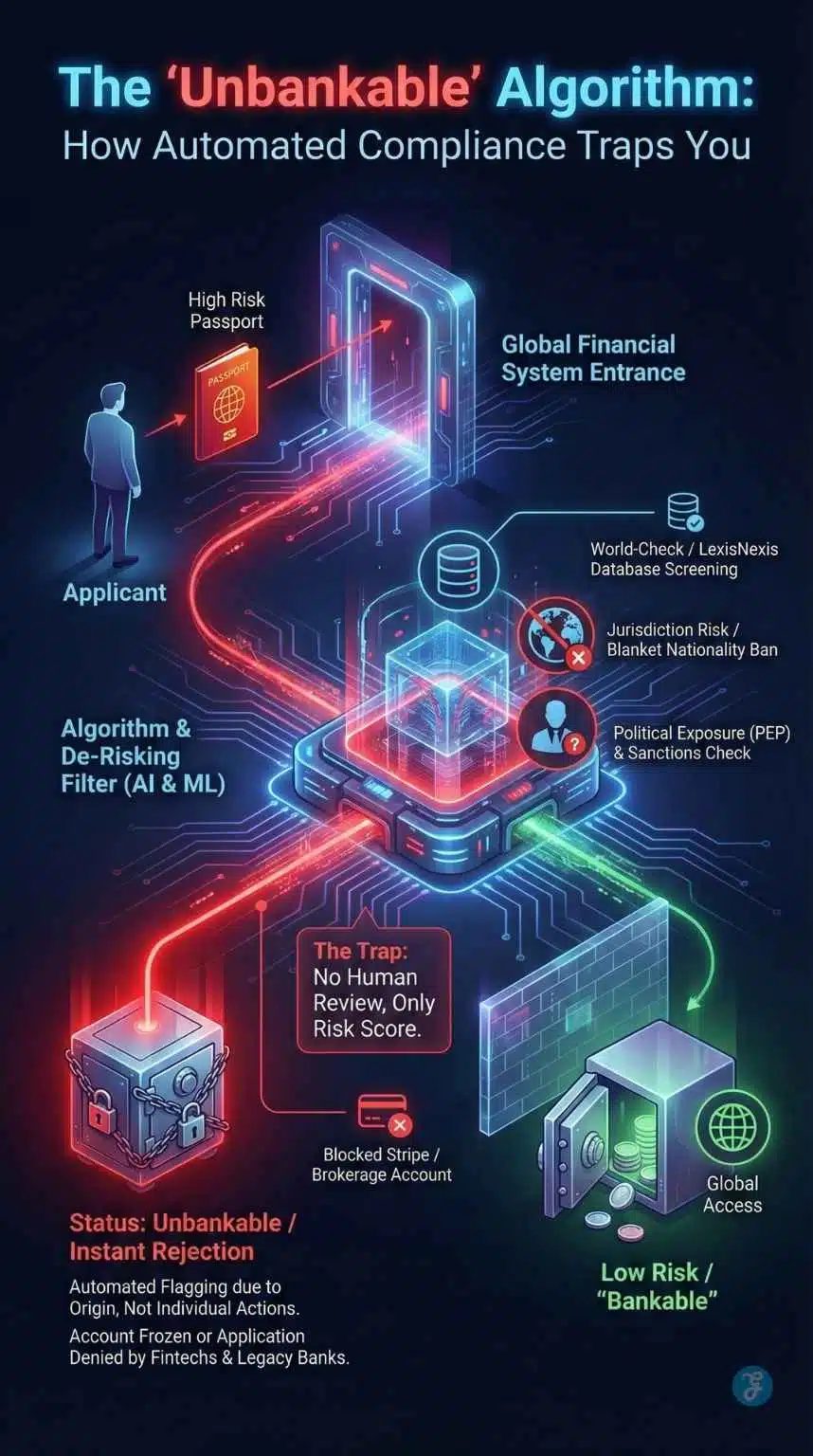

Why You Are “Unbankable”: The Algorithm Problem

To solve the problem, you must first understand the machine you are fighting against. In 2026, banking is no longer human. When you apply for a fintech account like Stripe, Wise, or Revolut, or a brokerage account like Schwab, a human being rarely reviews your initial application. Instead, it is processed by sophisticated Artificial Intelligence (AI) and compliance software tailored to minimize risk.

The “De-Risking” Phenomenon

For the last decade, Western financial institutions have engaged in a massive trend called “de-risking.” The cost of compliance fines for money laundering (AML) or sanction violations has become so high that banks have decided it is cheaper to simply ban entire nationalities rather than vet individuals.

If your passport is from a country on the FATF (Financial Action Task Force) Grey List or a nation with comprehensive sanctions, the bank’s algorithm flags you immediately. It does not matter if you are a tech CEO in Lagos, a doctor in Tehran, or a software exporter in Karachi. To the algorithm, your passport creates a compliance headache that outweighs your potential profit as a customer.

The “High-Risk” Indicators

Financial institutions use databases like World-Check or LexisNexis to screen applicants. These databases categorize risk based on several factors:

- Jurisdiction Risk: The country issuing your ID.

- Political Exposure: Whether you are connected to government officials (PEP status).

- Sanctions Lists: Direct or indirect links to sanctioned entities.

The tragedy of the “Unbankable” status is that it is often a blanket ban. You are rejected not because of who you are, but because of where your documents were printed. This is where the strategic acquisition of a Caribbean passport changes the game.

The Caribbean Solution: How It Fixes the Problem

The Caribbean region—specifically the five nations offering Citizenship by Investment (CBI): St. Kitts & Nevis, Grenada, Antigua & Barbuda, St. Lucia, and Dominica, has positioned itself as a neutral, “safe” harbor for global citizens.

Moving from “Red Flag” to “Green Flag”

When you acquire citizenship from a country like St. Kitts & Nevis or Grenada, you obtain a new government-issued identity document. When you present this document to a bank’s KYC (Know Your Customer) portal, the algorithm sees a citizen of a British Commonwealth nation with a stable democracy and no global sanctions.

- Before: You upload a passport from a high-risk jurisdiction.

Result: Algorithm triggers “Enhanced Due Diligence” (EDD) or auto-rejection. - After: You upload a St. Kitts passport.

Result: Algorithm categorizes you as “Low/Medium Risk.”

Privacy vs. Transparency [A Crucial Distinction]

It is vital to understand that using Caribbean citizenship banking solutions is not about hiding assets. In 2026, transparency is unavoidable due to the Common Reporting Standard (CRS), which we will discuss later. This strategy is about access, not secrecy. You are providing legitimate, government-issued ID to satisfy the bank’s requirement for a low-risk customer profile. You are playing by their rules, but you are changing the pieces on the board.

Strategy A: Opening a Global Stripe Account

For digital entrepreneurs, Stripe is the holy grail of payment processing. However, Stripe is notoriously strict. You cannot open a Stripe account solely with a Caribbean passport because Stripe does not support businesses located in these islands for direct processing.

To succeed, you must use the “Caribbean + US LLC” Method. This is the gold standard for unbankable entrepreneurs in 2026.

Step 1: Form a US LLC (The Container)

Stripe requires your business to exist in a supported jurisdiction. The United States is the best option because it is the home of Stripe and offers a specific entity type called the Single-Member LLC (Limited Liability Company).

- Jurisdiction Choice:

- Wyoming: The preferred choice for privacy. Wyoming does not list members (owners) on a public database.

- Delaware: The standard for startups looking for venture capital, but slightly more expensive to maintain.

- Tax Status: As a non-resident alien (from the US perspective), a Single-Member LLC is a “disregarded entity.” This means the LLC itself pays no income tax; the tax liability passes through to you (which is often 0% in the US if you have no physical operations there).

Step 2: The EIN Acquisition

You cannot open a bank account without an Employer Identification Number (EIN) from the IRS.

- The Challenge: You do not have a Social Security Number (SSN).

- The Fix: You must apply for the EIN using Form SS-4. This process takes 14-30 days. Do not rush this step. A valid EIN is the backbone of your banking application.

Step 3: The “Identity Verification” Hack [The Pivot Point]

This is where your Caribbean passport becomes essential. Once your LLC is formed, you will apply for Stripe.

- Business Details: Enter your US LLC details (Name, EIN, Address).

- Personal Details: Stripe will ask for the “Business Representative” or “Ultimate Beneficial Owner.”

- The Switch: Do not use your original passport. Enter your Caribbean citizenship details.

- Stripe’s AI will scan the ID.

- It sees “St. Kitts & Nevis” or “Grenada.”

- It clears the KYC check.

If you had used your original high-risk passport here, Stripe’s risk engine might have flagged the account as “unsupported” or “high fraud risk,” even with a US LLC. The Caribbean passport sanitizes the application.

Step 4: Address Verification – The 2026 Trap

In 2026, Stripe updated its fraud detection to flag “Paper Companies.” They check if your personal address matches your digital footprint.

- The Mistake: Using a cheap PO Box.

- The Solution: Use a premium Virtual Office or Commercial Mail Receiving Agency (CMRA) that offers a unique suite number.

- The Digital Footprint: Be careful with your IP address. If you claim to be a Grenadian citizen but your IP address consistently pings from a sanctioned country, Stripe will ask for a utility bill. It is safer to access your account via a VPN or VPS located in a neutral country, or better yet, from the Caribbean itself if you reside there.

Step 5: Connecting the “Bankable” Bank

Stripe needs a place to send the money. You cannot link a bank account from your home country. You need a US-domiciled bank account. Since traditional banks (Chase, Wells Fargo) require a physical visit, you will use Fintech banks like Mercury, Relay, or Wise Business.

- These banks also perform KYC.

- Present your Caribbean passport during their onboarding.

- Once approved, link this digital bank account to Stripe.

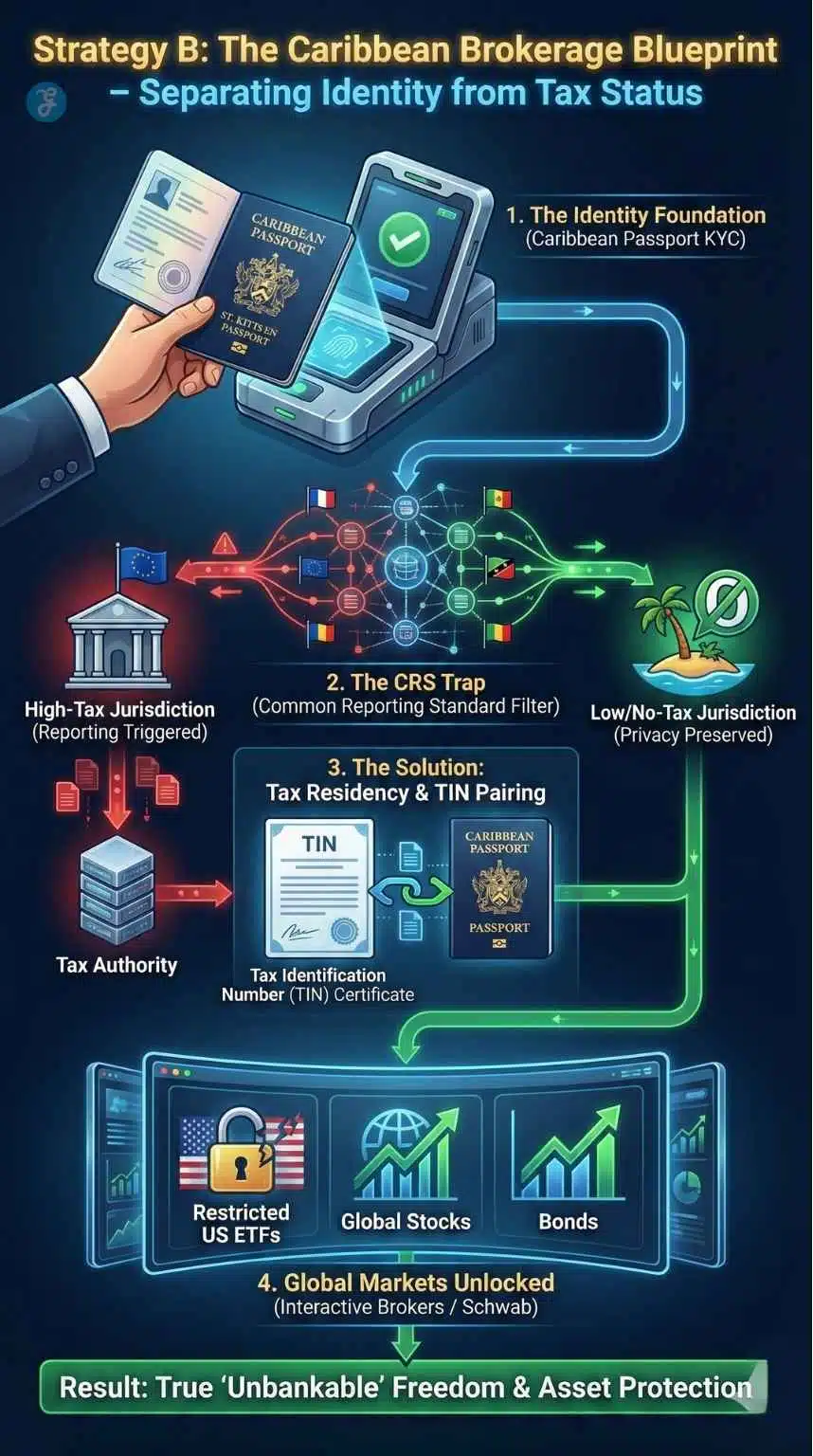

Strategy B: Opening Global Brokerage Accounts

While Stripe is about cash flow, brokerage accounts (Interactive Brokers, Schwab International, Saxo Bank) are about wealth preservation. The rules here are different. Brokerages are obsessed with Tax Residency.

The “CRS” Trap

The Common Reporting Standard (CRS) is a global information exchange network. Over 100 countries share banking data to prevent tax evasion.

- The Scenario: You open an Interactive Brokers account with a St. Kitts passport.

- The Question: The bank asks, “Where are you tax resident?”

- The Trap: If you answer with your home country (High Risk), you might still be rejected due to sanctions or internal policy. If you answer “St. Kitts” but don’t live there, you are committing fraud.

The Solution: True “Unbankable” Freedom

To be truly unbankable (in the positive sense) and secure a brokerage account, you often need to stack Residency on top of Citizenship.

1. Obtain a Tax ID (TIN)

A passport proves who you are; a TIN proves where you pay tax. To make your brokerage account bulletproof, you should obtain a Tax Identification Number from a jurisdiction that is safe and banking-friendly.

- Option A: The Caribbean Island Itself. St. Kitts and Antigua allow citizens to obtain a TIN and a driver’s license. This solidifies your connection to the island.

- Option B: Third-Party Residency. Many digital nomads use a UAE (Dubai) residence or a Paraguay residence. You open the brokerage account using your Caribbean passport (Identity) and your UAE residence (Tax Status). This separates you completely from your high-risk home country.

2. Accessing Restricted Markets

With a Caribbean passport, you gain access to investment products often blocked for others. For example, many US ETFs are restricted for European residents (due to PRIIPs regulations). By onboarding as a Caribbean citizen (where these regulations don’t apply), you can often access the full range of US financial products.

The Crypto Advantage: Off-Ramping & Exchanges

For many digital entrepreneurs, the problem isn’t just processing fiat currency; it’s off-ramping cryptocurrency without triggering an account freeze. Traditional banks often view high-volume crypto transfers as money laundering. However, certain Caribbean jurisdictions have pivoted to become “Crypto Harbors.”

The “Crypto-Friendly” Hierarchy:

- Antigua & Barbuda: This is currently the top choice for Web3 natives. The country passed the Digital Assets Business Bill, creating a legal framework for crypto. Banks in Antigua are accustomed to receiving funds from major exchanges (Binance, Kraken) provided the source of funds is documented.

- St. Kitts & Nevis: Recently passed legislation allowing Virtual Assets to be used as Proof of Funds for the citizenship application itself (with extra due diligence fees). This signals a banking sector that understands digital wealth.

The Strategy:

- The “Middleman” Account: Do not send crypto proceeds directly to your US LLC bank account (Mercury/Wise) if you can avoid it. These fintechs are risk-averse.

- The Flow: Crypto Exchange $\rightarrow$ Caribbean Bank Account (opened with your new passport) $\rightarrow$ US LLC Account (as a “Capital Injection”).

- This extra step creates a clear paper trail within a jurisdiction that legally recognizes digital assets, sanitizing the funds before they hit the US banking system.

Best Caribbean Passports for Banking [2026 Ranked]

Not all passports are created equal. In the world of banking compliance, “Reputation” is a tangible currency. Below is a ranking of the Caribbean CBI programs specifically based on their utility for opening bank and merchant accounts.

| Rank | Country | Banking Reputation | Key Advantage for Entrepreneurs |

| 1 | Grenada | 5/5 | The Business Heavyweight. Grenada is the only Caribbean CBI nation with a US E-2 Treaty. This diplomatic tie signals to banks that Grenada is scrutinized and trusted by the US government. It is widely accepted by Fintechs and legacy banks. |

| 2 | St. Kitts & Nevis | 4/5 | The Platinum Brand. As the oldest program (est. 1984), it has high name recognition. The recent price hike (to $250k+) has actually helped its banking reputation, as it signals to bankers that the holder is wealthy and not just looking for a “cheap” passport. |

| 3 | Antigua & Barbuda | 4/5 | The “Genuine Link” Choice. Antigua requires citizens to visit the island for 5 days within the first 5 years. While annoying for some, banks love this. It proves a genuine link to the country, making KYC checks smoother. |

| 4 | St. Lucia | 3/5 | The Efficient Option. St. Lucia is fast and efficient. However, because it has historically been a lower-cost option, some conservative European banks may scrutinize the “Source of Funds” more aggressively during onboarding. |

| 5 | Dominica | 2/5 | The Travel Passport. Excellent for visa-free travel, but tougher for banking. Dominica processed huge volumes of applications in the past, leading to higher scrutiny from compliance officers. It is still workable, but expect more questions. |

The Investment and Costs [2026 Update]

If you are ready to execute this strategy, you must understand the financial commitment. As of 2026, the Caribbean nations have harmonized their pricing to a higher standard to appease the EU and the US.

1. The Citizenship Cost

You generally have two routes:

- Donation (NDF): A non-refundable contribution to the government.

- Range: $200,000 – $250,000 for a single applicant.

- Real Estate: Buying government-approved property.

- Range: $400,000+ (minimum investment).

- Pros: You get a physical address and a potential “genuine link” to the island, which helps with banking proof of address.

2. The “Structure” Cost

Don’t forget the costs to build your banking infrastructure:

- US LLC Setup: ~$500 – $1,000 (one-time).

- Mail Forwarding/Registered Agent: ~$300 – $500 per year.

- Tax/Accounting Filing: ~$500 – $1,500 per year (for the US LLC).

Total Estimated Capital Required: You should have roughly $220,000 – $270,000 in liquid capital to execute the “Unbankable” escape plan fully (Passport + Legal Setup).

Navigating the Risks [Compliance and Legal]

While this article outlines a powerful strategy, it is critical to navigate the legal landscape with eyes wide open.

The “Sham” Warning

In 2026, AI algorithms are looking for “shams.” If you open a Stripe account claiming to be a St. Kitts business, but you ship all your products from a warehouse in a sanctioned country, you will be caught. Your business operations must align with your new identity structure.

Tip: Use 3PL (Third Party Logistics) centers in neutral countries (US, EU, China) to fulfill orders. Do not ship directly from a high-risk jurisdiction if you can avoid it.

Reporting is Mandatory

Never assume that a second passport allows you to hide income.

- If you are a US Person (Citizen or Green Card holder), you are taxed on worldwide income regardless of your second passport.

- If you live in Europe/Canada/Australia, CFC (Controlled Foreign Corporation) rules may apply to your offshore entities.

- Always report your new accounts to your relevant tax authority. The goal of this strategy is access, not evasion.

The “Hidden” Hurdle: Document Legalization [Apostille]

Most people fail this process not because of their background, but because of their paperwork. You cannot simply scan your new passport and email it to a Swiss or American bank.

The “Apostille” Requirement

Global banks operate under the Hague Apostille Convention. They require your documents to be “legalized” to prove they are not forgeries.

- The Mistake: Sending a raw scan of your passport or utility bill.

- The Requirement: You must send the physical document to a government office in the Caribbean to receive an Apostille Stamp. This is a specific seal that makes the document legally valid internationally.

- 2026 Update, “e-Apostilles”: Some forward-thinking jurisdictions (like St. Kitts) have moved to digital e-Apostilles, which speeds up banking onboarding from weeks to days. When choosing a passport, ask your agent: “Does this island issue e-Apostilles?” If yes, your banking setup will be 50% faster.

Final Thoughts: The Price of Freedom

Being “Unbankable” is a suffocating feeling. It limits your growth, caps your potential, and leaves your financial destiny in the hands of an unsympathetic algorithm. But the global financial system is not a monolith; it is a network of gates. Some gates are closed to you by birth, but others can be opened by investment.

A Caribbean Citizenship Banking Solution is the key to those gates. By combining a reputable second passport with a robust US or International corporate structure, you can reclaim your financial sovereignty. It requires a significant upfront investment, but for the serious global entrepreneur, the ROI, measured in stable payment processing, access to global markets, and peace of mind, is infinite.

In the digital economy of 2026, your passport is no longer just about where you can travel; it is about where you can trade. Choose wisely.