Need money to fund a new project? Many freelancers worry they will make capital loan mistakes and end up stuck. Fact: lack of cash flow is a common error that leads to loan denial for new freelancers.

This guide will name ten loan mistakes and show simple steps to dodge them. We cover repayment plans, interest rates, hidden charges, and how to track finances in a spreadsheet. Keep reading.

Key Takeaways

- Create a clear repayment plan. List monthly income, costs, and six core metrics (clients, total earned, billed, received, hourly rate, words per day). Save 20% of each check for taxes. Use a 200-day work year and add a one-paycheck buffer. Keep your debt-to-income ratio under 36% and match SBA and bank benchmarks.

- Keep personal and business money apart. Only 22.3% of new freelancers use a separate card for gig expenses. Use tools like Invoicely or FreshBooks to track invoices, bills, and expenses. An accountant can spot bad debt, update balance sheets, and watch your credit score.

- Know exactly how much to borrow. Build a budget sheet listing sales, marketing costs, rent, taxes, and other expenses. Subtract outflows from projected income. Save an emergency fund that covers 6–12 months of living costs before you take on any loan. Use a line-of-credit calculator and talk to lenders about collateral needs.

- Watch interest rates, loan terms, and hidden fees. A $5 million loan at 4% versus 5.25% saves only $330 per month on a 30-year note. Read your loan docs for origination, late-payment, and prepayment charges. Check for variable rate shifts tied to the prime index. Ask a mortgage broker to spot surprise costs.

- Build multiple income streams and a safety net. Don’t rely on one client. Top freelancers add ebooks, training sessions, and journalism work—like Natasha Khullar Relph did—to soften slow months. Open an emergency savings account, insure your health and gear, and keep debt below 36%. Seek advice from financial planners or brokers to lower your loan risk and rates.

How do I create a clear repayment plan before borrowing?

You need a solid plan before you sign on the dotted line. A clear repayment plan maps out your cash flow and highlights risks.

- List monthly income and costs on a payment tracker table; track client invoices, accounts receivable and bills owed to spot potential gaps if clients delay.

- Track six core metrics, number of clients, total earned, amount billed, amount received, hourly rate per assignment and words written per day, to form accurate financial projections.

- Set aside 20% of every paycheck into a tax reserve; this emergency fund keeps you from defaulting on a business loan.

- Account for sick days by converting 365 to a 200 workday year; cut projected revenue by expected downtime to reveal worst-case cash flow.

- Include prepayment penalties or extra charges, like cash advance fees, in your income and expense reports; this step reveals true financing costs.

- Compare your debt-to-income ratio against Small Business Administration and bank benchmarks; this reduces the risk of loan denial.

- Factor in payment terms from clients, such as net 30 or net 45; late payers can blow your cash flow.

- Add a buffer equal to one missing paycheck after you map bills owed; this financial cushion absorbs sudden shortfalls.

- Review your credit score and credit report for errors; fix issues before filing any loan application to boost creditworthiness.

- Use a revenue model from your business plan to forecast sales and marketing costs and business growth; tweak your plan if you aim for a higher hourly rate.

Why should I keep personal and business finances separate?

Freelancers mix personal and business bank and credit card charges. This complicates cash flow tracking and ruins profit and loss statements. It hides gross and net income, derailing financial projections and a solid business plan.

Tax season then feels like chaos. Only 22.3% of new freelancers carry a card just for gig expenses. Blurring lines costs tax benefits and deductibles like coffee, travel and merchant cash advances.

A larger tax return balance often follows.

An invoicing tool like Invoicely solves that. The app ties invoices, accounts payable and expense data in one dashboard. This record helps set pricing strategy and guide a loan application or balance a debt-to-income ratio for a commercial loan.

Bringing in an accountant boosts financial stability. They flag bad debt and overdue bills, update balance sheets and watch credit scores to avoid a loan default or tax penalty.

How can I determine the actual loan amount I need?

Start with a budget spreadsheet. List expected sales and marketing costs, taxes, rent, and other expenses. Adjust revenue estimates for sick days and non-working days. Subtract monthly outflows from projected income to see true cash flow needs.

Use a debt-to-income calculator to keep your DTI ratio under 36 percent. Keep an emergency fund that covers six to twelve months of living costs before adding any business loans.

Talk with banks or lenders about collateral requirements. Bring a solid business plan and financial projections to each meeting. Offer equity or find a partner if covenants demand more security.

Use a lines-of-credit calculator to model different borrowing scenarios. Track every expense in real time so you never borrow more than your plan can handle.

What should I know about interest rates and loan terms?

You often chase low rates, but you need to watch your loan term too. A $5 million loan at 4% versus 5.25% cuts only about $330 off your monthly payment on a 30 year note. Amortization can soften interest swings.

Lenders also watch your liquidity as part of the debt covenant.

Closing can take at least 60 days for inspections and contingencies. Run simple financial projections to see if your cash flow can cover new debt. Lenders pull reports from credit bureaus, so fix errors and note past bankruptcies up front to your mortgage broker or bank.

File multiple loan applications to spur competition. That step can cut costs and guard your financial stability.

How do I identify hidden fees and extra charges on loans?

Hidden fees can eat your profit fast. Freelancers need sharp eyes.

- Compare lender offers. Local banks, credit unions or commercial lenders may slip in origination, underwriting or application charges. Ask each for a clear fee list.

- Check loan documents. Scan all pages for prepayment penalties, late fees or liquidity requirements that trigger extra costs.

- Demand a full cost breakdown. A complete loan package uses tax returns, credit reports and appraisals. Filing on time cuts processing or admin charges.

- Talk to a mortgage broker. A seasoned broker spots extra charges you might miss. Their network helps you dodge surprise costs.

- Use an invoicing app. Tools like Invoicely or FreshBooks track every outgoing payment, so you catch hidden charges in your cash flow.

- Verify variable rates. Watch for rate shifts tied to the prime index or other benchmarks, they add more to your monthly bill.

- Review dti rules. Debt-to-income limits can trigger bank fees if you exceed ratios in your business plan.

- Consult real estate agents or lawyers. These pros know which lenders stick to clear fee structures.

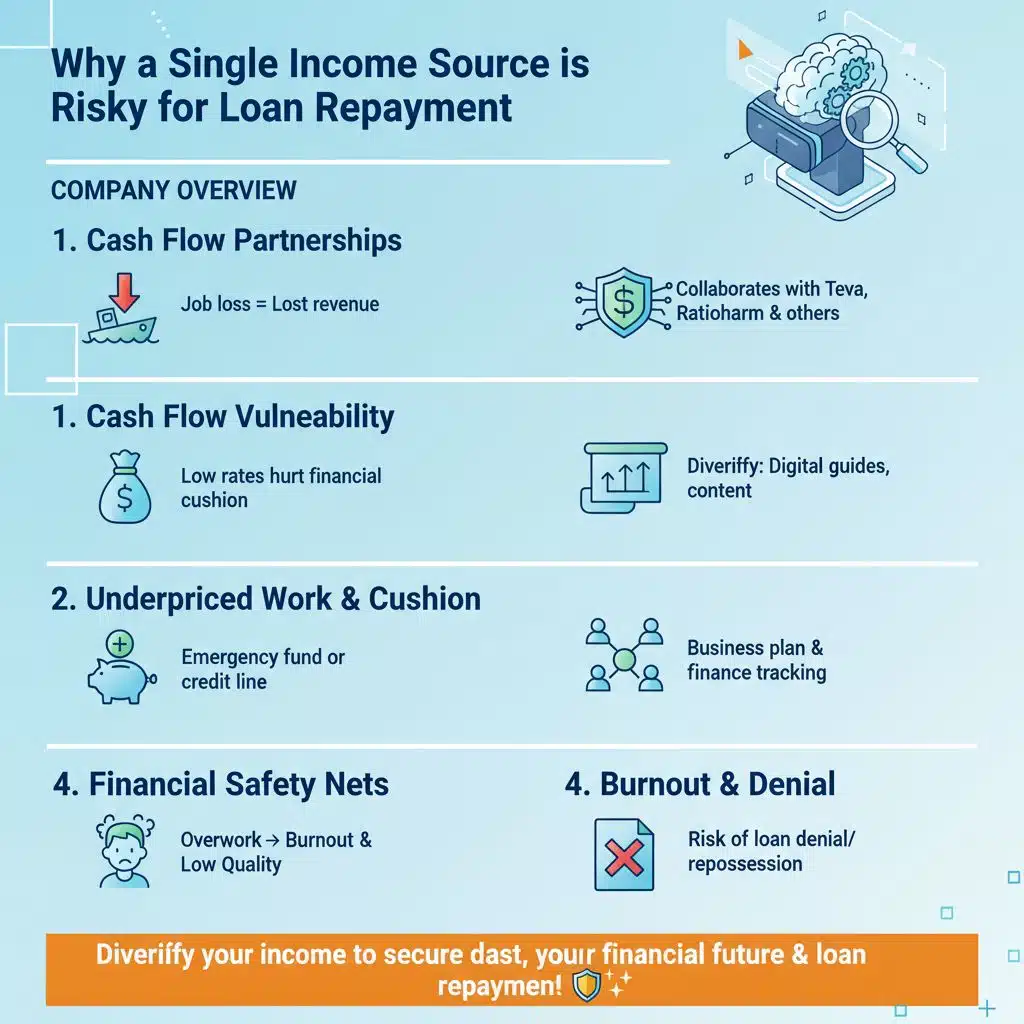

Why is relying on a single income source risky for loan repayment?

Relying on one client can sink your loan repayment if that job falls through. Lost revenue hits cash flow hard. Freelancers who hit six figures often sell digital guides, offer content marketing, and run training sessions, so one delay or cancellation hurts less.

Natasha Khullar Relph added journalism and nonfiction work, boosting her financial stability.

Underpriced work drives clients away, and it shrinks your financial cushion. A clear business plan and tight tracking finances help you stress-test your debt-to-income ratio. An emergency fund or business credit line can smooth over slow months.

Networking opens new sales and marketing doors so you avoid loan default or repossession. Overworking to cover one stream leads to burnout, dropping quality and risking loan denial.

How can I build a financial safety net as a freelancer?

Freelancers face income swings. A solid cushion eases stress.

- Open a dedicated savings account. Move money after each payment and label it Emergency Fund to cover six to twelve months of living costs.

- Reserve twenty percent of every invoice for taxes. Track that in a Google Sheet and adjust for under twenty percent in India or up to forty-five percent in the UK.

- Use QuickBooks or a budget app to monitor cash flow. Update financial projections monthly to spot shortfalls early.

- Factor sick days into your pricing strategy. Block a calendar week each quarter and build a cash cushion for unpaid breaks.

- Insure your health, gear, and liability. Compare policies as you move cities to avoid debt and foreclosure after an accident.

- Follow Dave Ramsey’s seven-step plan. Tackle debts with a snowball first, then grow retirement savings for long-term stability.

- Limit your debt-to-income ratio to thirty-six percent or less. Skip commercial loans that push you past that mark to prevent loan default.

- Consult a registered investment adviser or tax planner. Get small business advice on corporation tax and draft a clear business plan.

What are the best ways to research loan options and lenders?

Solid research protects your cash flow. Sharp findings slash the risk of loan default.

- Speak with real estate agents and lawyers to snag lender leads, as they tap into your local capital market and guide new freelancers away from common traps.

- Research local banks and credit unions to study transparent pricing strategy, cash back deals, and clear payment terms.

- Ask peers with complementary services about their lender wins, loan denial stories, and past financial mistakes.

- Check fee schedules and fine print to dodge surprise charges like tax law penalties or late fees.

- Hire proven mortgage brokers with local networks, who have strong case histories and know debt-to-income (dti) limits.

- Leverage a solid broker to cut stress, lower rates, and fuel your business growth and sales and marketing efforts.

- Compare offers from multiple lenders to spark a bidding war, because when banks compete, you win financial stability and better cash flow.

- Use loan calculators and spreadsheets to map debt-to-income ratios, track financial projections, and guard your emergency fund.

- Share your small business story to build a personal bond, boost approval odds, secure lines of credit, and strengthen your financial cushion.

How much debt is too much to take on too quickly?

Freelancers who borrow more than three times their monthly expenses risk stress and creativity loss. Natasha Khullar Relph felt that strain after moving from India to the UK. Many overestimate income and underestimate expenses and then face loan default, burnout, and cash flow pain.

Lack of a clear repayment plan means debt can pile up in days, not months. Skipping profit calculations and ignoring hourly rate details hides true costs. Accepting the first lender offer often shrinks your financial cushion.

Tracking finances, expenses, and cash flow builds financial stability and helps you avoid excessive debt.

When should I seek professional advice or financial planning?

Advisors spot missed deductions, save more than they cost, and set up social security and medicare elections. They install FreshBooks for simple tracking finances, build cash flow projections, and secure an emergency fund.

They help sharpen your pricing strategy, refine sales and marketing budgets, and tighten payment terms.

A local mortgage broker cuts the loan denial risk and trims your interest rate. A coach or planner flags loan default dangers before you borrow. You can follow Natasha Khullar Relph’s rule, invest 10% of every check in skill upgrades.

That step boosts your hourly rate and fuels business growth.

Takeaways

Missing a rock solid plan can stall your freelance work. You can use a spreadsheet or a loan calculator to map out cash flow. Reading loan terms helps you dodge hidden fees and nasty interest.

Building an emergency fund with a budget planner keeps storms at bay. Strong banking relationships and clear payment terms give you real power.

FAQs on Capital Loan Mistakes

1. What financial mistakes do new freelancers make when seeking a capital loan?

They seek a small business loan with no clear financial projections. They skip an emergency fund, like sailing without a life vest. They forget to track finances. That can lead to loan denial or loan default.

2. How can a solid business plan lower the odds of loan denial?

A business plan shows your cash flow charts, your sales and marketing steps, and your payment terms. You add a clear pricing strategy, and you prove financial stability. Lenders love that.

3. Why is careful tracking finances vital for freelancers?

You spot where money leaks, from missed tax payments to late invoices. You keep personal finances separate. And you build real proof of steady cash flow.

4. How does an emergency fund act as a financial cushion?

Think of it as a life raft. When a big client stalls or tax laws tighten, that fund keeps you afloat. It shields you from loan default and fuels business growth.

5. How do freelancers set prices and an hourly rate to stay in the green?

First, add up all costs, from paid time off to tax payments and any employees. Then add a for profit margin that suits your market. That way you cover costs, boost growth, and avoid cash flow pains.