Many business owners sit and ask: is the Romanian market a gold mine or a trap? They eye foreign investment but fear hidden tax rules. They worry these rules may hurt growth. They want a clear path in a tough investment climate.

Did you know IT&C staff pay zero income tax on gross pay up to 10,000 lei a month? In this guide, you will see five key incentives that can cut your costs. We explain corporate income tax breaks, show VAT rate cuts, and point out local tax exemptions in industrial parks.

We review R&D support and share how to form a limited liability company. Read on.

Key Takeaways

- Foreign IT&C staff pay no income tax on up to 10,000 lei monthly. Firms also skip profit tax on reinvested earnings and cut tax by up to 10% when they boost equity.

- R&D firms can deduct 50% of research costs and get a 100% profit tax exemption for innovation. U.S. FDI reached $2.9 billion in 2022, and total FDI in Romania hit $11.2 billion.

- Companies can claim training costs up to 0.5% of annual payroll and reclaim 90% of agri course fees. The Ministry of Education covers up to 60% of virtual-reality lab expenses.

- Businesses in industrial parks pay no local or property tax. A software firm in Bucharest North Park paid zero for seven years. A Dolj farm saved 50%, and a Craiova factory gets cuts until 2030.

- The state offers grants and tax credits for power grids, water plants, and data hubs. EU investors get approval in 70 days; non-EU in 135 days. FDI deals over €2 million face screening from July 18, 2024.

Tax Incentives

The Romanian Fiscal Code cuts profit tax when you reinvest your earnings, and slashes levies if you boost your company’s capital. A simple ROI calculator shows your true savings, and audit software helps you track every deduction in real time.

Tax exemption for reinvested profits

Companies can skip corporate income tax on profits they plow back into new projects under the Romanian fiscal code. The law lets foreign direct investments funnel funds into machinery, research, or staff training and avoid taxable profit on that slice.

This perk boosts the investment climate and drives economic growth in the Romanian market.

Taxpayers track costs in billing software to grab deductions and tap accelerated depreciation rules. ANAF’s portal simplifies tax payments and keeps capital gains checks clear for small and medium enterprises.

Reductions for maintaining or increasing equity

A company that keeps or adds more equity wins tax cuts. Romanian fiscal code trims profit tax in this case. A capital boost by the owner cuts tax by up to 10%. Investors must update articles of incorporation at the chamber of commerce.

They file proof of money on the tax return. The next fiscal year feels lighter with a smaller bill.

This perk can improve the investment climate in Romania. A healthy equity base acts like a safety net in the romanian economy and the european market. New ventures in industrial parks tap into it, too.

You must file bank statements and equity plans. You still register for VAT if you exceed 300,000 RON. Staff pay 10% salary tax, plus 25% social security and 10% health insurance. The employer adds 2.25% labor insurance on each payroll.

Research and Development (R&D) Incentives

Romania gives profit tax breaks to R&D firms that unleash fresh prototypes in labs, under the Romanian Fiscal Code. AI hubs and green tech teams also grab EU grants, so they can scale fast with fewer tax stops.

Tax incentives for R&D activities

Companies in the Romanian market can deduct R&D costs from their corporate tax base. The fiscal code lets businesses slash bills by half of research spending. Such perks enhance the business environment, spark economic growth and open new investment opportunities.

U.S. foreign direct investment in Romania hit $2.9 billion in 2022. All foreign investment climbed to $11.2 billion, up 6.6 percent from 2021.

Exemption from profit tax for innovation and R&D companies

Under the Romanian fiscal code, start-ups that invest in new tech can skip profit tax. R&D labs enjoy a one hundred percent break on net gains. Local hubs and industrial parks host around 116 billion US dollars of foreign investment stock, or 38.4 percent of GDP.

Romania’s economy rose 4.1 percent in 2022 and 2.1 percent in 2023.

Tax teams file claims through a digital return portal to secure the break. Innovation hubs and science centers use this tool to improve their cash flow. Analysts praise the move for its boost to economic development and the European market.

Foreign founders spot fresh investment opportunities in a smooth business environment.

Professional and Technical Education Support

Skill credits boost skills at local trade schools, and the Ministry of Labour grants income tax cuts for apprenticeships. The European Social Fund runs practical sessions with expert coaches, so your crew can hit the ground running.

Tax benefits for professional training programs

Companies deduct training costs from their profit tax base under the Romanian fiscal code. Firms claim up to 0.5 percent of annual payroll per tax year. They cover courses in health and safety, management and telecommuting skills.

This cut boosts the investment climate for foreign investments and spurs economic growth in the Romanian economy.

Food and farm employers secure extra credits when they upskill employees in agri and food sectors. The labour code lets them reclaim 90 percent of course fees via the state budget.

They use the refund to lower next tax year dues. Workers gain new skills, and businesses see better cost control.

Support for technical education collaborations

Tech firms join vocational centers to build hands-on labs. The Ministry of Education covers up to 60 percent of the bill for virtual reality courses. Each program follows the labor code rules on employment contracts and teleworker policies.

Firms risk fines up to 10 percent of global revenue or void FDI clearance for non-compliance.

Local professors lead workshops on robotics, AI models, and digital twin tools. You might meet a future engineer coding a drone on your company floor. Investors spot fresh talent and test skills in the Romanian market and European market.

This push fuels economic development and strengthens the investment climate.

Local Tax Exemptions

In manufacturing zones, new ventures win breaks on asset levies, freeing up cash to hire and grow. The Romanian Fiscal Code hands out perks, and tax law teams up with locals to grease the wheels.

Incentives for businesses in industrial parks

Companies in industrial parks claim full local tax breaks under the Romanian Fiscal Code. Firms register with the Romanian Fiscal Authorities within 30 days. A financial account unlocks full compliance.

This boost drives foreign investment in the Romanian economy and lifts the investment climate. New investment opportunities emerge in the European market. It aligns with EU laws on transfer pricing and GDPR.

Manufacturers and office firms see property tax cuts too. Technology hubs give relief on these fees. Firms boost economic development by hiring staff fast. Regional offices use a digital filing tool to process requests.

They speed review and cut red tape.

Exemptions on property taxes in certain areas

Local councils grant full cuts on property tax in industrial parks and privileged areas. A software maker in Bucharest North Park paid zero for seven years. It files claims under the Romanian Fiscal Code via a national web portal.

This move drives foreign investment and economic growth. Teams in IT&C units enjoy 0 percent income tax on pay up to Lei 10,000 monthly, so they spend more on local sites.

A farm in Dolj Province saved half its levy under this plan. A new factory in Craiova secured the same perk until 2030. They log each case in the Land Registry. Local rules sharpen the investment climate in the romanian economy.

It fuels more occupation, lifts access to the european market, and boosts economic development.

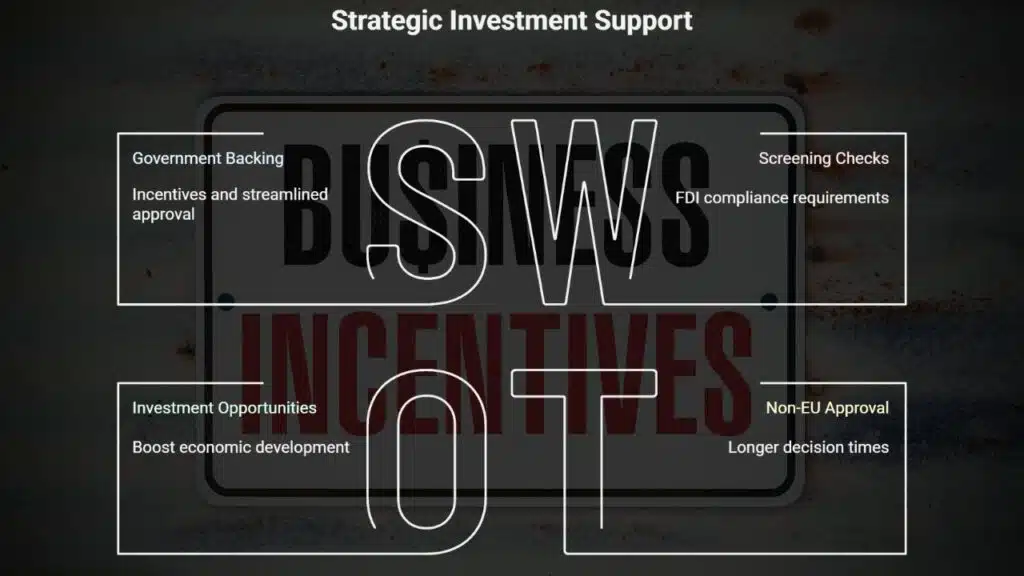

Strategic Investment Support

The Ministry of Environment backs power grid upgrades, with low-cost loans and EU grant schemes. The Romanian Fiscal Code slashes fees for defense systems, locks in tax breaks under European Economic Area rules.

Incentives for investments in critical infrastructure and national security sectors

Romania gives cash grants and tax credits to firms that build or upgrade power grids, water treatment plants, border security, or data hubs. A single panel vets projects in critical infrastructure, national security, and financial systems.

EU investors win approval in up to 70 days, while non-EU firms see decisions in 135 days. Fast clearance boosts foreign investment and lifts the Romanian economy.

A fund run by the Ministry of Environment co-sponsors smart cameras and rescue centers. This support joins loans and insurance covers under the Romanian fiscal code. Investors tap more investment opportunities and boost economic development.

They also secure spots in industrial parks, gain access to the European market, and strengthen the investment climate and business environment.

Benefits for large-scale industrial projects

Big factories plant roots in industrial parks and snag tax breaks under the romanian fiscal code. That setup brightens the business environment and draws foreign investment to the romanian market.

Companies tap co-financing from a European lender, which opens doors to the european market. Projects run through a budget review and a viability check to shape budgets.

Officials speed up permits through a joint venture model and new infrastructure financing routes. The lean process boosts the investment climate, driving economic growth and fresh investment opportunities.

Screening checks kick in on July 18, 2024 for deals above €2 million under the EU screening mechanism. Risk of fines up to 10% of global turnover for FDI noncompliance keeps firms on track and fuels economic development.

Takeaways

Romania greets foreign investors with smart tax breaks, R and D credits, training support, industrial park perks and strategic project aid. A limited liability company can form fast with as little as one leu in capital.

You can tap zero percent income tax on IT paychecks and profit relief on reinvested funds. This low VAT rate and clear Trade Register steps speed your process. These incentives spark growth in Romania’s open investment climate.

FAQs

1. What makes Romania a top spot for foreign investment?

Romania blends a pro-business environment with a clear romanian fiscal code. You find modern industrial parks, easy access to the european market, and a stable investment climate. The romanian economy is on a growth path, so you ride the wave of economic growth right away.

2. What tax perks do I get as a foreign investor?

You may qualify as a tax resident and enjoy a low income tax rate. Some zones let you claim depreciated assets fast. Pensions and social charges shrink in key regions, so hires or retirees cost you less.

3. Can I set flexible work rules in Romania?

Yes, you can use temporary work contracts and clear rules on overtime and working hours. The romanian labour law spells out when you can pause work for force majeure or a strike. It also sets fair terms for termination, so you face no nasty surprises.

4. How does Romania speed up economic development?

The state funds R&D, boosts the industrial parks and links them to the european market. Local grants fuel startups, while big projects build roads and ports. This mix drives steady economic development across the romanian market.

5. How do I get more details or ask questions?

You can send an e-mail address to the investment office or leave a note in their inbox on the official site. They reply fast, and they guide you to the right experts.