Many people conjure images of jewelry or coins when gold is mentioned. Jewelry is a first thought for those who look at gold less as an investment, while anyone keen on investments consider coins and bullion bars. A gold bar suggests a rectangular and stackable mini brick that gleans with value.

These are arguably, the most standardized ways of directly owning the physical asset without the heightened attraction that comes with gold coins.

Despite, coins being typically favored over bars because of their versatility, variety, and worldwide recognition, they come with a slightly higher premium over the spot price compared to bullion bars. Bars sell for roughly the same as the gold market price; with only a rail thin margin.

Bars attract specific buyers, those interested in pure metal with no other associated attributes. At a glance, bullion bars all look similar, relatively nondescript. Visit – How Much Does a Gold Bar Weigh? – SuperMoney – to learn the weight of a gold bar.

The Basics of Gold Bars

Gold bars also known as gold bullion are rectangular in shape and have been refined. They’re produced by pouring precious molten metal into molds or ingots. These trace back to the Roman era but may predate those times. Most bars from those periods were melted to produce bullion coins.

The bars were also used as currency in Egyptian and Mesopotamian periods. Those did not meet a particular standard and were weighed to determine the value. These were also known as ingots, a reference to their manufacturing method.

Weight, Purity, and Content

A gold bar could range in weight from less than a troy ounce up to several pounds or kilograms. The most widely used bullion bars for trade and investments are the kilobar, which weighs 32.15 troy ounces or a kilogram. It can resemble a brick or be flat. The premium attached to these bars is meager over gold’s spot price.

Central banks and bullion dealers trading internationally deal with bars weighing 438 troy ounces or 12.4 kilograms.

While bullion bars are usually pure gold, more modern bars, in particular, may not be entirely produced using the metal. Gold is a soft precious metal and by adding other metals, it helps preserve the original shape, making the bars more storage-friendly and stackable.

The metals added to the composition are usually copper, platinum, silver, and on. These can cause the bar to change its tone. For example, adding silver may give the bar a lighter hue.

The purity is denoted in millesimal fineness and represents gold content peer thousand parts. A bar with a .999 fineness is 99.9 percent fine gold. Purity can range up to 99.99 percent pure, known as “four nines.” A pure gold bar will be no less than 99.95 percent pure.

Gold Bar Design and Shape

The design with gold bars is relatively straightforward. There will be markings on either the top or sides designating the purity, fineness, melt, etc. The underneath will have the stamp or design pattern.

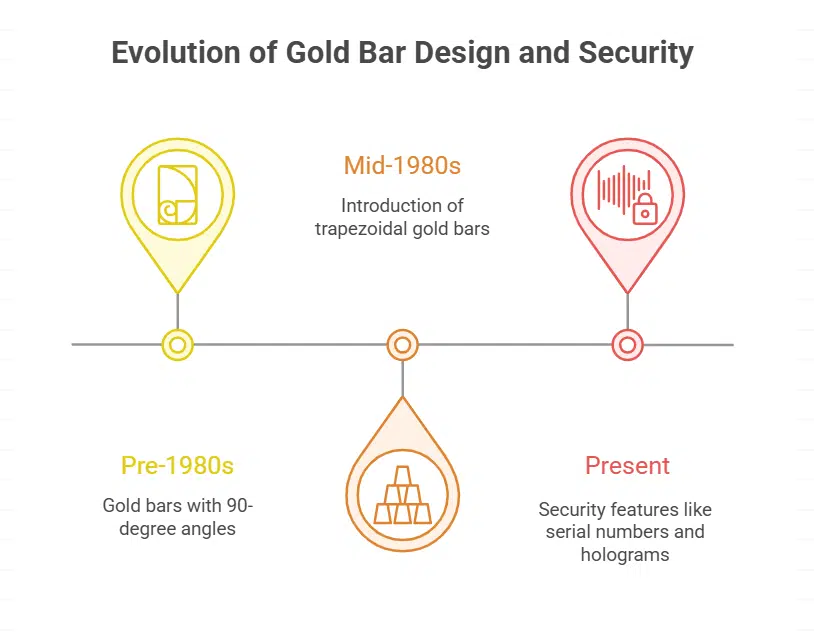

The mint’s name will be reflected on the face. For security purposes, manufacturers may use serial numbers or even holograms.

A certificate of authenticity enables investors to verify their gold’s genuineness. This certificate will bear a serial number that matches the one stamped on the bar. The bar’s assay card includes essential details including weight, purity, hallmarks, and the assayer’s contact details.

There are no design intricacies, no themes or means of standing out. However, if you look at the design from bars manufactured before the mid 1980s in the US, you will note subtle differences from modern bars.

All four angle were 90 degrees; today, only two are right angles with the body being more of a trapezoid.

Buy From Authorized Sellers

Now that bullion bar weights and sizes are explained , the information can prove overwhelming. Fortunately, there are providers like Money Metals readily available to address questions and concerns. Well-known, authorized companies like these help clients make informed decisions.

When searching for an authorized seller, you want to check reviews and ratings o on reputable sites, such as the BBB – Better Business Bureau. You want a dealer who is transparent with fees, these sellers prove to be credible and trustworthy.

They will offer a secure online transaction infrastructure and have solid credentials. You want to steer clear of individual sellers and marketplaces.

Final Thought

As an investor or prospective buyer, you want to do your homework when it comes to bullion bar’s purity, size, dimensions, and weight. Owning physical gold involves additional charges, including insurance and storage fees, markups linked with trading, and transaction fees.

Doing due diligence in research before jumping in is essential. Many dealers provide educational literature on the website, and most will address questions if you contact them or make an appointment to sit down to gather more information.