For years now, the idea of a BRICS currency has resurfaced with almost ritual regularity. Each summit revives it. Each global crisis lends it fresh urgency. Each geopolitical rupture gives it sharper political meaning. And yet, despite the rhetoric, despite the headlines, no single BRICS currency exists today.

That absence has led many to dismiss the project outright, as an overhyped talking point or a geopolitical fantasy aimed more at signalling defiance than delivering results. That conclusion, however, is too simplistic. The real story is not about a missing banknote or a shared mint. It is about something slower, quieter, and potentially more disruptive: a series of overlapping, often uncoordinated efforts by BRICS members to loosen the dollar’s grip on global trade and finance without confronting it head-on.

The question, then, is not whether BRICS will launch a euro-style common currency. It will not. The more important question is whether BRICS is laying the foundations of an alternative financial architecture, one that could coexist with the dollar while steadily reducing dependence on it. That distinction is often lost in public debate, but it is central to understanding what is actually unfolding.

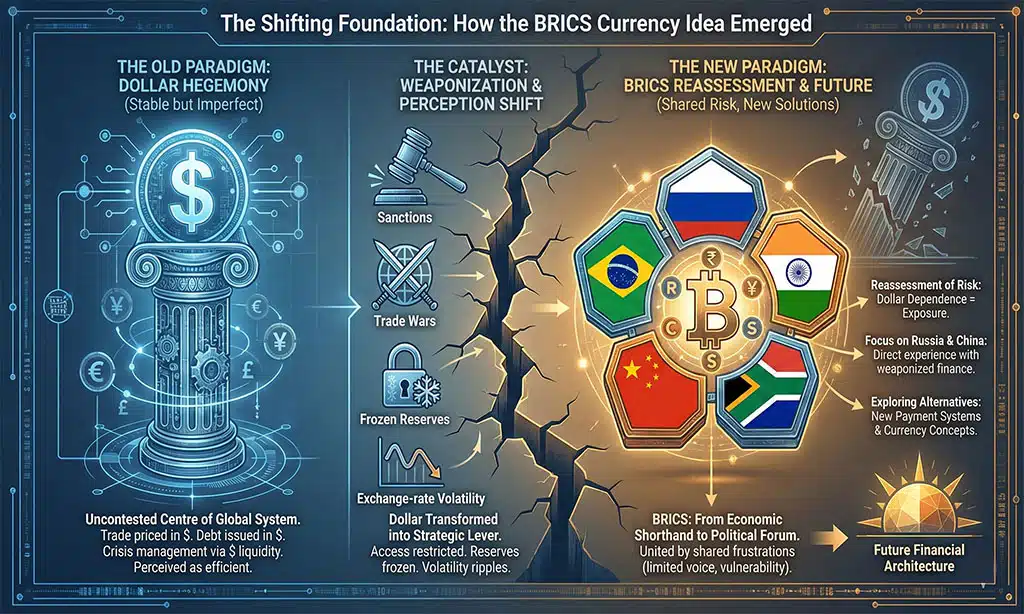

How the BRICS Currency Idea Took Shape

BRICS was never conceived as a monetary bloc. It emerged first as an economic shorthand, then evolved into a political forum bound loosely by shared frustrations rather than shared institutions. What united Brazil, Russia, India, China and South Africa was not ideology, but experience: limited voice in Western-led financial institutions and vulnerability to external economic shocks.

For decades, the US dollar sat at the centre of the global system, largely uncontested. Trade was priced in dollars. Debt was issued in dollars. Crises were managed through dollar liquidity. For most countries, this arrangement was efficient, even if imperfect.

That perception has changed.

Sanctions, trade wars, weaponized finance, and sudden shifts in US monetary policy have transformed the dollar from a neutral facilitator into a strategic lever. Access to payment systems can now be restricted. Reserves can be frozen. Exchange-rate volatility can ripple through emerging economies overnight.

For several BRICS members, most notably Russia and China, this shift was not theoretical. It was experienced directly. The result has been a reassessment of risk. Dollar dependence, once taken for granted, is now viewed as exposure.

What the BRICS Currency Is Actually Meant to Do

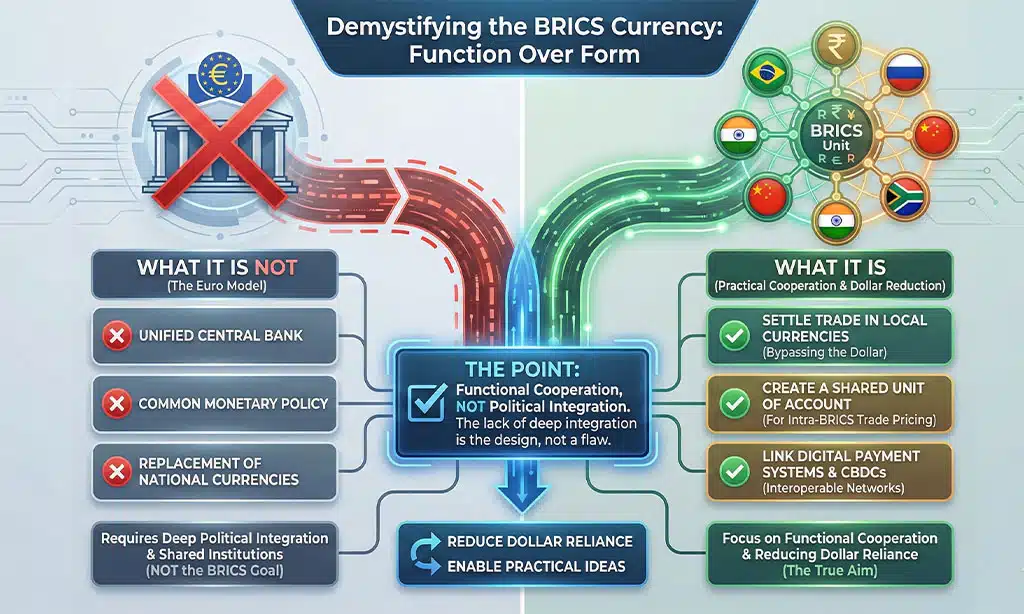

Much of the confusion surrounding the BRICS currency debate stems from a false comparison with the euro. The euro was born out of deep political integration, shared institutions, and decades of economic convergence. BRICS has none of these, and does not aspire to replicate them.

There is no serious proposal within BRICS for:

- a unified central bank

- a common monetary policy

- the replacement of national currencies

Instead, the discussion revolves around function rather than form.

At its core, the BRICS currency conversation includes three practical ideas:

- settling trade in local currencies rather than dollars

- creating a shared unit of account for intra-BRICS trade

- linking digital payment systems and central bank digital currencies

Each of these reduces dollar reliance without demanding political integration. That is not a flaw. That is the point.

Why the Push Has Gained Urgency

Timing matters. The renewed momentum behind the BRICS currency debate is not accidental. It reflects a convergence of pressures that have altered the global economic landscape.

Several forces are at play:

- Financial sanctions have exposed the fragility of access-based systems

- Higher US interest rates have exported inflation and instability

- Supply-chain disruptions have raised the cost of dollar-based trade

- Digital payment technologies have matured faster than regulation

Add to this the expansion of BRICS itself. With new members and partners, many of them energy producers or major trading economies, the bloc’s economic footprint has grown substantially. Scale alters the range of what is possible. What once seemed largely symbolic now appears more conceivable in limited, case-specific applications.

This does not mean a sudden break from the dollar. It means experimentation at the margins, where risk is lower and incentives are clearer.

The Argument for a Financial Shift

Supporters of the BRICS initiative do not argue that the dollar is about to collapse. What they argue is more measured: that the era of uncontested monetary dominance is fading.

Their case rests on several claims.

First, efficiency. Settling trade in local or BRICS-linked currencies can reduce transaction costs, currency conversion losses, and dependence on intermediary banks. For developing economies, these are not trivial savings.

Second, resilience. Financial autonomy is increasingly framed as a component of national security. The ability to trade and invest without exposure to external pressure has become a strategic objective.

Digital currencies and interoperable payment systems offer the possibility of bypassing parts of legacy infrastructure, though most remain experimental and constrained by regulation, trust, and cross-border coordination. This is not about ideology; it is about speed and flexibility, tempered by unresolved questions around governance, security, and cross-border trust.

Fourth, alignment. Many countries in the Global South share concerns about dollar volatility and Western conditionality. A BRICS-led framework offers an alternative without demanding political allegiance.

Taken together, these factors suggest not a revolution, but a recalibration.

Possible Monetary Pathways for BRICS

| Approach | Core Idea | Precedent | Likelihood |

|---|---|---|---|

| Single Common Currency | One currency, one policy | Eurozone | Very low |

| Basket-Based Unit | Weighted currency index | IMF SDR | Moderate |

| Trade Settlement Currency | Limited to trade use | Bilateral swaps | High |

| Digital Interoperability | Linked CBDCs | Ongoing pilots | Very high |

Why the Challenges Are Real

None of this means the path is smooth. Structural constraints remain significant, and ignoring them would be naive.

The first is economic imbalance. China’s economy far exceeds that of other BRICS members. Any shared mechanism risks becoming yuan-dominated, which raises legitimate concerns about asymmetry rather than independence.

The second is policy divergence. Inflation control, capital mobility, and exchange-rate regimes differ sharply across the bloc. Coordination, even at a technical level, is difficult.

The third is trust. Currencies ultimately rest on confidence—in institutions, governance, and dispute resolution. BRICS lacks a shared framework capable of sustaining that trust at scale.

The fourth is market depth. The dollar’s power is reinforced by deep financial markets, hedging instruments, and legal predictability. These ecosystems cannot be built quickly.

This is why BRICS leaders consistently avoid language about replacing the dollar. Their focus remains firmly on alternatives, not substitutes.

Is This Really De-Dollarisation?

The term “de-dollarisation” is often misunderstood. It does not imply abandonment. It implies diversification.

What is emerging across BRICS resembles portfolio management, even if it is driven more by national risk assessments than by collective design.

- reducing exposure rather than eliminating it

- spreading risk across currencies and systems

- creating options where none existed

This is already visible in trade invoicing, reserve composition, and payment experimentation. None of it threatens the dollar’s dominance in the short term. But collectively, it reduces exclusivity.

From this angle, the BRICS initiative aligns with broader global trends rather than opposing them.

Dollar System vs BRICS-Led Alternatives

| Factor | Dollar-Based System | BRICS Alternatives |

| Institutional Trust | High, but politicised | Limited, evolving |

| Market Liquidity | Extremely deep | Fragmented |

| Sanctions Risk | High leverage | Lower exposure |

| Technological Design | Legacy-heavy | Digital-first |

| Adoption Curve | Slow | Experimental but fast |

The Skeptical View

Critics argue that the BRICS currency debate overstates coherence and understates constraint. They point out that most intra-BRICS trade is still conducted in dollars, that capital controls and currency volatility limit the appeal of local-currency settlement, and that firms, not governments, ultimately choose invoicing currencies based on liquidity and hedging options. From this perspective, de-dollarisation efforts reflect political signalling more than structural change, constrained by the absence of deep financial markets, shared legal frameworks, and investor trust. In this view, the dollar’s dominance persists not because alternatives are suppressed, but because they remain less functional at scale.

India’s Cautious Calculus

India’s stance illustrates the internal diversity of BRICS. Unlike Russia or China, India does not frame the dollar as an adversary. It sees value in stability and access, even as it explores alternatives.

India supports:

- local currency trade

- digital payment interoperability

- incremental financial autonomy

At the same time, it avoids any step that could undermine macroeconomic stability or provoke unnecessary confrontation. This balancing act reflects a broader truth: BRICS is not a unified bloc with a single worldview. It is a coalition of overlapping, sometimes competing interests.

That diversity slows progress—but it also prevents reckless acceleration.

The Quiet Role of BRICS Institutions

The most meaningful shifts are not happening in speeches, but in institutions. The New Development Bank, for instance, has steadily increased local-currency lending. This does not grab headlines, but it matters.

Rather than announcing a new currency, BRICS is building alternative financial plumbing. Less dramatic. More durable.

History suggests this approach is more likely to endure.

Three Plausible Outcomes

Looking ahead, three scenarios appear realistic.

A functional outcome, where digital settlement systems gain traction within BRICS and partner economies, reducing dollar usage in trade without destabilising markets.

A symbolic outcome, where the idea remains politically useful but operationally limited.

A crisis-driven outcome, where geopolitical or financial shocks accelerate adoption in ways no planner anticipated.

Monetary history shows that systems change not by design alone, but under pressure.

Pipe Dream or Pragmatic Shift?

Calling the BRICS currency a pipe dream misses the point. It is not a single project with a fixed endpoint. It is a process…uneven, experimental, and deliberately cautious.

Calling it a revolution overstates its speed. Revolutions are abrupt. This is incremental.

What the BRICS currency debate really signals is a changing world:

- trust in financial neutrality is weakening

- monetary power is becoming more distributed

- technology is lowering entry barriers

The dollar will remain dominant for the foreseeable future. But dominance is no longer synonymous with monopoly.

Between Vision and Viability: What Will Actually Determine Success

Whether the BRICS currency initiative evolves into something consequential will not be decided by declarations or summit communiqués. It will be determined by a narrower, more prosaic set of variables that rarely attract headlines but ultimately govern monetary outcomes. The distance between ambition and impact, in this case, is measured less in political will than in institutional capacity, market behaviour, and credibility over time.

The first determinant is usage, not announcement. Currencies gain relevance because firms, banks, and investors choose them—not because governments endorse them. Even within BRICS, private-sector actors remain highly sensitive to liquidity, hedging availability, settlement speed, and legal enforceability. As long as the dollar offers superior depth across these dimensions, it will remain the default choice for large-scale trade and finance. Any BRICS-linked mechanism that fails to meet these practical thresholds will remain peripheral, regardless of geopolitical enthusiasm.

The second factor is trust asymmetry within the bloc itself. BRICS is often discussed as a collective, but its members occupy vastly different positions in the global financial hierarchy. China’s currency is more internationalized than those of its partners, yet it remains constrained by capital controls. India’s financial system is deepening but remains cautious by design. Russia operates under sanctions that shape its incentives differently. These divergences complicate coordination. A shared system cannot advance faster than the comfort level of its most risk-averse participants, nor can it function smoothly if it is perceived as disproportionately benefiting one member over others.

Third is the institutional question. Monetary systems endure when they are supported by credible dispute resolution, transparency, and rule-bound governance. This is where BRICS faces its steepest climb. Unlike the Bretton Woods institutions or even regional arrangements such as the eurozone, BRICS lacks a dense web of binding rules and enforcement mechanisms. That absence is intentional—it preserves sovereignty—but it also limits scalability. Incremental cooperation works well for pilot projects and bilateral settlements; it becomes harder when volumes rise and disputes inevitably follow.

Technology, often framed as a shortcut, is better understood as an accelerant rather than a substitute. Digital payment systems, central bank digital currencies, and cross-border interoperability can reduce friction, but they cannot manufacture trust where it does not exist. Nor can they fully bypass regulatory, legal, and political constraints. The risk for BRICS is not technological failure, but overestimating what technology alone can resolve. Successful monetary innovation historically follows institutional consolidation, not the other way around.

External conditions will also matter. Periods of global stability tend to reinforce incumbent systems; periods of crisis expose their weaknesses. If the global economy remains relatively predictable, BRICS-led alternatives are likely to expand slowly and selectively. If, however, financial fragmentation deepens through sanctions escalation, payment-system disruptions, or abrupt shifts in monetary policy, the incentive to adopt non-dollar pathways will intensify. In that sense, the future of the BRICS currency effort may be shaped as much by Washington and Brussels as by Beijing or New Delhi.

Crucially, success does not require displacement. A modest but durable reduction in dollar reliance across specific corridors… energy trade, development finance, regional supply chains, would already mark a significant shift. Monetary influence is not binary. It accumulates through repetition, normalization, and habit. Systems that appear marginal for years can become indispensable under the right conditions.

What this suggests is a narrowing of expectations. The most plausible outcome is not a dramatic realignment of the global monetary order, but the emergence of a layered system: the dollar at the core, complemented by alternative channels that absorb pressure, provide optionality, and reduce vulnerability at the margins. That may fall short of the rhetoric that often surrounds BRICS summits, but it would still represent a meaningful adaptation to a more fragmented world.

In that light, the BRICS currency debate is less about replacing an old system than about preparing for its imperfections. The question is no longer whether the dollar will dominate, but whether dominance can coexist with choice. The answer to that question will define the next phase of global finance.

The Path Forward

The BRICS currency debate is not about overthrowing the dollar. It is about insurance, autonomy, and flexibility in a fragmented global economy. Its success will not be measured by the launch of a new currency, but by quieter outcomes: smoother trade, diversified reserves, and resilient payment systems.

In that sense, it is neither fantasy nor upheaval. It is an adaptation.

And in a world where financial certainty is increasingly scarce, adaptation may prove to be the most radical strategy of all.