Bitcoin, the world’s largest and most well-known cryptocurrency, has experienced a significant price correction, falling to $115,000 as of late July 2025. The drop comes after Bitcoin reached a new all-time high of $123,000 earlier this month, fueled by institutional buying, ETF momentum, and retail enthusiasm.

However, momentum has now shifted, with institutional investors starting to offload their Bitcoin positions and reallocate capital toward Ethereum, the second-largest cryptocurrency by market cap. This shift in focus has contributed to the downward pressure on Bitcoin, which is struggling to maintain key technical support.

Key Resistance and Bearish Outlooks: Why $115,000 Matters

Market analysts are closely watching the $115,000 price level, which has become a crucial resistance zone for Bitcoin. The inability to hold above this mark has raised concerns among short-term traders and technical analysts, who now warn of a potential retreat to $111,000—Bitcoin’s former record high from early 2025.

Such retracements are not unusual in the crypto space. Historically, Bitcoin has gone through sharp corrections following major rallies, often pulling back to retest previous highs or key support levels before resuming an upward trend. In this case, however, Bitcoin has yet to test its last major breakout point, raising speculation that further downside could be ahead.

Bearish projections are increasing in volume, with some traders forecasting that unless strong demand reappears near $115,000, a move to the $110,000–$108,000 range is possible in the short term. On-chain metrics, including exchange inflows and miner wallet activity, also suggest that more BTC may be entering the market for liquidation.

Market Rotation: Capital Flows Into Ethereum

While Bitcoin struggles to maintain support, Ethereum (ETH) is rapidly gaining investor attention. Ethereum has outperformed most major assets over the past month, currently trading at $3,600—its highest level of the year. Over the last 30 days, ETH has climbed over 50%, significantly outpacing Bitcoin’s year-to-date return.

This surge is driven by renewed confidence in Ethereum’s ecosystem and a shift in investor strategy. Ethereum is increasingly viewed not only as a digital asset but as a foundational layer for decentralized applications, NFTs, Web3 services, and DeFi protocols.

As a result, large institutional investors and high-net-worth individuals are rotating their holdings from Bitcoin to Ethereum. This capital reallocation reflects growing belief that Ethereum offers higher upside potential in the short to medium term due to ongoing technological upgrades and expanding use cases.

Ethereum Poised for a New Cycle: Predictions of $8,000 to $10,000

Several market analysts and blockchain investment firms have recently updated their Ethereum forecasts for 2025. Many now expect the ETH price to reach between $8,000 and $10,000 by year-end, assuming current momentum continues.

This bullish projection is based on several key developments:

-

Ethereum’s transition to Proof-of-Stake through the Merge has drastically reduced its energy consumption.

-

EIP-1559, the fee burn mechanism, has made ETH more deflationary over time.

-

Upcoming Layer-2 scaling solutions, including zk-Rollups and Optimistic Rollups, are improving network scalability and user experience.

-

Institutional adoption of ETH staking is growing via platforms like Coinbase and Lido, locking up more supply and reducing market float.

In contrast to Bitcoin, which functions primarily as a digital store of value, Ethereum’s versatility has positioned it as a core infrastructure asset in the blockchain economy.

August Seasonality and Bitcoin’s Historical Performance

Seasonal trends are also working against Bitcoin’s performance. Historically, August is one of the weakest months for cryptocurrencies in terms of price performance and trading volume. This pattern has been consistent for over a decade, with multiple sources like CoinGlass and Messari showing negative returns for Bitcoin in most Augusts since 2013.

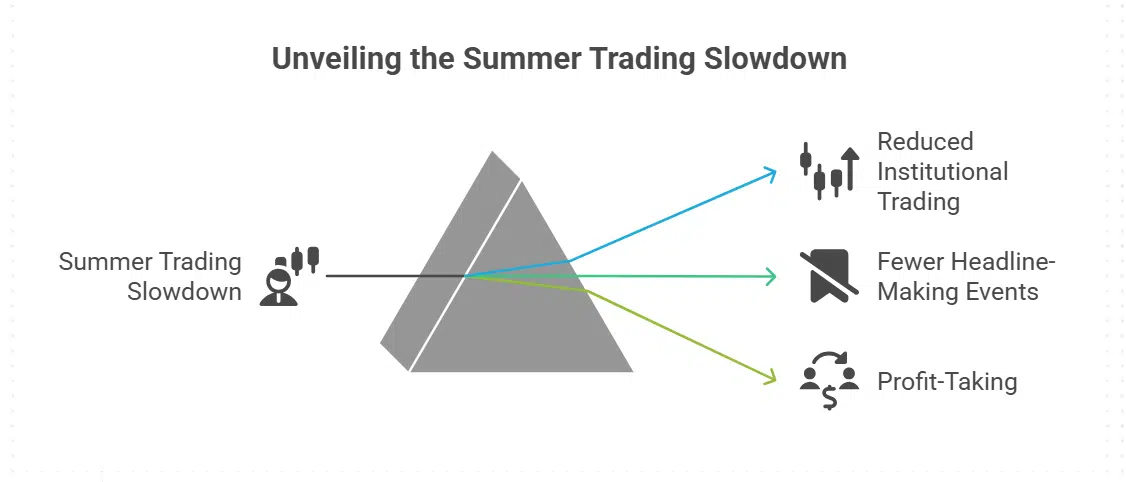

The reasons behind this seasonal dip include:

-

Reduced institutional trading volumes during summer.

-

Fewer headline-making events or policy announcements.

-

Profit-taking by traders after strong second-quarter rallies.

Although Bitcoin is still up 24% year-to-date, recent weeks have seen a significant pullback. The cryptocurrency’s three-month gain of 25.99% reflects the earlier breakout phase but masks the current softness in price momentum.

Should You Buy Bitcoin Now? Caution or Opportunity

Given the volatility, the question many retail investors are asking is whether this dip presents a buying opportunity or a warning sign of deeper correction.

Unlike equities, Bitcoin does not receive formal buy or sell ratings from Wall Street firms due to regulatory reasons. However, analysts and crypto funds rely on technical indicators and on-chain metrics to assess potential entry points.

A few key signals to consider:

-

Relative Strength Index (RSI) for Bitcoin is moving toward oversold territory.

-

Exchange reserves are increasing, suggesting potential selling pressure.

-

Hash rate remains stable, indicating miner confidence.

For long-term holders, Bitcoin’s current price range may represent an attractive accumulation zone. However, for short-term traders, caution is advised until Bitcoin reclaims support above $118,000–$120,000.

Ethereum Dominance Rises in the Crypto Market

As Ethereum continues to attract inflows, its share of the total crypto market cap is rising. Known as ETH dominance, this metric has climbed steadily in recent weeks and now sits at over 22%, compared to Bitcoin’s declining dominance of around 48%.

This shift reflects how investors are prioritizing blockchain platforms that can power a wide range of applications—DeFi, NFTs, tokenized assets, and more. With Ethereum leading development across all these sectors, its market strength is likely to continue through Q3 and Q4.

Key Stats Summary (as of July 25, 2025):

| Cryptocurrency | Current Price | 30-Day Performance | Year-to-Date Return |

|---|---|---|---|

| Bitcoin (BTC) | $115,000 | -6.5% | +24% |

| Ethereum (ETH) | $3,600 | +52% | +61% |

Market at a Crossroads

The crypto market is experiencing a moment of divergence. Bitcoin, after a record-setting surge, is undergoing a healthy but sharp correction. Meanwhile, Ethereum is riding a powerful wave of momentum driven by strong fundamentals and rising institutional adoption.

Investors should watch key resistance and support levels carefully. For Bitcoin, the $115,000 zone is a pivot point. For Ethereum, any close above $3,800 could signal the next leg higher toward the $4,500 resistance level.

Ultimately, whether one sees the current moment as a buy-the-dip opportunity or a signal to wait depends on investment goals, risk tolerance, and belief in the underlying technology.