After a sluggish start to 2025, the cryptocurrency market is showing strong signs of recovery. Early excitement following Donald Trump’s presidential win had briefly sparked record highs in major cryptocurrencies. But for months, the momentum faded. Now, however, a renewed wave of optimism—fueled by stable interest rates, corporate earnings, and a tentative trade deal—has pushed the crypto market back into the green. And Ethereum might be leading the charge.

A New Chapter for Bitcoin: BTC Crosses $100,000

Bitcoin, the world’s largest cryptocurrency by market capitalization, surged past the much-anticipated $100,000 threshold this week. As of Friday, it traded at approximately $103,000, representing a more than 5% gain over the past seven days. This rally comes after several months of volatility, during which Bitcoin saw prices dip as low as $72,000 following a post-election speculative boom.

So, what’s driving the recent surge?

Market Sentiment Is Rebounding

Investor confidence returned to the broader financial markets this week, which lifted risk-on assets like cryptocurrencies:

-

Federal Reserve Holds Interest Rates Steady: The U.S. Federal Reserve’s decision not to hike interest rates during its May meeting reassured investors. With inflation data cooling and economic indicators holding firm, investors believe aggressive tightening is behind us. (Barron’s)

-

Wall Street’s Earnings Season Stays Solid: Better-than-expected earnings from key tech and financial firms helped stabilize U.S. markets. As a result, the S&P 500 and Nasdaq both posted weekly gains—giving further strength to digital asset prices.

-

Trump’s Trade Announcement: President Trump’s tentative announcement of a new trade deal, reportedly with the United Kingdom, has improved the outlook for global commerce. This deal, combined with speculation about reduced tariffs on China, helped boost investor morale. (Business Insider)

-

Institutional Inflows: According to data from CoinShares and Reuters, institutional investors have poured nearly $1.8 billion into Bitcoin-related products over the past few weeks—indicating strong long-term confidence in the crypto asset class.

Ethereum Makes a Major Comeback

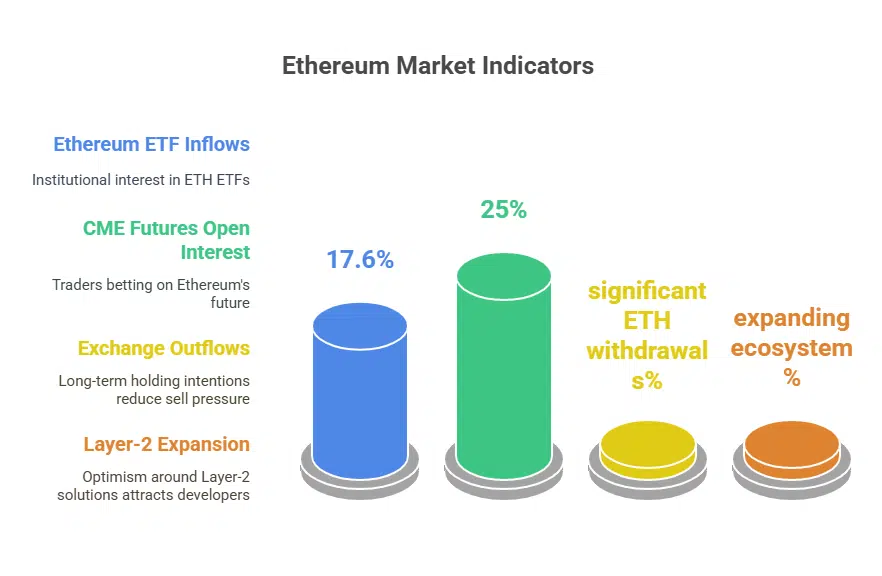

While Bitcoin’s return to the spotlight grabbed headlines, Ethereum’s (ETH) performance has been equally, if not more, remarkable. Ethereum gained 25% over the past seven days, briefly reaching $2,300, driven by multiple bullish factors:

Institutional Interest Spikes

-

Ethereum ETF Inflows: Ether-focused exchange-traded funds recorded net inflows of $17.6 million just this week, according to data from Blockchain.News. That surge indicates growing institutional interest in ETH-based financial products.

-

CME Futures Open Interest: The open interest in Ethereum futures on the Chicago Mercantile Exchange jumped 25%, signaling that traders are betting big on the future of the asset.

-

Exchange Outflows: On-chain analytics firm Glassnode reported significant ETH withdrawals from major exchanges like Binance. Such moves often reflect long-term holding intentions, reducing sell pressure and helping stabilize price momentum.

-

Layer-2 Expansion: Ethereum’s ecosystem is expanding, with optimism around Layer-2 solutions like Arbitrum and Optimism continuing to attract developers and DeFi projects.

Altcoins Join the Rally: Solana, BNB, XRP Show Gains

The broader altcoin market also saw upward momentum:

-

Solana (SOL) rose 13% to approximately $169. As one of the fastest Layer-1 blockchain networks, Solana has benefited from growing NFT activity and the launch of new DeFi protocols.

-

BNB (Binance Coin) gained around 5%, trading at $662, amid signs that Binance is stabilizing its global regulatory footprint after a turbulent 2024.

-

XRP also posted moderate gains, trading at $2.39, as Ripple continues to expand its remittance partnerships in Asia and Latin America.

Crypto markets seem to be re-aligning with equities, suggesting that digital assets are now increasingly seen as high-risk, high-reward components of traditional portfolios.

Controversy Surrounds Trump’s Meme Coin: Ethics, Law, and Crypto Collide

While the market outlook is turning bullish, one crypto story is raising more eyebrows than excitement: the controversy surrounding $TRUMP, the unofficial meme token associated with the 45th—and now again, 47th—President of the United States.

What Is Trump Coin?

Dubbed “Trump Coin” or $TRUMP, the token was launched just days before Trump’s inauguration in January 2025. It quickly drew attention from both supporters and speculators. Promoted heavily on social media and linked to exclusive access events, the token gained momentum fast—but so did legal concerns.

Exclusive Events Raise Ethical Red Flags

As reported by Bloomberg, the developers behind Trump Coin recently announced a controversial promotion:

“More than 200 of the meme coin’s largest holders would be invited to a dinner with President Trump at his golf club in Virginia on May 22. The top 25 holders would receive VIP access and a private reception.”

The move has sparked widespread backlash. Critics say this crosses ethical lines—essentially turning financial support into political access. The idea that access to the President could be “bought” through meme coin accumulation has alarmed watchdog groups.

Foreign Investors and Campaign Finance Concerns

Another troubling dimension: According to blockchain analysis firms and media investigations, a large percentage of token volume came from overseas buyers, especially in crypto hubs like Singapore, Dubai, and the Cayman Islands.

Legal analysts warn that if these tokens are linked to campaign contributions, this may violate U.S. campaign finance laws, which prohibit foreign nationals from contributing to federal election campaigns.

Who Profited?

According to data analyzed by CryptoQuant and reported in Mint, while over 764,000 small-scale investors suffered losses on the Trump coin, just 58 wallets reportedly made over $1 billion in combined profits—suggesting a highly centralized distribution.

Additionally, the coin’s creators reportedly earned $334 million in fees and royalties—raising concerns about exploitative tokenomics.

Lawmakers Respond with Proposed “MEME Act”

In response, a group of U.S. Senators led by Chris Murphy (D-CT) and Richard Blumenthal (D-CT) introduced the “MEME Act” (Memecoin Ethics & Misuse Elimination Act) in early May. The proposed law would bar current or former federal officials from promoting or financially benefiting from digital assets during or shortly after holding office.

Crypto’s Resurgence Is Real—but Risks Remain

The crypto market’s latest rally signals renewed optimism. With Bitcoin reclaiming historic highs and Ethereum showing strong fundamentals, institutional interest is returning with force. However, the growing intersection between politics and digital assets is raising red flags that can’t be ignored.

As crypto matures, so too must its legal and ethical boundaries. Investors, regulators, and policymakers all face the challenge of navigating a rapidly evolving landscape—where innovation, speculation, and influence intersect in unprecedented ways.