Hey there, are you curious about making money in a thrilling, new digital space, but unsure where to begin? The metaverse, a vast online environment full of virtual worlds, can feel like a complex challenge, especially with virtual real estate.

You might question whether investing in digital land is worth your time or hard-earned cash.

Surprisingly, the market for virtual property is thriving, with sales of digital assets exceeding $500 million in 2021 alone. That’s an incredible amount of money for something intangible, isn’t it? In this blog, I’ll outline the top places to invest in virtual real estate, such as Decentraland and The Sandbox, and share straightforward strategies to generate profit using NFTs and blockchain technology.

Stay with me, and let’s discover this together!

Key Takeaways

- Virtual real estate sales hit over $500 million in 2021, showing a booming market.

- The Sandbox has over 2 million monthly active users and saw $85 million in land sales in 2022.

- Decentraland land prices jumped from $6,000 in 2021 to $15,000 by early 2022.

- Somnium Space land starts at $3,000, with over 150,000 active users joining the platform.

- The metaverse market is worth $47 billion now and could reach $800 billion by 2024.

Top Factors That Determine Virtual Real Estate Value

Hey there, wanna know what makes virtual real estate a hot deal in the metaverse? Stick with me, and let’s uncover the key pieces that drive the worth of digital land!

Platform popularity and activity

Platform popularity plays a big role in virtual real estate value. Think of it like a hot neighborhood in the real world, where everyone wants to be. In the metaverse, platforms like The Sandbox, with over 2 million monthly active users, show huge demand.

More users mean more eyes on your digital land, bumping up its worth fast.

Activity levels also matter a ton. A buzzing platform, packed with events and user-generated content, keeps virtual worlds alive. Take The Sandbox again, they racked up $85 million in virtual land sales in 2022.

That kind of action tells you people are eager to buy, build, and play in these digital spaces. Stick with lively spots, and your investment could shine!

Location within the metaverse

Hey there, folks, let’s talk about why location is crucial in the metaverse for securing virtual real estate. Think of it like choosing a spot in a lively city, where proximity to the excitement can significantly increase your property’s value.

In virtual worlds like Decentraland, a piece of digital land close to popular hubs or trending events attracts more avatars and enhances user interaction. Land prices there surged from $6,000 in 2021 to an impressive $15,000 by early 2022, demonstrating just how valuable a top location can be.

Now, envision acquiring virtual property in Somnium Space, where prices start at $3,000 depending on the spot and current demand. A location near active areas or exciting virtual experiences, like concerts, can grab attention and pull in visitors.

It’s all about being at the center of the digital community, where brands and groups gather on the Ethereum blockchain. So, choose carefully, and you might just secure a treasure in these captivating environments!

Scarcity and market trends

Scarcity drives the buzz in virtual real estate, folks. In the metaverse, digital land is limited, just like physical plots. This shortage pumps up the value of virtual land parcels, making them hot property.

Think of it as a rare comic book, only a few exist, so everyone wants a piece. With virtual land sales topping $500 million in 2021, you can see the frenzy.

Market trends also play a big role in this digital ecosystem. The metaverse market sits at $47 billion now, with projections soaring to $800 billion by 2024. Plus, virtual property values are set to jump from $4.12 billion in 2025 to $67.40 billion by 2034.

So, spotting trends on platforms like Decentraland or The Sandbox can mean big profits. Keep your eyes peeled for hype around NFTs and blockchain technology, as they fuel this wild ride.

Best Metaverse Platforms for Real Estate Investments

Hey there, wanna know where to grab the hottest virtual land in the metaverse? Stick with me, and let’s check out some top spots to invest your digital dollars!

Decentraland

Let’s talk about Decentraland, a leading destination in the metaverse for virtual real estate. This digital environment operates on the Ethereum blockchain, and you purchase items using MANA tokens.

Envision owning a plot of land in this space, where a single parcel once fetched an astonishing $2.43 million. That’s a significant investment for digital property!

Now, visualize this virtual arena alive with exciting events. Decentraland hosted the inaugural Metaverse Fashion Week, showcasing prominent brands like Dolce & Gabbana. Additionally, their virtual Burning Man event attracted over 50,000 participants.

With such strong user involvement, it’s evident why investors are considering virtual property here for substantial gains in this digital landscape.

The Sandbox

Hey there, readers, let’s talk about a popular destination in the metaverse known as The Sandbox. This platform, launched in 2020, is a major player in virtual real estate and gaming, attracting over 2 million monthly active users.

It operates using SAND tokens, a form of digital currency, and emphasizes metaverse gaming with a wealth of user-generated content. Envision crafting your own virtual worlds with their toolkit, which already includes 18,000 user-created assets!

Now, imagine this: marketplace transactions on The Sandbox reached over $350 million in 2022. That’s an enormous amount of money for digital land and virtual assets! If you’re interested in virtual property, this platform provides a thriving digital economy.

Secure some land NFTs, design unique virtual experiences, or simply trade on the ethereum blockchain. It’s like staking a claim in a new territory, brimming with opportunities to profit and expand.

Voxels (Formerly Cryptovoxels)

Voxels, once known as Cryptovoxels, is an exciting place in the metaverse for virtual real estate enthusiasts. It’s all about creativity, everyone, with over 500 digital art galleries to discover.

Envision owning a slice of digital land where art enthusiasts come together, isn’t that impressive?

This platform showcases incredible virtual art exhibitions and auctions, featuring a prestigious Sotheby’s gallery. If you’re passionate about virtual property, Voxels offers a vibrant digital community to explore.

Plus, it generated $5 million in revenue from virtual land in 2022, so the excitement is undeniable!

Somnium Space

Hey there, folks, let’s chat about Somnium Space, a hot spot in the metaverse for virtual real estate. This platform is buzzing with over 150,000 active users, and it offers some cool tools for building digital land parcels.

Imagine crafting your own virtual world, right from scratch, on the Ethereum blockchain!

Guess what? Land prices here kick off at around $3,000, based on where it’s at and how much folks want it. With such a lively crowd and advanced development tools, Somnium Space draws in real estate investors looking to snag digital assets.

So, if you’re itching to jump into virtual property or host virtual experiences, this place might just be your ticket!

Strategies for Maximizing Returns on Virtual Properties

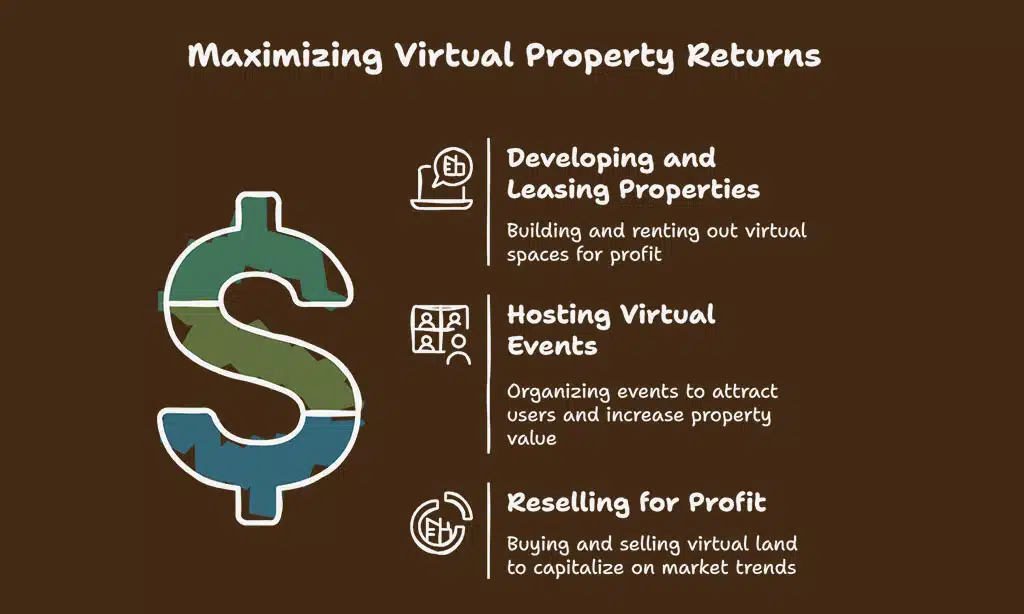

Hey, wanna make the most of your virtual land in the metaverse? Let’s chat about some slick ways to boost your profits with digital assets like NFTs and tokenized parcels!

Developing and leasing properties

Building up virtual land in the metaverse is a popular trend right now. Think of it as flipping a house, but in a digital environment. You acquire some digital real estate, enhance it with unique designs or games, and then rent it out.

Renting land parcels in high-traffic areas, especially on platforms like Decentraland or The Sandbox, can generate significant returns. Folks want spots where many users gather, so location is crucial.

Imagine being a digital landlord, leasing out your virtual property for events or shops. You can also provide advertising space or branded experiences to businesses looking to connect with the metaverse audience.

With blockchain technology securing your ownership through NFTs, it’s like having a deed no one can tamper with. So, start developing these virtual spaces, and see your cryptocurrency wallet increase with rents from tenants.

Hosting virtual events and experiences

Hey there, folks, let’s chat about making a splash with virtual events in the metaverse. Picture throwing a massive party, like virtual concerts or cool exhibitions, right on your digital land.

These gatherings, built on platforms using blockchain technology, pull in huge crowds. Take Decentraland’s 2022 Metaverse Music Festival, for instance, it drew over 80,000 users across just four days.

That’s a big deal for boosting your virtual property’s worth.

Now, imagine hosting conferences or wild virtual experiences on your plot. It’s like turning your digital real estate into a hot spot where everyone wants to hang out. With NFTs securing ownership, you can monetize these events on metaverse platforms.

So, get creative with user engagement, and watch your virtual land parcels become the talk of the digital ecosystem.

Reselling for profit

Let’s talk about earning quick cash by reselling virtual real estate in the metaverse. Imagine snagging a plot of digital land in a popular area like Decentraland at a low price, and then, suddenly, prices soar from $6,000 in 2021 to $15,000 by early 2022.

That’s a significant profit waiting for you if you make the right moves.

Flip that virtual property quickly, and you’re capitalizing on market trends. Target locations with strong interest, create something striking, and sell it for a gain. With platforms leveraging blockchain technology and NFTs, or non-fungible tokens, your digital assets are safely stored on the Ethereum blockchain.

So, explore this virtual economy, and see your investment increase!

Risks and Challenges of Investing in Virtual Real Estate

Hey, investing in virtual real estate can be a wild ride, full of ups and downs. Watch out, though, because the market can shift faster than a roller coaster, and you might face some tricky legal bumps along the way.

Market volatility

Market swings in virtual real estate can hit hard, folks. Prices for digital land in the metaverse often jump or crash without much warning. This wild ride, known as market volatility, ties straight to speculation and hype.

One day, a plot in Decentraland might cost a fortune, and the next, it’s worth peanuts. It’s a bit like playing the stock market on fast forward, and you’ve gotta keep your eyes peeled.

On top of that, scams and cyberattacks add fuel to this fire. Fraud can trick you out of your digital assets in a snap, while security breaches threaten your cryptocurrency wallet.

Imagine buying virtual property, only to lose it to a sneaky hacker. Staying sharp and guarding your investments in this digital ecosystem is a must with such risks lurking around.

Legal and regulatory uncertainties

Hey there, let’s chat about a tricky part of virtual real estate in the metaverse. See, investing in digital land or properties tied to blockchain technology sounds awesome, but it’s not all smooth sailing.

Governments might step in with rules about data privacy, taxes, and user rights. Back in 2021, the European Union even floated ideas for such laws. So, your ownership of virtual assets or NFTs could face new limits or costs.

Now, here’s another catch. Since ownership often depends on blockchain and tokenization, what happens if a metaverse platform shuts down? Your digital ecosystem investment might just vanish.

It’s a real risk with no clear fix yet. Stay sharp about these legal twists in virtual worlds, folks, because they can mess with your plans for digital real estate.

Takeaways

Well, folks, investing in virtual real estate within the metaverse is like striking gold in a digital Wild West. Think of platforms like Decentraland and The Sandbox as your new frontier towns, buzzing with chances to buy digital land and build cool stuff.

I’m telling ya, with the right moves, your virtual property could turn into a cash cow. So, jump into this wild online world, and let’s see where your avatar takes you next!

FAQs

1. What exactly is virtual real estate in the metaverse, and why should I care?

Hey, think of virtual real estate as digital land in virtual worlds like The Sandbox or metaverse platforms. It’s property you can buy as NFTs, non-fungible tokens, using a cryptocurrency wallet, and it’s tied to blockchain technology like the Ethereum blockchain. Folks, it’s a hot ticket right now, with market growth soaring as tech giants dive into this digital ecosystem!

2. Where can I snag the best virtual property deals right now?

Check out spots like Decentraland or Axie Infinity for prime virtual land parcels. They’re buzzing with community engagement and user-generated content, making your digital assets pop with value.

3. How do I even buy digital real estate, buddy?

Well, you’ll need some crypto, like BTC or Sand tokens, in your cryptocurrency wallet to grab land NFTs or tokenized assets. Just hop onto metaverse gaming platforms, pick your virtual land, and seal the deal on the blockchain. Watch out for market volatility though, it’s a wild ride!

4. Is there money to be made with virtual land leasing or other tricks?

Oh, absolutely, pal, you can play landlord in these virtual environments by leasing out your digital real estate to others for virtual concerts or immersive experiences. It’s like being a mogul in a digital economy, especially if you tap into blockchain games or virtual reality, VR, setups.

5. What’s the catch with investing in metaverse land, huh?

Listen up, there’s stuff like crypto winters and bear markets that can freeze your crypto assets faster than a popsicle in a blizzard. Plus, cybersecurity is a biggie, you gotta protect your virtual assets from digital bandits. And don’t forget taxation, Uncle Sam might want a slice of your virtual pie via the Federal Trade Commission rules!

6. Why are places like Bored Ape Yacht Club or Yuga Labs getting all the hype?

Man, these names are gold in the metaverse because they mix virtual experiences with crazy popular NFTs. They’re building digital economies with network effects that pull in target groups via social media buzz. If you’re into entrepreneurship, snagging virtual property near their zones could be like striking oil in a virtual desert!