Selecting the right student loan refinancing options is one of the most effective ways to lower your monthly debt burden in 2026. These financial products allow you to replace multiple high interest loans with a single new loan at a lower interest rate. By securing better terms you can save thousands of dollars over the life of your repayment journey.

The current economic landscape has seen a stabilization in rates which makes now an ideal time to compare different lenders. Utilizing the student loan refinancing options on this list can help you pay off your debt faster while freeing up cash for other life goals. This guide provides a detailed look at the top lenders helping graduates regain control of their financial future.

Selection Criteria For Our Top Rankings

We evaluated dozens of national and regional lenders to find the most competitive products for modern borrowers. Our team prioritized firms that offer transparent pricing and robust protection programs for those facing financial hardship. The following weighting shows how we determined the final rankings for this year.

| Criterion | Weighting |

| Interest Rates | 35% |

| Repayment Flexibility | 25% |

| Fee Structure | 20% |

| Customer Support | 20% |

Discovering The 10 Best Student Loan Refinancing Options For Success

The following list contains the most reliable and competitive lenders currently operating in the United States. Each selection provides unique benefits ranging from zero fees to specialized income based repayment plans. These options will help you find the perfect match for your specific credit profile and financial needs.

1. SoFi

SoFi remains a dominant force in the market by offering a comprehensive suite of member benefits alongside competitive rates. They provide a seamless digital application process that caters to high earning professionals and medical residents. The platform is famous for its lack of hidden fees and its commitment to helping members achieve broader financial success through career coaching. This is a vital resource for anyone looking to scale their digital marketing efforts.

Special Features:

-

Access to one on one career coaching and financial planning sessions

-

Unemployment protection that pauses payments while helping you find work

-

No application or origination or late payment fees ever

Things To Consider:

-

Typically requires a higher credit score for the best advertised rates

-

Does not offer a traditional cosigner release program

Best For: High earning professionals and those seeking career support

2. Earnest

Earnest is widely recognized for its extreme flexibility in allowing borrowers to customize their monthly payments. You can pick an exact monthly payment that fits your budget and the software will calculate your precise loan term. They also allow eligible borrowers to skip one payment every year without penalty. This makes it a top choice for those who want a highly personalized repayment experience. It remains a reliable staple for those focused on deep financial authority.

Special Features:

-

Precision pricing that allows you to choose your exact monthly payment

-

Ability to skip one payment per year for any reason after six months

-

Switch between fixed and variable rates once every six months

Things To Consider:

-

Does not allow for the use of cosigners on their refinance loans

-

Not available to borrowers who live in the state of Nevada

Best For: Borrowers who want total control over their payment schedule

3. RISLA

The Rhode Island Student Loan Authority stands out as a rare nonprofit option that offers national availability. They are one of the few private lenders to offer an income based repayment plan similar to federal options. This provides a significant safety net for borrowers who are worried about future fluctuations in their salary. Their rates are consistently among the lowest in the nonprofit sector. It simplifies the bridge between research and writing.

Special Features:

-

Income based repayment program for those facing financial hardship

-

Specialized nursing forgiveness program for qualifying residents

-

Low fixed interest rates that do not change over time

Things To Consider:

-

Only offers fixed rate loans with no variable rate options

-

Application process may feel more traditional than newer fintech sites

Best For: Borrowers seeking federal-style protections in a private loan

4. Laurel Road

Laurel Road is the premier choice for healthcare professionals including doctors and dentists and nurses. They offer specialized discounts for members of the American Medical Association and other professional groups. Their platform is designed to handle the high debt loads typically associated with medical and graduate degrees. They provide a very streamlined experience for those with advanced educational backgrounds. It is an essential tool for those focused on authority building.

Special Features:

-

Dedicated specialized rates and discounts for healthcare practitioners

-

Ability to refinance during the final semester of your degree

-

Economic hardship forbearance for up to twelve months total

Things To Consider:

-

Maximum benefits are heavily skewed toward the medical field

-

Variable rate caps can be higher than some other competitors

Best For: Doctors and dentists and other medical professionals

5. ELFI

Education Loan Finance is known for providing every borrower with a dedicated personal advisor. This advisor helps you navigate the entire process from pre-qualification to your final payment. They are an excellent option for those with large balances of over fifty thousand dollars who want a human touch. The company frequently receives top marks for its high level of personalized customer service. It provides a great user experience for everyday financial tasks.

Special Features:

-

Personal student loan advisor assigned to every single applicant

-

Referral program that pays bonuses for successful friend signups

-

No application or origination or prepayment penalties

Things To Consider:

-

Requires a minimum loan balance of ten thousand dollars to qualify

-

Cosigner release is not an option once the loan is finalized

Best For: Borrowers with large balances who value personal guidance

6. Citizens Bank

Citizens Bank is a traditional financial institution that offers the reliability of a major national bank. They provide a unique multi year borrowing option that allows students to plan for their entire education in one go. For those refinancing their existing debt they offer loyalty discounts to current bank customers. It is a solid choice for those who prefer the security of a brick and mortar brand. It helps bridge the gap between search volume and human curiosity.

Special Features:

-

Loyalty discounts for existing Citizens Bank account holders

-

Ability for parents to refinance loans taken out for their children

-

Robust mobile app for managing all your banking and loans together

Things To Consider:

-

The application process can require more documentation than fintechs

-

Customer service is handled through a large traditional call center

Best For: Existing bank customers and parents refinancing for kids

7. LendKey

LendKey acts as a marketplace that connects you with local credit unions and community banks. This unique model often results in lower rates because smaller institutions have lower overhead costs. You get the benefit of a modern digital interface while your loan is serviced by a local community lender. It is the best of both worlds for those who want to support local banking. It is a solid choice for those starting their debt payoff journey.

Special Features:

-

Access to rates from hundreds of community banks and credit unions

-

Interest only repayment options available for the first few years

-

Cosigner release available after making on time payments for a set period

Things To Consider:

-

Eligibility and terms can vary significantly based on the local lender

-

You may need to join a specific credit union to finalize the loan

Best For: Borrowers who want to support local credit unions

8. Splash Financial

Splash Financial is a high speed marketplace that allows you to compare multiple offers in just a few minutes. They partner with a wide variety of banks and credit unions to find the lowest possible rate for your profile. Their platform is particularly strong for those who want to see several options at once without multiple hard credit checks. It provides a very efficient way to shop the market quickly. It makes complex data easy for writers to use.

Special Features:

-

Fast pre-qualification that shows multiple lender offers instantly

-

Specialized programs for medical and dental residents

-

Zero fees for application or origination or early payoff

Things To Consider:

-

Splash is a marketplace rather than the actual lender of the funds

-

Customer service may involve both Splash and the final bank partner

Best For: Comparison shoppers who want to see multiple quotes at once

9. MEFA

The Massachusetts Educational Financing Authority offers fixed rate refinancing to borrowers nationwide. They are a nonprofit entity that focuses on keeping costs low for families and students. One of their biggest advantages is that they do not require you to have graduated to qualify for a loan. This makes them an essential resource for those who left school before completing their degree. It is a futuristic addition to any modern financial stack.

Special Features:

-

No graduation requirement which is rare in the refinancing industry

-

Simple fixed rate structure with no hidden fees or surprises

-

Strong focus on family education and financial literacy resources

Things To Consider:

-

Does not offer variable rate options for those seeking lower starts

-

The website and portal are less modern than fintech competitors

Best For: Borrowers who have not completed their college degree

10. Credible

Credible is a powerful comparison engine that provides a “best rate guarantee” for its users. They allow you to fill out a single form and receive actual pre-qualified rates from several top lenders. This platform is perfect for those who are at the very beginning of their research process. It helps you understand exactly where you stand in the current market without any guesswork. It reveals the intent behind the query in a visual way.

Special Features:

-

Best rate guarantee that pays you if you find a better offer elsewhere

-

Integration with a large network of both bank and fintech lenders

-

Clean and intuitive dashboard for comparing different loan terms

Things To Consider:

-

You will still need to complete a final application with the chosen lender

-

Some regional lenders may not be represented on the platform

Best For: Borrowers in the early stages of comparing multiple lenders

2026 Student Loan Market Overview

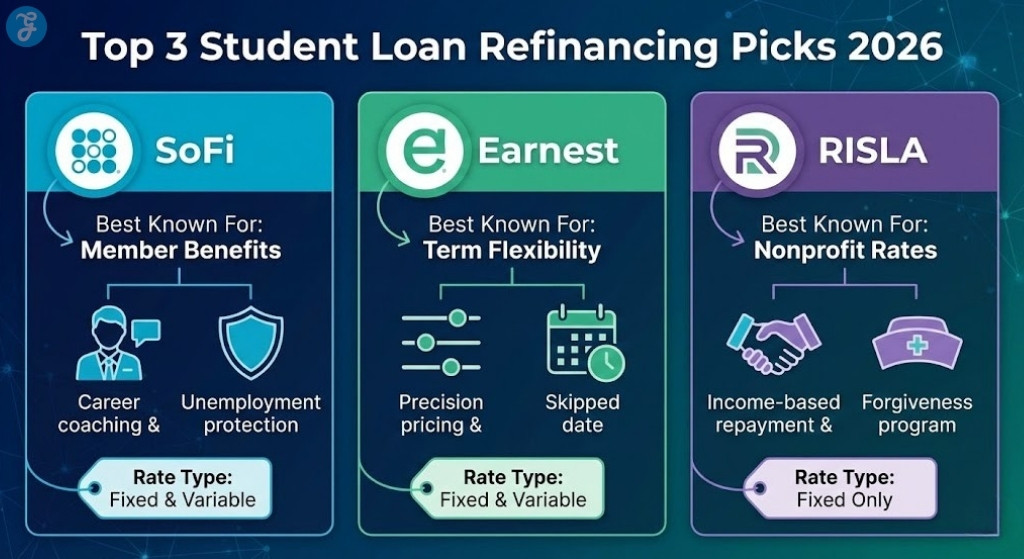

The market for refinancing has become increasingly specialized with lenders targeting specific professions like doctors or teachers. Most top tier providers now offer digital pre-qualification tools that show you estimated rates without affecting your credit score. This table highlights three of the most popular platforms available to borrowers in the 2026 landscape.

| Lender Name | Best Known For | Rate Type |

| SoFi | Member Benefits | Fixed & Variable |

| Earnest | Term Flexibility | Fixed & Variable |

| RISLA | Nonprofit Rates | Fixed Only |

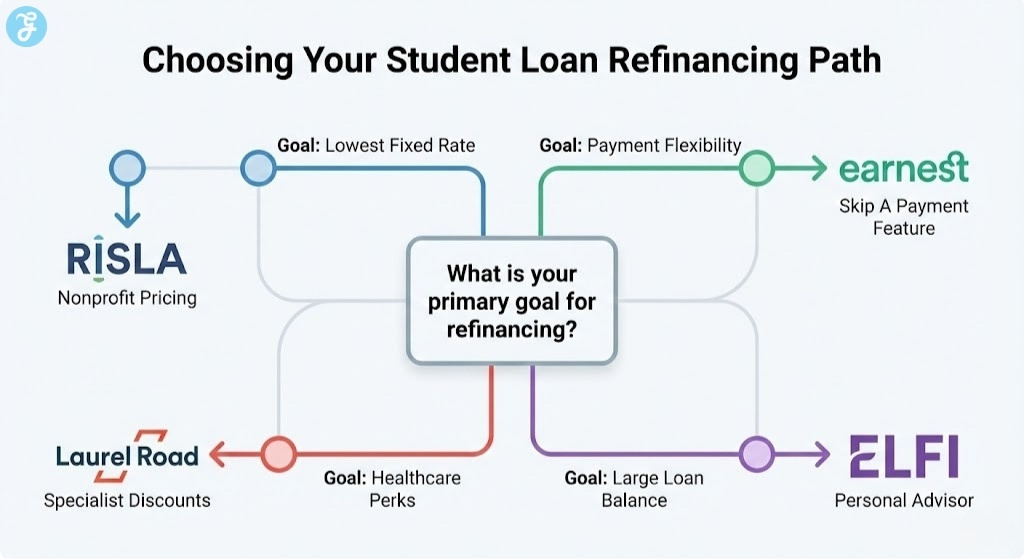

How To Choose The Right Refinancing Plan

Selecting a lender depends on whether you prioritize the absolute lowest interest rate or the most flexible repayment terms. You should always check for hidden fees and look at the long term history of the company’s customer service. This comparison matrix helps you align your specific financial priorities with the most appropriate lending institution.

| Priority Goal | Recommended Lender | Primary Advantage |

| Lowest Fixed Rate | RISLA | Nonprofit Pricing |

| Payment Flexibility | Earnest | Skip A Payment |

| Healthcare Perks | Laurel Road | Specialist Discounts |

| Large Balances | ELFI | Personal Advisor |

Final Thoughts On Managing Student Debt

Winning the battle against student debt in 2026 requires a proactive approach to your interest rates. The student loan refinancing options mentioned here provide the tools necessary to reduce your financial stress. By choosing a lender that fits your professional profile you can significantly shorten your path to total financial freedom.