As tax regulations for digital assets reach a fever pitch, choosing the right software is no longer just about convenience—it is about audit protection. For the 2025 tax year, the IRS and global tax authorities have shifted their focus toward complex maneuvers like DeFi liquidity provisioning, NFT royalties, and cross-chain bridging. This makes automated tracking a necessity for anyone with more than a handful of trades.

The introduction of the Form 1099-DA in early 2026 for the 2025 calendar year marks a new era of transparency. Centralized brokers are now required to report gross proceeds directly to the IRS, meaning the government already has a “receipt” of your activity. To ensure your filings are accurate and to avoid costly penalties, you need a robust tool that can reconcile these reports with your own on-chain data.

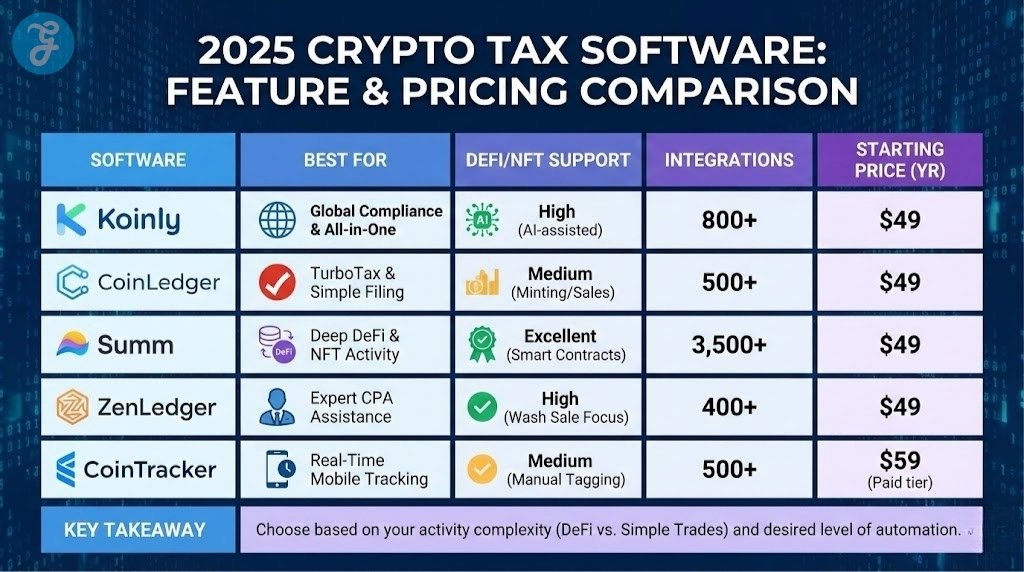

Here’s a quick overview:

| Software | Best For | Integrations | Pricing Starts |

| Koinly | Global Compliance | 800+ | $49/year |

| CoinLedger | TurboTax Users | 500+ | $49/year |

| CoinTracker | Portfolio Tracking | 500+ | $59/year |

| Summ (CryptoTaxCalc) | DeFi & NFT Experts | 3,500+ | $49/year |

| ZenLedger | Expert Assistance | 400+ | $49/year |

Here are the 5 Best Crypto Tax Software Tools for the 2025 Tax Year

Selecting the best crypto tax software is critical because of the massive variance in how tools handle different blockchains. For the 2025 tax year, the following five platforms have separated themselves from the pack through superior API connectivity and automated tax-loss harvesting.

1. Koinly

Koinly is arguably the most versatile platform on the market in 2026. It supports tax reporting for more than 20 countries, making it the top choice for international investors. The software uses artificial intelligence to identify internal transfers between your own wallets, which prevents you from being taxed on “self-transfers” that aren’t actually sales.

For the 2025 tax year, Koinly has upgraded its dashboard to show both realized and unrealized gains in real-time. This allows you to see exactly how much you owe before the year ends, giving you a chance to sell losing assets to offset your gains. Its ability to reconcile problematic transactions with just a few clicks is why it remains a favorite among high-volume traders.

Best For: Individual traders and hobbyists looking for an all-in-one global solution.

Pros:

- Massive Integration: Connects to 800+ exchanges, wallets, and blockchains.

- Free Preview: You can see your tax liability for free and only pay when you need to download the report.

Cons:

- Pricing scales quickly if you have thousands of transactions.

2. CoinLedger

Formerly known as CryptoTrader.Tax, CoinLedger has doubled down on simplicity for the 2025 tax year. It is specifically designed for the US market, with native “one-click” exports for TurboTax and H&R Block. If you are a casual investor who uses major exchanges like Coinbase or Kraken, CoinLedger is often the fastest path to a finished return.

One of its standout features in 2026 is its robust support for NFTs. It can automatically track the minting costs and secondary sale profits of digital collectibles across multiple marketplaces. For those who prioritize a clean, modern user interface over complex technical settings, CoinLedger is a top contender for the best crypto tax software.

Best For: US-based investors who use TurboTax and want a “frictionless” experience.

Pros:

- Simplicity: The onboarding process is one of the smoothest in the industry.

- Customer Support: Offers live chat even on the free plan level.

Cons:

- Less international support compared to Koinly.

3. Summ (Formerly CryptoTaxCalculator)

Summ has recently rebranded and positioned itself as the “power user” tool for the 2025 tax year. It features the most extensive support for DeFi protocols, covering over 3,500 different crypto projects. If you are yield farming, providing liquidity, or using cross-chain bridges, Summ is significantly better at “auto-labeling” these complex smart contract interactions than its competitors.

The software includes advanced inventory methods and a sophisticated tax-loss harvesting tool. In 2026, it is frequently cited by professionals as the best crypto tax software for accurately identifying the fair market value of obscure airdrops and points-farming rewards.

Best For: Active DeFi participants and NFT traders who interact with hundreds of protocols.

Pros:

- Deep DeFi Coverage: Handles complex on-chain moves that other tools often miss.

- Audit-Ready Reports: Provides a granular “CPA-ready” audit trail for every transaction.

Cons:

- The interface can be a bit more technical and “serious” for a beginner.

4. ZenLedger

ZenLedger stands out for its “Grand Unified Accounting” feature. This allows you to view your crypto taxes alongside your traditional stock and bond investments for a total financial picture. For the 2025 tax year, ZenLedger has expanded its “Expert Assist” plans, which allow you to pay a flat fee to have a crypto-savvy CPA review your entire transaction history for errors.

This “human-in-the-loop” model is ideal for high-net-worth investors who are worried about the new Form 1099-DA reporting requirements. Having a professional verify your cost basis can save you from an IRS audit and ensure you are not overpaying.

Best For: Investors who want the option of professional, expert-led filing assistance.

Pros:

- CPA Integration: Built-in tools for sharing data directly with your personal accountant.

- Tax-Loss Harvesting: Very clear dashboard for identifying “wash sale” opportunities.

Cons:

- Higher-tier plans for complex DeFi are among the most expensive on the list.

5. CoinTracker

CoinTracker is a dual-purpose tool: a world-class portfolio tracker and a reliable tax calculator. For the 2025 tax year, it offers real-time monitoring of your capital gains across 10,000+ cryptocurrencies. Because it has a very polished mobile app, it is the best choice for traders who want to check their tax liability on the go.

It integrates seamlessly with the largest exchanges and is the “official” crypto partner for many major financial platforms. While it is excellent for general tracking, users should note that very intricate DeFi moves might still require some manual tagging.

Best For: General investors who want a high-quality mobile app for year-round portfolio tracking.

Pros:

- Trust Factor: Used by over 1 million people and backed by major industry players.

- Real-Time Data: Updates your tax status as soon as you make a trade.

Cons:

- The free plan is quite limited, offering only a basic tax summary without downloads.

How to Choose the Best Crypto Tax Software

With the IRS now requiring Form 1099-DA, your software choice is more about accuracy than ever before. Use this checklist to ensure your tool is ready for the 2025 tax year.

Crypto Tax Readiness Checklist:

-

API Coverage: Does the software support all the exchanges and wallets you used in 2025?

-

Cost Basis Methods: Can it switch between FIFO, LIFO, and HIFO to optimize your return?

-

DeFi Labeling: Does it correctly identify “wrapping” tokens as a transfer or a taxable event?

-

Direct Export: Does it allow you to upload a file directly into TurboTax or H&R Block?

| If you are a… | Use… | Primary Reason |

| Casual HODLer | CoinLedger | Easiest TurboTax integration |

| DeFi Degan | Summ | Best smart contract recognition |

| Global Investor | Koinly | Supports 20+ different tax regions |

| Active App User | CoinTracker | Best real-time mobile tracking |

| Pro/HNW Investor | ZenLedger | Full CPA-assisted filing options |

If you are still having trouble deciding:

-

Best Overall for Most Users: Koinly (Unbeatable balance of price, ease of use, and global support).

-

Best for Seamless Filing: CoinLedger (Deepest integration with TurboTax and H&R Block).

-

Best for Advanced DeFi: Summ (Formerly CryptoTaxCalculator, specifically built for complex on-chain activity).

-

Best for Full Service: ZenLedger (Offers the option to have a CPA handle your entire crypto filing).

-

Best for Mobile Users: CoinTracker (Excellent real-time portfolio monitoring via app).

Wrap-Up: Filing with Precision

The best crypto tax software for 2025 is the one that reduces your manual work while providing a bulletproof audit trail. As the IRS moves toward more automated enforcement with the 1099-DA, guessing on your cost basis is no longer an option. By selecting a tool like Koinly for its global reach or Summ for its DeFi depth, you can ensure your filings are 100% accurate. Remember, the goal of tax software isn’t just to report; it’s to help you keep more of your hard-earned gains through strategic planning.

Ready to start your 2025 return? Most of these tools allow you to import your data for free—sync your wallets today to see where your liability stands.