Expats and entrepreneurs in Japan often feel like fish out of water when they hunt for a bank. They worry about high transfer fees, poor exchange rates, and no English support. Fact: Banks ask for a residence card and proof of address to open an account.

This guide lists seven top picks, from Shinsei Bank to MUFG Bank. It compares debit card perks, ATM withdrawal fees, and online banking tools. It shows who offers low-cost international transfers and English-speaking staff.

Read on.

Key Takeaways

- All banks need a valid residence card and proof of address. Shinsei Bank, Sony Bank, and Japan Post Bank accept a signature instead of a hanko seal.

- International transfer fees vary widely: Shinsei charges 2,000 JPY, SMBC Trust (Prestia) 2,200 JPY per month (waived over 500,000 JPY balance), Sony offers three free transfers then 2,500 JPY each, Japan Post Bank charges 3,000 JPY online or 7,500 JPY at a branch, and MUFG Bank fees start at 2,500 JPY plus 5 %.

- ATM withdrawal fees run from 110 JPY to 330 JPY per use. Seven Bank ATMs at 7-Eleven are open 24/7. Rakuten Bank gives five free withdrawals a month, and MUFG waives fees during business hours.

- Full English support comes from Shinsei Bank, SMBC Trust Bank (Prestia), and Sony Bank. Rakuten Bank and Seven Bank offer limited English menus, while Japan Post Bank provides basic pamphlets and branch help.

- Sony Bank and Rakuten Bank let you open an account online in minutes with zero opening fees. Both offer multi-currency features and low-cost international transfers via their apps.

Key Factors to Consider When Selecting a Japanese Bank

Bank clerks ask for a Zairyu card with at least three months of validity. Proof of address, like a utility bill, secures a smooth application. Some branches even accept a signature or a personal seal, so you can pick one you like.

Most foreigner customers show a work or student visa and proof of employment. Simple steps can save hours at the counter.

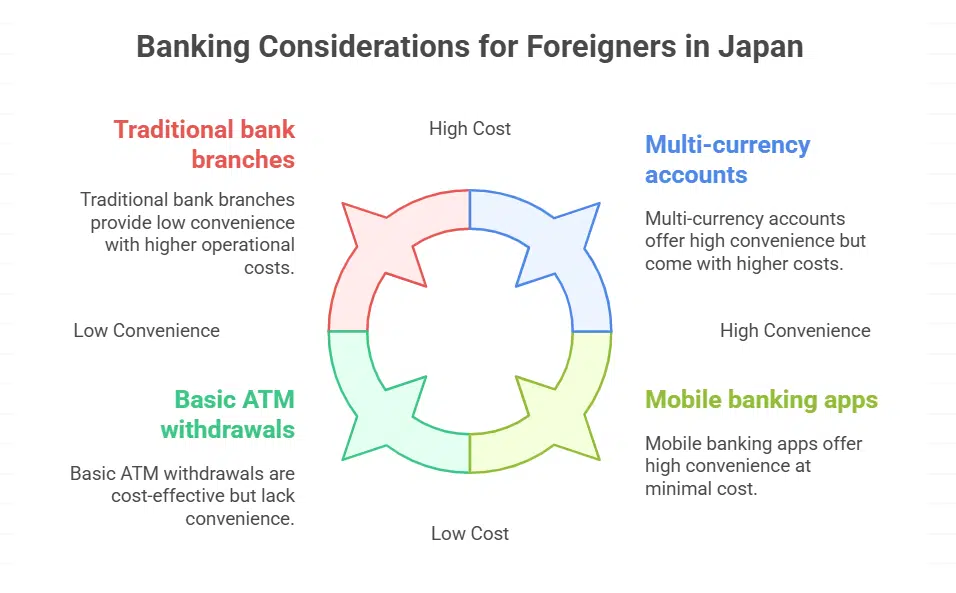

Fee plans differ by bank. ATM withdrawals cost around 110 to 220 yen each. Mobile banking apps let you track JPY balances on the go. English-speaking staff can cut the confusion faster than machine translations.

Credit card perks vary, so shop around for lower transfer fees or multi-currency accounts. Online banking tools, like web portals or chat support, add convenience. Few banks stay closed on Sundays, but convenience stores keep ATMs live.

The 7 Best Banks in Japan for Expats and Entrepreneurs

These banks offer online banking in English and zip your wire transfers overseas. One even treats a utility bill like a VIP ticket when you sign up with a residence card.

Shinsei Bank

Shinsei Bank offers an easy route for foreigners in Japan to open a Japanese bank account. Applicants need at least six months of residency or a work contract in Japan plus a Japanese cell phone.

Applicants must order a Starter Pack for the application forms. Applicants present a Residence card plus either a Japanese driving license or a Certificate of Residence, known as a Juminhyo.

Shinsei Bank does not ask for a hanko seal.

The bank charges 2,000 JPY for most international transfers. It waives fees for platinum and gold customers. Online banking supports English and Japanese. Users track transfers and pay bills from mobile or desktop.

SMBC Trust Bank (Prestia)

Foreigners in japan can use SMBC Trust Bank’s dual-language service to open a japanese bank account in English or Japanese. A simple signature replaces a personal seal, so customers skip hanko hassles.

English-speaking staff at branches process forms with your residence card or passport.

The bank charges 2,200 yen per month, but waives the fee for average balances above 500,000 yen. A GOLD account option avoids fees for clients who seek extra perks. You can make international transfers with low transfer fees and track them in the online banking platform or mobile app.

Sony Bank

Sony Bank offers full English online banking for expats in Japan. You can hold Japanese yen and multiple foreign currencies in a single account. Low-cost or free international transfers send money abroad in a few taps.

The system handles currency exchange right in the app. You do not hit any extra transfer fees.

Account opening costs zero and you finish in minutes with just a residence card. Tech fans will love its sleek dashboard and easy menus. English-speaking staff help with any concern.

Entrepreneurs and foreigners in Japan like its smooth online tools.

Japan Post Bank

Foreigners in Japan find opening a Japanese bank account at Japan Post Bank easy, thanks to multilingual support in English and Chinese. Prospective account holders must present a residence card and proof of employment or school enrollment.

Applicants also need proof of address, like a utility bill. Account processing can take weeks, and the bank mails a passbook later.

International transfers incur fees of 3,000 JPY online or 7,500 JPY at a branch. Many expats in Japan choose online banking to dodge steep transfer fees. Staff at local branches guide customers through SWIFT transfers.

Service options remain more limited than Shinsei Bank or SMBC Trust Bank (Prestia).

Seven Bank

Seven Bank connects with 7-Eleven convenience outlets across Japan, so foreigners in Japan can find an ATM day or night. Its English-friendly machines let expats in Japan switch language menus for easy cash withdrawals.

Charges stand at 110 yen for transfers on weekdays, with weekend fees up to 330 yen. Prepaid Visa ATM cards work at 24-hour convenience outlets and post office ATMs.

It does not let you receive money from overseas, so you must use a different service for wire transfers. Online banking services run in Japanese, which can confuse non-Japanese speakers.

It lacks credit cards and multi-currency accounts. This setup suits customers who need basic ATM access but not full banking services.

Rakuten Bank

Rakuten Bank offers expats in Japan a full digital bank account. The online portal works all day, every day in Japanese. Account holders get five free cash machine withdrawals each month at partner sites.

The bank does not ask for a personal seal to open a Japanese bank account.

This option ranks with JP Bank, Shinsei Bank, and MUFG Bank as a top choice for foreigners. It sets clear transfer fees for international transfers, making overseas wire transfers competitive.

You can link a Wise multi-currency account for added flexibility.

MUFG Bank

MUFG Bank runs one of Japan’s biggest branch networks, ideal for foreigners in Japan who need a reliable japanese bank account. It charges 2,500 JPY for yen and foreign currency outbound transfers, and 3,000 JPY plus a 5 percent fee for some cross-border wires.

Incoming money transfers cost 1,500 JPY plus 5 percent of the amount. The bank uses SWIFT for fast international payments.

ATM machines cost nothing during regular hours at most branches but add a 110 JPY atm withdrawal fee after hours. The online banking service works only in Japanese, yet it stays free to use.

Some customers praise the mobile app for English-friendly ATM menus. Expats in Japan can tap this network for clear rates and widespread access.

Comparison of Services, Fees, and English Support

Here is a quick side by side look.

| Bank | Key Services | Fees | English Support |

|---|---|---|---|

| Shinsei Bank |

|

|

|

| SMBC Trust Bank (Prestia) |

|

|

|

| Sony Bank |

|

|

|

| Japan Post Bank |

|

|

|

| Seven Bank |

|

|

|

| Rakuten Bank |

|

|

|

| MUFG Bank |

|

|

|

Tips for Opening an Account as a Foreigner in Japan

Opening a Japanese bank account can feel tricky for expats. Each step gets easier with the right paperwork.

- Present your valid work or student visa and Zairyu card that has at least three months of remaining validity. Japanese banks require six months of residency or proper permit and often reject tourist visas.

- Provide proof of address with a recent utility bill or rental contract. Tokyo branches often ask for water, gas, or electricity statements.

- Carry your passport and a domestic photo ID such as a driver’s license. Some SMBC Trust Bank, Sumitomo Mitsui Banking Corporation, and MUFG Bank branches also ask for proof of employment.

- Ask if you need a personal seal or if a signature works. Shinsei Bank, Sony Bank, and Japan Post Bank let some foreigners use signatures instead of hanko.

- Research banks with English-speaking staff and online banking. Rakuten Bank and SBI Shinsei Bank apps offer English menus and the happy program.

- Compare international transfer costs, ATM withdrawal fees, and currency conversion rates. Multi-currency accounts like Wise can cut foreign currency exchange charges.

- Choose a debit card or visa debit option to save on prepaid cards. Seven Bank and Mizuho Bank ATMs work at convenience stores across Japan.

- Download the bank’s mobile app to track balances and set alerts. Online banking tools help expats in Japan avoid long branch visits.

Takeaways: Finding Your Best Banking Partner in Japan

Finding the right bank feels like picking a strong tea in a busy café. It gives you smooth transfers and low fees. Shinsei welcome pack and global money service serve your abroad needs.

The postal savings bank adds local branch support. You judge transfer costs, ATM levies, service hours, and English help. You cut through red tape and pay rent, bills, or suppliers without sweat.

Your partner bank shapes your Japan journey.

FAQs on Best Banks in Japan

1. How do expats in japan open a japanese bank account?

You need your residence card, a personal seal, and proof of employment or a utility bill. Then visit Mizuho Bank, Shinsei Bank, or Japan Post Bank, staff often speak English. Online banking kicks in within days.

2. Which banks have english speaking staff for expats in japan?

Sony Bank and Shinsei Bank offer english speaking staff, they guide you like a friend, Rakuten Bank helps via chat or phone, and SBI Shinsei Bank steps in when you need extra support.

3. How can I get a multi currency account to cut international transfer costs?

Set up a Wise multi currency account, link it to your Japanese bank account, it cuts international transfer costs like a good pruner, trimming extra fees, and speeds up international transfers. You can hold yen, dollars, euros, all in one place. One client said, “I saved half my fees.”

4. Which banks charge low atm withdrawal fees in japan?

Use Seven Bank or Japan Post Bank for low atm withdrawal fees, SMBC Trust Bank also has fee free slots on some days, check the fee schedule before you go.

5. What do I need for opening a bank account in japan?

You need a residence card, a personal seal, and proof of employment or a recent utility bill. Some branches ask for a proof of address letter, requirements can vary.

6. Are there special perks for foreigners in japan at banks?

Shinsei Bank’s Happy Program gives points that turn into gifts or fee waivers. Rakuten Bank offers cash back on services. Mizuho Bank even runs cherry blossom viewing deals for expats in japan.